TIDMFBT

RNS Number : 6309Q

Forbidden Technologies PLC

01 December 2016

1 December 2016

Forbidden Technologies plc

("Forbidden" or the "Company")

Placing to raise GBP3 million

and

Notice of General Meeting

Placing

Forbidden Technologies plc (AIM: FBT), the AIM-quoted

market-leading cloud video platform owner, is pleased to announce a

placing to raise GBP3 million (before expenses) through the issue

of 30,000,000 new ordinary shares of 0.8 pence each (the "Placing

Shares") at a price of 10 pence per Placing Share (the "Placing")

in two tranches.

The Placing was conducted by Allenby Capital Limited ("Allenby

Capital") and the Placing Shares have been placed with

institutional and other investors, including existing shareholders.

Of the funds raised, GBP2,247,575 is conditional, inter alia, on

the approval of shareholders at a general meeting of the Company to

be held on 28 December 2016 (the "GM" or "General Meeting") of a

resolution to provide authority to the Directors to issue and allot

new ordinary shares otherwise than on a pre-emptive basis, further

details of which are set out below.

The net proceeds of the Placing, which will be approximately

GBP2.81 million, will be used to finance further sales, sales

support, sales implementation and product development support where

necessary and to support working capital through to profitability

and cash generation.

A circular (the "Circular"), containing information in relation

to the Placing and convening the General Meeting, is expected to be

sent to shareholders today. The information contained below has

been extracted from, and should be read in conjunction with, the

Circular. The Circular will also be posted on the Company's

website: www.forbidden.co.uk in due course.

Commenting on the placing, Aziz Musa, CEO of Forbidden

Technologies plc said:

"We are building an increasingly strong pipeline of

opportunities and the funds raised will help support our sales

ambitions. This is an exciting time for the Company and the Board

is committed to ensuring growth continues and is optimised as we

look to move towards profitability and cash generation."

Enquiries:

Forbidden Technologies plc

David Main, Chairman

Aziz Musa, Chief Executive

Tel: +44 (0)20 8879 7245

Allenby Capital Limited (Nominated Adviser and Broker)

Nick Naylor

John Depasquale

Richard Short

Katrina Perez

Tel: +44 (0)20 3328 5656

Redleaf Communications (Financial PR Adviser)

Rebecca Sanders-Hewett

David Ison

Susie Hudson

Tel: +44 (0)20 7382 4730

Email: forbidden@redleafpr.com

About Forbidden Technologies plc

Forbidden Technologies plc (AIM: FBT, www.forbidden.co.uk)

floated in February 2000.

The Company develops and markets a powerful cloud video platform

with multiple applications which can be used by rights holders,

broadcasters, sports and news video specialists, post-production

houses, other mass market digital video channels, corporates and

consumers. The platform applications help customers improve their

time to market on time sensitive content, and efficiently exploit

the full value of their content.

Websites:

www.forbidden.co.uk

www.forscene.com

www.eva.co

www.captevate.com

Social media:

www.facebook.com/FORscene

www.plus.google.com/+Forscenepro/posts

www.linkedin.com/company/forscene

www.twitter.com/forscenepro

www.youtube.com/user/ForsceneTraining

PLACING STATISTICS

Number of Existing Ordinary Shares 150,486,199

Placing Price per Placing Share 10 pence

Number of First Placing Shares 7,524,250

Number of Second Placing Shares 22,475,750

Total number of Placing Shares being

placed on behalf of the Company 30,000,000

Enlarged Share Capital immediately following

the Placing and Admission 180,486,199

Number of Placing Shares as a percentage 16.62 per

of the Enlarged Share Capital cent.

Estimated net proceeds receivable GBP2.81 million

by the Company

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Latest time and date for receipt 10:00 a.m. on 26

of completed Forms of Proxy December 2016

Admission and commencement of

dealings in the First Placing 08:00 a.m. on 6

Shares December 2016

General Meeting 10:00 a.m. on 28

December 2016

Admission and commencement of

dealings in the Second Placing 08:00 a.m. on 29

Shares December 2016

DEFINITIONS

The following definitions apply throughout this document, unless

the context requires otherwise:

"Act" the Companies Act 2006 (as amended);

"Admission" First Admission and/or Second Admission

(as the context requires);

"AIM" the market of that name operated

by the London Stock Exchange;

"AIM Rules" the AIM Rules for Companies and (where

the context admits) the AIM Rules

for Nominated Advisers (each as amended

from time to time);

"Allenby Capital" Allenby Capital Limited, a private

limited company incorporated in England

& Wales under registered number 6706681

and having its registered office

at 3 St Helen's Place, London, EC3A

6AB, the Company's nominated adviser

and broker for the purposes of the

Placing and Admission;

"Board" or "Directors" the directors of the Company as at

the date of this document, whose

names are set out on page 4 of this

document;

