TIDMKEFI

RNS Number : 3504Z

Kefi Gold and Copper PLC

14 September 2022

14 September 2022

KEFI Gold and Copper plc

("KEFI" or the "Company")

Issue of Jibal Qutman Exploration Licences

-- Two Exploration Licences issued to facilitate development of the Jibal Qutman Gold Project

-- Award of final Jibal Qutman Exploration Licence expected shortly

-- DFS for Initial 500,000 oz gold development Q1 2023, first production 2024

KEFI (AIM: KEFI), the gold and copper exploration and

development company with projects in the Federal Democratic

Republic of Ethiopia and the Kingdom of Saudi Arabia is pleased to

announce the issue of two of the three required Exploration

Licences covering the Jibal Qutman Gold Project area through the

Company's Gold and Minerals Limited ("G&M") joint venture in

Saudi Arabia. G&M is owned 30% by KEFI and 70% by its partner

Abdul Rahman Saad Al Rashid and Sons Ltd ("ARTAR").

Jibal Qutman Licences

-- 'Jibal Qutman North' and 'Jibal Qutman Southeast' Exploration

Licences ("ELs") have been issued on an initial 5-year term,

covering 174Km(2) .

-- The original and outstanding Jibal Qutman Exploration

Licence, covering an additional 99 Km(2) , is still undergoing

renewal and is expected to be granted in the coming weeks.

-- Upon its issuance, the three contiguous licences

(collectively referred to as the "JQ EL") will cover a combined

area of over 270km(2) .

-- The Definitive Feasibility Study ("DFS") for the development

is now focused on an initial production plan of c.500,000 oz gold

over a 10-year period, rather than the initial Preliminary

Feasibility Study target of c.200,000 oz gold, which was modelled

on a gold price of US$1,200/oz.

-- The JQ EL are situated on the highly prospective

'Nabitah-Tathlith' fault zone and offer additional exploration

upside beyond the known 733,000 oz JORC gold resource, with further

gold mineralisation already documented across the JQ EL.

-- Field programmes for the DFS, which includes confirmation

drilling, environmental baseline studies, geotechnical and

metallurgical drilling, are expected to commence in October 2022

following the award of the third exploration licence.

-- Project development and exploration teams dedicated to this

project have now been formed, with key elements currently

in-country preparing to re-enter the area.

-- The DFS is targeted for completion at the end of Q4

2022/early Q1 2023, depending upon the timing of the grant of the

outstanding Exploration Licence. Environmental permits are targeted

for Q1 2023.

-- A subsequent Mining Licence Application ("MLA") is expected to be resubmitted in early 2023

-- Long lead items for the proposed Jibal Qutman processing

plant are being scheduled, with the longest having an 18-month

period from purchase to commissioning.

-- Project financing in mid-2023 for Jibal Qutman is expected to

be sourced and implemented within Saudi Arabia, which has

well-developed international capital markets and a mandate to

invest in the country's mineral resources.

Broader Saudi Arabia Portfolio

-- G&M is rapidly becoming a leading

explorer/developer/producer in the fast-emerging Saudi minerals

sector following the recent overhaul of the local regulatory

system.

-- In addition to Jibal Qutman, G&M is focused on the

development of the Hawiah Copper-Gold Project, with an existing

JORC resource of 24.9Mt at 0.9% copper, 0.85% zinc, 0.62 g/t gold

and 9.81 g/t silver.

-- Exploration teams are also mobilising to the recently awarded

exploration projects, namely the Jabal Hillit and Qunnah 'Al

Qassim' exploration licences (straddling the prospective Ad

Dawadimi and Afif terranes in the eastern portion of the Arabian

Shield in Saudi Arabia), and the Jadib Al Qahtanah exploration

licence, 45km east of the Mahad Ad Dahab mine, the principal

historic Saudi gold and silver mine.

-- Going forward the Company's Saudi assets are expected to have

shorter approval, financing and development schedules given there

is no need to resettle communities, less restrictive security

protocols and established capital markets and funding options.

