TIDMARB

RNS Number : 6391K

Argo Blockchain PLC

29 August 2023

Press Release

29 August 2023

Argo Blockchain plc

("Argo" or "the Company")

Interim Half Year Results 2023

Argo Blockchain plc, a global leader in cryptocurrency mining

(LSE: ARB; NASDAQ: ARBK), is pleased to announce its results for

the six months to 30 June 2023.

Highlights

-- Reduced non-mining operating costs and expenses by 21% in Q2

2023 compared to the prior quarter, resulting in a positive

Adjusted EBITDA of $1.0 million for the quarter (Adjusted EBITDA of

$2.3 million for H1 2023)

-- Reduced debt by $4 million during the quarter to $75 million

as of 30 June 2023, a $68 million reduction from $143 million at 30

June 2022

-- Total number of Bitcoin and Bitcoin Equivalent ("BTC") mined

during H1 2023 was 947, a 1% increase over the BTC mined in H1

2022, despite a 78% increase in the global hashrate from 30 June

2022 to 30 June 2023

-- Revenues of $24.0 million for H1 2023, a decrease of 31% from

H1 2022, driven primarily by a decrease in Bitcoin price and the

increase in the global hashrate and associated network

difficulty

-- Net loss was $18.8 million for H1 2023, compared to a net loss of $39.6 million in H1 2022

-- The Company ended June 2023 with $9.1 million of cash and 46

Bitcoin or Bitcoin Equivalent (together, "BTC") on its balance

sheet; post the period end, the Company raised $7.5 million in

gross proceeds via a share placement in July 2023

Post-period highlights

-- Increased total hashrate capacity to 2.6 EH/s with the

deployment of 1,242 BlockMiner machines at its Quebec

facilities

-- Expect to deploy an additional 1,628 BlockMiners in the

coming months, increasing the Company's total hashrate capacity to

2.8 EH/s

-- In July 2023, the Company raised $7.5 million of gross

proceeds via a share placement with institutional and retail

investors in the UK; the Company used a portion of these proceeds

to repay approximately $1.8 million in debt, and the Company's debt

balance at the end of July 2023 was $72 million

-- The Company is involved in advanced discussions to sell

certain non-core assets, and it continues to evaluate options for

further reducing debt

Fixed Price Power Purchase Agreement at Helios

During H1 2023, the Company achieved a mining margin of 42%,

which is an increase from the mining margin in H2 2022 of 33%. One

of the primary drivers of the improved mining margin was the

establishment of a fixed price power purchase agreement ("PPA") at

Helios in H1 2023, which covers a substantial portion of the

facility's electricity load. In addition to providing greater

certainty of power costs at Helios going forward, the fixed price

PPA also allows the Company to generate power credits via economic

curtailment. In Q2 2023, the Company generated approximately $1.1

million in power credits, and it expects to generate more

significant power credits during Q3 2023 as a result of the

continued heat wave in Texas.

Non-IFRS Measures

The following table shows a reconciliation of mining margin

percentage to gross margin, the most directly comparable IFRS

measure, for the six month periods ended 30 June 2023 and 30 June

2022.

Period ended Period ended

30 June 2023 30 June 2022

(unaudited) (unaudited)

$'000 $'000

-------------------------------------------- ------------- -------------

Gross margin (1,371) (44,651)

Gross margin percentage (6%) (129%)

Depreciation of mining equipment 12,047 14,081

Change in fair value of digital currencies (489) 55,011

Mining margin 10,187 24,441

-------------------------------------------- ------------- -------------

Mining margin percentage 42% 71%

-------------------------------------------- ------------- -------------

The following table shows a reconciliation of Adjusted EBITDA to

net (loss) / income, the most directly comparable IFRS measure, for

the six month periods ended 30 June 2023 and 30 June 2022.

Period ended Period ended

30 June 2023 30 June 2022

(unaudited) (unaudited)

$'000 $'000

-------------------------------------------- ------------- -------------

Net Loss (16,242) (39,580)

Interest expense 6,335 4,511

Income tax credit (2,321) (8,286)

Severance and restructuring 1,399 -

Foreign Exchange (1,403) (13,319)

Depreciation/Amortisation 12,698 15,204

Share based payment 1,889 3,654

Change in fair value of digital currencies (489) 55,011

Equity accounting loss from associate 458 636

-------------------------------------------- ------------- -------------

Adjusted EBITDA 2,324 17,832

-------------------------------------------- ------------- -------------

Inside Information and Forward-Looking Statements

This announcement contains inside information and includes

forward-looking statements which reflect the Company's current

views, interpretations, beliefs or expectations with respect to the

Company's financial performance, business strategy and plans and

objectives of management for future operations. These statements

include forward-looking statements both with respect to the Company

and the sector and industry in which the Company operates.

