Base Resources Limited Additional critical mineral product stream doubles Toliara Project's NPV

December 14 2023 - 1:00AM

UK Regulatory

TIDMBSE

AIM and Media Release

14 December 2023

Base Resources Limited

Additional critical mineral product stream doubles Toliara Project's NPV

Key Points

· Pre-feasibility study on the production of monazite has significantly

enhanced the forecast financial returns from the Toliara Project.

· With an incremental NPV10 of US$1.0 billion (post-tax, real), the Monazite

PFS has doubled the Toliara Project's overall NPV10 to US$2.0 billion (post-tax,

real).

· Monazite is a rich source of rare earth elements critical to the world's

green energy transition and represents 2.0% of the heavy mineral in the Toliara

Project's Mineral Resources estimate.

· The Monazite PFS demonstrates that tails from the mineral sands processing

planned under the Mineral Sands DFS2 can be easily upgraded to a monazite

product, for modest additional capital expenditure. Capitalising on what is

essentially a `waste' stream will make the Toliara Project one of the largest

and most cost-competitive sources of rare earth oxides globally.

· Other key incremental outcomes from the Monazite PFS include:

· IRR of 79%.

· Capex of US$71 million and a capital payback period of 1 year.

· Average annual monazite production of 21.8kt, containing 2.8kt of NdPr.

· LOM free cash flow of US$4.7 billion, averaging US$130 million per annum.

· Average annual EBITDA of US$164 million.

· Key overall outcomes from incorporating the Monazite Project in the Toliara

Project include:

· Average revenue to cash cost of sales ratio of 4.3 over the 38-year

modelled mine life.

· Increase of LOM free cash flow by 80% to US$10.6 billion, averaging US$306

million per annum.

· Average annual EBITDA of US$371 million.

African mineral sands producer and developer, Base Resources Limited (ASX & AIM:

BSE) (Base Resources) is pleased to release the outcomes of its pre-feasibility

study on exploitation of the contained monazite at its Toliara Project in

Madagascar through concentration of the existing waste stream from the project's

mineral sands processing facilities to produce a valuable monazite product

(Monazite PFS).

On an incremental basis, the Monazite PFS has delivered exceptional outcomes and

is a significant enhancement of the Toliara Project as outlined in the enhanced

definitive feasibility study on the project's mineral sands (Mineral Sands

DFS2). For modest additional estimated capital expenditure of US$71million, the

Monazite PFS outcomes include an incremental post-tax/pre-debt (real) NPV10 of

US$1.0 billion, IRR of 79% and an average revenue to cost of sales ratio of 7.9,

over an initial 38-year mine life. When combined with the Mineral Sands DFS2,

the Toliara Project has an overall post-tax/pre-debt (real) NPV10 of US$2.0

billion.

Managing Director of Base Resources, Tim Carstens, said:

"Put simply, the outcomes from our Monazite PFS reinforce our belief that

Toliara is the best undeveloped mineral sands project in the world.

Unsurprisingly, adding another critical mineral stream through concentrating

what would otherwise have been `waste' from the mineral sands processing has

materially improved the forecast financial performance of the project, with a

100% increase in NPV and free cash flow of almost US$10.6 billion over the

initial modelled life of the project. Utilising the waste stream as an

essentially free source of monazite feed will make the Toliara Project one of

the largest and most cost-competitive sources of rare earth oxides globally."

"We have always believed in the Toliara Project's potential to be a catalyst for

growth in Madagascar, creating transformational opportunities for our

communities, economic stimulus for the Toliara region and being a flagship

investment for the Government. The addition of the monazite product stream

enhances these opportunities for all stakeholders, with the project now forecast

to generate over US$4.7 billion in direct government revenue and community

development expenditure over the initial 38-year mine life."

"With the recent conclusion of Presidential elections in Madagascar and reform

of the mining regulatory regime well progressed, we believe that 2024 will see

conditions supportive of the Toliara Project's progression. We look forward to

resuming discussions with the newly formed Government early in the new year. We

remain confident that acceptable fiscal terms can be secured that will support

development of the Toliara Project, delivering clear and compelling benefits to

our host communities, the nation of Madagascar and our shareholders."

