TIDMDPLM

RNS Number : 9589D

Diploma PLC

27 June 2023

27 June 2023

Diploma PLC - CAPITAL MARKETS SEMINAR

Building high quality, scalable businesses for organic

growth

Diploma PLC, the value-add distribution group, is today hosting

a seminar setting out its strategy for building high quality,

scalable business for sustainable organic growth. The event will

give investors an opportunity to hear from members of the senior

management team who will provide practical insights into the

differentiated value-add business model; the exciting organic

growth potential; and the sustainability of the Group's long-term,

quality compounding performance delivery.

Quality compounding track record

Diploma has a long track record of delivering sustainable,

compounding financial performance:

-- Consistent, strong organic revenue growth : 5% on average for

the last 15 years, accelerating to 7% over the last three.

-- Accelerated by targeted acquisitions : driving total revenue

growth to 14% CAGR over the last 15 years, accelerating to 23% over

the last three.

-- Value-add customer propositions driving sustainably high

margins : EBIT margin averaging 18% over the last 15 years,

increasing to 19% over the last three.

-- Strong, compounding EPS growth : 15% over the last 15 years,

accelerating to 19% over the last 3.

-- Consistent, strong cash conversion : 90% free cash conversion

driving prudent balance sheet leverage.

-- Sustainable, high returns : ROATCE consistently in the high teens.

Differentiated value-add businesses

Value-add distribution is at the core of every Diploma business.

We distribute specialised products that are mission critical in our

customers' value chains; low component cost relative to their

budget; usually in their operating rather than capital budgets; and

with a 'service wrapper' of technical expertise, convenience or

customer productivity. The differentiated value-add proposition at

the heart of each of our businesses drives what we call the 'rule

of six': loyalty, and therefore share of wallet; a strong

reputation, and therefore growing market share; pricing power, and

therefore attractive margins.

Powerful, decentralised culture

Our decentralised culture is critical to successful delivery.

Our customers and value propositions, as well as our management and

performance, are all local. We believe in ownership at the front of

the organisation. We have commercial, accountable and empowered

management teams, and we support their development with leadership

programmes to equip them to manage bigger businesses. We have

excellent colleague engagement - a competitive advantage - and we

actively manage this with local initiatives to promote safe,

inclusive, and engaging environments.

Significant growth potential

Organic growth is our priority. Diploma is made up of 15 small

business units, each with significant growth potential in three

'buckets':

1. Structurally growing end-markets: our products and services

serve structurally growing end-markets, and we are increasingly

positioning towards these to provide a greater growth tailwind.

2. Penetrating core geographies: we are underpenetrated in our

core geographies of the US, Europe and the UK. We do not need to

enter tougher, risker countries to grow.

3. Extending our product capability: we do this incrementally,

and we do it more strategically too at a portfolio level to open up

new product verticals and grow our addressable market.

This strategy drives organic growth, scale and resilience. In

fragmented markets, we can accelerate organic growth with

complementary acquisitions. We have a strong track record over the

last four years, investing around GBP840m in 31 acquisitions which

are growing organically at an average of 15% and driving returns of

more than twice our cost of capital. We have an exciting pipeline

of around 50 near-term, active opportunities worth around GBP1bn.

Importantly, we are extremely disciplined and focus on businesses

with the right:

-- Core characteristics : value-add with high gross margin;

organic growth potential in one or more of our 'buckets'; and

capable management teams we can back.

-- Strategic fit : within our tightly managed portfolio.

-- Financial criteria : 20% ROATCE potential, year one for bolt-ons.

Resilience

Diploma has demonstrated resilience through systemic shocks such

as the global financial crisis and the pandemic, and this

resilience is increasing:

-- diversification in the three buckets drives revenue resilience;

-- the value-add nature of our products and services drives margin resilience; and

-- our low capital intensity drives resilient cash flows.

