TIDMHUM

RNS Number : 5962X

Hummingbird Resources PLC

21 December 2023

Hummingbird Resources plc / Ticker: HUM / Index: AIM / Sector:

Mining

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN, IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO ANY MEMBER STATE

OF THE EUROPEAN ECONOMIC AREA, THE UNITED STATES (OR TO ANY U.S.

PERSON), CANADA, JAPAN, AUSTRALIA, THE REPUBLIC OF SOUTH AFRICA, OR

ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION

OF THE RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

ARTICLE 7 OF THE MARKET ABUSE REGULATION EU NO. 596/2014, AS

RETAINED AND APPLICABLE IN THE UK PURSUANT TO SECTION 3 OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018, UPON THE PUBLICATION OF THIS

ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN

THE PUBLIC DOMAIN.

21 December 2023

Hummingbird Resources pl c

("Hummingbird", "Group" or the "Company")

Placement Update, Open Offer & Notice of General Meeting

Further to the Company's announcement on the 7 December 2023 of

a placement of up to US$30 million, including a part conditional

investment by the Company's largest shareholder and strategic

investor CIG SA ("CIG") (the "CIG Subscription") of US$25 million,

the Company i s pleased to confirm an additional conditional

subscription of c.US$2.0 million (c.GBP1.6 million) (the "Second

Tranche Subscription") from new shareholders that includes US$1.0

million from Ernie Nutter a Non-Executive Director of the Company.

Further, the Company is offering an open offer to its existing

shareholders to raise up to c.US$5.0 million (GBP4.0 million) (the

"Open Offer").

The CIG Subscription, the Subscription (including both the First

Tranche Subscription and the Second Tranche Subscription) and the

Open Offer (together the "Placement"), assuming full take up under

the Open Offer, and all shareholder resolutions are passed to

approve the Placement, would result in total gross proceeds for the

Company of c.US$32.7 million. The Placement will be used to

accelerate the Company's growth strategy, increase exploration, and

strengthen its balance sheet to provide capital support for the

Group's operations.

The shareholder circular containing full details of the

Placement, including details of how qualifying shareholders can

participate in the Open Offer (the "Circular"), will be published

today, together with a Notice of General Meeting to be held at

13:00 GMT on 10 January 2024, setting out the shareholder approvals

required to complete the Placement, and instructions on how to

vote. The Circular and Notice of General Meeting will be sent to

Shareholders today and available on the Company's website

shortly.

Highlights of the Strategic Investment and Placement Update

& Notice of General Meeting

-- The CIG Subscription, as previously announced, of US$25

million, is made up of two investment tranches, the first of which

has completed, with the second tranche of US$20.2 million being

subject to shareholder approval (the "CIG Second Tranche

Subscription"). CIG currently holds 29.9% of the Company's issued

share capital, and assuming the full take up under the Open Offer

and completion of the Placement will hold 40.2% of the Company's

enlarged share capital.

-- The Second Tranche Subscription has conditionally raised an

additional c.US$2.0 million (c.GBP1.6 million), also subject to

shareholder approval.

-- An Open Offer to qualifying shareholders to raise up to an

additional c.US$5.0 million (GBP4.0 million), also subject to

shareholder approval. CIG, together with the participant in the

First Tranche Subscription, have agreed not to take up their

entitlement in the Open Offer.

-- All new ordinary shares issued in connection with the

Placement will be issued at a price of 11.2625 pence per new

Ordinary Share.

-- The CIG Second Tranche Subscription, the Second Tranche

Subscription and the Open Offer are subject to approval by

Shareholders at a General Meeting to be held at 13:00 GMT on 10

January 2024, the details of which are set out in the Circular, an

extract from which is detailed below. The Second Tranche

Subscription and the Open Offer are each conditional on the

approval by shareholders of the CIG Second Tranche

Subscription.

All US$:GBP amounts used in this announcement have been

calculated based on an exchange rate of US$0.7937.

Extract from the Circular - Part 1 - Letter from the Chairman

(selected paragraphs)

Introduction

On 7 December, the Company announced that it is undertaking an

equity placement of up to approximately US$30 million, subject to,

inter alia, shareholder approval, comprised of a partially

conditional US$25 million investment by CIG and up to US$5 million

from other investors. The Placement is split across two tranches

with the following confirmed figures in respect of the second

tranche:

-- A firm first tranche of US$5.5 million, made pursuant to the

2023 Authorities, which involved the issue of the CIG First Tranche

Shares (which has resulted in a CIG holding of 29.999 per cent. in

the Company, as at the Latest Practicable Date) and the First

Tranche Subscription Shares and;

-- A conditional second tranche, subject to, inter alia,

shareholder approval, of approximately US$22.2 million, which

involves the issue of the CIG Second Tranche Shares (which,

dependant on the level of acceptances under of the Open Offer will

result in CIG establishing a holding of between 40.2 per cent. and

42.0 per cent. in the Company) and the issue of the Second Tranche

Subscription Shares. As part of the Second Tranche Subscription,

Ernie Nutter, director of the Company, is conditionally subscribing

for 6,993,780 Subscription Shares.

In addition, the Company is offering Shareholders the

opportunity to subscribe for new Ordinary Shares at the Issue Price

through the Open Offer, details of which are set out in this

document.

The Issue Price is 11.2625 pence per new Ordinary Share.

CIG is subscribing for the CIG Second Tranche Shares subject to,

inter alia, the granting of a Rule 9 Panel Waiver, to be approved

by the Rule 9 Waiver Resolution, of the obligations that would

otherwise fall upon CIG pursuant to Rule 9 of The Takeover Code to

make an offer for the entire issued share capital of the Company as

a result of the potential issue of the CIG Second Tranche Shares to

CIG, which will lead to its interest in the Company increasing to

over 30 per cent, to between 40.2 per cent. and 42.0 per cent.

dependent on the level of acceptances for the Open Offer. Further

details on the Rule 9 Waiver are set out in Part 5 of this

document.

