TIDMHFD

RNS Number : 9999H

Halfords Group PLC

19 July 2012

19 July 2012

Halfords Group plc

First-Quarter FY13 Interim Management Statement

Halfords Group plc, the UK's leading retailer of automotive and

leisure products and services and leading independent operator in

garage servicing and auto repair, today updates the market on its

trading performance for the 13-week period to 29 June 2012:

TOTAL REVENUE

Halfords Group -5.2%

-------

Retail -7.8%

-------

Autocentres +14.5%

-------

LIKE-for-LIKE (LfL) REVENUE

-------

Halfords Group -5.6%

-------

Retail -7.5%

-------

Car Maintenance +1.0%

-------

Car Enhancement -10.5%

-------

Leisure -10.5%

-------

Autocentres +9.2%

-------

Key Points for the Quarter

Retail

-- A weak start to the quarter with revenue LfL of -12.4% for

the first 8 weeks followed by an improvement in the following 5

weeks (LfL: +0.9%)

-- A solid performance in Car Maintenance with 3Bs fitting

penetration at 27.0% (Q1 FY12: 22.4%) contributing to a 26.9%

growth in Retail service revenues

-- Car Enhancement remains in decline but an encouraging positive LfL performance in Car Audio

-- Cycling and other Leisure revenues materially impacted by the

unseasonal weather conditions with Cycling revenues down 9.6%

-- Good progress in online revenues (+13.0%) with the new fulfilment proposition enhancing the multi-channel offer

-- Q1 gross margins and costs in line with our expectations

Autocentres

-- Pleasing performance with further strong growth in revenue and market share

-- Tyre fitting now represents in excess of 10% of Autocentre revenues

Group

-- Further progress in delivering the long-term strategy;

encouraging feedback from the 3 "laboratory" stores

-- Group remains cash generative with a strong balance sheet

-- The Board intends to declare at the time of the half-year

results an unchanged interim dividend of 8p per share, payable in

January 2013

-- David Wild steps down as Group CEO. Dennis Millard becomes

interim Executive Chairman. Search underway for replacement CEO

(see separate announcement)

Guidance for the Full Year

Whilst still early in the year, given the uncertain trading

environment our planning assumptions now reflect continuing

negative Retail LfLs in the remainder of the first half, with

second-half Retail LfLs likely to be flat to mid-single-digit

negative. Previous guidance on Retail margins and costs and on

Autocentres' profit growth is broadly unchanged. Under these

scenarios, FY13 Group Profit Before Tax for the year would range

between GBP62m and GBP70m and healthy underlying cash flows would

continue to be generated whilst making progress implementing our

strategic priorities.

Dennis Millard, interim Executive Chairman, commented:

"The consumer environment remains difficult and the unseasonal

weather conditions this quarter had a direct impact on sales of

cycles and outdoor leisure products. In this challenging economic

environment the management team will be focused on maximising our

trading performance and cash generation, prudent cost management

and delivering the longer term strategy outlined to shareholders in

May 2012."

Notes

1. Like-for-like sales represent revenues from UK and Irish

stores trading for greater than 365 days.

2. Where appropriate, revenues denominated in foreign currencies

have been translated at constant rates of exchange.

3. The range of PBT outcomes outlined above is based upon

financial modeling of the current business and a range of revenue

assumptions. The Board is not forecasting revenues for the

remainder of the year and retains the flexibility to react to

changing trading conditions. The above range of PBT outcomes

therefore does not represent a forecast and comes before

non-recurring items.

4. The information in this announcement is sourced from unaudited management accounts.

Enquiries

Halfords +44 (0) 1527 513 113

Dennis Millard, interim Executive Chairman

Andrew Findlay, Finance Director

Craig Marks, Head of Investor Relations

Maitland +44 (0) 207 379 5151

Neil Bennett

Tom Buchanan

Conference Call

There will be a conference call for analysts at 8.00am today.

The participant dial-in is +44 (0) 0203 140 0668 or +44 (0)800 368

1950 (toll free). The PIN is 900655#.

To access a recording of the call, the participant dial-in is

+44 (0) 0203 140 0698 or +44 (0)800 368 1890 (toll free). The PIN

is 385495#.

Forthcoming Newsflow

The Halfords Group plc Annual General Meeting on 29 July 2012

will be followed by a pre-close statement for the 26-week period to

28 September 2012 on 4 October 2012. The interim results will be

published on 8 November 2012.

Notes to Editors

www.halfords.com

www.halfordscompany.com

www.halfordsautocentres.com

Halfords Group plc

The Group is the UK's leading retailer of automotive, leisure

and cycling products and through Halfords Autocentres also one of

the UK's leading independent car servicing and repair operator.

Halfords customers shop at more than 460 stores in the UK and

Republic of Ireland and at halfords.com for pick-up at their local

store or direct home delivery. Halfords Autocentres operates from

more than 260 sites nationally and offers motorists

dealership-quality MOTs, repairs and car servicing at affordable

prices.

Halfords employs approximately 12,000 staff and sells around

10,000 product lines in stores, increasing to around 16,000 lines

online. The product offering encompasses significant ranges in car

parts, cycles, in-car technology, child seats, roof boxes, outdoor

leisure and camping equipment. Halfords own brands include the

in-store Bikehut department, for cycles and cycling accessories,

Apollo and Carrera cycles and exclusive UK distribution rights of

the premium ranged Boardman cycles and accessories. In outdoor

leisure, we sell a premium range of camping equipment, branded

URBAN Escape. Halfords offers customers expert advice and a fitting

service called "Wefit" for car parts, child seats, satellite

navigation and in-car entertainment systems, and a "Werepair"

service for cycles.

Cautionary Statement

This report contains certain forward-looking statements with

respect to the financial condition, results of operations, and

businesses of Halfords Group plc. These statements and forecasts

involve risk, uncertainty and assumptions because they relate to

events and depend upon circumstances that will occur in the future.

There are a number of factors that could cause actual results or

developments to differ materially from those expressed or implied

by these forward-looking statements. These forward-looking

statements are made only as at the date of this announcement.

Nothing in this announcement should be construed as a profit

forecast. Except as required by law, Halfords Group plc has no

obligation to update the forward-looking statements or to correct

any inaccuracies therein.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSDGGDRIDBBGDI

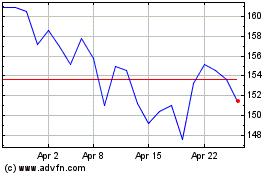

Halfords (LSE:HFD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Halfords (LSE:HFD)

Historical Stock Chart

From Jan 2024 to Jan 2025