TIDMHPAC

RNS Number : 1101Z

Hermes Pacific Investments PLC

13 December 2017

HERMES PACIFIC INVESTMENTS PLC

(AIM: HPAC)

Unaudited interim results for the six months ended 30 September

2017

Chairman's Statement

I am pleased to report the results and developments at Hermes

Pacific Investments plc ("HPAC" or the "Company") for the six

months ended 30 September 2017. During the period under review the

Company made a loss of GBP47,000 which is in line with the loss

reported for the corresponding period in the previous year. HPAC

had no revenues owing to a lack of any operating business and it

continues to manage its costs effectively while bringing the

spending to a minimum. The Company continues to seek investments

opportunities which would fit its business strategy. At the period

end the Company had net assets of GBP3,884,000 of which cash was

GBP3,774,000.

Review of the Company's activities

Hermes Pacific Investments plc is an investing company with a

focus on investing in the emerging markets of the Far East

including South East Asia. An investment can be via an acquisition

of an equity interest or direct interests in projects. it made no

investments in the six months under review.

The period under review has been influenced by the recent

unprecedented national events resulting in the devaluation of

sterling further to the outcome of the EU referendum on 23 June

2016, where the UK voters' decided to leave the European economic

zone, and the UK government commencing exit negotiations together

with the sudden, unpredicted change of the UK government. The main

impact of those changes has been a significant drop in the British

currency. The devaluation of the pound against the US dollar, which

is a preferred currency for overseas transactions, has affected

Company's investment evaluation process by making opportunities

more expensive..

Developments reflecting anti-globalisation moods have been

observed not only in Europe but also North America. The sentiment

encouraging "we are better off alone" movement can be seen through

events such as the election of populist leaders who tend to promote

isolationist policies. Since the election of Donald Trump the US

has rejected the Trans Pacific Partnership which connects East Asia

(excluding China) with the US, Canada, South America and

Australasia in a broad-spectrum trade agreement. A similar event to

the rejection by the UK of the European economic cooperation

model.

This is in contrast to Asia where the trend is reversed. The

Association of South East Asian Nations consisting of 10 Member

States recently approved the ASEAN Economic Community with free

trade and free labour movement. The company's preferred investment

targets are within these emerging economies where countries leaders

have recognised greater economic outcomes may be achieve by growing

together rather than apart. More so, over 0.5 billion people of the

Far East region experienced a drastic change in the standard of

living and increased opportunities over the past decade. The region

continues to grow faster than the rest of the world. The region's

domestic demand and consumption is bound to be driven by its

growing middle class and supported by corporate earnings and the

anticipated long period of economic growth.

Outlook

Despite the uncertainty in the global market, the Company sees

great growth potential in the higher-yielding emerging markets.

Therefore, while the Company may assess other investment

opportunities, Asia remains the focus of its investment

strategy.

I would like to thank shareholders for their continued

support.

Haresh Kanabar

Chairman

15 December 2017

Contacts:

Hermes Pacific Investments www.hermespacificinvestments.com

plc

Haresh Kanabar, Chairman +44 (0) 207 290 3340

WH Ireland Limited www.whirelandcb.com

Mike Coe, Ed Allsopp +44 (0) 117 945 3470

Unaudited Income Statement for the year ended 30 September

2017

Unaudited Unaudited

6 months 6 months Audited

ended ended Year ended

30 September 30 September 31 March

2017 2016 2017

Note GBP'000 GBP'000 GBP'000

Continuing activities

Revenue - - -

Cost of sales - - -

Gross loss/profit - - -

Other operating income - - -

Administrative expenses (50) (39) (106)

Operating loss (50) (39) (106)

Finance income 3 8 11

Finance costs - - -

Loss on ordinary activities

before taxation (47) (31) (95)

Tax expense - - -

Loss for the period from

continuing activities (47) (31) (95)

Other comprehensive income

Gain/(loss) arising in

the year 9 - 29

Loss for the period (38) (25) (66)

Basic and diluted loss

per share

From continuing operations 2 (1.6)p (1.9)p (4.0)p

Unaudited Balance Sheet as at 30 September 2017

Unaudited Unaudited

6 months 6 months Audited

ended ended Year ended

30 September 30 September 31 March

2017 2016 2017

Note GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Investments 144 112 135

144 112 135

Current assets

Trade and other receivables 5 5 1

Cash and cash equivalents 3,774 3,873 3,814

Total current assets 3,779 3,878 3,815

Total assets 3,923 3,990 3,950

Liabilities

Current liabilities

Trade and other payables (39) (27) (28)