The Panel has agreed to waive the obligation on CIG to make a

general offer that would otherwise arise as referred to above,

subject to the approval by the Independent Shareholders of the Rule

9 Waiver Resolution on a poll. Conditional upon the Resolutions

being passed at the General Meeting it is expected that the Second

Tranche Subscription Shares and CIG Second Tranche Shares will be

admitted to trading on AIM on 11 January 2024.

The Open Offer provides Qualifying Shareholders (other than CIG

and the subscriber under the First Tranche Subscription) with an

opportunity to participate in the proposed issue of the new

Ordinary Shares at the Issue Price.

The Company considers it important that, where reasonably

practicable, Shareholders have an opportunity to participate in its

equity placements. To that end, the Board is providing Qualifying

Shareholders with the opportunity to subscribe for the Open Offer

Shares under the Open Offer at the Issue Price. In connection with

the Open Offer, the Company will allot (at the Board's discretion

and conditional on Admission) up to 35,516,679 Open Offer Shares

and will make an announcement in due course once the total number

of Open Offer Shares subscribed for is known. The aggregate maximum

subscription under the Open Offer is capped at GBP4 million and so

will be exempt from the requirement to publish a prospectus

pursuant to the Prospectus Rules and/or the Prospectus Regulation

Rules.

The Company has called the General Meeting inter alia in order

to put to Shareholders the resolutions required to grant (i) the

authority to issue and allot the CIG Second Tranche Shares, the

Second Tranche Subscription Shares and the Open Offer Shares and

(ii) approve the Rule 9 Panel Waiver. If the Resolutions are not

approved the issue of the CIG Second Tranche Shares, the Second

Tranche Subscription Shares and the Open Offer Shares will not

proceed and the Company will not receive any funds from the

associated issue of these new Ordinary Shares. If the Rule 9 Waiver

Resolution is not approved, but the other Resolutions are approved,

the Second Tranche Subscription and the Open Offer, which are

conditional on the completion of the CIG Second Tranche

Subscription will not proceed and the CIG Second Tranche

Subscription will not proceed.

Information on the Placement and Open Offer more generally is

set out in this Part 1 of this document.

Issue Price

The Issue Price represents approximately a 2 per cent premium to

volume weighted average price of the Ordinary Shares for the 30 day

period ending on 6 December 2023, being the last practicable day

prior to the announcement of, inter alia, the CIG Subscription.

Use Of Funds

The proceeds of the Placement and the Open Offer (assuming that

the Open Offer is fully subscribed), will be US$ 32.7 million

(approximately GBP26.0 million). The Company will allocate the net

proceeds to strengthen the balance sheet of the business and

advance multiple growth initiatives as part of the Company's growth

strategy. These initiatives encompass exploration activities at

both the Yanfolila and Kouroussa Gold Mines, as well as maximising

the value of the Dugbe Gold Project.

Hummingbird intends to utilise the proceeds of the Placement and

Open Offer as follows:

-- Exploration Activities: c.US$5 million of the funds will be

directed towards increased exploration activities at the Yanfolila

and Kouroussa Gold Mines. The Company's exploration team has

developed a comprehensive exploration plan from FY-2024 onwards,

focused on high-probability targets aimed at increasing Resources

to Reserves for the Group, thereby extending the Life of Mine at

both operating assets.

-- Dugbe Gold Project Advancement: c.US$2 million of the

proceeds will be dedicated to progressing the Dugbe Gold Project in

Liberia, bringing this highly valuable asset closer to production.

The funds will be used to optimise the 2022 Definitive Feasibility

Study through FY-2024 and further progress the Project. Hummingbird

and Pasofino Gold Limited have identified several opportunities to

maximise the value of Dugbe and reduce the overall project capex

profile, including the optimisation of power usage, improvements to

the metallurgical recovery rates and additional exploration

activities.

-- Balance Sheet Strengthening: The remainder of the proceeds

will be used to strengthen the Company's balance sheet through

deleveraging and operational initiatives. The funds will be

allocated to provide additional capital support for the Group as it

completes operational initiatives at Yanfolila including, the

Komana East Underground operation, and the ramp up of Kouroussa to

commercial production in early FY-2024, as well as supporting the

deleveraging of the balance sheet.

The New Ordinary Shares will, when issued, rank pari passu in

all respects with each other and the Existing Ordinary Shares,

including the right to receive dividends and other distributions

declared following Admission.

CIG Subscription

Pursuant to the CIG Subscription Agreement, CIG has been issued

35,057,991 CIG First Tranche Shares and has conditionally

subscribed for a further 142,522,475 CIG Second Tranche Shares,

subject to, inter alia, shareholder approval. Assuming shareholder

approval is received, CIG will be interested in a total of

334,665,274 Ordinary Shares and, dependent on the level of

acceptances under the Open Offer, will have a holding of between

40.2 per cent. and 42.0 per cent. in the Enlarged Share Capital

.

The terms of the CIG Subscription Agreement include:

-- An undertaking by CIG that it will not (save in limited

circumstances) dispose of the CIG First Tranche Shares for a period

of 12 months from the date of their admission to trading on AIM or

the CIG Second Tranche Shares for 12 months from the date of

Admission; and

-- The grant to CIG of a pre-emption right in relation to

further equity issued by the Company while it holds 20 per cent. or

more of the Ordinary Shares.

As noted in the Company's 7 February 2023 announcement, CIG is

party to a relationship agreement with the Company and the

Company's nominated adviser, Strand Hanson Limited, which imposes

certain obligations on CIG in its position as a substantial

shareholder (as defined under the AIM Rules) in the Company to

ensure that the Company will at all times be capable of carrying on

its business independently of CIG and the members of its group. The

relationship agreement remains in force for so long as CIG's

holding remains at 10 per cent. or above of the Company's issued

share capital. Under the terms of the CIG Subscription Agreement,

CIG has also agreed not to make an offer for the Company without

the recommendation of the Board, for so long as its holding is at

15 per cent. or more of the Company's issued share capital, subject

to limited exceptions.

