TIDMKP2

RNS Number : 9135U

Kore Potash PLC

31 March 2023

31 March 2023

Kore Potash Plc

("Kore Potash" or the "Company")

("Group" refers to Kore Potash Plc and its subsidiaries)

Financial Results for Year Ended 31 December 2022

Kore Potash, the potash development company with 97%-ownership

of the Kola and DX Potash Projects in the Sintoukola Basin, located

within the Republic of Congo ("RoC"), today reports its audited

financial results and operational highlights for the year ended 31

December 2022 (the "Period").

The full financial report including its Corporate Governance

Statement is available online at the Company's website at

https://korepotash.com/wp-content/uploads/2023/03/Kore_Potash_plc_Annual_Report_2022.pdf

The financial statements contained within this announcement should

be read in conjunction with the notes contained within the full

financial report.

Highlights

-- On 1 April 2022, the Company announced it had received the

Optimisation Study on the Kola Project.

-- The detailed review of the Study was completed, and the

outcomes of the Study announced to shareholders on 27 June

2022.

-- On 28 June 2022, the Company announced it had signed a Head

of Agreement ("HoA") for the construction of Kola.

-- On 19 October 2022, the Company announced receipt of

correspondence from the Minister of Mines of the RoC on 12 October

2022 expressing discontent with the progress towards construction

of the Kola Project and providing the Company 30 days within which

to respond. The letter was received following the arrest and

subsequent release, without charge, of two senior employees of the

Company by the RoC police. Neither the employees nor the Company

have been informed of the reason for the arrests.

-- The Company provided a response to the Minister on 11

November 2022. On 17 December 2022, the Company met in person with

the Minister, and the discussion included a further update on the

progress towards financing Kola. At the end of the meeting the

Minister expressed his thanks for how the Company responded to his

most recent letter and assured the Company of his and the RoC

Government's ongoing support for Kore Potash and to develop the

Kola Project.

-- Since this time the Company has held multiple meetings with

the Minister of Mines and is assured that the Company has and will

continue to have his full support and that the Company's tenements

in the RoC remain in good standing.

-- Subsequent to the end of the period on the 24 January 2023,

the Company announced the updated Dougou Extension PFS and

Production Target.

Brad Sampson, Chief Executive of Kore Potash, commented: "During

2022, the Company continued to make tangible progress towards the

financing of the Kola Project.

Engagement with the Summit Consortium following the successful

completion of the Optimisation Study is progressing towards

finalisation of construction contract terms and the provision of

financing for the full construction cost of the Kola Project.

Global events continue to reinforce the importance of potash in

the production of food and the need for the development of new

potash projects outside the traditional northern hemisphere potash

production regions.

Our potash projects stand out globally. With very high in situ

quality, significant resources and a beneficial location, we

believe the Sintoukola Basin is one of the most promising

undeveloped potash regions in the world. It has the potential to

produce Muriate of Potash needed by farmers around the world for

generations."

Summary of financials

-- During the Period, the Group's Total Comprehensive Loss was

USD 10,174,361 (2021: Loss USD 13,470,876), and the Group

experienced net cash outflows from operating and investing

activities of USD 5,744,285 (2021: USD 7,499,811 million). Cash and

cash equivalents totalled USD 5,046,629 as at 31 December 2022

(2021: USD 11,092,509).

-- Group net assets decreased in the year to USD 167,650,279

(2021: USD 1 77,419,886 ). This was primarily driven by a USD

5,064,934 increase in exploration expenditure capitalised offset by

a USD 8,949,642 reduction in the capitalised exploration costs due

to the strengthening of the USD against the currency of the

RoC.

-- The Directors prepared a cash flow forecast for the period

ending 31 December 2024, which indicates that the Group will not

have sufficient liquidity to meet its working capital requirements

to the end of the going concern period (March 2024). Note 1 of the

financial statements provides more detail on the going concern

statement.

-- The company will be required to raise funds before Q4 2023 in

order to meet its current planned activities over the next 12

months. The Directors have considered various mitigating actions ,

which include raising additional capital to enable the Group to

continue to fund its working capital requirements. The Directors

have identified a number of potential funding options available to

the Group.

Kola Potash Project

-- The Company signed a non-binding Memorandum of Understanding

with Summit, on behalf of a consortium of investors and engineering

firms on 6 April 2021, to arrange the total financing required for

the construction of Kola, in the presence of the Minister of Mines

of the RoC and his key staff in Brazzaville.