Statements which include the words "remains confident", "expects",

"intends", "plans", "believes", "projects", "anticipates", "will",

"targets", "aims", "may", "would", "could", "continue", "estimate",

"future", "opportunity", "potential" or, in each case, their

negatives, and similar statements of a future or forward-looking

nature identify forward-looking statements. All forward-looking

statements address matters that involve risks and uncertainties

because they relate to events that may or may not occur in the

future, including the risk that the Company may receive the

benefits contemplated by its transactions with Galaxy, the Company

may be unable to secure sufficient additional financing to meet its

operating needs, and the Company may not generate sufficient

working capital to fund its operations for the next twelve months

as contemplated. Forward-looking statements are not guarantees of

future performance. Accordingly, there are or will be important

factors that could cause the Company's actual results, prospects

and performance to differ materially from those indicated in these

statements. In addition, even if the Company's actual results,

prospects and performance are consistent with the forward-looking

statements contained in this document, those results may not be

indicative of results in subsequent periods. These forward-looking

statements speak only as of the date of this announcement. Subject

to any obligations under the Prospectus Regulation Rules, the

Market Abuse Regulation, the Listing Rules and the Disclosure and

Transparency Rules and except as required by the FCA, the London

Stock Exchange, the City Code or applicable law and regulations,

the Company undertakes no obligation publicly to update or review

any forward-looking statement, whether as a result of new

information, future developments or otherwise. For a more complete

discussion of factors that could cause our actual results to differ

from those described in this announcement, please refer to the

filings that Company makes from time to time with the United States

Securities and Exchange Commission and the United Kingdom Financial

Conduct Authority, including the section entitled "Risk Factors" in

the Company's Annual Report on Form 20-F.

For further information please contact:

Argo Blockchain

Investor Relations ir@argoblockchain.com

------------------------------

Tennyson Securities

------------------------------

Corporate Broker

Peter Krens +44 207 186 9030

------------------------------

Tancredi Intelligent Communication

UK & Europe Media Relations

------------------------------

Salamander Davoudi argoblock@tancredigroup.com

Emma Valgimigli

Fabio Galloni-Roversi Monaco

Nasser Al-Sayed

------------------------------

About Argo:

Argo Blockchain plc is a dual-listed (LSE: ARB; NASDAQ: ARBK)

blockchain technology company focused on large-scale cryptocurrency

mining. With mining facilities in Quebec, mining operations in

Texas, and offices in the US, Canada, and the UK, Argo's global,

sustainable operations are predominantly powered by renewable

energy. In 2021, Argo became the first climate positive

cryptocurrency mining company, and a signatory to the Crypto

Climate Accord. For more information, visit www.argoblockchain.com

.

Interim Management Report

Argo entered 2023 on the heels of a transformational series of

transactions with Galaxy Digital Holdings Ltd. ("Galaxy") that

strengthened our balance sheet, improved our liquidity position,

and positioned Argo for profitable mining. As part of the

transactions, the Helios facility and real property in Dickens

County, Texas were sold to Galaxy for $65 million and existing

asset-backed loans were refinanced with a new $35 million

three-year asset-backed loan with Galaxy. The transactions reduced

total indebtedness by $41 million and allowed Argo to simplify its

operating structure.

Importantly, the Company maintained ownership of its entire

fleet of more than 27,000 mining machines. Its roughly 23,600

Bitmain S19J Pro mining machines at Helios are continuing to

operate in that facility pursuant to a hosting agreement with

Galaxy. During the first quarter of 2023, the Company completed the

transition of operations at Helios to the Galaxy team, and Argo has

been working closely with them to optimize mining operations and

performance. Currently, approximately 2.4 EH/s of total hashrate

capacity is deployed at Helios.

The hosting agreement with Galaxy provides Argo with

pass-through access to the power that Galaxy obtains through its

power purchase agreement ("PPA") for Helios, and the Company pays

an incremental hosting fee based on actual electricity usage. Argo

also has the ability to share in the proceeds when Helios undergoes

economic curtailment in order to monetize its fixed price PPA

during periods of high power prices. One of the primary benefits of

bitcoin mining is its flexible load consumption, which can be

curtailed during times of peak demand. This helps to stabilize the

Texas power grid and reduce price volatility for consumers. During

Q2 2023, the Company generated proceeds of approximately $1.1

million from economic curtailment at Helios; this helps to offset

the reduced BTC production from heat-related curtailment during the

summer months and improves mining margin.

During the first quarter of 2023, following the resignation of

Peter Wall from his roles as Interim Executive Chairman and Chief

Executive officer, the Board appointed Chief Operating Officer Seif

El-Bakly to serve as Interim CEO, and Matthew Shaw became Chairman

of the Board. Additionally, after a formal recruitment process led

by an executive search firm, the Board appointed Jim MacCallum as

Chief Financial Officer in April 2023.

With the new management team in place, the Company has focused

on three key pillars: financial discipline, operational excellence,

and strategic partnerships for growth.

Financial discipline

The sale of the Helios facility significantly changed the

Company's operating profile and presented an opportunity to

dramatically decrease both operating expenses and G&A. During

the first quarter, Argo reduced its non-mining operating expenses

by 68% compared to its run rate during the second half of 2022.

These cost reductions are particularly important in the current

inflationary environment. In the second quarter, non-mining

operating expenses were further reduced by an additional 21%, and

these cost savings are expected to be sustained. Cash generation

and preservation are high priorities for the Company.

In addition to reducing operating expenses, the Company

continues to explore opportunities to strengthen its balance sheet

and reduce indebtedness while maintaining profitable mining

operations. To do this, the Company is evaluating the sale of

certain non-core assets, including investments held on the balance

sheet, excess inventory and real estate. In the second quarter, the

Company sold approximately $1.0 million in ether tokens and used

the proceeds to pay down debt owed to Galaxy. Additionally, post

the period end, the Company issued 57.5 million shares in exchange

for $7.5 million of gross proceeds, a portion of which will be used

to repay debt owed to Galaxy.