CIG intends to finance the CIG Subscription through internal

cash resources.

Rule 9 Panel Waiver

The Company requires a waiver granted by the Takeover Panel,

pursuant to Rule 9 of the Takeover Code. The Company will also

require Independent Shareholder approval to permit the issue of the

CIG Second Tranche Shares, which would, if such new Ordinary Shares

were issued, result in an increase in CIG's shareholdings to more

than 30 per cent. and trigger a mandatory offer to Shareholders

under Rule 9. Full details of the Rule 9 Panel Waiver are set out

in Part 5 of this document.

Subscription

Certain investors have agreed to subscribe directly with the

Company for the Subscription Shares at the Issue Price pursuant to

subscription letters entered into individually with the respective

Subscribers and the Company. The First Tranche Subscription Shares

were issued at the same time as the CIG First Tranche Shares, and

it is expected, subject to Shareholder approval, that the Second

Tranche Subscription Shares will be issued at the same time as the

CIG Second Tranche Shares.

Details Of the Open Offer

Open Offer Entitlement

In recognition of their continued support to the Company, the

Company considers it important that, where reasonably practicable,

Shareholders have an opportunity to participate in its equity

placements.

The Company is providing all Qualifying Shareholders with the

opportunity to subscribe, at the Issue Price, for an aggregate

maximum of 35,515,679 Open Offer Shares, raising gross proceeds of

up to GBP4 million.

Qualifying Shareholders may apply for Open Offer Shares under

the Open Offer at the Issue Price on the following basis:

1 Open Offer Share for every 12.525 Existing Ordinary Shares

held by them and in their names rounded down to the nearest

whole number of Ordinary Shares and in proportion for any number of

Existing Ordinary Shares held on the Record Date up to their Open

Offer Entitlement. Fractional entitlements which would otherwise

arise will not be issued to the Qualifying Shareholders but will be

made available under the Excess Application Facility.

For the avoidance of doubt, "Qualifying Shareholders" excludes

CIG and the subscriber pursuant to the First Tranche

Subscription.

Excess Entitlements

The Excess Application Facility enables Qualifying Shareholders

to apply for Excess Shares in excess of their Open Offer

Entitlement. Not all Shareholders will be Qualifying Shareholders.

Shareholders who are located in, or are citizens of, or have a

registered office in certain overseas jurisdictions will not

qualify to participate in the Open Offer. The attention of Overseas

Shareholders is drawn to the section entitled "Overseas

Shareholders" below.

Valid applications by Qualifying Shareholders will be satisfied

in full up to their Open Offer Entitlements. Qualifying

Shareholders can apply for less or more than their Open Offer

Entitlements but the Company cannot guarantee that any application

for Excess Shares under the Excess Application Facility will be

satisfied as this will depend in part on the extent to which other

Qualifying Shareholders apply for less than or more than their own

Open Offer Entitlements. The Company may satisfy valid applications

for Excess Shares in whole or in part but reserves the right at its

sole discretion not to satisfy, or to scale back, applications made

in excess of Open Offer Entitlements.

Qualifying Shareholders should note that the Open Offer is not a

rights issue and therefore the Open Offer Shares which are not

applied for by Qualifying Shareholders will not be sold in the

market for the benefit of the Qualifying Shareholders who do not

apply under the Open Offer. The Application Form is not a document

of title and cannot be traded or otherwise transferred.

Application has been made for the Open Offer Entitlements and

Excess CREST Open Offer Entitlements for Qualifying CREST

Shareholders to be admitted to CREST. It is expected that the Open

Offer Entitlements and the Excess CREST Open Offer Entitlements

will be admitted to CREST as soon as reasonably practicable after

at 8.00 a.m. on 11 January 2024. Applications through the CREST

system may only be made by the Qualifying Shareholder originally

entitled or by a person entitled by virtue of a bona fide market

claim.

The Open Offer Shares must be paid in full on application. The

latest time and date for receipt of completed Application Forms or

CREST applications and payment in respect of the Open Offer is

11.00 a.m. on 9 January 2024.

Further details of the Open Offer and the terms and conditions

on which it is being made, including the procedure for application

and payment, are contained in Part 3 of this document and on the

accompanying Application Form. The Open Offer is conditional on,

inter alia, completion of the Second Tranche Subscription and the

CIG Second Tranche Subscription.

Overseas Shareholders

The attention of Qualifying Shareholders who have registered

addresses outside the United Kingdom, or who are citizens or

residents of countries other than the United Kingdom, or who are

holding Existing Ordinary Shares for the benefit of such persons,

(including, without limitation, custodians, nominees, trustees and

agents) or who have a contractual or other legal obligation to

forward this document or the Application Form to such persons, is

drawn to the information which appears in paragraph 6 of Part 3 of

this document.

In particular, Qualifying Shareholders who have registered

addresses in or who are resident in, or who are citizens of,

countries other than the UK (including without limitation the

United States of America and Canada), should consult their

professional advisers as to whether they require any governmental

or other consents or need to observe any other formalities to

enable them to take up their entitlements under the Open Offer.

General Meeting

The Notice of General Meeting is set out in Part 9 of this

document.

CIG Resolutions

The CIG Resolutions which are required in order to enable the

Company to issue and allot the CIG Second Tranche Shares and are

summarised below.

Resolution 1

Resolution 1, if passed will grant to the Directors a general

authority to allot the CIG Second Tranche Shares and will be

proposed as an ordinary resolution. To be passed an ordinary

resolution requires a simple majority of the votes cast at the

General Meeting (by Shareholders present in person or by proxy) to

be cast in its favour.

This authority, if granted by Shareholders, will expire on the

date falling 6 calendar months from the date of the passing of the

Resolution and will, unless the General Resolutions are passed, be

in addition to the 2023 Authorities.

