TIDMGACA

RNS Number : 4183J

General Accident PLC

16 August 2023

INFORMATION FOR GENERAL ACCIDENT PLC PREFERENCE SHAREHOLDERS

GENERAL ACCIDENT PLC

Unaudited results for the six months ended 30 June 2023

These results are published for the benefit of preference

shareholders of General Accident plc (the Company) for the six

months ended 30 June 2023. The preference shares have remained

listed on the London Stock Exchange following the merger of the

Company with Commercial Union plc, in June 1998 to form CGU plc

(CGU), and the subsequent merger of CGU with Norwich Union plc in

May 2000 to form Aviva plc (formerly CGNU plc).

The Company transferred its interest in its subsidiaries to its

parent company, Aviva plc in 2005, in return for an inter-company

loan with Aviva plc. The income of the Company for the six months

to 30 June 2023 consists of interest received on this loan.

The principal risks and uncertainties facing the Company for the

remainder of the year are:

-- Credit risk: The net asset value of the Company's financial

resources is exposed to the potential default on the loan and

short-term receivables due from its parent, Aviva plc. The external

issuer credit rating of Aviva plc (representing an issuer's ability

to meet its overall financial commitments as they fall due) is

A.

-- Interest rate risk: Effective from 1 January 2023, interest

rate risk arises as the loan receivable is subject to a floating

interest rate based on the SONIA swap rate. The net asset value of

the Company's financial resources is exposed to potential

fluctuations in interest rates impacting investment income. The net

asset value of the Company's financial resources is not anticipated

to be materially affected by fluctuations in interest rates.

-- Risk of non-payment : The payment of the preference share

dividends is made in cash by the parent of the Company, Aviva plc.

If Aviva plc had insufficient cash at any time to pay the dividend

it could use its revolving credit facility with Aviva Group

Holdings (AGH), utilising AGH's cash balances.

The Company is part of the Aviva plc group (Group) and Aviva plc

owns 100% of the Company's ordinary issued share capital.

Condensed income statement Unaudited Unaudited

results results

6 months to 6 months to

30 June 30 June

2023 2022

GBPm GBPm

Investment income 223 33

----------------------------------------- ----------- -----------

Total income 223 33

Profit on ordinary activities before tax 223 33

Tax on profit on ordinary activities* - -

----------------------------------------- ----------- -----------

Profit for the period 223 33

----------------------------------------- ----------- -----------

Basic earnings per share (pence) 1.1 0.1

----------------------------------------- ----------- -----------

* Tax on investment income is GBPnil due to losses surrendered

by a fellow Group company at no charge to cover any tax liabilities

arising on the Company's profits.

Condensed statement of financial position Unaudited Audited

30 June 31 December

2023 2022

GBPm GBPm

Total assets 14,144 13,932

--------------------------------------------- --------- -----------

Equity attributable to ordinary shareholders 13,894 13,682

Preference share capital 250 250

Total equity 14,144 13,932

Liabilities - -

--------- -----------

Total equity and liabilities 14,144 13,932

--------------------------------------------- --------- -----------

Condensed statement of changes in equity Unaudited Unaudited

results results

6 months to 6 months to

30 June 30 June

2023 2022

GBPm GBPm

Total equity at 1 January 13,932 13,932

Profit for the period 223 33

------------------------------------------- ----------- -----------

Total comprehensive income for the period 223 33

Dividends (11) (11)

Total equity at 30 June 14,144 13,954

------------------------------------------- ----------- -----------

Condensed statement of cash flows Unaudited Unaudited

results results

6 months to 6 months to

30 June 30 June

2023 2022

GBPm GBPm

Cash flows from financing activities - -

----------------------------------------- ----------- -----------

Net cash from financing activities - -

----------------------------------------- ----------- -----------

Total net increase/(decrease) in cash and - -

cash equivalents

Cash and cash equivalents at 1 January - -

----------------------------------------- ----------- -----------

Cash and cash equivalents at 30 June(1) - -

----------------------------------------- ----------- -----------

(1) The closing balance as at 30 June 2023 is GBP309 (2022:

GBP9). The majority of the Company's cash requirements are met by

Aviva plc.

Basis of preparation

The results for the six months to 30 June 2023 have been

prepared on the basis of the accounting policies set out in the

Company's 2022 Annual Report and Accounts. The interim accounts do

not constitute statutory accounts as defined by section 434 of the

Companies Act 2006. The auditor has reported on the 2022 accounts

and the report was unqualified and did not contain a statement

under section 498(2) or (3) of the Companies Act 2006. The

Company's 2022 Report and Accounts have been filed with the

Registrar of Companies.

During the period, there have been no changes in the nature of

related party transactions from those described in the Company's

2022 accounts.

The results for the six months are unaudited.

The unaudited results of Aviva plc for the six months ended 30

June 2023 are available on application to the Group Company

Secretary, Aviva plc, St. Helen's, 1 Undershaft, London EC3P 3DQ. A

copy can also be found on the Aviva plc website at www.aviva.com

.

Going concern

A going concern review has been undertaken as part of the 2023

interim reporting process. After making enquires, the directors

have a reasonable expectation that the Group has adequate resources

to continue in operational existence over a period of at least

twelve months from the date of approval of the interim accounts.

For this reason, the Company continues to adopt the going concern

basis in preparing the interim accounts.

Responsibility statement

The directors confirm that these condensed interim financial

statements have been prepared in accordance with International

Accounting Standard 34, "Interim Financial Reporting", as adopted

by the UK and as issued by the IASB and that the interim management

report includes a fair review of the information required by DTR

4.2.7 and DTR 4.2.8, namely:

(1) An indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

(2) Material related party transactions in the first six months

and any material changes in the related party transactions

described in the last annual report.

K A Cooper A Dinwiddie N Harrison

Director Director Director

Enquiries:

Rupert Taylor Rea, Investor Relations Director, Aviva plc

rupert.taylorrea@aviva.com, +44 (0)7385 494 440

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDIIDBDGXU

(END) Dow Jones Newswires

August 16, 2023 03:00 ET (07:00 GMT)

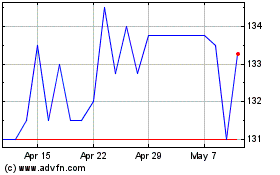

Gen.acc.8se.pf (LSE:GACA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Gen.acc.8se.pf (LSE:GACA)

Historical Stock Chart

From Nov 2023 to Nov 2024