TIDMBILB

RNS Number : 1188T

Bilby PLC

24 March 2016

Bilby Plc ("Bilby" or the "Group")

Acquisitions of DCB and Spokemead

Placing to raise GBP5.0 million

Bilby, the holding company for gas heating, electrical and

building services companies, is pleased to announce the acquisition

of DCB (Kent) Limited for a maximum consideration of GBP4.0

million. DCB provides high quality building, refurbishment and

maintenance services to housing associations and local authorities

throughout Kent, Sussex, Essex and London. DCB also provides

disabled adaptations to occupied homes and public buildings through

a specialist division, Living Solutions, which was founded in

2001.

Bilby is also pleased to announce the acquisition of Spokemead

Maintenance Limited for a maximum consideration of GBP8.7 million.

Spokemead provides electrical installation, repairs and maintenance

services to local authority owned housing stock and has been the

principal contractor for a major London borough for the electrical

installation, repairs and maintenance for some 25 years winning

three successive five year contracts.

The acquisitions mark important further progress in Bilby's buy

and build strategy, which targets complementary businesses

servicing housing associations and local authorities in London and

the South East. The Group sees increasing opportunity in these

markets driven by government legislation such as the Right to

Repair and the Decent Homes Standard.

DCB and Spokemead will expand the range of services that Bilby

offers, as well as broadening its customer base and geographical

reach in London and the South East. DCB and Spokemead will continue

to operate under their respective brands and will also benefit from

the increased purchasing power and strong financial position of the

Enlarged Group.

The cash consideration for the Acquisitions is being financed by

a placing of 4,237,288 new Ordinary Shares to new and existing

institutional investors to raise GBP5.0 million (before expenses)

and debt funding by way on an extension of existing debt facilities

provided by HSBC Bank plc.

Commenting on the acquisition, Phil Copolo, Deputy Executive

Chairman of Bilby, said: "We are very pleased to announce the

acquisitions of DCB and Spokemead, two successful businesses that

will further enhance the Group's offer and reach. With their strong

management, both businesses have long-established reputations for

delivering high levels of service. Furthermore these acquisitions

will further enhance Bilby's ability to tender for larger-scale

contracts."

Enquiries

Bilby Plc 020 8269 3777

Phil Copolo, Executive Deputy Chairman

David Ellingham, Managing and Business Development Director

Katherine O'Reilly, Finance Director

Panmure Gordon (UK) Limited 020 7886 2500

(Nominated Adviser and Broker)

Dominic Morley

Charles Leigh-Pemberton

James Greenwood

Hudson Sandler 020 7796 4133

(Financial PR)

Charlie Jack

Emily Dillon

This Announcement should be read in its entirety. In particular,

you should read and understand the information provided in the

"Important Notices" section of this Announcement.

IMPORTANT NOTICES

This Announcement may contain and the Company may make verbal

statements containing "forward-looking statements" with respect to

certain of the Company's plans and its current goals and

expectations relating to its future financial condition,

performance, strategic initiatives, objectives and results.

Forward-looking statements sometimes use words such as "aim",

"anticipate", "target", "expect", "estimate", "intend", "plan",

"goal", "believe", "seek", "may", "could", "outlook" or other words

of similar meaning. By their nature, all forward-looking statements

involve risk and uncertainty because they relate to future events

and circumstances which are beyond the control of the Company,

including amongst other things, United Kingdom domestic and global

economic business conditions, market-related risks such as

fluctuations in interest rates and exchange rates, the policies and

actions of governmental and regulatory authorities, the effect of

competition, inflation, deflation, the timing effect and other

uncertainties of future acquisitions or combinations within

relevant industries, the effect of tax and other legislation and

other regulations in the jurisdictions in which the Company and its

respective affiliates operate, the effect of volatility in the

equity, capital and credit markets on the Company's profitability

and ability to access capital and credit, a decline in the

Company's credit ratings; the effect of operational risks; and the

loss of key personnel. As a result, the actual future financial

condition, performance and results of the Company may differ

materially from the plans, goals and expectations set forth in any

forward-looking statements. Any forward-looking statements made in

this Announcement by or on behalf of the Company speak only as of

the date they are made. Except as required by applicable law or

regulation, the Company expressly disclaims any obligation or

undertaking to publish any updates or revisions to any

forward-looking statements contained in this Announcement to

reflect any changes in the Company's expectations with regard

thereto or any changes in events, conditions or circumstances on

which any such statement is based.