KEFI Production Targets & Economics

-- The successful launch of Tulu Kapi and then Jibal Qutman

within the following six months or so, should see first gold pour

for both at the end of 2024.

-- Combined initial production of the Jibal Qutman Gold and Tulu

Kapi Gold Projects is expected c.200,000 oz per annum of gold (KEFI

beneficial interest c.120,000 oz pa gold).

-- Net Operating Cash Flow (Earnings Before Interest Tax and

Depreciation less Royalties and Sustaining Capital Expenditure) at

a flat gold price of US$1,645/oz (CIBC long term consensus forecast

as at August 2022) of Tulu Kapi is estimated to average GBP74

million (US$86 million) over the following 7 years (KEFI beneficial

interest estimated at GBP52 million (US$60 million)*.We have yet to

publish updated estimates for Jibal Qutman which will further

increase these estimates.

-- These preliminary projections do not take into account any upside from the projects.

-- Ongoing drilling at the Hawiah Copper-Gold Project, KEFI's

recent Saudi discovery, is also expected to yield increased

resources and a Preliminary Feasibility Study in Q4 2022. Its

mineral resources, in gold-equivalent terms, are already

approximately those of Tulu Kapi and Jibal Qutman combined before

any further resource uplift.

-- KEFI have established development personnel and contractors

with the wherewithal to develop these 2 million tonnes per annum

gold open pit/CIL (Carbon-In-Leach) projects. These are

complimented by in-country operations designed to maximise skills

transfer and local employment.

*EBITDA is based on internal management modelling used for

preparation of the 2021 Annual Report published on 1 June 2022 and

updated for the most recent published long term consensus gold

price. These estimates will shortly be updated for Tulu Kapi for

the final model adopted for project finance. Jibal Qutman estimates

will be published with the DFS.

KEFI Executive Chairman, Harry Anagnostaras-Adams,

commented:

"The regulatory processes in Saudi Arabia continue to facilitate

fast-tracking development of the Jibal Qutman Gold Project for its

construction to commence mid-2023 and first gold at the end of

2024. Our team at G&M has mobilised in anticipation that the

third of our three Jibal Qutman licence applications will be issued

within weeks.

"As a 2 million tonnes per annum open pit/CIL gold project,

Jibal Qutman is similar to Tulu Kapi in Ethiopia. The estimated

KEFI beneficial interest in the combined EBITDA of the Tulu Kapi

Gold project Gold project is GBP52 million per annum ($60 million

per annum) from 2025. That does not reflect any estimates for Jibal

Qutman or our larger expectations for Tulu Kapi, such as

anticipated resource growth of both open pit operations, the

underground at Tulu Kapi, the satellite prospects at both projects

and, of course, our Hawiah Copper-Gold discovery, the 2021 reported

resources of which already approximated those of the other two

projects combined (in gold-equivalent terms)."

Jibal Qutman Project Background

Geology and Exploration

As announced on 3 August 2022, the land access issues which have

delayed the start of the 733,000 oz Jibal Qutman Gold Project have

been resolved. As part of this process, it has been agreed that an

area of over 270Km2 is to be granted, covering the original Jibal

Qutman Exploration Licence, plus a significant land package along

strike to the north and south (see Figure 1 in the appendix

accessible via the following link:

http://www.rns-pdf.londonstockexchange.com/rns/3504Z_1-2022-9-13.pdf).

The maximum Exploration Licence size permitted under the 2020

updated Saudi mining law are typically 100Km(2) , as such, three

licences are required to cover the complete exploration area. Two

of these licences, covering the northern and southern extensions of

the Jibal Qutman gold system have now been issued and collectively

cover an area of 174Km(2) .

These two new ELs cover the north and south strike extension of

the Jibal Qutman gold system, which is part of the highly

prospective Nabitah-Tathlith Fault Zone that runs north-south

across much of the Arabian Shield.

