TIDMLEX

RNS Number : 2922E

Lexington Gold Limited

29 June 2023

29 June 2023

Lexington Gold Ltd

("Lexington Gold" or the "Company")

Final Results for the year ended 31 December 2022

and Availability of Annual Report and Financial Statements

Lexington Gold (AIM: LEX), the gold exploration and development

company with projects in North and South Carolina, USA, is pleased

to announce its audited results for the year ended 31 December

2022.

Copies of the Company's full Annual Report and Financial

Statements for the financial year to 31 December 2022 will be made

available to download from the Company's website at

www.lexingtongold.co.uk and will be posted to shareholders on or

before 30 June 2023.

Financial Summary

-- Net loss for the year from continuing operations was US$0.9 million (2021: US$1.0 million).

-- Total assets were US$5.1 million (2021: US$4.8 million) at the year end.

-- Net cash position of US$0.42 million (2021: US$0.95 million) as at the year end.

-- Total liabilities of US$0.1 million (2021: US$0.1 million) as at the year end.

Corporate Summary

2022 was a very successful year for Lexington Gold. The team has

delivered on a series of important exploration milestones across

the Company's existing project portfolio, including the

commissioning and release of an updated and increased independent

JORC resource estimate for the Loflin deposit, the completion of

the latest reverse circulation ("RC") drilling campaign across both

the Carolina Belle and JKL Projects and the establishment of a

maiden independent JORC Mineral Resource Estimate for the

Jones-Keystone side of the JKL Project towards the end of the

year.

Post-year end, on 15 May 2023, the Company announced a major

corporate development namely the proposed acquisition of 76% of

White Rivers Exploration (Pty) Limited ("WRE") in South Africa,

which has a number of significantly larger projects and prospects

than those explored by Lexington Gold to date. The Company's

strategic emphasis will remain on the exploration for, and

development of, gold resources, with a particular focus on areas

with known significant historical gold production. Successful

completion of the proposed WRE acquisition will enable the Company

to explore in the Witwatersrand gold fields, an area which was

historically the largest single gold producing district in the

world, alongside progression of the Company's existing projects in

the Carolinas, USA, with the aim of maximising long term

shareholder value. At the Company's Special General Meeting held on

26 June 2023 the Company's shareholders voted to approve such

proposed acquisition.

Operational Highlights

During 2022, Lexington Gold conducted a number of key

exploration activities on its existing portfolio projects as

follows:

Initial and Maiden Drill Results for Carolina Belle

In February 2022, the Company announced assay results received

in respect of the first 11 holes from its 32 hole RC drill

programme at the Carolina Belle Project. These drill results

identified and confirmed the down-dip extension and main historical

ore-zone mined during the historical third-party Iola and Uwarra

gold mining operations. Selected highlights from the results

included:

-- 4m @ 2.1 g/t Au from 64m to 68m in hole CRBC-24

-- 11m @ 1.01 g/t Au from 68m to 79m (combined Hangingwall,

Footwall and mined out historical main ore-zone) in hole CRBC-22

including:

o Footwall intersection of 4m @ 1.62 g/t Au from 72m to 76m

o Hangingwall intersection of 4m @ 0.7 g/t from 68m to 72m

o Main historical ore-zone intersected between 72.2m and

73.2m

-- Potential second gold mineralised zone intersected

approximately 25m above the main historical Iola and Uwarra

ore-zone with:

o 4m @1.53 g/t Au from 48m to 52m in hole CRBC-22

RC Drilling Programme at Jones-Keystone-Loflin Project (

"JKL")

Progress continued in February 2022 as the Company also

announced the completion of its Phase 2 RC drilling programme on

the Loflin side of the JKL Project and mobilisation of the rig for

a maiden drilling programme on the Jones-Keystone side of this

project. A total of 18 drill holes for an aggregate of 1,695m were

drilled at Loflin, with two additional RC drill holes drilled in a

newly identified area due to the significant sulphide

mineralisation intersected on the southern side, later named Loflin

South, and outside of the previously known Loflin resource.

