TIDMIBST

RNS Number : 0486N

Ibstock PLC

18 January 2023

18 January 2023

Ibstock plc

Trading Update for the year ended 31 December 2022

Ibstock plc ('Ibstock' or the 'Group'), a leading UK

manufacturer of clay and concrete building products and solutions,

today issues a trading update for the year ended 31 December 2022,

ahead of its full year results, due to be announced on 8 March

2023.

Q4 trading

-- Resilient performance in final quarter of the year driven

by a continued focus on price and margin management and good

operational execution

-- As expected, Q4 sales volumes reduced compared to the prior

year, across both new build and Repairs, Maintenance & Improvement

(RMI) activity

-- Disciplined cost management underpinned a solid EBITDA margin

performance

-- Completed disposal of surplus property in Sussex generated

cash proceeds of GBP8 million, further strengthening the balance

sheet

Strong financial performance in 2022

-- Full year revenues expected to increase by 25% to approximately

GBP510 million (2021: GBP409 million)

-- Adjusted EBITDA expected to be modestly ahead of our previous

expectations

-- Cash generation ahead of our previous expectations, resulting

in net debt [1] at 31 December 2022 of around GBP46 million

(December 2021: GBP39 million) after growth capital investments

of over GBP35 million and GBP30 million share buyback

Outlook

-- Growth investments at Atlas and Aldridge (wire cut factories

in the West Midlands) are on track, delivering the UK's first

net zero [2] bricks from the end of this year

-- Ibstock Futures continues to develop brick slips strategy;

initial investment of GBP8 million in 2023 in automated line

to accelerate our slips network capacity build ahead of Nostell

factory being developed

-- Whilst we continue to expect conditions in 2023 to be more

challenging than 2022, we are increasingly well positioned

to capitalise on market opportunities and remain confident

in our ability to deliver against our ambitious medium-term

financial targets

Joe Hudson, CEO of Ibstock PLC, said:

"The business delivered a resilient performance in the final

quarter of 2022, despite, as expected, lower sales volumes across

both new build and RMI markets reflecting a more cautious demand

environment . A continued disciplined focus on cost management,

alongside our dynamic commercial approach, underpinned a solid

margin performance in Q4 and resulted in adjusted EBITDA for 2022

that was modestly ahead of our previous expectations.

"The strong performance achieved in 2022 reflects the strategic

progress we have made as a business over recent years. Our balance

sheet is strong, we continue to make good progress towards our

ambitious 2030 ESG targets, and our growth investments in both the

core business and Ibstock Futures are progressing well. We are

particularly excited about the prospect of producing the UK's first

net zero(2) carbon brick at our redeveloped Atlas factory before

the end of this year.

"Whilst in the short-term we expect market conditions to be more

challenging, we remain well positioned to deliver strong growth

over the medium-term."

Trading performance

The Group delivered a resilient trading performance in the final

quarter of the year, with a continued focus on margin management

and strong operational execution. As expected, sales volumes in the

final quarter reduced compared to the comparative period. We

continued to price dynamically to recover significant cost

inflation, which, combined with disciplined management of cost,

helped ensure a solid margin performance. Revenues for the full

year were approximately GBP510 million, an increase of around 25%

compared to 2021.

Given the resilient trading performance in Q4, the Group expects

to report adjusted EBITDA for 2022 modestly ahead of its previous

expectations.

Ibstock Futures

We have continued to make good progress in developing the

Ibstock Futures business during the final quarter, with integration

of our acquired businesses progressing well and further development

of our sustainability initiatives to use existing clay reserves to

manufacture cementitious replacements.

We have also continued to develop the brick slip investment

strategy and identified opportunities to re-configure the project,

to both accelerate commissioning of an initial capacity extension,

and incorporate more advanced and efficient process technology into

the purpose built factory at Nostell. As part of this, we initiated

an investment of up to GBP8 million, in Q4 2022, on an automated

slip line, providing capacity for up to 17 million slips and coming

on stream within 12 months. At this stage, commissioning for the

main line is expected in late 2024 .