Resolution 1 is conditional on Resolution 2 and the Rule 9

Waiver Resolution being passed at the General Meeting

Resolution 2

Resolution 2, if passed will grant to the Directors the

authority to allot the CIG Second Tranche Shares on a non

pre-emptive basis and will be proposed as a special resolution. To

be passed a special resolution requires at least three quarters of

the votes cast at the General Meeting (by Shareholders present in

person or by proxy) to be cast in favour of it.

This authority, if granted by Shareholders, will expire on the

date falling 6 calendar months from the date of the passing of the

Resolution and will, unless the General Resolutions are passed, be

in addition to the 2023 Authorities.

Resolution 2 is conditional on Resolution 1 and the Rule 9

Waiver Resolution being passed at the General Meeting

In the event that the CIG Resolutions and the Rule 9 Resolution

are not passed at the General Meeting:

a) the CIG Second Tranche Subscription will not complete;

b) the Second Tranche Subscription will not complete; and

c) the Open Offer will not complete.

Subscriptions Resolutions

Resolution 3

Resolution 3, if passed will grant to the Directors a general

authority to allot the Second Tranche Subscription Shares and will

be proposed as an ordinary resolution. To be passed an ordinary

resolution requires a simple majority of the votes cast at the

General Meeting (by Shareholders present in person or by proxy) to

be cast in its favour.

This authority, if granted by Shareholders, will expire on the

date falling 6 calendar months from the date of the passing of the

Resolution and will, unless the General Resolutions are passed, be

in addition to the 2023 Authorities and the authority granted by

Resolution 1.

Resolution 4

Resolution 4, if passed will grant to the Directors a authority

to allot the Second Tranche Subscription Shares on a non

pre-emptive basis and will be proposed as a special resolution. To

be passed a special resolution requires at least three quarters of

the votes cast at the General Meeting (by Shareholders present in

person or by proxy) to be cast in favour of it.

This authority, if granted by Shareholders, will expire on the

date falling 6 calendar months from the date of the passing of the

Resolution and will, unless the General Resolutions are passed, be

in addition to the 2023 Authorities and the authority granted by

Resolution 2.

The Subscription Resolutions are conditional on the passing of

the CIG Resolutions and the Rule 9 Waiver Resolution. In the event

that the Subscription Resolutions are not passed at the General

Meeting, the Second Tranche Subscription will not complete.

Open Offer Resolutions

Resolution 5

Resolution 5, if passed will grant to the Directors a general

authority to allot the Open Offer Shares and will be proposed as an

ordinary resolution. To be passed an ordinary resolution requires a

simple majority of the votes cast at the General Meeting (by

Shareholders present in person or by proxy) to be cast in its

favour.

This authority, if granted by Shareholders, will expire on the

date falling 6 calendar months from the date of the passing of the

Resolution and will, unless the General Resolutions are passed, be

in addition to the 2023 Authorities and the authority granted by

Resolution 1 and 3.

Resolution 6

Resolution 6, if passed will grant to the Directors an authority

to allot the Open Offer Shares on a non pre-emptive basis and will

be proposed as a special resolution. To be passed a special

resolution requires at least three quarters of the votes cast at

the General Meeting (by Shareholders present in person or by proxy)

to be cast in favour of it.

This authority, if granted by Shareholders, will expire on the

date falling 6 calendar months from the date of the passing of the

Resolution and will, unless the General Resolutions are passed, be

in addition to the 2023 Authorities and the authority granted by

Resolution 2 and 4.

The Open Offer Resolutions are conditional on the CIG

Resolutions and the Rule 9 Waiver Resolution. In the event that the

Open Offer Resolutions are not passed at the General Meeting, the

Open Offer will not complete.

General Resolutions

In addition, at the General Meeting the General Resolutions will

be proposed to refresh and replace the 2023 Authorities and are

summarised below.

Resolution 7

Resolution 7, if passed, will grant to the Directors a general

authority to allot:

a) in relation to a pre-emptive rights issue only, equity

securities (as defined by section 560 of the Act) up to a maximum

nominal amount of GBP5,550,141, which represents approximately two

thirds of the Enlarged Share Capital (assuming the full take up of

the Open Offer). This maximum is reduced by the nominal amount of

any Relevant Securities allotted under paragraph (b) below;

b) in any other case, Relevant Securities up to a maximum

nominal amount of GBP2,775,071 which represents approximately one

third of the Enlarged Share Capital (assuming the full take up of

the Open Offer). This maximum is reduced by the nominal amount of

any equity securities allotted under paragraph (a) above in excess

of GBP2,775,070.

Therefore, the maximum nominal amount of Relevant Securities

(including equity securities) which may be allotted under this

resolution is GBP5,550,141. Resolution 7 will be proposed as an

ordinary resolution. To be passed an ordinary resolution requires a

simple majority of the votes cast at the General Meeting (by

Shareholders present in person or by proxy) to be cast in its

favour.

This authority, if granted by Shareholders, will expire on the

date which is 18 months after the date on which it is passed or, if

earlier, the date of the next annual general meeting of the Company

and will, be in substitution for 2023 Authorities, but will be in

addition to the authority granted by Resolutions 1, 3 and 5.

The Directors currently intend only to make use of this

authority:

a) in connection with the grant of any options to the directors

of the Company and employees of the Company's group; and

b) as may be necessary to manage the Company's capital resources.

Resolution 7 is conditional on the passing of the CIG

Resolutions, the Subscription Resolutions and the Rule 9 Waiver

Resolution.

Resolution 8

Resolution 8, if passed, will give the Directors power, pursuant

to the authority to allot granted by Resolution 7 to allot equity

securities (as defined by section 560 of the Act) or sell treasury

shares for cash without first offering them to existing

shareholders in proportion to their existing holdings up to a

maximum nominal amount of GBP832,521 which represents approximately

10 per cent. of the Enlarged Share Capital (assuming the full take

up of the Open Offer).