Scaling our decentralised Group

As we grow, we naturally need to do things differently, whilst

always preserving our value-add customer proposition and our

decentralised culture. Building effective scale is therefore key to

sustaining long-term delivery. We develop our businesses' operating

models: investing incrementally in talent, technology and

facilities to deliver their customer propositions at scale. To

manage a growing decentralised Group, we ensure that we have a

focused portfolio, governed by simple strategic and financial

frameworks. We have lean structures and dynamic leaders, and we

complement the local culture with the power of the Group - the

'Diploma identity': leadership; networks; commercial collaboration;

and best practice sharing.

Sustainable quality compounding

We believe that sustainable, quality compounding comes from a

balance of ambition with discipline, and we have encapsulated this

as our "financial model". The financial model is not a forecast, it

is there to set a level of expectations for sustainable

delivery.

We are ambitious.

-- Organic revenue growth is our first priority: model 5%.

-- Total revenue growth is accelerated by quality acquisitions: model 10%.

-- Value-add drives strong operating margins: model 17%.

-- All of this drives double digit compounding EPS growth

We are disciplined.

-- Capital-light business model drives strong cash conversion: model 90%.

-- Capital stewardship focused on strong ROATCE: model high teens.

-- Balance sheet discipline maintains prudent leverage: model < 2.0x.

-- We are committed to a progressive dividend. We have done so

for over 30 years, and we intend to grow it by 5% every year.

We have a differentiated value-add service distribution model.

It is delivered every day by brilliant people in a powerful

decentralised culture. Our strategy is clear, unchanged and

working. We have exciting growth prospects and we expect to

continue delivering sustainable quality compounding.

The event takes place today at 2:00 at the Numis Auditorium, 45

Gresham Street, London EC2V 7BF. The presentation will be streamed

live. Please register via the following link: register here

Any investors who wish to attend the event in person but have

yet to register please contact ava.jarman@teneo.com. Copies of the

presentation and a replay of the webcast will be available on the

Diploma Investor Relations website following the event.

For further information please contact:

Diploma PLC +44 (0)20 7549 5700

Johnny Thomson, Chief Executive Officer

Chris Davies, Chief Financial Officer

Kellie McAvoy, Head of Investor Relations

Teneo +44 (0)20 7353 4200

Martin Robinson

Olivia Peters

NOTE TO EDITORS:

Diploma PLC is a decentralised, value-add distribution Group.

Our businesses deliver practical and innovative solutions that keep

key industries moving - from energy and infrastructure to

healthcare.

We are a distribution group with a difference. Our businesses

have the technical expertise, specialist knowledge, and long-term

relationships required to deliver value-add products and services

that make our customers' lives easier. These value-add solutions

drive customer loyalty, market share growth and strong margins.

Our decentralised model means our specialist businesses are

agile and empowered to deliver the right solutions for their

customers, in their own way. As part of Diploma, our businesses can

also leverage the additional resources, opportunities and expertise

of a large, international and diversified Group to benefit their

customers, colleagues, suppliers and communities.

We employ c.3,000 colleagues across our three Sectors of

Controls, Seals and Life Sciences. Our principal operating

businesses are located in the UK, Northern Europe, North America

and Australia.

Over the last fifteen years, the Group has grown adjusted

earnings per share (EPS) at an average of c.15% p.a. through a

combination of organic growth and acquisitions. Diploma is a member

of the FTSE 250 with a market capitalisation of c.GBP3.9bn.

Further information on Diploma PLC can be found at

www.diplomaplc.com

The person responsible for releasing this Announcement is John

Morrison, Company Secretary.

LEI: 2138008OGI7VYG8FGR19

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFIDRSIRFIV

(END) Dow Jones Newswires

June 27, 2023 02:00 ET (06:00 GMT)

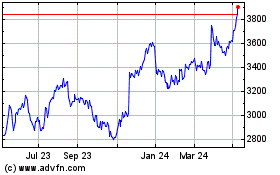

Diploma (LSE:DPLM)

Historical Stock Chart

From Mar 2024 to Apr 2024

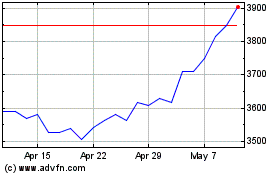

Diploma (LSE:DPLM)

Historical Stock Chart

From Apr 2023 to Apr 2024