In March 2022, the Company completed its maiden drilling

programme on the Jones-Keystone side of the JKL Project, drilling a

total of 6 holes for an aggregate of 675m, and thereby concluded

the overall 5,000m RC drilling campaign. Initial logging identified

multiple intersections of alteration zones and sulphide

mineralisation, with the largest combined intersection identified

being over 50m. In the subsequent weeks, the Company announced the

first drill results from Jones-Keystone which exceeded

expectations, as they showed multiple intersections of 24m width

and over and grades of between 1.37 g/t and 1.69 g/t gold, with all

gold intersections starting above 100m depth and representing

commercial grades and mineable widths. Key results included:

-- Hole JKRC-002: 52m @ 0.99 g/t Au from 72m to 124m including:

o 24m @ 1.37 g/t Au from 80m to 104m

o 16m @ 1.7 g/t Au from 84m to 100m

o 4m @ 2.75 g/t Au from 92m to 96m

-- Hole JKRC-004: 40m @ 1.27 g/t Au from 20m to 60m including:

o 28m @ 1.69 g/t Au from 28m to 56m

o 16m @ 2.5 g/t Au from 28m to 44m

o 4m @ 4.56 g/t Au from 36m to 40m

-- Hole JKRC-003: 28m @ 1.37 g/t Au from 64m to 92m including:

o 8m @ 3.1 g/t Au from 64m to 72m

o 4m @ 4.96 g/t Au from 64m to 68m

Drill Results for Loflin

Following completion of the abovementioned drilling programme,

in March 2022 the Company announced initial assay results for

Loflin relating to 8 of the 18 RC drill holes from the campaign,

with 6 holes from Loflin South and 2 holes from the north-eastern

extension of the main Loflin deposit. The assay results confirmed a

significant new discovery, which was named Loflin South. Selected

highlights from the assay results included:

-- Hole LFRC-006: 36m @ 1.67 g/t Au and 1.89 g/t Ag from 20m to 56m including:

o 12m @ 3.27 g/t Au and 2.9 g/t Ag from 28m to 40m

o 4m @ 5.63 g/t Au and 3.5 g/t Ag from 32m to 36m

-- Hole LFRC-002: 20m @ 1.52 g/t Au and 1.67 g/t Ag from 16m to 36m including:

o 4m @ 3.01 g/t Au and 2.45 g/t Ag from 32m to 36m

-- Hole LFRC-003: 8m @ 1.32 g/t Au from 80m to 88m including:

o 4m @ 1.45 g/t Au from 80m to 84m

In May 2022, the Company announced the remaining assay results

from Loflin which involved shallow-level infill drilling and

testing of the North-Eastern, South-Western and Southern boundaries

and extensions.

Selected results included:

-- Hole LFRC-018: 24m @ 1.07 g/t Au and 2.76 g/t Ag from 4m to 28m including:

o 4m @ 2.34 g/t Au and 6.41 g/t Ag from 24m to 28m

-- Hole LFRC-009: 16m @ 1.27 g/t Au and 3.79 g/t Ag from 16m to 32m including:

o 8m @ 1.76 g/t Au and 6.48 g/t Ag from 20m to 28m; and

o 4m @ 1.93 g/t Au and 6.11 g/t Ag from 24m to 28m

-- Hole LFRC-010: 4m @ 0.58 g/t Au from 48m to 52m

-- Hole LFRC-016: 4m @ 0.73 g/t Au from 4m to 8m

27% upgrade to initial maiden JORC resource at Loflin

In July 2022, following completion of the drill programme, the

Company also announced the results of the 1m sample re-splits at

Loflin, which underlined the success of the RC drill campaign. The

deposit exhibited significant shallow mineralisation, with grades

of up to 10g/t gold achieved as well as multiple Intersections of

20m+ widths at mineable grades, including 34m at an average grade

of 1.75 g/t gold. These results were incorporated into the existing

geological model and database with the aim of achieving an upgrade

to the pre-existing JORC Resource estimate for Loflin. In August

2022, the Company was pleased to confirm a 27% increase in the

contained gold estimated for the Loflin deposit, with a total

Inferred Resource of 2,596,000t @ 0.99 g/t Au for 82,700 oz of

contained gold, which included over 9,000 gold ounces from the

newly discovered Loflin South.

