Current Report Filing (8-k)

February 15 2022 - 7:31AM

Edgar (US Regulatory)

0001102432false00011024322022-02-092022-02-09iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 9, 2022

|

Viking Energy Group, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-29219

|

|

98-0199508

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

|

15915 Katy Freeway Suite 450, Houston, Texas

|

|

77094

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (281) 404-4387

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act: None.

|

Title of each class

|

|

Trading Symbols(s)

|

|

Name of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On February 9, 2022, Viking Energy Group, Inc. (“Viking”) entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) to purchase (the “Purchase”) 51 units (the “Units”), representing 51%, of Viking Protection Systems, LLC (“Viking Protection”), from Jedda Holdings LLC (“Jedda”).

In consideration for the Units, Viking agreed to issue to Jedda, shares of a new class of Convertible Preferred Stock of Viking with a face value of $10,000 per share (the “Preferred Shares”), or pay cash to Jedda, if applicable, as follows:

|

|

a.

|

475 Preferred Shares will be issued to Jedda on closing, and such shares will be convertible into shares of common stock of Viking (“Viking Common Stock”) based on a conversion price of $0.60 per share:

|

|

|

|

|

|

|

b.

|

upon the sale of ten thousand units of the electric transmission ground fault prevention trip signal engaging system (the “System”), Viking shall, at the option of Jedda (i) pay Jedda $1,000,000 in cash; or (ii) issue to Jedda 100 Preferred Shares convertible into Viking Common Stock based on a conversion price of $0.75 per share;

|

|

|

|

|

|

|

c.

|

upon the sale of twenty thousand units of the System, Viking shall, at the option of Jedda (i) pay Jedda $2,000,000 in cash; or (ii) issue to Jedda 200 Preferred Shares convertible into Viking Common Stock based on a conversion price of $1.00 per share;

|

|

|

|

|

|

|

d.

|

upon the sale of thirty thousand units of the System, Viking shall, at the option of Jedda (i) pay Jedda $3,000,000 in cash; or (ii) issue to Jedda 300 Preferred Shares convertible into Viking Common Stock based on a conversion price of $1.25 per share;

|

|

|

|

|

|

|

e.

|

upon the sale of fifty thousand units of the System, Viking shall, at the option of Jedda (i) pay Jedda $4,000,000 in cash; or (ii) issue to Jedda 400 Preferred Shares convertible into Viking Common Stock based on a conversion price of $1.50 per share; and

|

|

|

|

|

|

|

f.

|

upon the sale of one hundred thousand units of the System, Viking shall, at the option of Jedda (i) pay Jedda $6,000,000 in cash; or (ii) issue to Jedda 600 Preferred Shares convertible into Viking Common Stock based on a conversion price of $2.00 per share.

|

Notwithstanding the above, Viking shall not effect any conversion of any Preferred Shares, and Jedda shall not have the right to convert any Preferred Shares, to the extent that after giving effect to the conversion, Jedda (together with Jedda’s affiliates, and any persons acting as a group together with Jedda or any of Jedda’s affiliates) would beneficially own in excess of 4.99% of the number of shares of the Viking Common Stock outstanding immediately after giving effect to the issuance of shares of Viking Common Stock issuable upon conversion of the Preferred Share(s) by Jedda. Jedda, upon not less than 61 days’ prior notice to Viking, may increase or decrease the beneficial ownership limitation, provided that the beneficial ownership limitation in no event exceeds 9.99% of the number of shares of Viking Common Stock outstanding immediately after giving effect to the issuance of shares of Viking Common Stock upon conversion of the Preferred Share(s) held by Jedda and the beneficial ownership limitation provisions of this Section shall continue to apply. Any such increase or decrease will not be effective until the 61st day after such notice is delivered to Viking.

Viking Protection was formed on or about January 31, 2022, and Jedda was issued all 100 units of Viking Protection in consideration of Jedda’s assignment to Viking Protection of all of Jedda’s intellectual property and intangible assets, including patent rights, know-how, procedures, methodologies, and contract rights in connection with an electric transmission ground fault prevention trip signal engaging system, and related patent application(s).

On February 9, 2022, the Purchase was closed, Viking acquired 51 units (51%) of Viking Protection from Jedda with Jedda retaining the remaining 49 units (49%) of Viking Protection, and Viking is obligated to create and issue the 475 Preferred Shares to Jedda. Viking and Jedda then entered into an Operating Agreement on February 9, 2022 (the “Operating Agreement”), governing the operation of Viking Protection.

The foregoing descriptions of the Securities Purchase Agreement and Operating Agreement do not purport to be complete and are qualified in their entirety by reference to the Securities Purchase Agreement and Operating Agreement, copies of which are filed as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K and incorporated in this Item 1.01 by reference in their entirety.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The information contained in Item 1.01 above is incorporated by reference into this Item 2.01.

Item 3.02 Unregistered Sales of Equity Securities.

The information contained in Item 1.01 above is incorporated by reference into this Item 3.02. The shares were sold to Jedda in reliance on the exemption from registration under Section 4(a)(2) of the Securities Act of 1933, as amended, and/or Rule 506(b) promulgated thereunder, as there was no general solicitation, and the transaction did not involve a public offering.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit

No.

|

|

Description

|

|

10.1

|

|

Securities Purchase Agreement, by and between Viking Energy Group, Inc., and Jedda Holdings LLC, dated as of February 9, 2022

|

|

10.2

|

|

Operating Agreement of Viking Protection Systems, LLC, by and between Viking Energy Group, Inc., and Jedda Holdings LLC, dated as of February 9, 2022

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

VIKING ENERGY GROUP, INC.

|

|

|

|

|

|

|

|

Date: February 15, 2022

|

By:

|

/s/ James A. Doris

|

|

|

|

Name:

|

James A. Doris

|

|

|

|

Title:

|

Chief Executive Officer

|

|

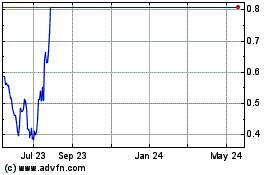

Viking Energy (QB) (USOTC:VKIN)

Historical Stock Chart

From May 2024 to Jun 2024

Viking Energy (QB) (USOTC:VKIN)

Historical Stock Chart

From Jun 2023 to Jun 2024