Operational excellence

Argo continues to operate both of its owned data centers in

Quebec, Canada. The Baie Comeau site is over 40,000 square feet and

has 15 MW of 99% renewable power capacity sourced from the nearby

Baie Comeau hydroelectric dam. The Company's Mirabel facility,

located adjacent to the Mirabel airport near Montreal, has

approximately 30,000 square feet of mining space with 5 MW of 99%

renewable power capacity sourced from Hydro-Quebec.

Optimization of both capacity and existing operations at both

Quebec facilities continues. In June 2023, the Company began to

receive and deploy its BlockMiner mining machines ordered from ePIC

Blockchain Technologies. As of 31 July 2023, the Company has

deployed 1,242 BlockMiners at its Quebec facilities (representing

approximately 130 PH/s) and expects to deploy the remaining 1,628

machines (an additional 170 PH/s) by the end of Q4 2023.

Growth & strategic partnerships

While the Company's primary focus in H1 2023 was on financial

discipline and operational excellence at its existing facilities,

management continues to explore opportunities where mining can be

paired with stranded or wasted energy. There is tremendous

potential for energy generators to utilize mining as a balancing

and optimization tool, particularly in the energy transition where

limitations currently exist in the ability to store renewable

energy. Argo is evaluating several projects with companies across

the energy value chain.

For the remainder of 2023, the Company will continue to focus on

strengthening the balance sheet and growing the business with a

strong emphasis on financial discipline and operational excellence.

On behalf of the Board, I would like to thank all of our

shareholders and stakeholders. I am excited for Argo to continue in

its mission of powering the world's most innovative and sustainable

blockchain infrastructure in this next stage of the Company's

development.

Sincerely,

Matthew Shaw

Chairman of the Board

Responsibility Statement

We confirm that to the best of our knowledge:

-- the Interim Report has been prepared in accordance with

International Accounting Standards 34, Interim Financial Reporting;

and

-- gives a true and fair view of the assets, liabilities,

financial position and profit/loss of the Group; and

-- the Interim Report includes a fair review of the information

required by DTR 4.2.7R of the Disclosure and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

set of interim financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year.

-- the Interim Report includes a fair review of the information

required by DTR 4.2.8R of the Disclosure and Transparency Rules,

being the information required on related party transactions.

The Interim Report was approved by the Board of Directors and

the above responsibility statement was signed on its behalf by:

Matthew Shaw

Chairman of the Board

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS

Period ended Period ended

30 June 2023 30 June 2022

(unaudited) (unaudited)

Note $'000 $'000

---------------------------------------------------------- ----- ------------- -------------

Revenues 23,996 34,644

Direct costs (15,093) (10,203)

Power credits 1,284 -

---------------------------------------------------------- ----- ------------- -------------

Mining margin 10,187 24,441

Depreciation of mining equipment (12,047) (14,081)

Change in fair value of digital currencies 6 489 (55,011)

---------------------------------------------------------- ----- ------------- -------------

Gross margin (1,371) (44,651)

---------------------------------------------------------- ----- ------------- -------------

Operating costs and expenses (7,863) (11,653)

Restructuring (1,399) -

Foreign exchange 1,403 13,319

Depreciation/amortisation (651) (1,123)

Share based payment (1,889) (3,654)

Operating loss (11,770) (47,762)

---------------------------------------------------------- ----- ------------- -------------

Fair value change of investments - (368)

Gain on settlement of contingent consideration - 5,239

Gain on sale of investment - 172

Finance cost (6,335) (4,511)

Equity accounted loss from associate (458) (636)

Loss before taxation (18,563) (47,866)

---------------------------------------------------------- ----- ------------- -------------

Tax credit 5 2,321 8,286

Net Loss (16,242) (39,580)

---------------------------------------------------------- ----- ------------- -------------

Other comprehensive loss

Items which may be subsequently reclassified

to profit or loss:

* Currency translation reserve (1,562) (5,726)

* Equity accounted OCI from associate - (10,793)

* Fair value loss on intangible digital assets - (537)

Total other comprehensive loss, net

of tax (1,562) (17,056)

---------------------------------------------------------- ----- ------------- -------------

Total comprehensive loss (17,804) (56,636)

---------------------------------------------------------- ----- ------------- -------------

Weighted average shares outstanding 477,825,166 469,182,463

Basic earnings per share* $(0.03) $(0.08)

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at As at As at

30 June 31 December 1 January

2023 2022 2022

(unaudited) (audited) (audited)