-- The Summit Consortium includes:

o BRP Global, headquartered in Abu Dhabi, who will provide

royalty financing in conjunction with product offtake.

o SEPCO Electric Power Construction Corporation ("SEPCO") , an

international engineering and construction group headquartered in

Jinan, China and with offices in Dubai which is a wholly owned

subsidiary of Power Construction Corporation of China ("Power

China"). SEPCO will be the Engineering Procurement and Construction

("EPC") contractor for Kola within the Summit Consortium. SEPCO has

significant construction experience globally across a range of

industries, including power, oil and gas chemical, energy-reduction

and environmental protection and infrastructure projects. SEPCO has

completed major construction projects in 25 countries, including 44

EPC contracts in 11 countries with seven of these in Africa, in

addition to its construction capability, SEPCO will also assist in

arranging the debt financing: and

o China ENFI Engineering Corporation ("ENFI"), subcontracted by

SEPCO and headquartered in Beijing, is a significant engineering

group with specific mining, processing, and potash experience. ENFI

is a mining technology leader in China and has provided technical

services for the design and construction of more than 400 mining

operations around the world. ENFI's potash specific experience

includes design and construction of an underground potash mine in

southeast Asia.

-- During the period, the Summit Consortium completed the

Optimisation Study with the successful outcomes:

o Capital cost reduced by USD 520 million to USD 1.83 billion on

an EPC basis compared to the Definitive Feasibility Study ("DFS")

capital cost of USD 2.35 billion on an equivalent EPC basis.

o Construction period reduced to 40 months from the DFS

construction period of 46 months.

o Key financial metrics improved on DFS outcomes (at potash

pricing averaging USD 360/tonne unchanged from the DFS):

-- Kola NPV(10) post tax improved to USD 1.623 billion

-- IRR improved to 20% on ungeared post tax basis

o At a potash price of USD 1000/t Muriate of Potash ("MoP") CFR

Brazil (less than potash price of approximately USD 1100/t MoP CFR

Brazil when announced in June 2022) the Kola financial metrics

improve to:

-- NPV(10) post tax USD 9.354 billion

-- IRR of 49% on ungeared post tax basis

o Designed with a nameplate production capacity of 2.2Mtpa of

MoP.

o MoP production scheduled over an initial 31 year project

life.

o Designed as a conventional mechanised underground potash mine

with shallow shaft access. Ore from underground is transported to

the process plant via an overland conveyor approximately 25 km

long. After processing, the MoP product is conveyor transported 11

km to the marine export facility. MoP is conveyed from the storage

area onto barges via the dedicated barge loading jetty and then

trans-shipped into ocean going vessels for export.

-- On 28 June 2022, Kore Potash signed a HoA for the

construction in the presence of the Minister of State and Minister

of Mining Industry and Geology of the RoC, Mr Pierre Oba.

The HoA confirms the timeline for SEPCO to complete their

discussions with Kore Potash ahead of presenting the Company an EPC

contract proposal for Kola. It also provides additional clarity on

matters that SEPCO are required to finalise in advance of

presenting Kore Potash with the construction contract proposal.

The HoA provides for:

o Kola to be designed and constructed as a conventional

underground potash mine and processing plant producing up to 2.2

Mtpa of granular MoP over an initial 31 year life.

o The granular MoP produced will be at a minimum quality of

95.3% KCI in line with international standards.

o The capital cost to construct will be USD 1.83 billion and the

construction period will be 40 months.

o During the preconstruction engineering design phase, the HoA

provides SEPCO with an opportunity to adjust the costs related to

the underground mine portion of the works. SEPCO's current capital

cost is based in part upon information collected during the DFS

Study phase, some of which SEPCO continues to review. Should the

final agreed quantities of materials and labour or the underground

construction period differ materially from the baseline, SEPCO will

be able to adjust proportionately. The underground portion of the

works (excluding equipment and infrastructure) is currently

estimated as USD 164 million, which represents 9% of the total

capital cost.

o SEPCO will also be able to adjust the capital cost if the

Chinese RMB or Congolese FCFA currency exchange rates to the US

dollar vary materially prior to commencement of the works. In such

circumstance only the cost of affected works or components may be

adjusted.