Panmure Gordon is authorised and regulated by the Financial

Conduct Authority (the "FCA") in the United Kingdom and is acting

exclusively for the Company and no one else in connection with the

Placing, and Panmure Gordon will not be responsible to anyone

(including any Placees) other than the Company for providing the

protections afforded to its clients or for providing advice in

relation to the Placing or any other matters referred to in this

Announcement.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by Panmure Gordon or by any of its

affiliates or agents as to, or in relation to, the accuracy or

completeness of this Announcement or any other written or oral

information made available to or publicly available to any

interested party or its advisers, and any liability therefore is

expressly disclaimed.

THIS ANNOUNCEMENT IS RESTRICTED AND IS NOT FOR RELEASE,

PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR

INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES, AUSTRALIA,

CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA, NEW ZEALAND OR ANY

OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR

DISTRIBUTION WOULD BE UNLAWFUL. THIS ANNOUNCEMENT HAS NOT BEEN

APPROVED BY THE LONDON STOCK EXCHANGE, NOR IS IT INTENDED THAT IT

WILL BE SO APPROVED.

MEMBERS OF THE PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN THE

PLACING. THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS

DIRECTED ONLY AT: (A) PERSONS IN MEMBER STATES OF THE EUROPEAN

ECONOMIC AREA ("EEA") WHO ARE QUALIFIED INVESTORS AS DEFINED IN

SECTION 86(7) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000, AS

AMENDED ("QUALIFIED INVESTORS"), BEING PERSONS FALLING WITHIN THE

MEANING OF ARTICLE 2(1)(e) OF DIRECTIVE 2003/71/EC AS AMENDED,

INCLUDING BY THE 2010 PROSPECTUS DIRECTIVE AMENDING DIRECTIVE

(DIRECTIVE 2010/73/EC) AND TO THE EXTENT IMPLEMENTED IN THE

RELEVANT MEMBER STATE (THE "PROSPECTUS DIRECTIVE"); AND (B) IN THE

UNITED KINGDOM, QUALIFIED INVESTORS WHO ARE PERSONS WHO (I) HAVE

PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS FALLING

WITHIN ARTICLE 19(5) (INVESTMENT PROFESSIONALS) OF THE FINANCIAL

SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005, AS

AMENDED (THE "ORDER"); (II) ARE PERSONS FALLING WITHIN ARTICLE

49(2)(A) TO (D) (HIGH NET WORTH COMPANIES, UNINCORPORATED

ASSOCIATIONS, ETC.) OF THE ORDER; OR (III) ARE PERSONS TO WHOM IT

MAY OTHERWISE BE LAWFULLY COMMUNICATED (ALL SUCH PERSONS TOGETHER

BEING REFERRED TO AS "RELEVANT PERSONS").

THIS ANNOUNCEMENT AND THE INFORMATION IN IT MUST NOT BE ACTED ON

OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS. PERSONS

DISTRIBUTING THIS ANNOUNCEMENT MUST SATISFY THEMSELVES THAT IT IS

LAWFUL TO DO SO. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH

THIS ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO RELEVANT PERSONS AND

WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS. THIS ANNOUNCEMENT

DOES NOT ITSELF CONSTITUTE AN OFFER FOR SALE OR SUBSCRIPTION OF ANY

SECURITIES IN THE COMPANY.