Resolution 8 will be proposed as a special resolution. To be

passed a special resolution requires at least three quarters of the

votes cast at the General Meeting (by Shareholders present in

person or by proxy) to be cast in favour of it.

The directors have no immediate plans to make use of this

authority other than in those circumstances which are referred to

in the explanation relating to Resolution 7.

This authority, if granted by Shareholders, will expire and will

expire on the date which is 18 months after the date on which it is

passed or, if earlier, the date of the next annual general meeting

of the Company and will, be in substitution for 2023 Authorities,

but will be in addition to the authority granted by Resolutions 2,

4 and 6.

Resolution 8 is conditional on the passing of the CIG

Resolutions, the Subscription Resolutions, the Rule 9 Waiver

Resolution and Resolution 7.

Resolution 9

Resolution 9 is the Rule 9 Waiver Resolution and will be

proposed as an ordinary resolution for of Independent Shareholders

to approve the Rule 9 Panel Waiver. If passed it will approve the

Rule 9 Panel Waiver and (subject to the passing of the CIG

Resolutions) will allow the issue of the CIG Second Tranche Shares

to CIG without CIG being required to make a mandatory offer under

Rule 9.

Irrevocable Undertakings and Recommendation

The Directors consider the issue of the Second Tranche

Subscription Shares, the CIG Second Tranche Shares and the Open

Offer Shares to be fair and reasonable and in the best interests of

the Company as a whole and accordingly unanimously recommend that

Shareholders vote in favour of Resolutions 1 to 8 in this

regard.

The Independent Directors, who have been so advised by Strand

Hanson Limited, consider the Proposals set out in this document to

be fair and reasonable and in the best interests of the Company and

its Independent Shareholders as a whole, including in respect of

the intentions of CIG in respect of the ongoing strategy and

operation of the Group, as set out in paragraph 4 of Part 7 of this

document. In providing advice to the Independent Directors, Strand

Hanson Limited has taken into account the commercial assessment of

the Independent Directors .

Accordingly, the Independent Directors unanimously recommend

that Independent Shareholders vote in favour of the Rule 9 Waiver

Resolution (which is to be proposed as Resolution 9), as the

Independent Directors intend to do in respect of their own

beneficial holdings.

Stephen Betts, Dan Betts and Tom Hill (being the only Directors

holding Ordinary Shares as at the Last Practicable Date) and CIG,

holding, in aggregate, between them approximately 31.4 per cent. of

the Existing Ordinary Shares, have undertaken to vote in favour of

the Resolutions in respect of their respective holdings of Ordinary

Shares in the Company. For the avoidance of doubt, CIG is not able

to vote in respect of Resolution 9.

In addition, certain shareholders, holding, in aggregate,

between them approximately 2.00 per cent. of the Existing Ordinary

Shares, have indicated, without having signed an undertaking, that

they intend to vote in favour of the Resolutions.

The CIG Second Tranche Subscription is conditional on the

passing of the CIG Resolutions and the Rule 9 Waiver Resolution.

The Second Tranche Subscription is conditional on the passing of

the CIG Resolutions, Rule 9 Waiver Resolution and the Subscription

Resolutions. The Open Offer is conditional on the passing of the

CIG Resolutions, the Rule 9 Waiver Resolution and the Open Offer

Resolutions.

Extract from the Circular - Definitions

The following definitions apply throughout this document unless

the context otherwise requires:

2023 AGM the last annual general meeting of

the Company held on 29 June 2023

2023 Authorities the shareholder authorities granted

by resolutions 4 and 5 as set out

in the notice of the 2023 AGM

Act the Companies Act 2006 (as amended)

acting in concert has the meaning attributed to it

in the Takeover Code

Admission admission to trading on AIM of the

New Ordinary Shares becoming effective

in accordance with the AIM Rules

AIM the AIM market operated by the London

Stock Exchange

AIM Rules the AIM Rules for Companies published

by the London Stock Exchange from

time to time

Application Form the application form enclosed with

this document on which Qualifying

Non-CREST Shareholders may apply

for Open Offer Shares under the Open

Offer

Articles the articles of association of the

Company as at the date of this document

Board or Directors the board of directors of the Company

from time to time

borrowed or lent in the context of the Takeover Code,

includes for these purposes any financial

collateral arrangement of the kind

referred to in Note 4 on Rule 4.6

of the Takeover Code, but excludes

any borrowed shares which have either

been on-lent or sold

certificated or in certificated an Ordinary Share recorded on the

form Company's share register as being

held in certificated form (namely,

not in CREST)

Chairman the Chairman of the Board from time

to time

CIG CIG SA, an investment company registered

in the Trade and Personal Property

Credit Register of Burkina Faso with

registered number BF OUA 2019 B 2606,

and which is controlled by the same

principal as the Company's primary

lending bank

CIG Announcement RNS Number 0128W released by the

Company on 7 December 2023 relating

to, inter alia, the CIG Subscription

CIG First Tranche Shares 35,057,991 of the CIG Subscription

Shares

CIG First Tranche Subscription the unconditional subscription for

the CIG First Tranche Shares at the

Issue Price

CIG Resolutions those Resolutions numbered 1 and

2 in the Notice of General Meeting

CIG Second Tranche Shares 142,522,475 of the CIG Subscription

Shares

CIG Second Tranche Subscription the conditional subscription for

the CIG Second Tranche Shares at

the Issue Price

CIG Subscription the subscription by CIG for the CIG

Subscription Shares at the Issue

Price pursuant to the CIG Subscription

Agreement

CIG Subscription Agreement the agreement dated 6 December 2023

between the Company (1) and CIG (2)

in respect of the CIG Subscription

CIG Subscription Shares 177,580,466 new Ordinary Shares

Company Hummingbird Resources plc, a company

registered in England and Wales with

Company number 05467327

connected persons in the context of the Takeover Code,

means in relation to a Director,

those persons whose interests in

Ordinary Shares the Director would

be required to disclose pursuant

to Part 22 of the Companies Act 2006

and related regulations and includes

any spouse, civil partner, infants

(including step children), relevant

trusts and any company in which a

director holds at least 20 per cent.