In November 2022, the Company was pleased to announce receipt of

a maiden independent JORC Mineral Resource Estimate for the

Jones-Keystone side of the JKL Project prepared by Pivot Mining

Consultants Pty Limited. The results exceeded expectations, with an

estimated resource of 128,000oz, taking the aggregate inferred

Mineral Resource Estimate for the JKL Project to over 210,000 oz of

gold.

Fundraisings

Lexington Gold carried out two fundraisings in 2022. In April,

the Company signed unsecured convertible loan agreements with two

significant shareholders and three of its directors with respect to

borrowing an aggregate amount of GBP335,000, in order to provide it

with additional working capital and financial flexibility. In light

of market conditions at that time, and the subdued share price, the

Board felt that this was the most appropriate funding route to

avoid excessive dilution, which an equity raise would have caused.

The conversion rights for the lenders concerned were set at a level

of 3.2p per share (subject to adjustment in certain prescribed

circumstances), which was approximately 30.6 per cent. above the

prevailing closing middle market share price of 2.45p per

share.

In October 2022, following a recovery in the Company's share

price, the Company successfully completed a placing, raising

GBP500,000 (before expenses) at 4.7p per share, which represented

an approximate 13.6 per cent. premium to the 30 day volume weighted

average price at that time. The abovementioned loan facility was

converted in full, together with the accrued interest thereon,

alongside such placing.

Joint Broker Appointment

On 15 August 2022, the Company appointed WH Ireland Limited as

its Joint Broker.

Post-year end events

The Company's momentum from 2022 has been maintained during the

first half of 2023 to date. Following completion of soil sampling

early on in the year at the Jennings-Pioneer Project, in April 2023

the Company announced the associated assays, with the results

reaffirming the high potential of Jennings-Pioneer, particularly

the mineralised extension from the historical Barite Hill pit onto

the Company's property, with surface sampling returning up to

1.735g/t Au. As well as elevated gold values, the samples also

indicated significant base metal assays, with the presence of

barite and tellurium, which could add further potential value to

the project given their diverse industrial applications.

In March 2023, the Company entered into a US$150,000 unsecured

loan facility with Lexington Gold's Chairman, Edward Nealon, to

support the group's ongoing working capital requirements and the

costs associated with evaluating potential additional new gold

projects/opportunities.

In May 2023, the Company announced a substantial development in

the form of the proposed acquisition of 76 per cent. of WRE, an

exploration and development company with significant gold assets in

the Witwatersrand gold fields in South Africa, which historically

was the largest single gold producing district in the world . The

aggregate amount payable by the Company under the associated WRE

Acquisition and Loan Agreements is GBP0.3m, by way of the provision

of a subordinated loan to WRE, and up to GBP6.4m to be settled by

way of the issue of new common shares in Lexington Gold based on

certain pre-determined milestones being satisfied, with any such

shares being subject to a 12-month lock-up arrangement followed by

a 12-month orderly market arrangement from the date of their

issue.

WRE's current tenement interests have been estimated by WRE's

management to contain non-code compliant potential resources of

over 37 million ounces of gold. WRE has focussed its exploration

efforts on shallow (200 to 1,200m depth) deposits close to

well-established infrastructure. Its tenement interests comprise 10

prospecting rights (six granted licences and four renewal

applications), which are grouped into five projects. This includes

a joint venture (the Jelani Resources JV) with Avgold Limited, a

subsidiary of Harmony Gold Mining Company Limited. Such JV project

has a non-code compliant independently estimated resource of 6.02

million ounces of gold at an average grade of 6.47 g/t.

WRE was established by well-known Australian explorer, Mark

Creasy, in 2002, with whom the Company has on 12 May 2023 entered

into a one year unsecured loan agreement for a principal amount of

GBP0.3m. Further details of the proposed WRE transaction and its

conditions precedent are set out in the Company's announcement of

15 May 2023 and Note 23 to the full annual report and financial

statements.

