Delta Faces New International Challenge--Update

April 12 2018 - 7:30AM

Dow Jones News

By Doug Cameron

Delta Air Lines Inc. said international travel boosted profits

in the latest quarter as the industry faces a potential shakeout of

the Trans-Atlantic market following a rival's interest in buying a

fast-growing low-cost carrier.

Buoyant demand from business travelers and a weaker U.S. dollar

have boosted international sales for airlines including Delta, the

largest U.S. operator on flights to and from Europe.

Delta has been exporting its own low-fare model from domestic

flights onto international services, in part because of competition

from Norwegian Air Shuttle A/S, a pioneer of cheap, longhaul

flights.

International Consolidated Airlines Group SA, parent of British

Airways and Iberia, said Thursday that it had built a minority

stake in Norwegian Air Shuttle ASA , one of the largest customers

of Boeing Co. 787 jets. IAG, as the company is known, counts

American Airlines Group Inc. among its partners through a

longstanding joint venture to share sales and profits.

Delta is partnered with Air France-KLM SA and Virgin Atlantic

Airways Ltd. in Europe, anchored by minority stakes of its own. A

takeover of Norwegian could threaten Delta's position in the

Trans-Atlantic market, even as the airline reported

forecast-beating quarterly earnings and record revenue.

Delta's Trans-Atlantic revenue rose 15% in the quarter to March

31 from a year earlier, outpacing growth in domestic and other

overseas markets.

Shares in Delta, the No. 2 U.S. airline by traffic, and its

rivals have in recent months been hit by investor concerns that

excess capacity could hit earnings. The shares were up 1% in

pre-open trade.

Delta said its closely watched average revenue was expected to

rise by 3% to 5% in the June quarter after climbing 5% in the three

months to March 31.

Investors monitor the rise in total revenue per available seat

mile as a sign of how well the industry is absorbing extra flying

capacity, which tends to put downward pressure on fares.

The industry is still reeling from the January announcement by

United Continental Holdings Inc. that it plans to grow capacity by

as much as 6% a year, a faster clip than Delta or larger rival

American.

Delta and other carriers have said they won't boost their own

flying plans to keep market share, but investors remain concerned

that lower fares and higher labor costs will hit profits.

Atlanta-based Delta reported profits of $547 million in the

March quarter compared with $561 million a year earlier. Per-share

earnings rose a penny to 78 cents, with the adjusted total of 74

cents beating Wall Street estimates. Revenue rose 10% to $9.97

billion, a record for the quarter.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

April 12, 2018 08:15 ET (12:15 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

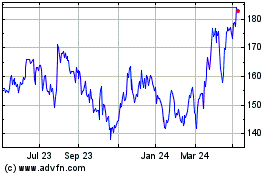

International Consolidat... (LSE:IAG)

Historical Stock Chart

From Apr 2024 to May 2024

International Consolidat... (LSE:IAG)

Historical Stock Chart

From May 2023 to May 2024