of its voting capital

Coris Bank Coris Bank International (Burkina

Faso)

Coris Holdings Coris Holdings SA, a 63.61 per cent.

shareholder in Coris Bank

CREST the relevant system (as defined in

the CREST Regulations) in respect

of which Euroclear is the operator

(as defined in those regulations)

CREST Manual the rules governing the operation

of CREST, as published by Euroclear

CREST member a person who has been admitted by

Euroclear as a system-member (as

defined in the CREST Regulations)

CREST participant a person who is, in relation to CREST,

a system participant (as defined

in the CREST Regulations)

CREST member account ID the identification code or number

attached to a member account in CREST

CREST participant ID shall have the meaning given in the

CREST Manual

CREST payment shall have the meaning given in the

CREST Manual

CREST Regulations the Uncertificated Securities Regulations

2001 (S.I. 2001 No, 3755) (as amended)

CREST sponsor a CREST participant admitted to CREST

as a CREST sponsor

CREST sponsored member a CREST member admitted to CREST

as a sponsored member (which includes

all CREST Personal Members)

dealing or dealt in the context of the Takeover Code,

includes:

(a) acquiring or disposing of relevant

securities, of the right (whether

conditional or absolute) to exercise

or direct the exercise of the voting

rights attaching to relevant securities,

or of general control of relevant

securities; (b) taking, granting,

acquiring, disposing of, entering

into, closing out, terminating, exercising

(by either party) or varying an option

(including a traded option contract)

in respect of any relevant securities;

(c) subscribing or agreeing to subscribe

for relevant securities; (d) exercising

or converting, whether in respect

of new or existing relevant securities,

any securities carrying conversion

or subscription rights; (e) acquiring,

disposing of, entering into, closing

out, exercising (by either party)

of any rights under, or varying,

a derivative referenced, directly

or indirectly, to securities; (f)

entering into, terminating or varying

the terms of any agreement to purchase

or sell securities; (g) redeeming

or purchasing, or taking or exercising

an option over, any of its own relevant

securities by the offeree company

or an offeror; and (h) any other

action resulting, or which may result,

in an increase or decrease in the

number of relevant securities in

which a person is interested or in

respect of which he has a short position

derivatives include any financial product whose

value in whole or in part is determined

directly or indirectly by reference

to the price of an underlying security

Enlarged Share Capital the 832,521,218 Ordinary Shares in

issue following the issue allotment

and admission to trading of the New

Ordinary Shares, assuming full subscription

for the Open Offer Shares

Euroclear Euroclear UK & International Limited,

the operator of CREST

Excess Application Facility the arrangement pursuant to which

Qualifying Shareholders may apply

for additional Open Offer Shares

in excess of their Open Offer Entitlement

in accordance with the terms and

conditions of the Open Offer

Excess CREST Open Offer in respect of each Qualifying CREST

Entitlement Shareholder, their entitlement (in

addition to their Open Offer Entitlement)

to apply for Open Offer Shares pursuant

to the Excess Application Facility,

which is conditional on them taking

up their Open Offer Entitlement in

full

Excess Entitlement Open Offer Shares in excess of the

basic Open Offer Entitlement (but

not in excess of the total number

of Open Offer Shares)

Excess Shares Ordinary Shares applied for by Qualifying

Shareholders under the Excess Application

Facility

Ex-entitlement Date the date on which the Existing Ordinary

Shares are marked "ex" for entitlement

under the Open Offer, being 8.00

a.m. on 21 December 2024

Existing Ordinary Shares 640,495,504 Ordinary Shares in issue

as at the date of this document

FCA the Financial Conduct Authority

Financial Promotion Order the Financial Services and Markets

Act 2000 (Financial Promotion) Order

2005 (as amended)

First Tranche Subscription the unconditional subscription for

the First Tranche Subscription Shares

First Tranche Subscription 3,518,814 of the Subscription Shares

Shares

Form of Proxy the form of proxy for use in connection

with the General Meeting

FSMA the Financial Services and Markets

Act 2000 (as amended)

General Meeting the general meeting of the Company

to be held at the offices of Gowling

WLG (UK) LLP at 4 More London Riverside,

London SE1 2AN at 1:00 p.m. on 10

January 2024 , or any adjournment

thereof, notice of which is set out

at the end of this document

General Resolutions those Resolutions numbered 7 and

8 in the Notice of General Meeting

Group together the Company and its subsidiary

undertakings

Independent Directors all of the Directors, with the exception

of Ernie Nutter, who is participating

in the Second Tranche Subscription

Independent Shareholders all of the Shareholders, with the

exception of CIG

interest in the context of the Takeover Code,

a person having an interest in relevant

securities includes where a person

(a) owns securities; (b) has the

right (whether conditional or absolute)