For further information, please contact :

Lexington Gold Ltd www.lexingtongold.co.uk

Bernard Olivier (Chief Executive Officer) via Yellow Jersey

Edward Nealon (Chairman)

Mike Allardice (Group Company Secretary)

Strand Hanson Limited (Nominated Adviser) www.strandhanson.co.uk

Matthew Chandler / James Bellman / Abigail T: +44 207 409 3494

Wennington

WH Ireland Limited (Joint Broker) www.whirelandplc.com

Katy Mitchell / Enzo Aliaj T: +44 207 220 1666

Peterhouse Capital Limited (Joint Broker) www.peterhousecap.com

Duncan Vasey / Lucy Williams (Broking) T: +44 207 469 0930

Eran Zucker (Corporate Finance)

Yellow Jersey PR Limited (Financial Public www.yellowjerseypr.com

Relations) T: +44 7948 758 681

Charles Goodwin / Annabelle Wills / Soraya

Jackson

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended by virtue of the Market Abuse

(Amendment) (EU Exit) Regulations 2019.

Note to Editors :

Lexington Gold (AIM: LEX) is a gold exploration and development

company currently holding interests in four diverse gold projects,

covering a combined area of approximately 1,675 acres in North and

South Carolina, USA. The projects are situated in the highly

prospective Carolina Super Terrane ("CST"), which has seen

significant historic gold production and is host to several

multi-million-ounce mines operated by majors. It was also the site

of the first US gold rush in the early 1800s, before gold was

discovered in California.

Further information is available on the Company's website:

www.lexingtongold.co.uk . Neither the contents of the Company's

website nor the contents of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this announcement.

Key Extracts from the Company's audited

Annual Report and Financial Statements are set out below :

Chairman's Statement

I am delighted to report on another highly successful year for

Lexington Gold Ltd ("Lexington" or the "Company") for the twelve

months ended 31 December 2022. Since providing our half-year

update, we have continued to advance our exploration activities

across all of our existing projects, meeting our objectives in

terms of significantly increasing our independently reported gold

resource estimate and building shareholder value. We have also made

significant progress during 2023 to date, having recently announced

details of a proposed acquisition which we believe will potentially

serve to transform our prospects and the scale of the Company.

The first half of 2022 was dominated by our focus on completing

the drill programme on both the Loflin and Jones-Keystone sides of

the Jones-Keystone-Loflin ("JKL") Project. Assay results confirmed

a significant new discovery, named Loflin South, whilst we also

received exceptional assay results for the six reverse circulation

("RC") drill holes at Jones-Keystone. In August 2022, we announced

an updated independent JORC (2012) Mineral Resource Estimate for

the Loflin deposit, including over 9,000 gold ounces from Loflin

South, which increased the Loflin deposit resource estimate by 27%.

The JORC resource estimation of 128,000 gold ounces for the

Jones-Keystone side of the project announced towards the end of the

year also surpassed our expectations, taking the total JORC

inferred mineral resource estimate for the JKL Project to over

210,000 gold ounces.

Further to completion of the Company's maiden 2021 drill

campaign at Carolina Belle, the Company reviewed and updated its

geological model for this project over the course of 2022. The

maiden 2021 drill campaign achieved multiple intersections of 1g/t

Au or more and improved the delineation of the historic third-party

mining operations and the nature of the ore-zones targeted by such

operations. Following extensive review of the project, a Phase II

drilling campaign is currently being prepared.

Advancements were also made at our Jennings-Pioneer Project with

assays from soil sample grid and rock sampling announced in April

2023. The analysis of soil assays in conjunction with field

mapping, identified 13 gossans within three separate mineralisation

trends: the Barite Hill Trend, the Jennings Trend and the Self

Trend. The Barite Hill Trend is particularly exciting and

represents the northeast extension of the historic Barite Hill

Mine, which produced 59,000 oxide ounces in the early 1990s. The

Barite Hill Trend continues 600m along strike onto the Company's

tenured property, and surface sampling has outlined a siliceous

alteration halo extending 600m to the northeast and sulphide

mineralisation extending over 350m to the northeast, with gossanous

surface rock chips returning up to 1.735g/t Au.