Note $'000 $'000 $'000

--------------------------------- ----- ------------ ------------ -----------

ASSETS

Non-current assets

Investments at fair value

through income and loss 419 414 543

Investments accounted for

using the equity method 2,529 2,863 18,642

Intangible assets 6 1,464 2,103 7,560

Property, plant and equipment 7 70,333 76,992 150,571

Right of use assets 536 525 472

Total non-current assets 75,281 82,897 177,788

--------------------------------- ----- ------------ ------------ -----------

Current assets

Trade and other receivables 8 4,395 6,802 85,481

Digital assets 9 - 443 108,956

Cash and cash equivalents 9,148 20,092 15,923

Total current assets 13,543 27,337 210,360

--------------------------------- ----- ------------ ------------ -----------

Total assets 88,824 110,234 388,148

--------------------------------- ----- ------------ ------------ -----------

EQUITY AND LIABILITIES

Equity

Share capital 10 634 634 622

Share premium 10 202,103 202,103 196,911

Share based payment reserve 10,389 8,528 2,531

Foreign currency translation

reserve (30,457) (28,895) 1,623

Fair value reserve - - 551

Other comprehensive income

of equity accounted associates - - 8,744

Accumulated surplus (deficit) (184,865) (168,623) 71,623

--------------------------------- ----- ------------ ------------ -----------

Total equity (2,196) 13,747 282,605

--------------------------------- ----- ------------ ------------ -----------

Current liabilities

Trade and other payables 11 9,913 10,023 10,233

Loans and borrowings 12 14,407 11,605 31,558

Deferred tax 3,390 2,648 386

Income tax - - 10,360

Contingent consideration - - 10,889

Lease liability 5 5 10

--------------------------------- ----- ------------ ------------ -----------

Total current liabilities 27,715 24,281 63,436

--------------------------------- ----- ------------ ------------ -----------

Non - current liabilities

Deferred tax 4,265 7,941 730

Issued debt - bond 12 37,943 37,809 36,303

Loans and borrowings 12 20,544 25,916 4,575

Lease liability 553 540 499

Total liabilities 91,020 96,487 105,543

--------------------------------- ----- ------------ ------------ -----------

Total equity and liabilities 88,824 110,234 388,148

--------------------------------- ----- ------------ ------------ -----------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share capital Share premium Currency Share based Accumulated Total

translation payment reserve deficit

reserve

$'000 $'000 $'000 $'000 $'000 $'000

--------------------------- -------------- -------------- ------------- ----------------- ------------ ---------

Balance at 1 January 2023 634 202,103 (28,895) 8,528 (168,623) 13,747

Loss for the period - - - - (16,242) (16,242)

Other comprehensive income - - (1,562) - - (1,562)

Foreign exchange movement - - - (28) - (28)

Stock based compensation

charge - - - 1,889 - 1,889

Balance at 30 June 2023 634 202,103 (30,457) 10,389 (184,865) (2,196)

--------------------------- -------------- -------------- ------------- ----------------- ------------ ---------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Currency Share Fair Other Accumulated Total

capital premium translation based value comprehensive surplus/

reserve payment reserve income of (deficit)

reserve associates

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

------------------ --------- --------- ------------ --------- ---------- -------------- ------------ ---------

Balance at 1

January

2022 622 196,911 1,623 2,531 551 8,744 71,623 282,605

Loss for the

period - - - - - - (39,580) (39,580)

Other

comprehensive

income - - (5,726) - (537) (10,793) - (17,056)

Foreign exchange

movement - - - 1,301 (14) - - 1,287

Stock based

compensation

charge - - - 3,654 - - - 3,654

Common stock

issuance 2 138 - - - - - 140

Common stock

options/warrants

exercised 10 5,054 - - - - - 5,064

Balance at 30

June

2022 634 202,103 (4,103) 7,486 - (2,049) 32,043 236,114

------------------ --------- --------- ------------ --------- ---------- -------------- ------------ ---------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

Period ended Period ended

30 June 2023 30 June 2022

(unaudited) (unaudited)

Note $'000 $'000

----------------------------------------------- ----- --------------- -----------------

Cash flows from operating activities

Loss before tax (18,563) (47,866)

Adjustments for:

Depreciation/Amortisation 12,698 15,204

Foreign exchange movements (1,403) (13,319)

Finance cost 6,335 4,511

Fair value change in digital assets - 40,371

Realised (gain)/loss in digital assets (489) 6,372

Investment fair value movement - 368

Gain on investment - (173)

Impairment of intangible digital

assets - 3,904

Share of loss from associate 458 636

Gain on settlement of contingent

consideration - (5,239)

Share based payment expense 1,889 3,654

Working capital changes:

Increase in trade and other receivables 8 (892) (1,204)

(Decrease)/Increase in trade and

other payables 11 (973) 3,098

Decrease in digital assets 443 21,593

Net cash flow (used in)/from operating

activities (497) 31,910

----------------------------------------------- ----- --------------- -----------------

Investing activities

Proceeds from sale of intangibles/investments 989 173

Purchase of tangible fixed assets 7 (1,301) (63,893)

Mining equipment prepayments - (45,972)

----------------------------------------------- ----- --------------- -----------------

Net cash used in investing activities (312) (109,692)

----------------------------------------------- ----- --------------- -----------------

Financing activities

Proceeds from borrowings 16 811 86,065

Lease payments - (17)

Loan repayments (3,381) (10,890)

Interest paid (5,247) (4,511)

Proceeds from shares issued - 151

----------------------------------------------- ----- --------------- -----------------

Net cash from (used in)/from financing

activities (7,817) 70,798

----------------------------------------------- ----- --------------- -----------------

Net decrease in cash and cash equivalents (8,626) (6,984)

Effect of foreign exchange changes

in cash (2,318) 2,261

Cash and cash equivalents, beginning

of period 20,092 15,923

----------------------------------------------- ----- --------------- -----------------

Cash and cash equivalents, end of

period 9,148 11,200

----------------------------------------------- ----- --------------- -----------------

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS

1. COMPANY INFORMATION

Argo Blockchain plc ("the company") is a public company, limited

by shares, and incorporated in England and Wales. The registered

office is Eastcastle House, 27/28 Eatcastle Street, London,

England, W1W 8DH. The company was incorporated on 5 December 2017

as GoSun Blockchain Limited.

