Dialog Corporation - Result of Tender Offer,etc

April 25 2000 - 5:04AM

UK Regulatory

RNS Number:5128J

Dialog Corporation PLC

25 April 2000

THE DIALOG CORPORATION ANNOUNCES 100% ACCEPTANCE

OF TENDERS AND CONSENTS FROM HOLDERS OF ITS

11% SENIOR SUBORDINATED NOTES DUE 2007

LONDON -- April 25, 2000-- The Dialog Corporation plc ("Dialog" or the

"Company") (LSE:DLG, NASDAQ:DIAL) announced today that as of 12:01a.m.

(Eastern time) on April 21, 2000, it has accepted for purchase the entire

$180,000,000 aggregate principal amount of its outstanding 11% Senior

Subordinated Notes Due 2007 (the "Notes") tendered in connection with its

previously announced tender offer and consent solicitation ("Offer").

The purpose of the Offer and Consent Solicitation is to facilitate the

Company's transformation into Bright Station plc

(http://www.brightstation.com), the new name for The Dialog Corporation,

subject to shareholder approval at the upcoming Extraordinary General

Meeting (EGM) on April 27. Bright Station's three technology-focused

divisions will include: Web Solutions (WSD), eCommerce (ECD) and the

Internet Ventures Division (IVD), an incubator for promising Internet

start-ups. Bright Station's assets and brands include InfoSort, Muscat,

WebTop, WebCheck, Sparza, OfficeShopper and the SmartLogik Knowledge

Management business.

Last week, Bright Station announced an agreement with BAA PLC which is

deploying the SmartLogik knowledge management solution on the desktops

of over 5,500 employees. Separately, Bright Station commenced a

partnership with news feed supplier Moreover.com (http://www.moreover.com)

to significantly enhance NewsZone, Webtop.com's free news database.

On March 23, 2000 Dialog announced a proposed refinancing and

restructuring of the Group through the sale of its Information

Services Division (ISD) to The Thomson Corporation (TSE: TOC), the

proceeds of which will enable the repayment of all the Group's

outstanding senior and high yield debt. Accordingly, Dialog made an

Offer to Purchase for any and all of the 11% Senior Subordinated

Notes. Under the terms of the Offer, Dialog offered to purchase

outstanding Notes at an amount, per $1,000 principal amount of Notes

tendered pursuant to the Offer, equal to $1,000 per $1,000 principal

amount, plus accrued and unpaid interest. Dialog's obligation to pay

for Notes tendered, is subject to certain conditions which are

described in the Offer to Purchase and Consent Solicitation Statement

that was sent to Noteholders.

Contact:

Dan Wagner, Chief Executive 020 7930 6900 or dan_wagner@dialog.com

US Investor Relations:

Robert Rinderman/David 001 212 835 8500 or dial@jcir.com

Collins

UK/European Investor Relations:

John Olsen/James Longfield 020 7357.9477 or jolsen@hogarthpr.co.uk

END

RTEIIFVASTIEFII

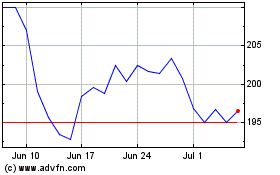

Direct Line Insurance (LSE:DLG)

Historical Stock Chart

From Jan 2025 to Feb 2025

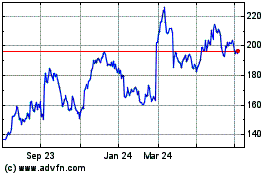

Direct Line Insurance (LSE:DLG)

Historical Stock Chart

From Feb 2024 to Feb 2025