-- On 10 October 2022, Kore Potash announced that SEPCO had

delivered the EPC proposal for Kola. The EPC proposal was approved

for presentation to Kore Potash by the Boards of SEPCO, and its

parent company, Power China.

The EPC proposal reflects the capital cost and construction

timeline reported in the Optimisation Study and the terms agreed to

in the HoA. The EPC proposal includes an EPC Agreement which

details the contractual terms in a format congruent with the FIDIC

Silver book (2nd Edition, 2017) conditions of contract.

The contractual terms are being finalised prior to acceptance of

the EPC. Kore Potash and SEPCO are in dialogue to complete this

process. The Company notes that it may transpire that SEPCO will

require further SEPCO and Power China Board approvals prior to the

finalisation of the contractual terms.

DX DFS

-- Subsequent to the Period, the Company released its update on

the DX PFS and Production Target on 24 January 2023.The Company

reported the following highlights:

o Production Target of 15.5Mt sylvinite at a grade of 30.63 %

KCl demonstrates initial project life of 12 years at a production

rate of 400,000 tpa MoP.

o Production Target based on Proven and Probable Ore Reserves

and 13% of the Inferred Mineral Resources that represents 30% of

the life of project MoP production.

o NPV(10) (real) of USD 275 million and 27% IRR on a real post

tax basis at life of project average granular MoP price of USD

450/t.

o Approximately 2.9 years post-tax payback period from first

production.

o Proven and Probable Ore Reserve of 9.31 Mt sylvinite at an

average grade of 35.7% KCl.

o Mineral Resource of 129 Mt at an average grade of 24.9%

KCl.

o Higher confidence in the distribution of Sylvinite within the

Top Seams and improved understanding of the Sylvinite/Carnallite

boundary within the Hanging Wall Seam.

The financial statements below should be read in conjunction

with the notes contained within the full financial report which is

available online at the Company's website at

https://korepotash.com/wp-content/uploads/2023/03/Kore_Potash_plc_Annual_Report_2022.pdf

STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2022

Parent Consolidated Entity

Dec 2022 Dec 2021 Dec 2022 Dec 2021

Continuing operations USD USD USD USD

Other Revenue 1,092,147 834,158 - -

Directors' remuneration (814,597) (743,353) (418,962) (440,853)

Equity compensation benefits (9,412) (34,596) (9,412) (34,596)

Salaries, employee benefits and consultancy

expense (890,518) (1,113,966) (293,292) (687,623)

Credit loss provision - - - -

Administration expenses (542,146) (850,424) (546,507) (675,174)

Interest income 66,956 14,698 66,956 14,709

Interest and finance expenses (3,935) (4,365) (3,935) (4,708)

Net realised and unrealised

foreign exchange losses (308,801) (112,951) (308,801) (112,951)

----------- ------------ ------------ ------------

Loss before income tax expense (1,410,306) (2,010,799) (1,513,953) (1,941,196)

Income tax - - - -

----------- ------------ ------------ ------------

Loss for the year (1,410,306) (2,010,799) (1,513,953) (1,941,196)

=========== ============ ============ ============

Other comprehensive income/(loss)

Items that may be classified subsequent

to profit or loss

Exchange differences on translating

foreign operations - - (8,660,408) (11,529,680)

----------- ------------ ------------ ------------

Other comprehensive income/(loss) for

the year - - (8,660,408) (11,529,680)

----------- ------------ ------------ ------------

TOTAL COMPREHENSIVE LOSS FOR THE YEAR (1,410,306) (2,010,799) (10,174,361) (13,470,876)

=========== ============ ============ ============

Loss attributable to:

Owners of the Company (1,410,306) (2,010,799) (1,513,822) (1,941,196)

Non-controlling interest - - (131) -

-----------

(1,410,306) (2,010,799) (1,513,953) (1,941,196)

----------- ------------ ------------ ------------

Total comprehensive loss attributable

to:

Owners of the Company (1,410,306) (2,010,799) (10,174,230) (13,470,876)

Non-controlling interest - - (131) -

-----------

(1,410,306) (2,010,799) (10,174,361) (13,470,876)

----------- ------------ ------------ ------------

Basic and diluted loss per share (cents

per share) (0.04) (0.06) (0.04) (0.06)