On 21 December 2017, the company changed its name to Argo

Blockchain Limited and re-registered as a public company, Argo

Blockchain plc.

On 12 January 2018, Argo Blockchain plc acquired a 100%

subsidiary, Argo Innovation Labs Inc. (together "the Group"),

incorporated in Canada.

On 22 November 2022, the Group formed Argo Operating US LLC and

Argo Holdings US Inc.

On 21 December 2022, Argo Innovation Facilities (US) Inc became

Galaxy Power LLC. On 28 December 2022, the Group sold Galaxy Power

LLC.

The principal activity of the group is Bitcoin mining.

The ordinary shares of the Group are listed under the trading

symbol ARB on the London Stock Exchange. The American Depositary

Receipt of the Group are listed under the trading symbol ARBK on

Nasdaq. The Group bond is listed on the Nasdaq Global Select Market

under the trading symbol ARBKL.

2. BASIS OF PREPARATION

The condensed consolidated interim financial statements for the

six months ended 30 June 2023 have been prepared in accordance with

IAS 34 'Interim Financial Reporting' and presented in US dollars

which is further described in Note 3. They do not include all the

information required in annual financial statements in accordance

with IFRS and should be read in conjunction with the consolidated

financial statements for the year ended 31 December 2022, which

have been prepared in accordance with International Financial

Reporting Standards as issued by the IASB. The report of the

auditors on those financial statements was unqualified.

The financial statements have been prepared under the historical

cost convention, except for the measurement to fair value certain

financial and digital assets and financial instruments.

Critical accounting judgements and key sources of estimation

uncertainty

The preparation of financial statements in conformity with IFRS

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates. In preparing these

condensed consolidated interim financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the financial statements for

the year ended 31 December 2022.

3. ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of

these condensed consolidated interim financial statements are

consistent with those of the previous financial year, except the

change in presentational currency from British Pounds to US Dollars

and recognition of power credits within Mining Margin in the

Statement of Comprehensive Income. The Group changed its

presentational currency to US Dollars due to the fact its revenues,

direct costs, capital expenditures and debt obligations are now

predominantly denominated in US Dollars.

In order to satisfy the requirements of IAS 8 and IAS 21 with

respect to a change in the presentation currency, the statutory

financial information as previously reported in the Group's Annual

Reports have been restated from GBP into US Dollars using the

procedures outlined below:

-- Assets and liabilities were translated to US Dollars at the

closing rates of exchange at each respective balance sheet date

-- Share capital, share premium and other reserves were

translated at the historic rates prevailing at the dates of

transactions

-- Income and expenses were translated to US Dollars at an

average rate at each of the respective reporting years on a monthly

basis. This has been deemed to be a reasonable approximation to

exchange rates at the date of the transactions.

-- Differences resulting from the retranslation were taken to

currency translation reserve within equity

-- All exchange rates used were extracted from the Group's underlying financial records

Power credits: The Group recognized power credits in relation to

selling power back to the power grid. The hosting facility sells

some of the Group's power back to the power grid when economically

feasible.

Going Concern

The preparation of consolidated financial statements requires an

assessment on the validity of the going concern assumption. 2022

was a challenging year for Bitcoin miners: the depressed price of

Bitcoin and the elevated global hashrate caused hashprice, the

primary measure of mining profitability, to reach all-time lows in

Q4 2022. In addition, global events resulted in disruption to

fossil fuel energy markets which resulted in a significant increase

in electricity prices. The low hashprice and elevated power prices

significantly reduced Argo's profitability and its ability to

generate free cash flow. During Q4 2022, the Group evaluated

several strategic alternatives to restructure our balance sheet and

improve our cash flow.

On 28 December 2022, the Group announced a series of

transactions with Galaxy Digital Holdings, Ltd. ("Galaxy") that

improved the Group's liquidity position and enabled the Group to

continue its mining operations. As part of the transactions, Argo

sold the Helios facility and real property in Dickens County, Texas

to Galaxy for $65 million and refinanced existing asset-backed

loans via a new $35 million, three-year asset-backed loan with

Galaxy. The transactions reduced total indebtedness by $41 million

and allowed Argo to simplify its operating structure.

While the Galaxy transactions strengthened the Group's balance

sheet, material uncertainties exist that may cast significant doubt

regarding the Group's ability to continue as a going concern and

meet its liabilities as they come due. The significant

uncertainties are:

1) The Group's debt service obligations of approximately $17.8

million to 31 August 2024. Please see the net debt tables under the

Group and Company cash flow statements for further information of

the Group's exposure to liabilities and net position at the year

end.

2) The Group's exposure to Bitcoin prices, power prices, and

hashprice, each of which have shown volatility over recent years

and have a significant impact on the Group's future profitability.