Financial position

Cash flow performance for the year was ahead of our

expectations, with closing net debt(1) of approximately GBP46

million (31 December 2021: GBP39 million), after growth capital

investments of over GBP35 million (over and above our normal

sustaining capital expenditure) and our GBP30 million share

buyback. Cash flow benefited from the strong trading performance

and a tight focus on cost and working capital management, as well

as reduced initial investment at Nostell in the year.

Closing net debt(1) also benefited from the sale of surplus land

at West Hoathly, Sussex, during the final quarter of the year, for

cash proceeds of GBP8 million. The clay factory on this site closed

as part of the 2020 restructuring programme. The profit on disposal

arising from this transaction will be treated as exceptional and

therefore outside the Group's adjusted earnings for the 2022

year.

During the final quarter of 2022, the Group agreed a buy-in

transaction for the main defined benefit pension scheme, involving

the purchase of an insurance contract with a specialist pensions

provider covering all remaining pension liabilities. This

transaction, which is expected to conclude during the 2023

financial year, represents a significant further step in removing

pensions risk from the Group's balance sheet.

During the final quarter of 2022, we also concluded a 12-month

extension to our GBP125 million Revolving Credit Facility (RCF),

extending maturity to November 2026 on similar terms to the

original agreement.

Outlook

Our balance sheet remains strong, and our growth investments in

both the core business and Ibstock Futures are progressing

well.

As we look forward, higher interest rates, inflation and

heightened market uncertainty are expected to impact the demand

picture in 2023. However, whilst in the short-term we expect market

conditions to be more challenging, we are increasingly well

positioned to capitalise on opportunities across diversified

construction markets and remain confident in our ability to deliver

against our ambitious medium-term financial targets.

- ends -

Enquiries to:

Ibstock plc

Chris McLeish, CFO 01530 261999

Citigate Dewe Rogerson 020 7638 9571

Kevin Smith

Holly Gillis

About Ibstock Plc

Ibstock plc is a leading UK manufacturer of clay and concrete

building products and solutions. Its principal products are clay

bricks, brick components, concrete roof tiles, concrete substitutes

for stone masonry, concrete fencing and pre--stressed concrete

products.

The Group's core two divisions are:

Ibstock Clay: The leading manufacturer by volume of clay bricks

sold in the United Kingdom. With 16 manufacturing sites Ibstock

Brick has the largest brick production capacity in the United

Kingdom. It operates a network of 19 active quarries located close

to its manufacturing plants. Ibstock Kevington provides masonry and

pre-fabricated component building solutions, operating from 6 sites

across the United Kingdom.

Ibstock Concrete: A leading manufacturer of concrete roofing,

walling, flooring and fencing products, along with lintels and

general concrete building products, with 14 manufacturing plants in

the United Kingdom.

Forward-looking statements

This announcement contains "forward-looking statements". These

forward-looking statements include all matters that are not

historical facts and include statements regarding the intentions,

beliefs or current expectations of the directors. By their nature,

forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances that are difficult

to predict and outside of the Group's ability to control.

Forward-looking statements are not guarantees of future performance

and the actual results of the Group's operations. Forward-looking

statements speak only as of the date of such statements and, except

as required by applicable law, the Group undertakes no obligation

to update or revise publicly any forward-looking statements.

[1] Net debt is stated on a consistent basis to prior periods,

excluding lease liabilities arising under IFRS16.

[2] Scope 1 and 2 carbon emissions

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTLDLLFXFLXBBZ

(END) Dow Jones Newswires

January 18, 2023 02:00 ET (07:00 GMT)

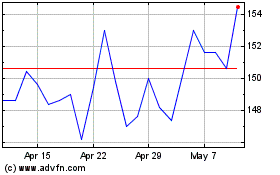

Ibstock (LSE:IBST)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ibstock (LSE:IBST)

Historical Stock Chart

From Feb 2024 to Feb 2025