to exercise or direct the exercise

of the voting rights attaching to

securities or has general control

of them; (c) by virtue of any agreement

to purchase, option or derivative,

has the right or option to acquire

securities or call for their delivery

or is under an obligation to take

delivery of them, whether the right,

option or obligation is conditional

or absolute and whether it is in

the money or otherwise; or (d) is

party to any derivative whose value

is determined by reference to the

prices of securities and which results,

or may result, in his having a long

position in them

Irrevocable Undertakings the irrevocable undertaking from

CIG and each of the Directors as

described in paragraph 6.1 of Part

6

ISIN International Securities Identification

Number

Issue Price 11.2625 pence per New Ordinary Share

Latest Practicable Date 20 December 2023 being the latest

practicable date prior to the publication

of this document

London Stock Exchange London Stock Exchange plc

New Ordinary Shares the Second Tranche Subscription Shares,

the CIG Second Tranche Shares and

the Open Offer Shares

Notice of General Meeting the notice of the General Meeting

set out at the end of this document

Open Offer the conditional invitation made to

Qualifying Shareholders to apply

to subscribe for Open Offer Shares

at the Issue Price on the terms and

subject to the conditions set out

in Part 3 (Terms and Conditions of

the Open Offer) of this document

and, where relevant, in the Application

Form

Open Offer Entitlement the pro rata entitlement of a Qualifying

Shareholder, pursuant to the Open

Offer, to subscribe for 1 Open Offer

Share for every 12.525 Existing Ordinary

Shares registered in their name as

at the Record Date

Open Offer Shares up to 35,515,679 new Ordinary Shares

conditionally offered to Qualifying

Shareholders pursuant to the Open

Offer

Official List the Official List of the FCA

Ordinary Shares ordinary shares of GBP0.01 each in

the capital of the Company

Overseas Shareholders Shareholders with registered addresses,

or who are citizens or residents

of, or incorporated in, countries

outside of the United Kingdom

Placement together the Subscription and the

CIG Subscription (but, for the avoidance

of doubt, excluding the Open Offer)

Qualifying CREST Shareholders Qualifying Shareholders holding Existing

Ordinary Shares in a CREST account

Qualifying Non-CREST Shareholders Qualifying Shareholders holding Existing

Ordinary Shares in certificated form

Qualifying Shareholders subject to any restrictions imposed

on Overseas Shareholders, holders

of Existing Ordinary Shares whose

names appear on the register of members

of the Company on the Record Date

as holders of Existing Ordinary Shares

and who are eligible to be offered

Open Offer Shares under the Open

Offer in accordance with the terms

and conditions set out in this document

and the Application Form and for

the avoidance of doubt the Open Offer

is not being made to (i) persons

in Restricted Jurisdictions; or (ii)

CIG; or (iii) any subscribers under

the First Tranche Subscription.

Proposals the proposals being the issue of

the Second Tranche Subscription

Shares, the CIG Second Tranche Shares

and the Open Offer Shares

Prospectus Rules the prospectus rules published by

the FCA pursuant to section 73A of

FSMA (as amended from time to time)

Prospectus Regulation EU Regulation 2017/1129 (which forms

part of UK domestic law pursuant

to the European Union (Withdrawal)

Act 2018) on the requirements for

a prospectus to be published when

securities are offered to the public

or admitted to trading

Receiving Agents Link Group, Corporate Actions, Central

Square, 29 Wellington Street, Leeds

LS1 4DL

Record Date 6.00 p.m. on 19 December 2023, being

the record date for the purposes

of the Open Offer

Registrars Link Group, Central Square, 29 Wellington

Street, Leeds LS1 4DL

Relevant Securities (a) shares in the Company other than

shares allotted pursuant to:

(i) an employee share scheme (as

defined by section 1166 of the Act);

or

(ii) a right to subscribe for shares

in the Company where the grant of

the right itself constituted a Relevant

Security; or

(iii) a right to convert securities

into shares in the Company where

the grant of the right itself constituted

a Relevant Security.

(b) any right to subscribe for or

to convert any security into shares

in the Company other than rights

to subscribe for or convert any security

into shares allotted pursuant to

an employee share scheme (as defined

by section 1166 of the Act). References

to the allotment of Relevant Securities

include the grant of such rights.

Resolutions the resolutions set out in the Notice

of General Meeting

Restricted Jurisdictions the United States of America, Australia,

Canada, Japan, the Republic of South

Africa and any other jurisdiction

where the extension or availability

of the Open Offer would breach any

applicable law

Rule 9 Rule 9 of the Takeover Code

Rule 9 Panel Waiver the waiver granted by the Takeover

Panel, subject to approval of the

Independent Shareholders, of the

obligation on CIG to make a mandatory

offer to Shareholders for the Ordinary

Shares not owned by CIG upon completion

of the issue of the CIG Second Tranche

Shares which would otherwise arise

under Rule 9

Rule 9 Waiver Resolution Resolution 9 as set out in the Notice

of General Meeting

Second Tranche Subscription 13,987,560 of the Subscription Shares

Shares

Second Tranche Subscription the conditional subscription by subscribers

other than CIG for the Second Tranche

Subscription Shares at the Issue

Price

Shareholders holders of Ordinary Shares

short position in the context of the Takeover Code,

means any short position (whether

conditional or absolute and whether

in the money or otherwise) including

any short position under a derivative,

any agreement to sell or any delivery

obligation or right to require another

person to purchase or take delivery

Subscription the direct subscription with the

Company by certain subscribers, other

than CIG, for the Subscription Shares

at the Issue Price

Subscription Shares together the First Tranche Subscription

Shares and the Second Subscription

Shares

uncertificated or uncertificated recorded on a register of securities

form maintained by Euroclear in accordance

with the CREST Regulations as being

in uncertificated form in CREST and

title to which, by virtue of the

CREST Regulations, may be transferred

by means of CREST

Takeover Code the City Code on Takeovers and Mergers

Takeover Panel the Panel on Takeovers and Mergers

UK or United Kingdom the United Kingdom of England, Scotland,

Wales and Northern Ireland

US or United States the United States of America, its

territories and possessions, any

state of the United States of America

and the District of Columbia

US Securities Act the US Securities Act of 1933 (as

amended)

VWAP volume weighted average price

GBP and p and GBP and pence the legal tender of the United Kingdom

from time to time

US$ or $ US dollars being the legal tender

of the United States from time to

time

Voting Record Time the time and date on which Shareholders

must be on the Company's register

of members in order to be able to

attend and vote at the General Meeting,

being 6.00 p.m. on 09 January 2024

Extract from the Circular - Statistics of the Placement and Open

Offer

Issue Price 11.2625 pence

Number of Existing Ordinary Shares in issue as at the date of this document 640,495,504

Percentage of Existing Ordinary Shares held by CIG as at the Latest Practicable Date 29.999 per cent.