STATEMENTS OF FINANCIAL POSITION

AS AT 31 DECEMBER 2022

Parent Consolidated Entity

Dec 2022 Dec 2021 Dec 2022 Dec 2021

USD USD USD USD

CURRENT ASSETS

Cash and cash equivalents 4,999,889 10,916,397 5,046,629 11,092,509

Trade and other receivables 112,272 88,836 200,251 197,996

TOTAL CURRENT ASSETS 5,112,161 11,005,233 5,246,880 11,290,505

------------- ------------- ------------- -------------

NON CURRENT ASSETS

Trade and other receivables 158,444,734 153,515,625 38,597 107,577

Property, plant and equipment - - 385,103 482,530

Exploration and evaluation expenditure - - 162,729,194 166,613,902

Investment in subsidiary 68 69 - -

TOTAL NON CURRENT ASSETS 158,444,802 153,515,694 163,152,894 167,204,009

------------- ------------- ------------- -------------

TOTAL ASSETS 163,556,963 164,520,927 168,399,774 178,494,514

------------- ------------- ------------- -------------

CURRENT LIABILITIES

Trade and other payables 396,982 356,882 749,469 1,074,602

Derivative financial liability 26 26 26 26

------------- ------------- ------------- -------------

TOTAL CURRENT LIABILITIES 397,008 356,908 749,495 1,074,628

------------- ------------- ------------- -------------

TOTAL LIABILITIES 397,008 356,908 749,495 1,074,628

------------- ------------- ------------- -------------

NET ASSETS 163,159,955 164,164,019 167,650,279 177,419,886

============= ============= ============= =============

EQUITY

Contributed equity - Ordinary

Shares 3,420,177 3,375,494 3,420,177 3,375,494

Reserves 172,999,244 172,642,133 221,586,467 230,029,754

Accumulated losses (13,259,466) (11,853,608) (56,793,651) (55,422,779)

------------- ------------- ------------- -------------

EQUITY ATTRIBUTABLE TO OWNERS

OF THE COMPANY 163,159,955 164,164,019 168,212,993 177,982,469

Non-controlling interests - - (562,714) (562,583)

------------- ------------- ------------- -------------

TOTAL EQUITY 163,159,955 164,164,019 167,650,279 177,419,886

============= ============= ============= =============

STATEMENTS OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2022

Consolidated Equity

Entity Attributable

to the

Foreign Shareholders

Share-Based Share Currency of Kore

Ordinary Payments Premium Translation Merger Accumulated Potash Non-Controlling Total

Shares Reserve Reserve Reserve Reserve Losses plc Interest Equity

USD USD USD USD USD USD USD USD USD

--------- ----------- ---------- ------------- ----------- ------------- -------------- --------------- --------------

Balance at

1 January

2021 2,451,768 9,866,536 32,004,080 (7,093,823) 203,738,800 (62,743,176) 178,224,185 (562,583) 177,661,602

Loss for the

period - - - - - (1,941,196) (1,941,196) - (1,941,196)

Other

comprehensive

loss for the

year - - - (11,529,680) - - (11,529,680) - (11,529,680)

--------- ----------- ---------- ------------- ----------- ------------- -------------- --------------- --------------

Total

comprehensive

loss for the

year - - - (11,529,680) - (1,941,196) (13,470,876) - (13,470,876)

--------- ----------- ---------- ------------- ----------- ------------- -------------- --------------- --------------

Transactions

with

shareholders

Cancellation

of

options - (6,015,412) - - - 6,015,412 - - -

Conversion of

performance

rights 6,024 (446,583) 51,772 - - 446,583 57,796 57,796

Cancellation

of

performance

rights - (2,799,598) - - - 2,799,598 - - -

Share issues 917,702 - 13,108,861 - - - 14,026,563 - 14,026,563

Share issue

costs - - (958,742) - - - (958,742) - (958,742)

Share based

payments - 103,543 - - - - 103,543 - 103,543

--------- ----------- ---------- ------------- ----------- ------------- -------------- --------------- --------------

Balance at 31

December

2021 3,375,494 708,486 44,205,971 (18,623,503) 203,738,800 (55,422,779) 177,982,469 (562,583) 177,419,886

========= =========== ========== ============= =========== ============= ============== =============== ==============

Loss for the

period - - - - - (1,513,822) (1,513,822) (131) (1,513,953)