THIS ANNOUNCEMENT IS NOT AN OFFER OF SECURITIES FOR SALE INTO

THE UNITED STATES. THE PLACING SHARES HAVE NOT BEEN AND WILL NOT BE

REGISTERED UNDER THE UNITED STATES SECURITIES ACT 1933, AS AMENDED

(THE "SECURITIES ACT") OR WITH ANY SECURITIES REGULATORY AUTHORITY

OF ANY STATE OR JURISDICTION OF THE UNITED STATES, AND MAY NOT BE

OFFERED, SOLD OR TRANSFERRED, DIRECTLY OR INDIRECTLY, IN THE UNITED

STATES EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION

NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT

AND IN COMPLIANCE WITH ANY APPLICABLE SECURITIES LAWS OF ANY STATE

OR OTHER JURISDICTION OF THE UNITED STATES. THE PLACING SHARES ARE

BEING OFFERED AND SOLD ONLY OUTSIDE THE UNITED STATES IN "OFFSHORE

TRANSACTIONS" WITHIN THE MEANING OF, AND IN ACCORDANCE WITH,

REGULATION S UNDER THE SECURITIES ACT AND OTHERWISE IN ACCORDANCE

WITH APPLICABLE LAWS. NO PUBLIC OFFERING OF THE PLACING SHARES IS

BEING MADE IN THE UNITED STATES, THE UNITED KINGDOM OR ELSEWHERE.

NO MONEY, SECURITIES OR OTHER CONSIDERATION FROM ANY PERSON INSIDE

THE UNITED STATES IS BEING SOLICITED AND, IF SENT IN RESPONSE TO

THE INFORMATION CONTAINED IN THIS ANNOUNCEMENT, WILL NOT BE

ACCEPTED.

(MORE TO FOLLOW) Dow Jones Newswires

March 24, 2016 03:00 ET (07:00 GMT)

EACH PLACEE SHOULD CONSULT WITH ITS OWN TAX ADVISERS AS TO

LEGAL, TAX, BUSINESS AND RELATED ASPECTS OF AN INVESTMENT IN

PLACING SHARES. THE DISTRIBUTION OF THIS ANNOUNCEMENT, ANY PART OF

IT OR ANY INFORMATION CONTAINED IN IT MAY BE RESTRICTED BY LAW IN

CERTAIN JURISDICTIONS, AND ANY PERSON INTO WHOSE POSSESSION THIS

ANNOUNCEMENT, ANY PART OF IT OR ANY INFORMATION CONTAINED IN IT

COMES SHOULD INFORM THEMSELVES ABOUT, AND OBSERVE, SUCH

RESTRICTIONS.

No action has been taken by the Company, Panmure Gordon or any

of their respective affiliates, agents, directors, officers or

employees that would permit an offer of the Placing Shares or

possession or distribution of this Announcement or any other

offering or publicity material relating to such Placing Shares in

any jurisdiction where action for that purpose is required.

This Announcement or any part of it does not constitute or form

part of any offer to issue or sell, or the solicitation of an offer

to acquire, purchase or subscribe for, any securities in the United

States (including its territories and possessions, any state of the

United States and the District of Columbia), Canada, Australia, the

Republic of South Africa, New Zealand, Japan or any other

jurisdiction in which the same would be unlawful. No public

offering of the Placing Shares is being made in any such

jurisdiction.

All offers of the Placing Shares will be made pursuant to an

exemption under the Prospectus Directive from the requirement to

produce a prospectus. In the United Kingdom, this Announcement is

being directed solely at persons in circumstances in which section

21(1) of the Financial Services and Markets Act 2000 (as amended)

(the "FSMA") does not apply.