Number of Second Tranche Subscription Shares** 13,987,560

Number of CIG Second Tranche Shares** 142,522,475

Maximum number of Open Offer Shares being offered pursuant to the Open Offer** 35,515,679

Number of New Ordinary Shares* 192,025,714

Enlarged Share Capital* 832,521,218

Market capitalisation of the Enlarged Share Capital at the Issue Price* c. GBP 93.8 million

Maximum percentage of the Enlarged Share Capital represented by the CIG Subscription Shares*** 42.0 per cent.

Percentage of the Enlarged Share Capital represented by the New Ordinary Shares** 23.1 per cent.

Maximum proceeds of the Open Offer* c. GBP 4,000,000

Estimated gross proceeds of the Placement (inclusive of the proceeds of the First Tranche c. $ 27,684,000

Subscription and the CIG First Tranche Subscription, but exclusive of any funds raised

pursuant

to the Open Offer)

ISIN of the Existing Ordinary Shares GB00B60BWY28

ISIN of the Open Offer Shares: Open Offer Entitlement GB00BP2F2566

ISIN of the Open Offer Shares: Excess CREST Open Offer Entitlement GB00BP2F2673

(*) Assuming that the Open Offer is fully subscribed

(**) Assuming that the Resolutions are passed at the General

Meeting

(***) Assuming that the Resolutions are passed at the General

Meeting and there is no uptake under the Open Offer

The exchange rate used throughout this document for converting

US dollars to pounds sterling is 0.7937

Extract from the Circular - Expected Timetable of Principal

Events

Each of the times and dates in the below is indicative only and

may be subject to change by the Company, in which event details of

the new times and dates will be notified to shareholders by

announcement through a Regulatory Information Service.

Record Date for entitlements under the Open Offer 6:00 p.m. on 19 December 2023

Voting Record Date for attendance and voting at the General 6:00 p.m. on 9 January 2024

Meeting

Publication of this Circular and (to Qualifying Non-CREST 21 December 2023

Shareholders only) the Application

Form

Ex-entitlement Date for the Open Offer 8:00 a.m. on 21 December 2023

Open Offer Entitlements and Excess CREST Open Offer As soon as practical after 8:00 pm on 22 December 2023

Entitlements credited to stock accounts

of Qualifying CREST Shareholders in CREST

Latest recommended time and date for requesting withdrawal 4:30 p.m. on 3 January 2024

of Open Offer Entitlements and

Excess CREST Open Offer Entitlements from CREST

Latest time and date for depositing Open Offer Entitlements 3.00 p.m. on 4 January 2024

and Excess CREST Open Offer Entitlements

into CREST

Latest time and date for splitting Application Forms (to 3.00 p.m. on 5 January 2024

satisfy bona fide market claims only)

Latest time and date for receipt of completed Forms of Proxy 1.00 p.m. on 8 January 2024

and receipt of electronic proxy

appointments via the CREST system

Latest time and date for receipt of the completed 11.00 a.m. on 9 January 2024

Application Form and appropriate payment

in respect of Open Offer Shares or settlement of relevant

CREST instruction

Announcement of result of Open Offer 10 January 2024

General Meeting 1.00 p.m. on 10 January 2024

Announcement of results of General Meeting 10 January 2024

Admission and commencement of dealings in the New Ordinary from 8:00 a.m. on 11 January 2024

Shares on AIM

CREST accounts expected to be credited for the New Ordinary from 8:00 a.m. on 11 January 2024

Shares

Latest date for posting of share certificates for the New by 18 January 2024

Ordinary Shares in certificated

form (if applicable)

Certain of the events in the above timetable are conditional

upon, inter alia, the approval of the Resolutions to be proposed at

the General Meeting.

All references to time and dates in this document are to time

and dates in London.

**ENDS**

Notes to Editors:

Hummingbird Resources plc (AIM: HUM) is a leading multi-asset,

multi-jurisdiction gold producing Company, member of the World Gold

Council and founding member of Single Mine Origin

(www.singlemineorigin.com). The Company currently has two core gold

projects, the operational Yanfolila Gold Mine in Mali, and the

Kouroussa Gold Mine in Guinea, which will more than double current

gold production once at commercial production. Further, the Company

has a controlling interest in the Dugbe Gold Project in Liberia

that is being developed by joint venture partners, Pasofino Gold

Limited. The final feasibility results on Dugbe showcase 2.76Moz in

Reserves and strong economics such as a 3.5-year capex payback

period once in production, and a 14-year life of mine at a low AISC

profile. Our vision is to continue to grow our asset base,

producing profitable ounces, while central to all we do being our

Environmental, Social & Governance ("ESG") policies and

practices.

For further information, please visit hummingbirdresources.co.uk or contact:

--

Daniel Betts, Hummingbird Resources Tel: +44 (0) 20 7409

CEO plc 6660

Thomas Hill,

FD

Edward Montgomery,

CD

James Spinney Strand Hanson Limited Tel: +44 (0) 20 7409

Ritchie Balmer Nominated Adviser 3494

-------------------------- ----------------------------

James Asensio Canaccord Genuity Limited Tel: +44 (0) 20 7523

Broker 8000

-------------------------- ----------------------------

Bobby Morse Buchanan Tel: +44 (0) 20 7466

Oonagh Reidy Financial PR/IR 5000

George Pope Email: HUM@buchanan.uk.com

-------------------------- ----------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAKAFASSDFEA

(END) Dow Jones Newswires

December 21, 2023 02:00 ET (07:00 GMT)

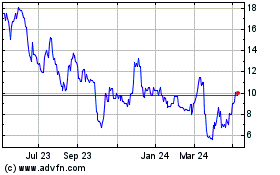

Hummingbird Resources (LSE:HUM)

Historical Stock Chart

From Apr 2024 to May 2024

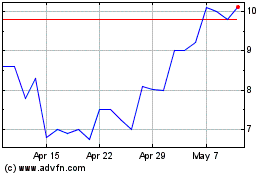

Hummingbird Resources (LSE:HUM)

Historical Stock Chart

From May 2023 to May 2024