British American Tobacco Sees Good Performance in 1st Half 2019

June 12 2019 - 1:55AM

Dow Jones News

By Adriano Marchese

British American Tobacco PLC (BATS.LN) said Wednesday that

business continues to perform well in the first half of fiscal 2019

and that it is on track to deliver a good performance for the full

year.

The tobacco company said that revenue on a constant-currency

basis is expected to be in the mid-to-upper half of its long-term

guidance range of 3% and 5%. It also said that adjusted operating

profit growth are in line with its guidance, but didn't provide any

further figures. Additionally, BATS expects to deliver high

single-figure adjusted diluted earnings-per-share growth at

constant currency.

BATS said that deleveraging remains on track, and that the

business expects to deliver free cash flow after dividends of 1.5

billion pounds ($1.9 billion) for the full year.

The company also said that it intends to consolidate its new

category portfolio into fewer brands.

Write to Adriano Marchese at adriano.marchese@dowjones.com

(END) Dow Jones Newswires

June 12, 2019 02:40 ET (06:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

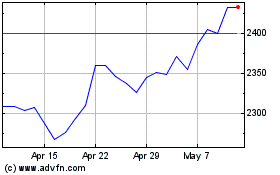

British American Tobacco (LSE:BATS)

Historical Stock Chart

From Apr 2024 to May 2024

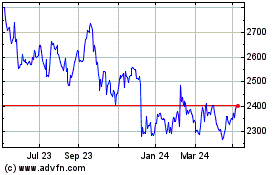

British American Tobacco (LSE:BATS)

Historical Stock Chart

From May 2023 to May 2024