CLS Holdings PLC Sale of Treasury Shares (6294S)

November 11 2013 - 1:00AM

UK Regulatory

TIDMCLI

RNS Number : 6294S

CLS Holdings PLC

11 November 2013

Release date: 11 November 2013

Embargoed until: 07:00

NOT FOR DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR

INTO THE UNITED STATES OR ANY OTHER JURISDICTION IN WHICH THE

DISTRIBUTION OR RELEASE WOULD BE UNLAWFUL

CLS Holdings plc

("CLS", the "Company" or the "Group")

Sale of Treasury Shares

The Company is pleased to announce that on 8 November 2013 it

sold 1,600,000 ordinary shares of 25p each in the Company

("Ordinary Shares"), previously held as treasury shares, at a price

of 1215 pence per Ordinary Share (the "Sale").

The Ordinary Shares were placed with a number of institutional

investors through the Company's joint broker, Liberum Capital.

The Board considers that the Sale, which is in response to

feedback from its institutional investors, will increase liquidity

in the trading of the Company's Ordinary Shares. It will also

provide additional strength to the Group's balance sheet and extra

flexibility to take advantage of opportunities which arise in the

real estate market and other opportunities within the Company's

existing portfolio.

Following the settlement of Ordinary Shares pursuant to the

Sale, which is expected to occur on or around 15 November 2013, the

Company will have 46,856,893 Ordinary Shares in issue, of which

2,903,103 Ordinary Shares will be held as treasury shares.

Therefore, the total number of Ordinary Shares in issue following

completion of the Sale, excluding treasury shares, and also the

total number of voting rights in the Company will be 43,953,790.

The Company does not have any other class of shares in issue other

than the Ordinary Shares.

The above figure of 43,953,790 may be used by shareholders as

the denominator for the calculations by which they will determine

if they are required to notify their interest in, or a change to

their interest in, Ordinary Shares in the Company under the FCA's

Disclosure and Transparency Rules.

Sten Mortstedt, Executive Chairman of CLS, commented:

"I am pleased that, by this placing, we have been able to

satisfy some of the demand for shares in the Company.

"The fact that the shares were sold at a premium to the past

five days' average closing price, is evidence that the investors

share our optimistic view of the future possibilities.

"The Sale should increase liquidity in the trading of the

Company's shares and will further strengthen our ability to exploit

future opportunities to add value for our shareholders."

-ends-

For further information, please contact:

CLS Holdings plc +44 (0)20 7582 7766

www.clsholdings.com

Sten Mortstedt, Executive Chairman

Henry Klotz, Executive Vice Chairman

Richard Tice, Chief Executive Officer

Liberum Capital Limited +44 (0)20 3100 2222

Tom Fyson

Thomas Bective

Charles Stanley Securities +44 (0)20 7149 6000

Mark Taylor

Kinmont Limited +44 (0)20 7087 9100

Jonathan Gray

Smithfield Consultants (Financial PR) +44 (0)20 7903 0669

Alex Simmons

Important Information

This announcement may not be published, distributed or

transmitted by any means or media, directly or indirectly, in whole

or in part, in or into the United States. This announcement does

not constitute an offer to sell, or a solicitation of an offer to

buy, securities in the United States. Securities may not be offered

or sold in the United States absent (i) registration under the U.S.

Securities Act of 1933, as amended (the "Securities Act") or (ii)

an available exemption from registration under the Securities Act.

The securities mentioned herein have not been, and will not be,

registered under the Securities Act and will not be offered to the

public in the United States.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEAXFPEFDDFFF

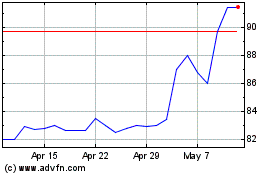

Cls (LSE:CLI)

Historical Stock Chart

From Jan 2025 to Feb 2025

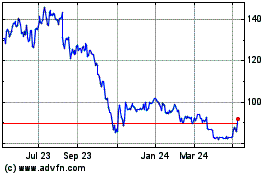

Cls (LSE:CLI)

Historical Stock Chart

From Feb 2024 to Feb 2025