The Placing Shares have not been approved or disapproved by the

US Securities and Exchange Commission, any state securities

commission or other regulatory authority in the United States, nor

have any of the foregoing authorities passed upon or endorsed the

merits of the Placing or the accuracy or adequacy of this

Announcement. Any representation to the contrary is a criminal

offence in the United States. The relevant clearances have not

been, nor will they be, obtained from the securities commission of

any province or territory of Canada or the Financial Markets

Authority of New Zealand, no prospectus has been lodged with, or

registered by, the Australian Securities and Investments Commission

or the Japanese Ministry of Finance; the relevant clearances have

not been, and will not be, obtained for the South Africa Reserve

Bank or any other applicable body in the Republic of South Africa

in relation to the Placing Shares and the Placing Shares have not

been, nor will they be, registered under or offering in compliance

with the securities laws of any state, province or territory of

Australia, Canada, Japan or the Republic of South Africa.

Accordingly, the Placing Shares may not (unless an exemption under

the relevant securities laws is applicable) be offered, sold,

resold or delivered, directly or indirectly, in or into Australia,

Canada, Japan, New Zealand or the Republic of South Africa or any

other jurisdiction outside the United Kingdom.

Persons (including, without limitation, nominees and trustees)

who have a contractual right or other legal obligations to forward

a copy of this Announcement should seek appropriate advice before

taking any action.

Bilby Plc ("Bilby" or the "Group")

Acquisitions of DCB and Spokemead

Placing to raise GBP5.0 million

Introduction

Bilby Plc (AIM: BILB.L), the holding company for P&R

Installation Company Limited ("P&R") and Purdy Contracts

Limited ("Purdy"), has today announced that it has conditionally

agreed to acquire the entire issued share capital of DCB (Kent)

Limited ("DCB") for a maximum consideration of GBP4 million and

Spokemead Maintenance Limited ("Spokemead") for a maximum

consideration of GBP8.7 million.

Bilby was established to provide a platform for strategic

acquisitions in the gas heating, electrical and building services

industries. Bilby remains focused on acquiring complementary

businesses that expand the range of services it offers and that

broaden its customer base and geographical reach in London and

South East England.

Background to and reasons for the Proposed Placing and

Acquisitions

Bilby, the holding company for P&R and Purdy, was

established to provide a platform for strategic acquisitions in the

gas heating, electrical and building services industries. All

potential acquisition targets must meet focused acquisition

criteria based around service synergies, revenue size, geographic

focus, management team, margins, cash flows and forward order

book.

Bilby's first acquisition was P&R in March 2015, an

established and award winning provider of gas heating appliance

installation and maintenance services. Purdy was acquired in July

2015 and provides gas maintenance installation and building

maintenance services to housing associations predominantly within

South East London.

The acquisitions of DCB and Spokemead are a significant further

step in Bilby's growth strategy, as the Group continues to expand

through targeted complementary acquisitions. DCB and Spokemead will

expand the range of services that Bilby offers, as well as

broadening its customer base and geographical reach in London and

the South East. DCB and Spokemead will continue to operate under

their respective brands and will also benefit from the increased

purchasing power and strong financial position of the Enlarged

Group. The proposed Acquisitions will also create further

opportunities for collaboration and selling of a wider and more

comprehensive range of services to Bilby's local authority and

housing association customers.

Both of the proposed Acquisitions are immediately earnings

enhancing. This statement is not intended to be a profit forecast

and should not be interpreted to mean that the earnings per

Ordinary Share for the current or future financial periods will

necessarily be greater than those for the relevant preceding

financial period.

Acquisitions

DCB (Kent) Limited

DCB was founded in 1998 and has grown revenues significantly in

recent years to become one of the leading independent contractors

in the South East, employing approximately 100 directly employed

staff. DCB has three office locations in Kent and East Sussex.

DCB provides high quality building, refurbishment and

maintenance services to housing associations and local authorities

throughout Kent, Sussex, Essex and London. DCB also provides

disabled adaptations to occupied homes and public buildings through

a specialist division, Living Solutions, which was founded in

2001.