Investment evaluation

Below are the key financial and production outcomes from the Monazite PFS,

together with the outcomes from Mineral Sands DFS2.

Attached to this release are supporting slides titled "Toliara Monazite Project

Pre-Feasibility Study" containing detailed information about the Monazite PFS

and its outcomes.

Unit Monazite Mineral Sands Combined

PFS DFS2

NPV10 (discount US$ millions 999 1,008 2,006

rate of 10%), post

tax, real

NPV8 post tax, US$ millions 1,281 1,385 2,666

real1

NPV10 spot US$ millions 679 1,008 1,687

monazite price

post tax, real1

IRR % 78.6% 23.8% 32.4%

Initial (Stage 1) US$ millions 71 520 591

Capex

Construction time Months 29 27 27

(Stage 1)

Stage 2 Capex US$ millions N/A 137 137

Capital Payback Years 1.0 4.5 3.6

Period (Stage 1 +

2)

Production - kt pa 21.8 N/A 21.8

Monazite

Production - kt pa N/A 1,033 1,033

ILM/RUT/ZIR

Life of mine (LOM) years 38 38 38

LOM Operating US$/t ore mined 0.98 3.78 4.92

Costs + Royalty

LOM Operating (A) US$/t produced 1,089 88 112

Costs + Royalty

LOM Revenue (B) US$/t produced 8,648 306 477

LOM Cash Margin (B-A) US$/t produced 7,559 218 365

LOM Revenue: Cost (B/A) Ratio : 1 7.9 3.5 4.3

of Sales Ratio

LOM Free Cash Flow US$ millions 4,733 5,922 10,655

[Note (1): Alternative NPV calculations are provided for illustrative and

comparative purposes. Spot monazite price assumed to be US$5,900/t. Base

Resources considers a 10%discount rate to be the most appropriate for evaluation

purposes.]

Investor briefings

Base Resources will host two investor briefings to discuss the outcomes from the

Monazite PFS on 19 December 2023 at 8.30am (AWST) and 5.00pm AWST / 9.00am BST.

The briefings will be hosted by Tim Carstens (Managing Director), Kevin Balloch

(Chief Financial Officer), Stephen Hay (General Manager - Marketing) and Andre

Greyling (General Manager - Growth).

The briefings will be by webcast and teleconference. Details for accessing each

are below. Participants will only be able to ask questions via the

teleconference line. Participants that propose using the teleconference line

will need to pre-register their details using the teleconference registration

URL provided below. Upon registering, participants will receive an email with

their unique PIN and dial-in details so that they can join the call on the day

without needing to speak to an operator.

Australia webcast and teleconference

Date: Tuesday, 19 December 2023

Time: 8.30am AWST / 11.30am AEST

Webcast URL: https://webcast.openbriefing.com/bse-mu-2023-au/

Teleconference pre-registration URL:

https://registrations.events/direct/OCP60911

UK webcast and teleconference

Date: Tuesday, 19 December 2023

Time: 5.00pm AWST / 9.00am BST

Webcast URL: https://webcast.openbriefing.com/bse-mu-2023-uk/

Teleconference pre-registration URL:

https://registrations.events/direct/OCP61023

Further information about the Monazite PFS and the PFS Materials

The supporting slides attached to this release titled "Toliara Monazite Project

Pre-Feasibility Study" form part of this release (together, this release and the

supporting slides are the PFS Materials). This release should be read together

with these slides. The information contained in the slides includes information

in relation to the modifying factors in JORC Code Table 1, and the material

assumptions (including in respect of the modifying factors) and underlying

methodologies and inputs used for the Monazite PFS and from which the financial

and production outcomes and other forward-looking statements set out in the PFS

Materials were derived.

