Karelian Diamond Res. Fundraising and Debt Capitalisation

May 19 2023 - 1:00AM

UK Regulatory

TIDMKDR

PRIOR TO PUBLICATION, THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT WAS

DEEMED BY THE COMPANY TO CONSTITUTE INSIDE INFORMATION FOR THE PURPOSES OF

REGULATION 11 OF THE MARKET ABUSE (AMENDMENT) (EU EXIT) REGULATIONS 2019/310.

WITH THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INFORMATION IS NOW CONSIDERED

TO BE IN THE PUBLIC DOMAIN.

IN ADDITION, MARKET SOUNDINGS WERE TAKEN IN RESPECT OF CERTAIN OF THE MATTERS

CONTAINED WITHIN THIS ANNOUNCEMENT, WITH THE RESULT THAT CERTAIN PERSONS BECAME

AWARE OF INSIDE INFORMATION. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THOSE PERSONS THAT RECEIVED INSIDE INFORMATION

IN A MARKET SOUNDING ARE NO LONGER IN POSSESSION OF SUCH INSIDE INFORMATION,

WHICH IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

19 May 2023

Karelian Diamond Resources plc

("Karelian Diamonds" or the "Company")

Fundraising of £100,000, Debt Capitalisation and Related Party Transactions

HIGHLIGHTS:

* Financing of £362,500 including fundraising of £100,000, issue of

Convertible Loan for £112,500 together with Debt Capitalisation of £125,000

and Creditor Conversion of £25,000

* Fundraising, Debt Capitalisation and Creditor Conversion totalling £250,000

at 2.5 pence per share

* Convertible Loan of £112,500 issued, convertible at 5 pence per share

* Both the Debt Capitalisation and Convertible Loan agreed with Conroy Gold

and Natural Resources PLC

* Funds to be used to accelerate exploration programmes in Finland and

Ireland

Karelian Diamond Resources PLC (AIM: KDR), the diamond and base metals

exploration and development company focused on Finland and Ireland, is pleased

to announce a fundraising of £100,000 to accelerate exploration on its

exploration programmes for diamonds in the Kuhmo region of Finland, where

interpretation of geophysical data has revealed a series of kimberlite targets

(announced by the Company on 7 June 2022), and exploration for nickel, copper

and platinum group metals in Northern Ireland.

The Company has also entered into an agreement with Conroy Gold and Natural

Resources PLC ("Conroy Gold") in relation to a debt capitalisation of £125,000

and a further debt exchange into a convertible loan of £112,500, further

details of which are set out below.

FUNDRAISING SUMMARY

* Placing of 4,000,000 new ordinary shares (the "Fundraising Shares") of ?

0.00025 each ("Ordinary Shares") to raise £100,000 before expenses (the

"Fundraising").

* The Fundraising was arranged at 2.5 pence per share (the "Issue Price"),

representing a discount of 3.8 per cent. to the closing mid-market price of

2.6 pence per Ordinary Share on 18 May 2023.

* In conjunction with the Fundraising, certain parties have also capitalised

amounts owed to them totalling £25,000 through satisfaction of these

amounts by the issue of 1,000,000 new Ordinary Shares at the Issue Price

(the "Investment Shares").

* The Fundraising increases the Company's exploration capacity and

strengthens its working capital position.

* Each Fundraising Share and Investment Share carries a warrant to subscribe

for one new Ordinary Share at a price of 5 pence per ordinary Share

exercisable for a period of 18 months from Admission (as defined below),

creating 5,000,000 warrants (the "Fundraising Warrants").

* The Fundraising has been arranged by First Equity Ltd who are acting as

placing agent to the Company for the purposes of the Fundraising. First

Equity Ltd will be issued with 400,000 warrants at a price of 2.5 pence per

Ordinary Share exercisable for a period of 18 months from Admission of the

Fundraising Shares ("Broker Warrants" and, together with the Fundraising

Warrants, the "Warrants").

* If at any time during the warrant exercise period the volume-weighted

average price (VWAP) of the Ordinary Shares exceeds 7.5p for 5 trading days

then the Company may give warrant holders notice to exercise their warrants

no later than 10 days after receipt of the notice following date which the

warrant will lapse. Should all the above Fundraising Warrants be exercised

on or before 30 November 2024, this would generate an additional £250,000

of funding for the Company over and above the amount secured through this

Fundraising. There can be no guarantee that any Warrants will be exercised

in the future and that additional proceeds will be received by the Company.