DCB provides services to housing associations and local

authorities such as AmicusHorizon, London Borough of Bexley,

Canterbury City Council, Tunbridge Wells Borough Council, Oxleas

NHS Foundation Trust, The Guinness Partnership and Eldon Housing

Association. Additionally, DCB has recently been re-awarded the

AmicusHorizon kitchens and bathrooms refurbishment contract for a

further 5 years with the potential for a further 5 year extension

at the client's option and, as part of a tendering process through

the South East Consortium, were also nominated as the preferred

contractor for East Kent Housing (for both Canterbury City Council

and Thanet District Council) for a 6 year term with the potential

for a further 5 year extension at the council's option. The current

management team will continue to manage and operate DCB within the

Bilby Group.

DCB reported revenues for the year ended 31 March 2015 of

GBP18.45 million (2014: GBP12.17 million) and adjusted(1) profit

before taxation of GBP339,356 (2014: GBP525,512). DCB had net

assets at 31 March 2015 of GBP557,691 (2014: GBP522,258).

(1) adjusted for non-recurring costs of GBP173,820 (2014:

GBP147,000) which will not be incurred post acquisition

Spokemead Maintenance Limited

The business which now comprises Spokemead has been established

for over 35 years with offices in St. Albans and South London and

has access to a skilled workforce of 30 fully qualified

electricians. Spokemead provides electrical installation, repairs

and maintenance services to local authority owned housing stock and

has been the principal contractor for a major London borough for

the electrical installation, repairs and maintenance for some 25

years winning three successive five year contracts. The current

management team will continue to manage and operate Spokemead

within the Bilby Group.

Spokemead reported revenues for the year ended 30 June 2015 of

GBP4.84 million (2014: GBP3.74 million) and profit before taxation

of GBP1.94 million (2014: GBP1.49 million). Spokemead had net

assets at 31 June 2015 of GBP2.28 million.

Acquisitions

The Company has entered into separate acquisition agreements in

relation to the sale and purchase of the entire issued share

capital of DCB and Spokemead as set out below.

DCB (Kent) Limited

Under the terms of the DCB Acquisition Agreement, Bilby has

agreed to acquire the entire issued share capital of DCB (Kent)

Limited for an aggregate maximum consideration of GBP4.0

million.

The consideration payable on Completion will be satisfied by the

payment by Bilby of GBP1.5 million in cash and the issue of 423,729

Initial Consideration Shares (with a value of GBP500,000 at the

Placing Price). Application will be made to the London Stock

Exchange for the Initial Consideration Shares to be admitted to

trading on AIM. It is expected that admission of the Initial

Consideration Shares, which will rank pari passu in all respects

with the Existing Ordinary Shares, will occur at 8.00 a.m. on 12

April 2016. The Initial Consideration Shares are subject to a

lock-in agreement until 13 April 2017.

Further consideration of up to GBP2.0 million shall be paid

subject to DCB achieving the performance targets over the three

years ending 31 March 2018 as detailed below:

(MORE TO FOLLOW) Dow Jones Newswires

March 24, 2016 03:00 ET (07:00 GMT)

-- In respect of the year ending 31 March 2016, subject to DCB

achieving a minimum adjusted profit before taxation of at least

GBP650,000, Bilby will pay an additional consideration of GBP1.0

million, of which GBP500,000 will be paid in cash and GBP500,000

through the issue of Additional Consideration Shares. If DCB does

not achieve a minimum adjusted profit before taxation of at least

GBP650,000 in the year ending 31 March 2016, then the aggregate

consideration above shall be subject to a reduction of GBP1 for

every GBP0.50 that the adjusted profit before taxation is less than

GBP650,000;

-- In respect of the year ending 31 March 2017, Bilby will pay

an additional consideration of an amount (if any) equal to 25 per

cent. of the amount by which DCB's turnover for the year ending 31

March 2017 exceeds GBP20 million (subject to a maximum of GBP22

million). Such payment (if any) shall be made 75 per cent. in cash

and 25 per cent. in Additional Consideration Shares;

-- In respect of the year ending 31 March 2018, Bilby will pay

an additional consideration of an amount (if any) equal to 25 per

cent. of the amount by which DCB's turnover for the year ending 31

March 2018 exceeds GBP21 million (subject to a maximum of GBP23

million). Such payment (if any) shall be made 75 per cent. in cash

and 25 per cent. in Additional Consideration Shares;

-- Any Additional Consideration Shares to be issued shall be

valued at the average closing mid-market quotation for an Ordinary

Share on AIM for the 20 Trading Days immediately preceding the date

of their issue;

-- Any Additional Consideration Shares are subject to a lock-in

agreement for 6 months from date of issue; and

-- Bilby reserves the right to satisfy all or part of the

Additional Consideration SharesUPDATE FC in cash.