The Group may have difficulty meeting its liabilities if there are

significant declines to the hashprice assumption or significant

increases to the power price, particularly where there is a

combination of both factors. The Directors' assessment of going

concern includes a forecast drawn up to 31 August 2024 using the

Group's estimate of the forecasted hashprice. Power costs are now

also partially fixed per kilowatt hour as Galaxy has hedged the

majority of the power obligations at Helios and, as per the hosting

agreement in place, the Group has access to this power. Anticipated

power costs based on this arrangement are reflected in the forecast

prepared.

Offsetting these potential risks to the Group's cash flow are

the Group's current cash balance, the Group's ability to generate

additional funds by issuing equity for cash proceeds and selling

certain non-core Group assets.

Based on information from Management, the Directors have

considered the period to 31 August 2024, as a reasonable time

period given the variable outlook of cryptocurrencies and the

Bitcoin halving due in May 2024. Based on the above considerations,

the Board believes it is appropriate to adopt the going concern

basis in the preparation of the Financial Statements. However, the

Board notes that the significant debt service requirements and the

volatile economic environment, indicate the existence of material

uncertainties that may cast significant doubt regarding the

applicability of the going concern assumption and the auditors made

reference to this in their audit report on the financial statements

for the year ended 31 December 2022.

4. ADOPTION OF NEW AND REVISED STANDARDS AND INTERPRETATIONS

The Group has adopted all recognition, measurement and

disclosure requirements of IFRS, including any new and revised

standards and Interpretations of IFRS, in effect for annual periods

commencing on or after 1 January 2023. The adoption of these

standards and amendments did not have any material impact on the

financial result or position of the Group.

Standards which are in issue but not yet effective:

At the date of authorisation of these financial statements, the

following Standards and Interpretation, which have not yet been

applied in these financial statements, were in issue but not yet

effective.

Standard Description Effective date for

or Interpretation annual accounting

period beginning on

or after

------------------- --------------------------------------- ---------------------

IAS 1 Non-current Liabilities with Covenants 1 January 2024

The Group has not early adopted any of the above standards and

intends to adopt them when they become effective.

No deferred tax asset has been recognised in respect of tax

losses carried forward on the basis that there is insufficient

certainty over the level of future profits to utilise against this

amount.

Income tax expense

The tax on the Group's profit before tax differs from the

theoretical amount that would arise using the weighted average tax

rate applicable to profits of the consolidated entities as

follows:

5. TAXATION

Period ended Period ended

30 June 2023 (unaudited) 30 June 2022

(unaudited)

$'000 $'000

--------------------------------- ------------------------- -------------

Income tax credit - foreign

tax - (7,785)

Deferred tax credit (2,321) (501)

--------------------------------- ------------------------- -------------

Taxation credit in the financial

statements (2,321) (8,286)

--------------------------------- ------------------------- -------------

Period ended Period ended

30 June 2023 30 June 2022

(unaudited) (unaudited)

$'000 $'000

Loss before taxation (18,563) (47,866)

----------------------------------------------- -------------- --------------

Expected tax recovery based on a

weighted average of 25% (2022 - 25%)

(UK, US and Canada) (4,640) (21,325)

Expenses not deductible in determining

taxable profit 512 52

Capital allowances in excess of depreciation - (7,250)

Other tax adjustments (2,543) 15,064

Losses utilised re prior years - (9,106)

Origination and reversal of temporary

differences 3,117 5,116

Unutilised tax losses carried forward 1,233 9,162

Taxation credit in the financial

statements (2,321) (8,286)

----------------------------------------------- -------------- --------------

6. INTANGIBLE ASSETS NOTE

Group Goodwill Digital Website 2023 Total

assets

$'000 $'000 $'000 $'000

----------------------------- ------ --------- ------------ ----------- ---------------

Cost

At 1 January 2023 96 5,942 873 6,911

Foreign exchange movements 16 69 19 104

Disposals - (1,868) - (1,868)

At 30 June 2023 102 4,143 892 5,147

------------------------------------- --------- ------------ ----------- ---------------

Amortisation and impairment

At 1 January - 4,045 762 4,807

Foreign exchange movement - 47 17 64

Disposal - (1,243) - (1,243)

Fair value gain - (34) - (34)

Amortisation charged during

the period - - 88 88

At 30 June 2023 - 2,524 803 3,327

------------------------------------- --------- ------------ ----------- ---------------

Balance at 1 January

2023 97 1,917 42 2,111

Balance At 30 June 2023 112 1,327 25 1,464

Intangible digital assets are cryptocurrencies owned but not

mined by the Group. The Intangible digital assets are recorded

at cost on the day of acquisition. Changes in fair value are

recorded in the fair value reserve in other comprehensive income.