Post-period end, on 15 May 2023, the Company announced the

exciting news that it had entered into conditional share

subscription and loan agreements to acquire 76% of White Rivers

Exploration Proprietary Limited ("WRE") (the "Proposed WRE

Acquisition"), which has a substantial portfolio of gold assets

estim ated by WRE's management to potentially contain over 37

million ounces in a world-renowned gold-producing area of

Witwatersrand in South Africa. This proposed transaction, which has

been approved by the Company's shareholders at a shareholders

meeting on 26 June 2023 is subject, inter alia, to conditions, has

the potential to significantly enhance Lexington's future prospects

whilst we continue to advance our existing projects in the

Carolinas to build further shareholder value and further

announcement(s) will be made in due course regarding the Proposed

WRE Transaction.

Completion of the Proposed WRE Acquisition would see Mark

Creasy, one of the mining industry's most successful entrepreneurs

and founder of WRE, become a significant shareholder in Lexington

and continue to play an important role in developing WRE's assets.

At the same time, we will be looking to capitalise on WRE's Joint

Venture arrangement with Avgold Limited, a subsidiary of Harmony

Gold Mining Company Limited, the largest gold producer by volume in

South Africa. If completed, the consideration payable in respect of

the acquisition of WRE principally comprises up to GBP6.4m of new

common shares in Lexington based on certain pre-determined

milestones being satisfied and the provision of a GBP0.3m

subordinated loan to WRE.

2023 is set to be a very significant year for Lexington. As

always, we are most grateful for the team's unwavering commitment

to advancing our projects and helping to build shareholder value.

As a Company, we look forward to updating shareholders on our

future progress.

Edward Nealon

Non-Executive Chairman

28 June 2023

Chief Executive's Operational and Financial Review

1 . Overview

2022 was a very successful year for Lexington. The team has

delivered on a series of important exploration milestones across

our existing project portfolio, including the commissioning and

release of an updated and increased independent JORC resource

estimate for the Loflin deposit, the completion of the latest RC

drilling campaign across both the Carolina Belle and JKL Projects

and the establishment of a maiden independent JORC Mineral Resource

Estimate for the Jones-Keystone side of the JKL Project towards the

end of the year.

Post-year end, on 15 May 2023, the Company announced a major

corporate development namely the proposed acquisition of 76% of

White Rivers Exploration (Pty) Limited ("WRE") in South Africa,

which has a number of significantly larger projects and prospects

than those we have been exploring to date. The Company's strategic

emphasis will remain on the exploration for, and development of,

gold resources, with a particular focus on areas with known

significant historical gold production. Successful completion of

the Proposed WRE Acquisition will enable us to explore in the

Witwatersrand gold fields, an area which was historically the

largest single gold producing district in the world, alongside

progression of our existing projects in the Carolinas, USA, with

the aim of maximising long term shareholder value.

During 2022, Lexington conducted the following exploration

activities on its portfolio projects:

Initial and Maiden Drill Results for Carolina Belle

In February 2022, we announced assay results received in respect

of the first 11 holes from the Company's 32 hole RC drill programme

at the Carolina Belle Project. These drill results identified and

confirmed the down-dip extension and main historical ore-zone mined

during the historical third-party Iola and Uwarra gold mining

operations. Selected highlights from the results included:

-- 4m @ 2.1 g/t Au from 64m to 68m in hole CRBC-24

-- 11m @ 1.01 g/t Au from 68m to 79m (combined Hangingwall,

Footwall and mined out historical main ore-zone) in hole CRBC-22

including:

o Footwall intersection of 4m @ 1.62 g/t Au from 72m to 76m

o Hangingwall intersection of 4m @ 0.7 g/t from 68m to 72m

o Main historical ore-zone intersected between 72.2m and

73.2m

-- Potential second gold mineralised zone intersected

approximately 25m above the main historical Iola and Uwarra

ore-zone with:

o 4m @1.53 g/t Au from 48m to 52m in hole CRBC-22

RC Drilling Programme at Jones-Keystone-Loflin Project (

"JKL")

Progress continued in February 2022 as we also announced the

completion of our Phase 2 RC drilling programme on the Loflin side

of the JKL Project and mobilisation of the rig for a maiden

drilling programme on the Jones-Keystone side of this project. A

total of 18 drill holes for an aggregate of 1,695m were drilled at

Loflin, with two additional RC drill holes drilled in a newly

identified area due to the significant sulphide mineralisation

intersected on the southern side, later named Loflin South, and

outside of the previously known Loflin resource.