Net assets 3,884 3,963 3,922

Equity

Share capital 2,333 2,333 2,333

Deferred share capital 1,243 1,243 1,243

Share premium account 5,781 5,781 5,781

Share based payments reserves 139 139 139

Revaluation reserve (29) (61) (38)

Retained losses (5,583) (5,472) (5,536)

Equity attributable to equity

holders of the parent 3,884 3,963 3,922

Unaudited Statement of Changes in Equity

Share

Ordinary Deferred based

share share Share payments Revaluation Retained

capital capital premium reserves reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Six months ended

30 September

2016

At 31 March 2016 2,333 1,243 5,781 139 (67) (5,441) 3,988

Total comprehensive

gain/loss for

the period - - - - 6 (31) (25)

At 30 September

2016 2,333 1,243 5,781 139 (61) (5,472) 3,963

Period ended

31 March 2017

At 30 September

2016 2,333 1,243 5,781 139 (61) (5,472) 3,963

Total comprehensive

gain/loss for

the period - - - - 23 (64) (41)

At 31 March 2017 2,333 1,243 5,781 139 (38) (5,536) 3,922

Six months ended

30 September

2017

At 31 March 2017 2,333 1,243 5,781 139 (38) (5,536) 3,922

Total comprehensive

gain/loss for

the period - - - - 9 (47) (38)

At 30 September

2017 2,333 1,243 5,781 139 (29) (5,583) 3,884

Unaudited Cash Flow Statement for the Year ended 30 September

2017

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 September 30 September 31 March

2017 2016 2017

Note GBP'000 GBP'000 GBP'000

Cash outflow from operating activities (43) (51) (113)

Net cash flow from operating activities (43) (51) (113)

Cash flows from financing activities

Other income 3 8 11

Net cash used in financing activities

- continuing operations 3 8 11

Net cash from financing activities 3 8 11

-------------- -------------- -----------

Decrease in cash and cash equivalents (40) (43) (102)

Cash and cash equivalents at start

of the period 3,814 3,916 3,916

Cash and cash equivalents at end

of the period 3,774 3,873 3,814

Notes to the unaudited consolidated interim statement for the

six months ended 30 September 2017

1. Basis of preparation

Hermes Pacific Investments Plc. is a public limited company

incorporated and domiciled in United Kingdom. The Company is an AIM

listed investment vehicle.

These Interim accounts have been prepared using the accounting

policies to be applied in the annual report and accounts for the

period ending 31 March 2018. These are consistent with those

included in the previously published annual report and accounts for

the period ended 31 March 2017, which have been prepared in

accordance with IFRS as adopted by the European Union.

The preparation of the interim statement requires management to

make judgements, estimates and assumptions that affect the

application of policies and reported amounts of assets and

liabilities, income and expenses. Actual results may differ from

these estimates.

The interim financial statements are unaudited and do not

constitute statutory accounts as defined in section 434(3) of the

Companies Act 2006.

The figures for the year ended 31 March 2017 have been extracted

from the audited annual report and accounts that have been

delivered to the Registar of Companies. BSG Valentine, the

Company's auditors, reported on those accounts. Their report was

unqualified and did not contain a statement under section 498 of

that Companies Act 2006.

2. Loss per ordinary share

Unaudited Unaudited

6 months 6 months Audited

ended ended Year ended

30 September 30 September 31 March

2017 2016 2017

GBP'000 GBP'000 GBP'000

Basic

Loss from continuing activities (25) (25) (95)

Total loss (25) (25) (95)

Basic loss per share (pence)

From continuing operations (1.07)p (1.07)p (4.0)p

(1.07)p (1.07)p (4.0)p

Weighted average number of

shares 2,333,295 2,333,295 2,333,295

There was no dilutive effect from the share options outstanding

during the period.

3. Copies of this statement will be available on the Company's

website www.hermespacificinvestments.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFIFFVLFLID

(END) Dow Jones Newswires

December 13, 2017 02:00 ET (07:00 GMT)

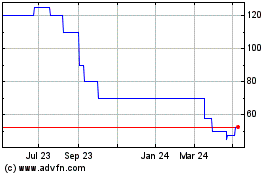

Hermes Pacific Investments (LSE:HPAC)

Historical Stock Chart

From Nov 2024 to Dec 2024

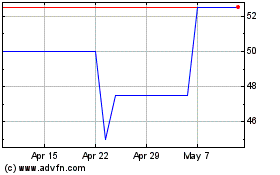

Hermes Pacific Investments (LSE:HPAC)

Historical Stock Chart

From Dec 2023 to Dec 2024