Aquila European Renewables PLC Company Update

February 26 2024 - 1:00AM

RNS Regulatory News

RNS Number : 3379E

Aquila European Renewables PLC

26 February 2024

26 February 2024

Aquila European Renewables

PLC

Company Update

Further to previous announcements noting the

Board's intention to consider broader options for the future of the

Company, it is pleased to announce that this process, including the

consideration of a potential combination of the Company with

another listed investment company by way of section 110 of the

Insolvency Act 1986 ("s110 combination"), has

commenced.

Following the receipt and review of a number of

indications of interest in a s110 combination, the Board has

instructed its advisers, Deutsche Numis, to commence a process of

mutual due diligence with multiple interested parties. Shareholders

should note that the engagement with parties interested in a s110

combination with the Company is still at a relatively early stage

and therefore there can be no certainty that this process will

result in a combination on terms which the Board considers to be in

the best interests of shareholders as a whole.

The Board expects to announce the full year

results to 31 December 2023 in April 2024 at which point it will

provide a further update, if not earlier, as the Board considers

appropriate.

For

further information please contact:

Deutsche Numis (Financial Adviser and

Broker) +44 020 7260

1000

David

Benda

Stuart Ord

George Shiel

Media contacts

Edelman Smithfield

Ged Brumby 07540 412 301

Hamza Ali 07976 308 914

Apex Listed Companies Services (UK) Limited (Company

Secretary) +44 020 3327

9720

LEI

Number: 213800UKH1TZIC9ZRP41

NOTES

The objective of Aquila European

Renewables plc is to provide investors with an attractive

long-term, income-based return in EUR through a diversified

portfolio of onshore wind, solar PV and hydropower investments

across continental Europe and Ireland. As a result of the

diversification of energy generation technologies, the seasonal

production patterns of these asset types complement each other,

providing a balanced cash flow profile, while the geographic

diversification serves to reduce exposure to any one single energy

market. In addition, a balance is maintained between government

supported revenues, fixed price power purchase agreements and

market power price risk. AER is targeting a dividend of 5.51 cents

per share in relation to the financial year ending 31 December

2023, with the aim of increasing this dividend progressively over

the medium term.

Further details can be found

at: www.aquila-european-renewables.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

UPDFLFIDFAIVFIS

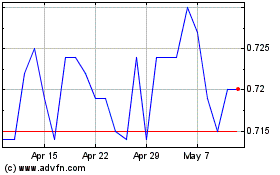

Aquila European Renewables (LSE:AERI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aquila European Renewables (LSE:AERI)

Historical Stock Chart

From Apr 2023 to Apr 2024