Other

comprehensive

loss for the

year - - - (8,660,408) - - (8,660,408) - (8,660,408)

--------- ----------- ---------- ------------- ----------- ------------- -------------- --------------- --------------

Total

comprehensive

(loss)/income

for

the year - - - (8,660,408) - (1,513,822) (10,174,230) (131) (10,174,361)

--------- ----------- ---------- ------------- ----------- ------------- -------------- --------------- --------------

Kore Potash

ltd

SA Divestment - - - (139,989) - 138,501 (1,488) - (1,488)

Transactions

with

shareholders

Conversion of

performance

rights - (4,449) - - - 4,449 - - -

Share issues 44,683 - 331,338 - - - 376,021 - 376,021

Share issue

costs - 11,895 - - - - 11,895 - 11,895

Share based

payments - 18,327 - - - - 18,327 - 18,327

--------- ----------- ---------- ------------- ----------- ------------- -------------- --------------- --------------

Balance at 31

December

2022 3,420,177 734,259 44,537,309 (27,423,901) 203,738,800 (56,793,651) 168,212,994 (562,714) 167,650,280

========= =========== ========== ============= =========== ============= ============== =============== ==============

STATEMENTS OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2022

Parent Share Share

Ordinary Based Payments Premium Merger Reorganisation Accumulated Total

Shares Reserve Reserve Reserve Reserve Losses Equity

USD USD USD USD USD USD USD

--------- --------------- ---------- ----------- -------------- ------------ -----------

Balance at 01 January

2021 2,451,768 9,866,536 32,004,080 203,738,800 (76,011,124) (19,104,403) 152,945,657

Loss for the year - - - - - (2,010,799) (2,010,799)

--------- --------------- ---------- ----------- -------------- ------------ -----------

Total comprehensive

loss for the year - - - - - (2,010,799) (2,010,799)

--------- --------------- ---------- ----------- -------------- ------------ -----------

Transactions with

shareholders

Conversion of

performance

rights 6,024 (446,583) 51,772 - - 446,583 57,796

Cancellation of

options - (6,015,412) - - - 6,015,412 -

Cancellation of

performance rights - (2,799,598) - - - 2,799,598 -

Share issue 917,702 - 13,108,861 - - - 14,026,563

Share issue costs - - (958,742) - - - (958,742)

Share based payments - 103,543 - - - - 103,543

--------- --------------- ---------- ----------- -------------- ------------ -----------

Balance at 31 December

2021 3,375,494 708,486 44,205,971 203,738,800 (76,011,124) (11,853,609) 164,164,018

========= =============== ========== =========== ============== ============ ===========

Loss for the year - - - - - (1,410,306) (1,410,306)

Total comprehensive

(loss)/income for

the year - - - - - (1,410,306) (1,410,306)

--------- --------------- ---------- ----------- -------------- ------------ -----------

Transactions with

shareholders

Conversion of

performance

rights - (4,449) - - - 4,449 -

Share issue 44,683 - 331,338 - - - 376,021

Share issue costs - 11,895 - - - - 11,895

Share based payments - 18,327 - - - - 18,327

Balance at 31 December

2022 3,420,177 734,259 44,537,309 203,738,800 (76,011,124) (13,259,466) 163,159,955

========= =============== ========== =========== ============== ============ ===========

STATEMENTS OF CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2022

Parent Consolidated Entity

Dec 2022 Dec 2021 Dec 2022 Dec 2021

USD USD USD USD

CASH FLOWS FROM OPERATING

ACTIVITIES

Payments to suppliers (593,005) (1,297,463) (1,151,137) (1,491,849)

Payments to employees (538,184) (552,462) (85,108) (209,230)

Net cash (used in) operating

activities (1,131,189) (1,849,925) (1,236,245) (1,701,079)

------------ ------------ ------------ ------------

CASH FLOWS FROM INVESTING

ACTIVITIES

Payments for plant and equipment - - (633) (2,216)

Payments for exploration

activities - - (4,574,363) (5,811,225)

Amounts advanced to related

parties (4,532,663) (5,683,153) - -

Interest received 66,956 14,698 66,956 14,709

------------ ------------ ------------ ------------

Net cash (used in) investing

activities (4,465,707) (5,668,455) (4,508,040) (5,798,732)