Base Resources has concluded that it has a reasonable basis for providing the

forward-looking statements set out in the PFS Materials. This includes a

reasonable basis to expect that Base Resources will, when required, be able to

fund development of the Toliara Project, including the additional capital

expenditure required to produce a monazite product, and obtain a legal right to

exploit monazite2. The Disclaimer & Important Notices on pages 2 and 3 of the

supporting slides apply to all the PFS Materials, including this announcement.

The PFS Materials also contain the outcomes from Mineral Sands DFS2 and select

information from that study. This information has been provided to

contextualise the outcomes of the Monazite PFS and because the Monazite PFS was

based on concentration of the monazite waste stream from the Mineral Sands

DFS2. For this reason, and to the extent material to the production and

financial outcomes from the Monazite PFS, the assumptions and underlying

methodologies and inputs used for the Mineral Sands DFS2 have also been included

in the PFS Materials.

For further information in relation to the Mineral Sands DFS2, refer to Base

Resources' announcement on 27 September 2021 "DFS2 enhances scale and economics

of the Toliara Project" available at

https://baseresources.com.au/investors/announcements/. Base Resources confirms

that all the material assumptions underpinning the production information and

forecast financial information disclosed in that announcement continue to apply

and have not materially changed.

[Note (2): The Toliara Project's existing mining tenure, Permis d'Exploitation

37242, does not currently provide the right to exploit monazite.]

ENDS.

The information contained within this release is considered inside information

as stipulated under the retained EU law version of the Market Abuse Regulation

(EU) No. 596/2014 (the UKMAR) which is part ofUKlaw by virtue of theEuropean

Union(Withdrawal) Act 2018. The information is disclosed in accordance with the

Company's obligations under Article 17 of theUKMAR. Upon the publication of

this release, this inside information is now considered to be in the public

domain.

For further information contact:

+--------------------------------+-----------------------------+

|Australian Media Relations |UK Media Relations |

+--------------------------------+-----------------------------+

|Citadel Magnus |Tavistock Communications |

+--------------------------------+-----------------------------+

|Cameron Gilenko and Michael Weir|Jos Simson and Gareth Tredway|

+--------------------------------+-----------------------------+

|Tel: +61 8 6160 4900 |Tel: +44 207 920 3150 |

+--------------------------------+-----------------------------+

This release has been authorised by the Board of Base Resources.

About Base Resources

Base Resources is an Australian based, African focused, mineral sands producer

and developer with a track record of project delivery and operational

performance. The Company operates the established Kwale Operations in Kenya and

is developing the Toliara Project in Madagascar. Base Resources is an ASX and

AIM listed company. Further details about Base Resources are available at

www.baseresources.com.au.

PRINCIPAL & REGISTERED OFFICE

Level 3, 46 Colin Street

West Perth, Western Australia, 6005

Email: info@baseresources.com.au

Phone: +61 8 9413 7400

Fax: +61 8 9322 8912

NOMINATED ADVISER & JOINT BROKER

Canaccord Genuity Limited

James Asensio / Raj Khatri / George Grainger

Phone: +44 20 7523 8000

JOINT BROKER

Berenberg

Matthew Armitt / Detlir Elezi

Phone: +44 20 3207 7800

This information was brought to you by Cision http://news.cision.com

The following files are available for download:

https://mb.cision.com/Public/22548/3893356/89a168c3d231921e.pdf Toliara Monazite Project Pre-Feasibility Study

END

(END) Dow Jones Newswires

December 14, 2023 02:00 ET (07:00 GMT)

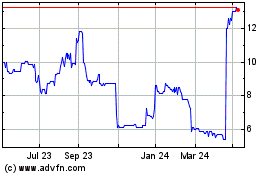

Base Resources (LSE:BSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

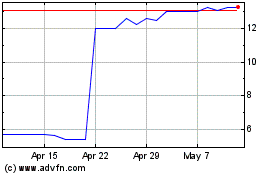

Base Resources (LSE:BSE)

Historical Stock Chart

From Apr 2023 to Apr 2024