Ancient and more modern artisanal mining excavations are known

to exist within the licence areas and the G&M exploration team

is confident of its ability to significantly expand the existing

Jibal Qutman resource base. Thirteen grab samples of mine dumps in

the Jibal Qutman Southeast EL taken by G&M in 2014, returned

grades of up to 66.5 g/t gold, averaging 10.5 g/t gold across all

13 samples. Ancient mining appears to have targeted quartz veins

with dump material presenting as quartz with strongly banded

sulphides (see Figure 2 in the attached appendix) - these veins

have not yet been identified in outcrop, as the area is

predominantly covered by alluvial/aeonian sands and gravels.

However, the quantity of dump material and the extent of more

recent artisanal mining are encouraging signs of significant,

sub-cropping continuation of the Jibal Qutman gold system. Grab

samples within the Jibal Qutman North EL area have returned gold

grades of up to 4.1 g/t gold, also associated with quartz

veining.

G&M exploration within the Jibal Qutman EL prior to 2016

focused on the 'Main Zone' trend, which presents as quartz veins

hosted within deformed volcanics and sediments. Shortly before the

end of this exploration phase, a second mineralised structure was

identified hosted within ultramafics on the eastern part of the

Jibal Qutman EL. This structure known as the 'Red Hill trend' is

yet to be fully explored and is open both along strike and at depth

within the Jibal Qutman resource area. Regional mapping has also

identified this structure within the adjoining Jibal Qutman North

and Southeast ELs, although at this stage it is untested.

Jibal Qutman DFS

Progress on the DFS continues, with Front End Engineering and

Design (FEED), plant layout and reserve definition nearing

completion. Metallurgical testing continues and preliminary

geotechnical design parameters have been agreed.

Whilst much of the DFS is being completed remotely, access to

the field is required to establish the baseline as part of the

Environmental and Social Impact Assessment (ESIA) and complete the

final geotechnical evaluation of the proposed reserve pits. This

cannot be completed until the final Jibal Qutman EL has been

issued, which may result in a delay to the final completion of the

study. However, at this stage, G&M believes the project is

still on track to proceed with financing and Mining Licence

submission in early 2023.

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Enquiries

KEFI Gold and Copper plc

Harry Anagnostaras-Adams (Managing Director) +357 99457843

John Leach (Finance Director) +357 99208130

SP Angel Corporate Finance LLP (Nominated

Adviser) +44 (0) 20 3470 0470

Jeff Keating, Adam Cowl

Tavira Securities Limited (Lead Broker) +44 (0) 20 7100 5100

Oliver Stansfield, Jonathan Evans

WH Ireland Limited (Joint Broker) +44 (0) 20 7220 1666

Katy Mitchell, Andrew de Andrade

IFC Advisory Ltd (Financial PR and IR) +44 (0) 20 3934 6630

Tim Metcalfe, Florence Chandler

Competent Person Statement

The information in this announcement that relates to geology,

exploration results and mineral resources is based on information

compiled by Mr Tomos Bryan, Exploration Manager for Gold &

Minerals Limited. Mr Bryan is a member of the Australasian

Institute of Mining and Metallurgy ("AusIMM"). Mr Bryan is a

geologist with sufficient relevant experience for Company reporting

to qualify as a Competent Person as defined in the JORC Code 2012.

Mr Bryan consents to the inclusion in this announcement of the

non-financial matters based on this information in the form and

context in which it appears.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBKNBDFBKDOCD

(END) Dow Jones Newswires

September 14, 2022 02:01 ET (06:01 GMT)

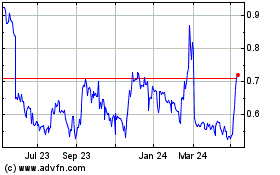

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Nov 2024 to Dec 2024

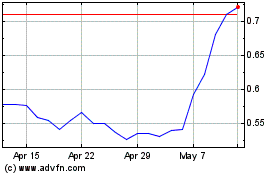

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Dec 2023 to Dec 2024