"Company" or Forbidden Technologies plc, a public

"Forbidden" limited company incorporated in England

& Wales under registered number 03507286

and having its registered office

at Tuition House, 27-37 St. George's

Road, Wimbledon, London, SW19 4EU;

"CREST" the computerised settlement system

(as defined in the CREST Regulations)

operated by Euroclear UK & Ireland

Limited which facilitates the transfer

of title to shares in uncertificated

form;

"CREST Regulations" the Uncertificated Securities Regulations

2001 (SI 2001/3755) including any

enactment or subordinate legislation

which amends or supersedes those

regulations and any applicable rules

made under those regulations or any

such enactment or subordinate legislation

for the time being in force;

"Enlarged Share the number of Ordinary Shares in

Capital" issue immediately following the Placing

and Admission;

"Existing Ordinary the 150,486,199 Ordinary Shares of

Shares" 0.8 pence each in the capital of

the Company in issue at the date

of this document;

"First Admission" admission of the First Placing Shares

to trading on AIM becoming effective

in accordance with Rule 6 of the

AIM Rules;

"First Placing the 7,524,250 new Ordinary Shares

Shares" which are to be placed in accordance

with the Placing Agreement without

being conditional on the passing

of the Resolution;

"Form of Proxy" the form of proxy enclosed with this

document for use by Shareholders

in connection with the General Meeting;

"General Meeting" the general meeting of the Company

or "GM" convened for 10:00 a.m. on 28 December

2016, notice of which is set out

on page 12 of this document;

"London Stock the London Stock Exchange Group plc;

Exchange"

"Notice of GM" the notice convening the GM, which

is set out on page 12 of this document;

"Options" options over Ordinary Shares in the

Company;

"Ordinary Shares" the ordinary shares of 0.8 pence

each in the capital of the Company

in issue from time to time;

"Placees" subscribers for Placing Shares pursuant

to the Placing;

"Placing" the conditional placing of the Placing

Shares by Allenby Capital as broker

for the Company at the Placing Price

pursuant to the Placing Agreement;

"Placing Agreement" the conditional agreement dated 30

November 2016 between the Company

and Allenby Capital relating to the

Placing;

"Placing Price" 10 pence per Placing Share;

"Placing Shares" the 30,000,000 new Ordinary Shares

to be issued pursuant to the Placing

which have been conditionally placed

by Allenby Capital, comprising the

First Placing Shares and the Second

Placing Shares;

"Resolution" the resolution set out in the Notice

of GM;

"Second Admission" admission of the Second Placing Shares

to trading on AIM becoming effective

in accordance with Rule 6 of the

AIM Rules;

"Second Placing the 22,475,750 new Ordinary Shares

Shares" which are to be placed in accordance

with the Placing Agreement conditionally

(inter alia) on the passing of the

Resolution at the GM;

"Shareholders" holders of Ordinary Shares and the

term "Shareholder" shall be construed

accordingly;

"United Kingdom" the United Kingdom of Great Britain

or "UK" and Northern Ireland; and

"GBP" and "pence" pounds and pence sterling respectively,

being the lawful currency of the

United Kingdom.

LETTER FROM THE CHAIRMAN

FORBIDDEN TECHNOLOGIES PLC

(Incorporated and registered in England and Wales under the

Companies Act 1985, with registered number 03507286)

Directors: Registered Office:

David Main (Chairman) Tuition House

Aziz Musa (Chief Executive Officer) 27-37 St. George's

Jonathan Lees (Chief Financial Road

Officer) Wimbledon

Stephen Streater (Research and London

Development Director) SW19 4EU

Jim Irving (Non-Executive Director)

Andrew Bentley (Non-Executive

Director)

1 December 2016

Dear Shareholder (and, for information only, holders of

Options)

Placing and Notice of General Meeting

1. Introduction

The Company announced earlier today a proposed placing to raise

GBP3 million (before expenses) through the issue of 30,000,000 new

Ordinary Shares at the Placing Price per new Ordinary Share in two

tranches: the First Placing Shares and the Second Placing

Shares.

The allotment of the Second Placing Shares is conditional, inter

alia, upon the Company obtaining approval of Shareholders at the

General Meeting to disapply Shareholders' statutory pre-emption

rights which would otherwise apply to the allotment of the Second

Placing Shares.

The purpose of this document is, amongst other things, to

explain the background to and reasons for the Placing and to

explain why the Board believes that the Placing will promote the

growth and success of the Company for the benefit of the

Shareholders as a whole, and seeks Shareholder approval to the

passing of the Resolution at the General Meeting of the

Company.

This document also contains the Directors' recommendation that

Shareholders vote in favour of the Resolution. Notice of the

General Meeting, at which the Resolution will be proposed, is set

out at the end of this document. A Form of Proxy is also enclosed

with this document for use at the GM.

