TIDMDPLM

RNS Number : 8549F

Diploma PLC

13 July 2023

13 July 2023

Diploma PLC

DIPLOMA DELIVERS: CONTINUED STRONG PERFORMANCE

Diploma PLC, the value-add distribution group, today issues a

trading update for the nine months ended 30 June 2023.

Strong year to date performance

Performance in the first nine months has been strong, in-line

with our expectations. We continue to drive organic growth by

positioning behind structurally growing end markets, penetrating

further in core developed geographies, and extending our product

range to expand addressable markets.

During the first nine months of FY 2023:

-- Organic revenue growth 9%: broad-based, volume-led growth

across the Group. Strong growth at Controls; Seals continues to

perform well; and Life Sciences has sustained the positive momentum

of H1.

-- Strategic acquisitions: the Group has separately announced today the acquisition of DICSA, a market-leading distributor of fluid power solutions into the European Seals aftermarket for c.GBP170m. TIE, which we acquired in March for GBP76m to enter the US Industrial Automation end market, is performing well.

-- Eight bolt-on acquisitions: for a total consideration of

GBP26m, of which two have completed since H1, all at attractive

valuations.

-- Reported revenue growth 21%: net contribution of 8% from

acquisitions and disposals, and a 4% foreign exchange benefit.

-- Strong operating margin : in-line with our expectations and

demonstrating the power of our resilient, value-added model which

drives customer loyalty and pricing power

Confidence in full year outlook

The first nine months of FY 2023 have increased our confidence

in our full year guidance of ca.7% organic revenue growth; ca.7%

contribution to revenue from acquisitions net of disposals;

operating margin ca.19%; and free cash flow conversion of

ca.90%.

The acquisition of DICSA will be immediately accretive, adding

ca.5% to EPS growth during the first full year of ownership. Our

acquisition pipeline is active and we remain disciplined. We expect

year end leverage of ca.1.0x following the acquisition of DICSA and

before any future acquisition investment. We expect Group ROATCE to

remain strong, at around 18%.

Our next scheduled update will be the publication of full year

results on 20 November.

Johnny Thomson, Chief Executive Officer, and Chris Davies, Chief

Financial Officer, will host a conference call for analysts and

investors this morning at 8:00am (UK time). Conference call dial in

details:

-- Number: +44 (0) 33 0551 0200

-- Password: Diploma

For further information please contact:

Diploma PLC +44 (0)20 7549 5700

Johnny Thomson, Chief Executive

Officer

Chris Davies, Chief Financial

Officer

Kellie McAvoy, Head of Investor

Relations

Teneo +44 (0)20 7353 4200

Martin Robinson

Olivia Peters

NOTE TO EDITORS:

Diploma PLC is a decentralised, value-add distribution Group.

Our businesses deliver practical and innovative solutions that keep

key industries moving - from energy and infrastructure to

healthcare.

We are a distribution group with a difference. Our businesses

have the technical expertise, specialist knowledge, and long-term

relationships required to deliver value-add products and services

that make our customers' lives easier. These value-add solutions

drive customer loyalty, market share growth and strong margins.

Our decentralised model means our specialist businesses are

agile and empowered to deliver the right solutions for their

customers, in their own way. As part of Diploma, our businesses can

also leverage the additional resources, opportunities and expertise

of a large, international and diversified Group to benefit their

customers, colleagues, suppliers and communities.

We employ ca.3,000 colleagues across our three Sectors of

Controls, Seals and Life Sciences. Our principal operating

businesses are located in the UK, Northern Europe, North America

and Australia.

Over the last fifteen years, the Group has grown adjusted

earnings per share (EPS) at an average of c.15% p.a. through a

combination of organic growth and acquisitions. Diploma is a member

of the FTSE 250 with a market capitalisation of c.GBP4.1bn.

Further information on Diploma PLC can be found at

www.diplomaplc.com

The person responsible for releasing this Announcement is John

Morrison, Company Secretary.

LEI: 2138008OGI7VYG8FGR19

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAPXAFFXDEFA

(END) Dow Jones Newswires

July 13, 2023 02:00 ET (06:00 GMT)

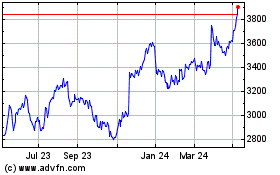

Diploma (LSE:DPLM)

Historical Stock Chart

From Mar 2024 to Apr 2024

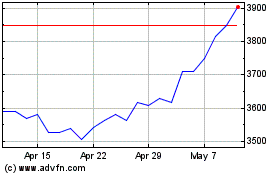

Diploma (LSE:DPLM)

Historical Stock Chart

From Apr 2023 to Apr 2024