Completion is conditional upon (i) the Resolutions being passed,

(ii) the Placing Agreement (a) having become unconditional in all

respects save as to the conditions relating to Admission, and (b)

not having been terminated prior to Admission, and (iii)

Admission.

Restrictive covenants preventing the DCB Vendors from competing

with DCB's business and customary warranties have been provided by

the DCB Vendors in the DCB Acquisition Agreement.

Spokemead Maintenance Limited

Under the terms of the Spokemead Acquisition Agreement, Bilby

has agreed to acquire the entire issued share capital of Spokemead

Maintenance Limited for a maximum consideration of GBP8.7

million.

The consideration payable will be satisfied on Completion by the

payment by Bilby of initial cash consideration of GBP5.7 million

and the issue of 423,729 Initial Consideration Shares (with a value

of GBP500,000 at the Placing Price). The Initial Consideration

Shares are subject to a lock-in agreement until 13 April 2017.

GBP2.7 million of the consideration is dependent on Spokemead

having minimum net assets of GBP2.7 million at Completion.

Further conditional deferred consideration of up to GBP2.5

million shall be paid subject to Spokemead achieving the following

performance targets as detailed below:

-- Up to GBP1.0 million in cash subject to Spokemead achieving a

minimum adjusted profit before taxation of GBP1.1 million for the

year ending 30 June 2016. To the extent the adjusted profits are

less than GBP1.1 million, the deferred cash consideration shall be

reduced on a pound for pound basis by an amount to equal to any

such shortfall;

-- Up to GBP1.0 million in Additional Consideration Shares

subject to Spokemead achieving a minimum adjusted profit before

taxation of GBP1.6 million for the year ending 30 June 2017. To the

extent the adjusted profits are less than GBP1.6 million, the value

of the Additional Consideration Shares issued shall be reduced on a

pound for pound basis by an amount to equal to any such

shortfall;

-- A further cash payment of GBP500,000 to be paid on the

renewal or continuation of certain of Spokemead's key contractual

arrangements in 2018/2019;

-- Any Additional Consideration Shares to be issued shall be

valued at the average closing mid-market quotation for an Ordinary

Share on AIM for 20 Trading Days immediately preceding the date of

their issue;

-- Any Additional Consideration Shares are subject to a lock-in

agreement for 6 months from date of issue; and

-- Bilby reserves the right to satisfy all or part of the

Additional Consideration Shares in cash.

Completion is conditional upon (i) the Resolutions being passed,

(ii) the Placing Agreement (a) having become unconditional in all

respects save as to the conditions relating to Admission, and (b)

not having been terminated prior to Admission, and (iii)

Admission.

Restrictive covenants preventing the Spokemead Vendors from

competing with Spokemead's business and customary warranties have

been provided by the Spokemead Vendors in the Spokemead Acquisition

Agreement.

Details of the Placing

Panmure Gordon has placed 4,237,288 Placing Shares at the

Placing Price with certain institutional and other shareholders as

agent for the Company, raising gross proceeds of GBP5.0 million.

The Placing Price of 118 pence per share represents a discount of

approximately 2.9 per cent. to the closing middle market price of

121.5 pence per Ordinary Share on 23 March 2016, being the last

practicable date prior to the publication of this document. The

Placing Shares will represent approximately 10.8 per cent. of the

issued share capital on Admission.