The Intangible digital assets held are detailed in the table

below:

As at 30 June 2023 Coins/tokens Fair value

Crypto asset name $'000

----------------------------------------------------- --------------- ----------------

Polkadot - DOT 32,955 170

Ethereum - ETH 213 70

Solana - SOL 17 6

LAYR 12,048 125

ASTRA 1 200

Alternative coins 392,971 756

At 30 June 2023 438,205 1,327

----------------------------------------------------- --------------- ----------------

7. TANGIBLE FIXED ASSETS

Group Office Mining Machine Leasehold Data Equipment Total

Equipment and Components Improvements centres

Computer

Equipment

$'000 $'000 $'000 $'000 $'000 $'000 $'000

----------------------- ------------ ----------- --------------- ------------- ------------ ---------- --------

Cost

At 1 January 2023 57 142,901 20,938 116 13,295 104 176,410

Foreign exchange

movement 3 4,489 985 5 625 5 6,112

Additions - - 3,300 - - 1,301 4,601

Transfer to another

class 513 - - 530 (3,803) 2,760 -

Disposals - - - - - - -

At 30 June 2023 572 145,390 25,222 652 10,117 4,710 187,124

----------------------- ------------ ----------- --------------- ------------- ------------ ---------- --------

Depreciation and

impairment

At 1 January 2023 17 79,248 18,233 105 1,801 14 99,419

Foreign exchange

movement 1 3,726 857 - 5 85 4,674

Depreciation charged

during the period 145 12,047 - 74 103 328 12,698

Disposals - - - - - - -

At 30 June 2023 163 95,021 19,091 179 1,910 427 116,791

----------------------- ------------ ----------- --------------- ------------- ------------ ---------- --------

Carrying amount

----------------------- ------------ ----------- --------------- ------------- ------------ ---------- --------

At 1 January 2023 40 62,653 2,705 11 11,494 89 76,992

----------------------- ------------ ----------- --------------- ------------- ------------ ---------- --------

At 30 June 2023 409 51,369 6,132 472 8,208 3,743 70,333

----------------------- ------------ ----------- --------------- ------------- ------------ ---------- --------

8. TRADE AND OTHER RECEIVABLES

As at As at 31 December

30 June 2023 2022 (audited)

(unaudited)

$'000 $'000

------------------------------------ -------------- ------------------

Trade and other receivables 706 -

Prepayments 2,214 5,978

Other taxation and social security 1,473 824

Total trade and other receivables 4,393 6,802

------------------------------------ -------------- ------------------

The directors consider that the carrying amount of trade and

other receivables is equal to their fair value.

9. DIGITAL ASSETS

Group Period ended Year ended

30 June 2023 31 December 2022

(unaudited) (audited)

$'000 $'000

------------------------------------- ------------------- ---------------------

Opening Balance 443 102,632

Additions

Crypto assets mined - 263

Crypto asset purchased and received 23,982 60,069

------------------------------------- ------------------- ---------------------

Total additions 23,982 60,332

Disposals

Crypto assets purchased & received - 419

Crypto assets sold (24,448) (107,456)

------------------------------------- ------------------- ---------------------

Total disposals (24,448) (107,037)

Fair value movements

Gain/(loss) on crypto asset sales 23 (55,315)

Movements on crypto assets held - (169)

Total fair value movements 23 (55,484)

Closing Balance - 443

------------------------------------- ------------------- ---------------------

The Group mined crypto assets during the period, which are

recorded at fair value on the day of acquisition. Movements in fair

value are recorded in change in fair value of digital currencies on

the statement of comprehensive loss.

10. ORDINARY SHARES

The Group had 477,825,166 Ordinary shares outstanding at 30 June

2023 and 31 December 2022.

Subsequent to June 30, 2023, the Group issued 57,500,000

ordinary shares for net proceeds of $7M.

The Group has in issue 10,544,406 warrants and options at 30

June 2023 (2022: 18,396,397).

The Group granted 6,616,487 restricted stock units (RSUs) and

1,973,892 performance stock units (PSUs) in 2023. The RSUs/PSUs

vest over 3 years from grant date. PSUs have performance conditions

that must be met as a condition of vesting. The grant price of the

RSUs/PSUs was GBP0.1288.

11. TRADE AND OTHER PAYABLES

As at As at

30 June 2023 31 December 2022

(unaudited) (audited)

$'000 $'000

------------------------------------ -------------- ------------------

Trade payables 2,040 3,253

Accruals and other payables 7,365 6,099

Other taxation and social security 507 690

Total trade and other creditors 9,912 10,043

------------------------------------ -------------- ------------------

The directors consider that the carrying value of trade and

other payables is equal to their fair value.

12. LOANS AND BORROWINGS

Non-current liabilities As at As at

30 June 2023 31 December

(unaudited) 2022 (audited)

$'000 $'000

--------------------------------------- --------------- -------------------

Issued debt - bond 37,943 37,809

Long term loan 18,200 23,131

Mortgages 2,344 2,785

Lease Liability 553 540

Total 59,040 64,265

--------------------------------------- --------------- -------------------

Current liabilities

--------------------------------------- --------------- -------------------

Loans 13,415 10,475

Mortgages 992 1,130

Lease Liability 5 5

Total 14,412 11,610

--------------------------------------- --------------- -------------------

The mortgages are secured against the two buildings at Mirabel

and Baie Comeau and are repayable over periods from 39 months to 42

months at an interest rate of lender prime + 0.5%.

In November 2021, the Group issued an unsecured 5-year bond with

an interest rate of 8.75%. The bonds mature on 30 November

2026.

In December 2022, the Group entered into a loan agreement with

Galaxy Digital LLC for USD$35 million (GBP29m). The Galaxy Digital

LLC loan is payable monthly based on an amortization schedule over

32 months with an interest rate of the secured overnight financing

rate by the Federal Reserve Bank of New York plus 11%. The loan is

secured by the Group's property, plant and equipment.