The placing of the Second Placing Shares is conditional, inter

alia, upon Shareholders passing the Resolution at the General

Meeting. The Directors intend to vote in favour of the Resolution

in respect of their own beneficial holdings in the Company which

amount in aggregate to 64,551,428 Ordinary Shares and represent

approximately 43 per cent. of the Company's Existing Ordinary

Shares.

The Directors believe that the Placing is the most appropriate

way to raise additional funds for Forbidden. The Directors consider

that the Placing provides greater certainty than other available

means of raising additional funds in a timely fashion and minimises

transactional costs.

2. Background to and reasons for the Placing

The Company operates in the large and growing cloud video

market. With its platform of cloud video applications and its

relationships, including those with Amazon Web Services and

Microsoft Azure, Forbidden is well positioned in this market. The

Company's focus is on helping customers unlock the value of their

content by reducing the time to market from camera to screen, and

increasing the ease and efficiency of using content in multiple

ways.

On 6 September 2016, the Company announced its interim results

for the six months ended 30 June 2016. As highlighted, the Company

raised GBP1.2 million (net) in an institutional fundraise announced

in May 2016 which provided the Company with liquid funds of GBP1.8

million at 30 June 2016. The Company is beginning to see the

benefits of the leaner cost structure that it implemented in May

2016, accruing a cost saving of approximately GBP1 million on an

annualised basis. Additionally, the Company grew its sales force

and increased invoiced sales to GBP445,000, reflecting a 25 per

cent. growth compared to the equivalent period in the previous

year. The Company's invoiced sales growth follows the relatively

flat invoiced sales amounts for each of the four previous six month

periods which ranged between GBP342,000 and GBP355,000.

Aligned with the Company's increased financial performance have

been some operational changes. Significantly, Aziz Musa, the

Company's CEO, has been directly leading the larger sales team.

Under his leadership, the sales and marketing team have implemented

a new sales and marketing process. With this new process and a

focus on selling against the revenue benefits of our applications,

the Company is seeing a material growth in our sales pipeline.

In this second half of the year, there continues to be

commercial traction in sports video solutions and overall in the US

market, including, as announced on 1 August 2016, a partnership

with an iconic sports, music and entertainment venue in New York.

The eva and Captevate applications are now included as part of the

Forscene platform and, where appropriate, are part of our proposals

to potential clients. In addition, the 12 month proof of concept,

with a UK broadcaster and global US technology company, is well

underway.

The sales growth generated in the first six months is continuing

which means we will be successful in delivering invoiced sales

growth this year whilst also realising approximately GBP0.5 million

in cost savings (both operational and capital expenditure) over

2015. The Company had a cash balance of GBP1.2 million as at 31

October 2016. The sales growth momentum is expected to continue

into 2017.

It is against this growth momentum that the Company is raising

additional funds to ensure that the Company has adequate capital to

finance further sales, sales support, sales implementation and

product development support where necessary. Management is

committed to ensuring that the Company's growth continues, and is

optimised, whilst also targeting profitability in 2018.

3. Details of the Placing and use of proceeds

The Placing is expected to raise a total of GBP3 million before

expenses. The net proceeds of the Placing, which will be

approximately GBP2.81 million, will be used to increase the

Company's sales and sales support capabilities, effectively

resource larger contracts with new customer implementation

capabilities, respond more rapidly to additional revenue related

product development requirements and strengthen the Company's

balance sheet for larger strategic sales.

Under the Placing, the Company has conditionally raised GBP3

million (before expenses) through a placing of 30,000,000 Ordinary

Shares at 10p per share with institutional and other investors. The

Company has entered into a Placing Agreement with Allenby Capital

under which Allenby Capital has agreed to use its reasonable

endeavours to procure Placees for the Placing Shares at the Placing

Price. The Placing has not been underwritten.

The Placing Shares will represent approximately 16.62 per cent.

of the Enlarged Share Capital. The Placing Price represents a

discount of approximately 11 per cent. to the closing mid-market

price on AIM of 11.25 pence per Existing Ordinary Share on 30

November 2016, being the last dealing day prior to publication of

this document.

The Company currently has limited authority to issue new

Ordinary Shares for cash on a non-pre-emptive basis. Accordingly,

the Placing is being conducted in two tranches.

The first tranche of the Placing, to raise a total of GBP752,425

by the issue of 7,524,250 Ordinary Shares (being the First Placing

Shares) at 10p each, has been carried out within the Company's

existing share allotment authorities. Application has been made for

the First Placing Shares to be admitted to trading on AIM and it is

expected that their admission to AIM will take place on 6 December

2016. The allotment of the First Placing Shares is conditional,

inter alia, upon First Admission and the Placing Agreement becoming

unconditional in respect of the First Placing Shares and not being

terminated in accordance with its terms prior to First

Admission.