The Placing is conditional upon, inter alia, the Resolutions

being passed at the General Meeting and Admission becoming

effective on or before 8.00 a.m. on 12 April 2016 (or such later

time and/or date as the Company and Panmure Gordon may agree, but

in any event no later than 8.00 a.m. on 26 April 2016).

Panmure Gordon may terminate the Placing Agreement in specified

circumstances, including for material breach of warranty at any

time prior to Admission, in the event of force majeure at any time

prior to Admission or on the material breach of certain other

obligations under the Placing Agreement.

Miton Asset Management ("Miton") is a related party of the

Company as defined by the AIM Rules for Companies by virtue of its

status as a substantial shareholder. Miton has agreed to subscribe

for 2,300,000 Placing Shares as part of the Placing, conditional on

Admission. The Directors consider, having consulted with the

Company's nominated adviser, Panmure Gordon, that the terms of the

Placing are fair and reasonable insofar as the Company's

shareholders are concerned.

Settlement and Dealings

Application will be made to the London Stock Exchange for the

Placing Shares and the Initial Consideration Shares to be admitted

to trading on AIM. It is expected that Admission of the Placing

Shares and the Initial Consideration Shares will occur at 8.00 a.m.

on 12 April 2016. The Placing Shares and the Initial Consideration

Shares will rank pari passu in all respects with the Existing

Ordinary Shares.

Current trading and prospects

Since 30 September 2015, both P&R and Purdy have continued

to strengthen their trading bases. This has included significant

contract wins with London Borough of Hackney, Royal Borough of

Greenwich, Hyde Housing Association and London Borough of Camden as

well as contract extensions with existing long term clients such as

Hexagon Housing Association and Central & Cecil Housing

Trust.

In November 2015 P&R achieved first place on a significant

framework tender process for gas support work for the South East

Consortium ("SEC"), a consortium of housing associations

responsible for giving access to over 140,000 properties in South

East England. The framework period is four years, with members

awarding contracts to their chosen providers starting in 2016 and

which are able to run for a period of up to seven years.

Additionally, Purdy was awarded second supplier of choice by SEC

for electrical services.

Bilby has submitted a proposal, as part of the procurement

process, for a framework agreement with Fusion21, a social

enterprise that provides leading procurement and regeneration

services to public sector organisations, large scale organisations

and the third sector, with a view to qualifying for Fusion21's

framework. A decision regarding the framework agreement is expected

shortly.

The Directors expect that the results for Bilby for the year

ending 31 March 2016 will be in line with market expectations.

General Meeting

A General Meeting of the Company will be held at the offices of

Hudson Sandler Limited, 29 Cloth Fair, London, EC1A 7NN at 11.00

a.m. on 11 April 2016.

The Directors currently do not have sufficient authority to

allot shares under the Act to effect the Placing. Accordingly the

Resolutions are being proposed at the General Meeting to ensure

that the Directors have sufficient authority to allot the Placing

Shares on a non-pre-emptive basis.

Recommendation and undertaking

The Directors consider that the Acquisitions and the Placing are

in the best interests of the Company and its Shareholders as a

whole. Accordingly, the Directors unanimously recommend that you

vote in favour of the Resolutions as each member of the Board has

irrevocably undertaken to do in respect of their beneficial

holdings and those of their connected parties amounting, in

aggregate, to 18,072,758 Ordinary Shares, representing

approximately 52.8 per cent. of the Existing Ordinary Shares of the

Company.

Expected Timetable of Principal Events

General Meeting 11.00 a.m. on 11 April 2016

Admission of the Placing Shares 8.00 a.m. on 12 April 2016

and the Initial Consideration

Shares to trading on AIM

CREST accounts to be credited 12 April 2016

in respect of the Placing Shares

in uncertificated form

Completion of the Acquisitions on or around 12 April 2016

Dispatch of share certificates Within 14 days of Admission

in respect of Placing Shares

to be issued in certificated

form

Definitions

(MORE TO FOLLOW) Dow Jones Newswires

March 24, 2016 03:00 ET (07:00 GMT)

The following definitions have been used in this

announcement:

"Acquisitions" the proposed acquisition of the entire

issued share capital of DCB and Spokemead

and "Acquisition" shall be construed

accordingly;

"Act" the Companies Act 2006 (as amended);

"Additional Consideration the new Ordinary Shares (if any) to be

Shares" allotted fully paid to the DCB Vendors

and/or the Spokemead Vendors on satisfaction

of certain performance targets;

"Admission" the admission of the Placing Shares and

the Initial Consideration Shares to trading

on AIM becoming effective in accordance

with the AIM Rules;

"AIM" the AIM market operated by the London

Stock Exchange;

"AIM Rules" the AIM Rules for Companies published

by the London Stock Exchange, as in force

at the date of this document;

"Company" or "Bilby" Bilby plc;

"Completion" completion of the Acquisitions in accordance

with their terms;

"CREST" the electronic system for the paperless

settlement of share transfers and the

holding of shares in uncertified form

administered and operated by Euroclear;

"DCB" DCB (Kent) Limited;

"DCB Acquisition Agreement" the sale and purchase agreement dated

24 March 2016 entered into between the

DCB Vendors and the Company relating

to the acquisition of DCB;

"DCB Vendors" Caroline Webster and Christopher Webster;

"Directors" or the the board of directors of the Company;

"Board"

"Enlarged Group" or the Group as enlarged by the Acquisitions;

"Bilby Group"

"Euroclear" Euroclear UK & Ireland Limited, the operator

of CREST;

"Existing Ordinary 34,247,845 existing Ordinary Shares in

Shares" issue at the date of this document;

"General Meeting" the general meeting of the Company convened

for 11.00 a.m. on 11 April 2016 (or any

reconvened meeting following any adjournment

thereof), notice of which is set out

at the end of this document;

"Group" the Company and its subsidiary undertakings;

"Initial Consideration the 847,458 new Ordinary Shares to be

Shares" allotted fully paid to the DCB Vendors

and the Spokemead Vendors on Completion;

"London Stock Exchange" London Stock Exchange plc;

"Ordinary Shares" ordinary shares of 10 pence each in the

Company;

"Panmure Gordon" Panmure Gordon (UK) Limited;

"Placees" the subscribers for Placing Shares pursuant

to the Placing;

"Placing" the proposed conditional placing of the

Placing Shares by Panmure Gordon as agent

for and on behalf of the Company at the

Placing Price on the terms of the Placing

Agreement;

"Placing Agreement" the conditional agreement dated 24 March

2016 entered into between the Company

and Panmure Gordon in connection with

the Placing;

"Placing Price" 118 pence per Placing Share;

"Placing Shares" the 4,237,288 new Ordinary Shares to

be conditionally placed for cash pursuant

to the Placing Agreement;

"Shareholders" holders of Ordinary Shares

"Spokemead" Spokemead Maintenance Limited;

"Spokemead Acquisition the sale and purchase agreement dated

Agreement" 24 March 2016 entered into between the

Spokemead Vendors and the Company relating

to the acquisition of Spokemead;

"Spokemead Vendors" Deborah Rooney and Neil Rooney;

"Trading Day" any day on which Ordinary Shares are

traded on AIM;

"United States" the United States of America, each state

thereof, its territories and possessions,

and all areas subject to its jurisdiction;

and

"Vendors" together the DCB Vendors and Spokemead

Vendors.

All references in this document to "GBP" or "p" are to the

lawful currency of the United Kingdom.

Words in the singular shall include the plural and in the plural

shall include the singular.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLLFVAVAIVFIR

(END) Dow Jones Newswires

March 24, 2016 03:00 ET (07:00 GMT)

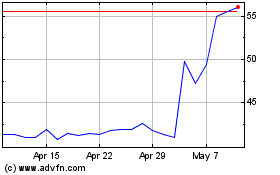

Kinovo (LSE:KINO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kinovo (LSE:KINO)

Historical Stock Chart

From Jul 2023 to Jul 2024