In March 2022, we completed the maiden drilling programme on the

Jones-Keystone side of the JKL Project, drilling a total of 6 holes

for an aggregate of 675m and thereby concluded the overall 5,000m

RC drilling campaign. Initial logging identified multiple

intersections of alteration zones and sulphide mineralisation, with

the largest combined intersection identified being over 50m. In the

subsequent weeks, we announced the first drill results from

Jones-Keystone which exceeded our expectations, as they showed

multiple intersections of 24m width and over and grades of between

1.37 g/t and 1.69 g/t gold, with all gold intersections starting

above 100m depth and representing commercial grades and mineable

widths. Key results included:

-- Hole JKRC-002: 52m @ 0.99 g/t Au from 72m to 124m including:

o 24m @ 1.37 g/t Au from 80m to 104m

o 16m @ 1.7 g/t Au from 84m to 100m

o 4m @ 2.75 g/t Au from 92m to 96m

-- Hole JKRC-004: 40m @ 1.27 g/t Au from 20m to 60m including:

o 28m @ 1.69 g/t Au from 28m to 56m

o 16m @ 2.5 g/t Au from 28m to 44m

o 4m @ 4.56 g/t Au from 36m to 40m

-- Hole JKRC-003: 28m @ 1.37 g/t Au from 64m to 92m including:

o 8m @ 3.1 g/t Au from 64m to 72m

o 4m @ 4.96 g/t Au from 64m to 68m

Drill Results for Loflin

Following completion of the abovementioned drilling programme,

in March 2022 we announced initial assay results for Loflin

relating to 8 of the 18 RC drill holes from the campaign, with 6

holes from Loflin South and 2 holes from the north-eastern

extension of the main Loflin deposit. The assay results confirmed a

significant new discovery, which we named Loflin South. Selected

highlights from the assay results included:

-- Hole LFRC-006: 36m @ 1.67 g/t Au and 1.89 g/t Ag from 20m to 56m including:

o 12m @ 3.27 g/t Au and 2.9 g/t Ag from 28m to 40m

o 4m @ 5.63 g/t Au and 3.5 g/t Ag from 32m to 36m

-- Hole LFRC-002: 20m @ 1.52 g/t Au and 1.67 g/t Ag from 16m to 36m including:

o 4m @ 3.01 g/t Au and 2.45 g/t Ag from 32m to 36m

-- Hole LFRC-003: 8m @ 1.32 g/t Au from 80m to 88m including:

o 4m @ 1.45 g/t Au from 80m to 84m

In May 2022, we announced the remaining assay results from

Loflin which involved shallow-level infill drilling and testing of

the North-Eastern, South-Western and Southern boundaries and

extensions.

Selected results included:

-- Hole LFRC-018: 24m @ 1.07 g/t Au and 2.76 g/t Ag from 4m to 28m including:

o 4m @ 2.34 g/t Au and 6.41 g/t Ag from 24m to 28m

-- Hole LFRC-009: 16m @ 1.27 g/t Au and 3.79 g/t Ag from 16m to 32m including:

o 8m @ 1.76 g/t Au and 6.48 g/t Ag from 20m to 28m; and

o 4m @ 1.93 g/t Au and 6.11 g/t Ag from 24m to 28m

-- Hole LFRC-010: 4m @ 0.58 g/t Au from 48m to 52m

-- Hole LFRC-016: 4m @ 0.73 g/t Au from 4m to 8m

27% upgrade to initial maiden JORC resource at Loflin

In July 2022, following completion of the drill programme, we

also announced the results of the 1m sample re-splits at Loflin,

which underlined the success of the RC drill campaign. The deposit

exhibited significant shallow mineralisation, with grades of up to

10g/t gold achieved as well as multiple Intersections of 20m+

widths at mineable grades, including 34m at an average grade of

1.75 g/t gold. These results were incorporated into the existing

geological model and database with the aim of achieving an upgrade

to the pre-existing JORC Resource estimate for Loflin. In August

2022, we were pleased to confirm a 27% increase in the contained

gold estimated for the Loflin deposit, with a total Inferred

Resource of 2,596,000t @ 0.99 g/t Au for 82,700 oz of contained

gold, which included over 9,000 gold ounces from the newly

discovered Loflin South.