In May 2023, the Group entered into a loan agreement with First

Insurance Funding for USD $811k. The loan is payable over 10 months

with an interest rate of 9.2%.

13. FINANCIAL INSTRUMENTS

As at As at

30 June 2023 31 December 2022

(unaudited) (audited)

$'000 $'000

------------------------------------------ --------------- -------------------

Carrying amount of financial assets

Measured at amortised cost

* Mining equipment prepayments - 5,978

* Trade and other receivables 2,178 824

* Cash and cash equivalents 9,148 20,092

Measured at fair value - Digital Assets - 443

Total carrying amount of financial

assets 11,328 27,337

------------------------------------------ --------------- -------------------

Carrying amount of financial liabilities

Measured at amortised cost

* Trade and other payables 9,913 10,022

* Short term loans 11,407 11,605

20,544 25,916

* Long term loans

* Issued Debt - bonds 37,943 37,809

* Lease liabilities 553 540

Total carrying amount of financial

liabilities 83,365 85,892

------------------------------------------ --------------- -------------------

Fair Value Estimation

Fair value measurements are disclosed according to the following

fair value measurement hierarchy:

- Quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1)

- Inputs other than quoted prices included within Level 1 that

are observable for the asset or liability, either directly (that

is, as prices), or indirectly (that is, derived from prices) (Level

2)

- Inputs for the asset or liability that are not based on

observable market data (that is, unobservable inputs) (Level 3).

This is the case for unlisted equity securities.

The following table presents the Group's assets and liabilities

that are measured at fair value at 30 June 2023 and 31 December

2022.

Level 1 Level 2 Level 3 Total

Assets $'000 $'000 $'000 $'000

---------------------------- -------- -------- -------- ------

Financial assets at fair

value through profit or

loss

Equity holdings 26 - 393 419

Intangible assets - crypto

assets - 1,327 - 1,327

Digital assets - - - -

Total at 30 June 2023 26 1,327 393 1,746

---------------------------- -------- -------- -------- ------

Level 1 Level 2 Level 3 Total

Assets $'000 $'000 $'000 $'000

---------------------------- -------- -------- -------- ------

Financial assets at fair

value through profit or

loss

Equity holdings 73 - 89 162

Intangible assets - crypto

assets - 2,129 - 2,129

Digital assets - 443 - 443

Total at 31 December 2022 73 2,572 89 2,734

---------------------------- -------- -------- -------- ------

All financial assets are in listed/unlisted securities and

digital assets.

There were no transfers between levels during the period.

The Group recognises the fair value of financial assets at fair

value through profit or loss relating to unlisted investments at

the cost of investment unless:

- There has been a specific change in the circumstances which,

in the Group's opinion, has permanently impaired the value of the

financial asset. The asset will be written down to the impaired

value;

- There has been a significant change in the performance of the

investee compared with budgets, plans or milestones;

- There has been a change in expectation that the investee's

technical product milestones will be achieved or a change in the

economic environment in which the investee operates;

- There has been an equity transaction, subsequent to the

Group's investment, which crystallises a valuation for the

financial asset which is different to the valuation at which the

Group invested. The asset's value will be adjusted to reflect this

revised valuation; or

- An independently prepared valuation report exists for the

investee within close proximity to the reporting date.

14. COMMITMENTS

The Group's material contractual commitments relate to the

hosting services agreement with Galaxy Digital Qualified

Opportunity Zone Business LLC, which provides hosting, power and

support services at the Helios facility. Whilst management do not

envisage terminating agreements in the immediate future, it is

impracticable to determine monthly commitments due to large

fluctuations in power usage and as such a commitment over the

contract life has not been determined. The agreement is for

services with no identifiable assets, therefore, there is no right

of use asset associated with the agreement.

As the company disclosed on February 8, 2023, it is currently

subject to a class action lawsuit. The case, Murphy vs Argo

Blockchain plc et al, was filed in the Eastern District of New York

on 26 January 2023. The company refutes all of the allegations and

believes that this class action lawsuit is without merit. The

company is vigorously defending itself against the action. We are

not currently subject to any other material pending legal

proceedings or claims.

15. RELATED PARTY TRANSACTIONS

Key management compensation - all amounts in $000's

Key management includes Directors (executive and non-executive)

and senior management. The compensation paid to related parties in

respect of key management for employee services during the period

was made only from Argo Blockchain PLC, amounting to: $60k (2022 -

$26) paid to Webslinger Advisors Inc. in respect of fees of Matthew

Shaw (Non-executive director); and Alex Appleton through Appleton

Business Advisors Limited was paid $22 (2022 - $126) during the

period.

Total director fees and remuneration, paid directly and

indirectly, totalled $280 (2022: $406).

16. SUBSEQUENT EVENTS

In July 2023, the Company issued 57,500,000 ordinary shares for

net proceeds of $7M.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PLMFTMTMTMLJ

(END) Dow Jones Newswires

August 29, 2023 02:20 ET (06:20 GMT)

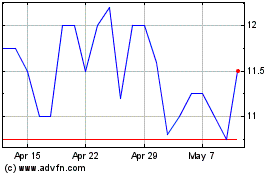

Argo Blockchain (LSE:ARB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Argo Blockchain (LSE:ARB)

Historical Stock Chart

From Apr 2023 to Apr 2024