Regency Mines PLC Sales and Revenues at MET (5411E)

October 19 2018 - 1:00AM

UK Regulatory

TIDMRGM

RNS Number : 5411E

Regency Mines PLC

19 October 2018

Regency Mines Plc

("Regency" or "the Company")

Sales and Revenue at MET

19 October 2018

Further to the announcement of 4 September 2018, Regency Mines

Plc, the natural resource exploration and development company with

interests in hydrocarbons and base metals, announces September

production numbers for its 47% owned associate Mining Equity Trust

(MET), LLC ("MET").

MET sold 44,020 tons of coal in September and achieved total

revenues of $1,959,036, against levels forecast on August 2018 of

59,250 tons of coal for a total revenue of $2,695,440. This

forecast had reflected the level being achieved on a daily basis in

the latter part of August 2018. For the ten month period to June

2019 MET retains its expectation of 692,196 tons of coal sales for

total revenues of $30,468,239.

MET produces metallurgical coal from its operations at

Richlands, Southwest Virginia. Cedar Bluff lies in the Central

Appalachian region in Virginia, USA, a centre of high quality coal

production. Metallurgical coal is, among other uses, an essential

ingredient in primary steel making for which there currently is no

substitute.

The Southwest Virginia coalfields produce a variety of coals

including steam, metallurgical, and industrial use coals. Steam and

metallurgical coal is generally shipped by rail and truck to power

plants and steel plants in the Eastern and Midwestern United

States. Higher value metallurgical coals are also transported by

rail to Hampton Roads, Virginia, the largest export terminal in the

US, where it is shipped to international customers.

Andrew Bell, Regency Chairman, comments: "MET faced some

maintenance and availability problems in September, and third party

sales still require to be built up to the planned levels. However

these issues have been promptly addressed and despite a planned 12

day downtime for one of the two high wall miners as it is moved to

a new location, we expect October and November sales to revert to

planned levels. Revenues per ton sold are improving and we expect

this trend to continue.

At the new location, we have the option to introduce a second

shift as demand builds. The new location also offers reduced

haulage costs to its key customers.

We also welcome the appointment of Jamie Ketron as President and

CEO of MET's operating subsidiary Omega Holdings, LLC. Her

experience as CFO at Omega and her business CV make her a highly

qualified appointment to the role.

The market for metallurgical coals continues strong."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information contact:

Andrew Bell 0207 747 9960 Chairman Regency Mines Plc

Scott Kaintz 0207 747 9960 Executive Director Regency Mines

Plc

Roland Cornish/Rosalind Hill Abrahams 0207 628 3396 NOMAD Beaumont Cornish Limited

Jason Robertson 020 7374 2212 Broker First Equity Limited

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTFKFDNKBDBNKD

(END) Dow Jones Newswires

October 19, 2018 02:00 ET (06:00 GMT)

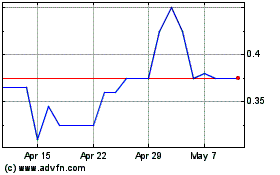

Corcel (LSE:CRCL)

Historical Stock Chart

From Apr 2024 to May 2024

Corcel (LSE:CRCL)

Historical Stock Chart

From May 2023 to May 2024