DEBT CAPITALISATION BY CONROY GOLD AND NATURAL RESOURCES PLC

As set out in the Company's financial statements, the Company shares

accommodation and staff with Conroy Gold which has certain common directors and

shareholders. As at the end of the six-month period ending 30 November 2022

Conroy Gold was owed ?234,651. The Company has agreed with Conroy Gold that it

will capitalise an amount equivalent to £125,000 of this balance into 5,000,000

new Ordinary Shares at the Issue Price (the "Debt Capitalisation Shares").

Remaining outstanding amounts equivalent to £112,500 will be incorporated into

a convertible loan note (the "Loan Note") with a term of 18 months attracting

an interest rate of 5% per annum payable on the redemption or conversion of the

Loan Note. The Loan Note can be converted at the option of Conroy Gold at 5

pence per Ordinary Share, which is equivalent to the exercise price of the

Fundraising Warrants.

On Admission, Conroy Gold will be interested in 5,000,000 Ordinary Shares

equivalent to 5.29% of the enlarged issued share capital of Karelian Diamonds

on Admission.

During the year ended 31 May 2022 Conroy Gold generated a loss before taxation

of ?256,484 on ?nil turnover. Net assets of Conroy Gold as at 30 November 2022

were ?22,623,787.

WORK PROGRAMME

The additional funding raised by Karelian Diamonds will contribute to the cost

of the work programmes detailed in the Company's announcement on 24th April

2023 and specifically in relation to the commencement of further work in the

Kuhmo region of Finland exploring for diamonds and in Northern Ireland for

nickel, copper and platinum group metals.

DEBT CAPITALISATION - RELATED PARTY TRANSACTIONS

The issue to Conroy Gold of the Debt Capitalisation Shares and the Loan Note

are deemed to be related party transactions pursuant to rule 13 of the AIM

Rules for Companies.

The Independent Directors (being Seamus Fitzpatrick and Dr Sor?a Conroy)

consider, having consulted with the Company's nominated adviser, Allenby

Capital Limited, that the terms of the Debt Capitalisation and the Loan Note

are fair and reasonable insofar as Shareholders are concerned.

ADMISSION, WARRANTS AND TOTAL VOTING RIGHTS

An application will be made to admit the Fundraising Shares, the Investment

Shares and the Debt Capitalisation Shares (totalling 10,000,000 new Ordinary

Shares) to trading on the AIM market of the London Stock Exchange on or around

26 May 2023 ("Admission"). The Fundraising Shares and the Investment Shares

have been issued to a combination of mainly new investors and certain existing

shareholders and, together with the Debt Capitalisation Shares, will represent

approximately 10.58 per cent. of the enlarged issued share capital of the

Company.

The Fundraising and Debt Capitalisation has been conducted within the Company's

existing share authorities and is conditional on admission of the Fundraising

Shares, the Investment Shares and the Debt Capitalisation Shares to trading on

AIM becoming effective.

Following the Admission, the issued share capital of the Company will comprise

94,492,749 Ordinary Shares, with one voting right per Ordinary Share. The

Company does not hold any shares in treasury. Therefore, the total number of

Ordinary Shares and voting rights in the Company will be 94,492,749.

Following Admission, the above figure may be used by shareholders in the

Company as the denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their interest

in, the share capital of the Company under the FCA's Disclosure Guidance and

Transparency Rules.

Further Information:

Karelian Diamond Resources plc

Professor Richard Conroy, Chairman +353-1-479-6180

Allenby Capital Limited (Nomad)

Nick Athanas / Nick Harriss +44-20-3328-5656

First Equity Limited (Broker)

Jason Robertson +44-20-7330-1883

Lothbury Financial Services

Michael Padley +44-20-3290-0707

Hall Communications

Don Hall +353-1-660-9377

http://www.kareliandiamondresources.com

END

(END) Dow Jones Newswires

May 19, 2023 02:00 ET (06:00 GMT)

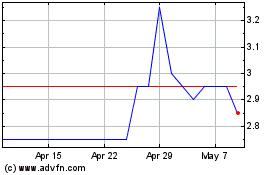

Karelian Diamond Resources (LSE:KDR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Karelian Diamond Resources (LSE:KDR)

Historical Stock Chart

From Dec 2023 to Dec 2024