------------ ------------ ------------ ------------

CASH FLOWS FROM FINANCING

ACTIVITIES

Proceeds from issue of shares 550 14,026,563 550 14,026,563

Payment for share issue

costs - (958,742) - (958,742)

Net cash provided by financing

activities 550 13,067,821 550 13,067,821

------------ ------------ ------------ ------------

Net (decrease)/increase

in cash & cash equivalents

held (5,596,346) 5,549,441 (5,743,735) 5,568,010

Cash and cash equivalents

at beginning of financial

year 10,916,397 5,443,551 11,092,509 5,555,000

Foreign currency differences (320,162) (76,595) (302,145) (30,501)

------------ ------------ ------------ ------------

Cash and cash equivalents

at end of financial year 4,999,889 10,916,397 5,046,629 11,092,509

============ ============ ============ ============

Market Abuse Regulation

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

This announcement has been approved for release by the Board of

Kore Potash.

END

For further information, please visit www.korepotash.com or

contact:

Kore Potash Tel: +27 84 603 6238

Brad Sampson - CEO

Tavistock Communications Tel: +44 (0) 20 7920

Emily Moss 3150

Adam Baynes

SP Angel Corporate Finance - Tel: +44 (0) 20 7470

Nomad and Broker 0470

Ewan Leggat

Charlie Bouverat

Shore Capital - Joint Broker Tel: +44 (0) 20 7408

Toby Gibbs 4050

James Thomas

Questco Corporate Advisory - Tel: +27 (11) 011 9205

JSE Sponsor

Doné Hattingh

Forward-Looking Statements

This release contains certain statements that are

"forward-looking" with respect to the financial condition, results

of operations, projects and business of the Company and certain

plans and objectives of the management of the Company.

Forward-looking statements include those containing words such as:

"anticipate", "believe", "expect," "forecast", "potential",

"intends," "estimate," "will", "plan", "could", "may", "project",

"target", "likely" and similar expressions identify forward-looking

statements. By their very nature forward-looking statements are

subject to known and unknown risks and uncertainties and other

factors which are subject to change without notice and may involve

significant elements of subjective judgement and assumptions as to

future events which may or may not be correct, which may cause the

Company's actual results, performance or achievements, to differ

materially from those expressed or implied in any of our

forward-looking statements, which are not guarantees of future

performance.

Neither the Company, nor any other person, gives any

representation, warranty, assurance or guarantee that the

occurrence of the events expressed or implied in any

forward-looking statement will occur. Except as required by law,

and only to the extent so required, none of the Company, its

subsidiaries or its or their directors, officers, employees,

advisors or agents or any other person shall in any way be liable

to any person or body for any loss, claim, demand, damages, costs

or expenses of whatever nature arising in any way out of, or in

connection with, the information contained in this document.

In particular, statements in this release regarding the

Company's business or proposed business, which are not historical

facts, are "forward-looking" statements that involve risks and

uncertainties, such as Mineral Resource estimates market prices of

potash, capital and operating costs, changes in project parameters

as plans continue to be evaluated, continued availability of

capital and financing and general economic, market or business

conditions, and statements that describe the Company's future

plans, objectives or goals, including words to the effect that the

Company or management expects a stated condition or result to

occur. Since forward-looking statements address future events and

conditions, by their very nature, they involve inherent risks and

uncertainties. Actual results in each case could differ materially

from those currently anticipated in such statements. Shareholders

are cautioned not to place undue reliance on forward-looking

statements, which speak only as of the date they are made. The

forward-looking statements are based on information available to

the Company as at the date of this release. Except as required by

law or regulation (including the ASX Listing Rules), the Company is

under no obligation to provide any additional or updated

information whether as a result of new information, future events,

or results or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FIFLEVRILVIV

(END) Dow Jones Newswires

March 31, 2023 02:00 ET (06:00 GMT)

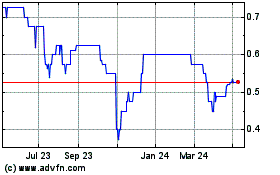

Kore Potash (LSE:KP2)

Historical Stock Chart

From Mar 2024 to Apr 2024

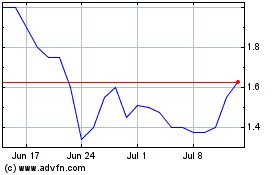

Kore Potash (LSE:KP2)

Historical Stock Chart

From Apr 2023 to Apr 2024