The second tranche of the Placing, to raise a total GBP2,247,575

by the issue of 22,475,750 Ordinary Shares (being the Second

Placing Shares) at 10p each, is conditional upon, inter alia, the

passing of the resolution to be put to shareholders of the Company

at the General Meeting (granting the Directors authority to issue

and allot new ordinary shares otherwise than on a pre-emptive

basis). In addition, the allotment of the Second Placing Shares is

conditional, inter alia, on the Placing Agreement becoming

unconditional in respect of the Second Placing Shares and not being

terminated in accordance with its terms prior to Second Admission.

It is expected that Second Admission will take place on 29 December

2016.

The Placing Agreement contains, inter alia, customary

undertakings and warranties given by the Company in favour of

Allenby Capital as to the accuracy of information contained in this

document and other matters relating to the Company. Allenby Capital

may terminate the Placing Agreement in specified circumstances

prior to Admission, including, inter alia, for material breach of

the Placing Agreement or any other warranties contained in it and

in the event of certain force majeure events occurring.

The Placing Agreement is conditional so far as concerns the

Second Placing upon, inter alia, Second Admission occurring by not

later than 8.00 a.m. on 29 December 2016 (or such later time and/or

date as the Company and Allenby Capital may agree, not being later

than 8.00 a.m. on 31 January 2017). If such condition is not

satisfied or, if applicable, waived, the Second Placing will not

proceed.

The Placing Shares will be issued credited as fully paid and

will rank pari passu in all respects with the Existing Ordinary

Shares, including the right to receive dividends and other

distributions declared on or after the date on which they are

issued.

It is expected that CREST accounts will be credited on the

relevant day of Admission and that share certificates (where

applicable) will be despatched within 5 working days of

Admission.

4. Application for Admission to AIM

Application will be made to the London Stock Exchange for the

Placing Shares to be admitted to trading on AIM. It is anticipated

that such admission will become effective and that dealings in the

First Placing Shares will commence at 08:00 a.m. on 6 December 2016

and that admission will become effective and dealings in the Second

Placing Shares will commence at 08:00 a.m. on 29 December 2016.

5. General Meeting

The notice convening the General Meeting to be held at Tuition

House, 27-37 St. George's Road, Wimbledon, London SW19 4EU at 10.00

a.m. on 28 December 2016 is set out at the end of this document. At

the General Meeting, Shareholders will consider a resolution, to be

passed as a special resolution, to disapply Shareholders' statutory

pre-emption rights which would otherwise apply to the allotment of

the Second Placing Shares.

6. Action to be taken

Shareholders will find accompanying this document a Form of

Proxy for use at the General Meeting. Whether or not Shareholders

intend to be present at the GM, they are requested to complete,

sign and return the Form of Proxy in accordance with the

instructions printed on it to the Company's registrars, Capita

Asset Services, as soon as possible and, in any event, so as to

arrive no later than 10:00 a.m. on 26 December 2016. Completion and

return of the Form of Proxy will not affect Shareholders' rights to

attend and vote in person at the General Meeting if they so wish.

Further information regarding the appointment of proxies can be

found in the notes to the Notice of GM.

Shareholders who hold their Ordinary Shares in uncertificated

form and receive this document and the accompanying Form of Proxy

through their broker or other intermediary, should complete and

send a letter of direction in accordance with the instructions

provided by their broker or other intermediary. Many brokers

provide a form and opportunity to submit voting instructions

online.

7. Documents Available

Copies of this document will be available to the public, free of

charge, at the Company's registered office and at the offices of

Allenby Capital, 3 St Helen's Place, London, EC3A 6AB, during usual

business hours on any weekday (Saturdays, Sundays and public

holidays excepted) for one month from the date of this document.

This document will also be available on the Company's website,

www.forbidden.co.uk.

8. Recommendation

The Board considers the Placing to be in the best interests of

the Company and its Shareholders as a whole and therefore the

Directors unanimously recommend that Shareholders vote in favour of

the Resolution to be proposed at the General Meeting, as they

intend to do in respect of their aggregate holding of 64,551,428

Existing Ordinary Shares (representing approximately 43 per cent.

of the Company's existing share capital).

Yours sincerely

David Main

Chairman

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOEKMMFMMGMGVZZ

(END) Dow Jones Newswires

December 01, 2016 02:00 ET (07:00 GMT)

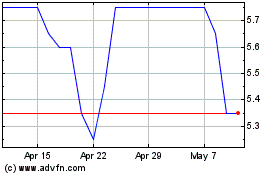

Blackbird (LSE:BIRD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blackbird (LSE:BIRD)

Historical Stock Chart

From Apr 2023 to Apr 2024