First Property's Funds Under Management Fall on Divestment, Lower Property Values

September 27 2023 - 3:12AM

Dow Jones News

By Anthony O. Goriainoff

First Property Group said third-party funds under management

fell from March due to the sale of one property, a reduction in

property values and a weakening of the euro, the currency in which

its Romanian and Polish properties are valued.

The U.K. property investment and management group said

third-party funds as at Aug. 31 were 383 million pounds ($465.7

million), compared with GBP400 million as at March 31. The company

said it sold one property in a U.K. fund valued at GBP5.4 million

and saw reductions in property values of GBP8 million.

Total funds under management as at Aug. 31--including properties

owned by the company--were GBP436 million, compared with GBP454

million as at March 31.

Group cash as at Aug. 31 was GBP6.6 million, compared with

GBP7.65 million on March 31. The company said the reduction was

mostly due to capital expenditure incurred at a property in Warsaw

related to upgrades to the heating and cooling system, among other

items.

"The group remains vigilant to market opportunities, in

particular with respect to its new activity as a lender," Chairman

Alasdair Locke said.

Shares at 0727 GMT were down 0.25 pence, or 1.45%, at 17

pence.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

September 27, 2023 03:57 ET (07:57 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

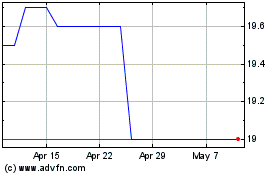

First Property (LSE:FPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

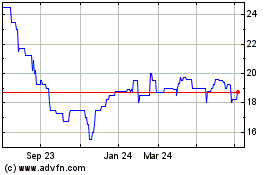

First Property (LSE:FPO)

Historical Stock Chart

From Apr 2023 to Apr 2024