In November 2022, we were pleased to announce receipt of a

maiden independent JORC Mineral Resource Estimate for the

Jones-Keystone side of the JKL Project prepared by Pivot Mining

Consultants Pty Limited. The results exceeded our expectations,

with an estimated resource of 128,000oz, taking the aggregate

inferred Mineral Resource Estimate for the JKL Project to over

210,000 oz of gold.

2 . Financial Performance

Net loss for the year from continuing operations was US$0.9

million (2021: US$1.0 million).

Total assets were US$5.1 million (2021: US$4.8 million) at the

year end.

Net cash position of US$0.42 million (2021: US$0.95 million) as

at the year end.

Total liabilities of US$0.1 million (2021: US$0.1 million) as at

the year end.

3 . Dividend

The directors have not declared a dividend (2021: Nil).

4 . Corporate Activities

Fundraisings

Lexington carried out two fundraisings in 2022. In April, the

Company signed unsecured convertible loan agreements with two

significant shareholders and three of its directors with respect to

borrowing an aggregate amount of GBP335,000, in order to provide it

with additional working capital and financial flexibility. In light

of market conditions at that time, and the subdued share price, the

Board felt that this was the most appropriate funding route to

avoid excessive dilution, which an equity raise would have caused.

The conversion rights for the lenders concerned were set at a level

of 3.2p per share (subject to adjustment in certain prescribed

circumstances), which was approximately 30.6 per cent. above the

closing middle market share price at the time of 2.45p per

share.

In October 2022, following a recovery in the Company's share

price, we successfully completed a placing, raising GBP500,000

(before expenses) at 4.7p per share, which represented an

approximate 13.6 per cent. premium to the 30 day volume weighted

average price at that time. The abovementioned loan facility was

converted in full, together with the accrued interest thereon,

alongside the placing.

Joint Broker Appointment

On 15 August 2022, the Company appointed WH Ireland Limited as

its Joint Broker.

5 . Post-Period Events

Our momentum from 2022 has been maintained during the first half

of 2023 to date. Following completion of soil sampling early on in

the year at the Jennings-Pioneer Project, in April 2023 we

announced the associated assays, with the results reaffirming the

high potential of Jennings-Pioneer, particularly the mineralised

extension from the historical Barite Hill pit onto our property,

with surface sampling returning up to 1.735g/t Au. As well as

elevated gold values, the samples also indicated significant base

metal assays, with the presence of barite and tellurium, which

could add further potential value to the project given their

diverse industrial applications.

In March 2023, the Company entered into a US$150,000 unsecured

loan facility with Lexington's Chairman, Edward Nealon, to support

the group's ongoing working capital requirements and the costs

associated with evaluating potential additional new gold

projects/opportunities.

In May 2023, we announced a substantial development in the form

of the Proposed WRE Acquisition to acquire 76 per cent. of WRE, an

exploration and development company with significant gold assets in

the Witwatersrand gold fields in South Africa, which historically

was the largest single gold producing district in the world . The

aggregate amount payable by the Company under the associated WRE

Acquisition and Loan Agreements is GBP0.3m, by way of the provision

of a subordinated loan to WRE, and up to GBP6.4m to be settled by

way of the issue of new common shares in Lexington based on certain

pre-determined milestones being satisfied, with any such shares

being subject to a 12-month lock-up arrangement followed by a

12-month orderly market arrangement from the date of their

issue.

WRE's current tenement interests have been estimated by WRE's

management to contain non-code compliant potential resources of

over 37 million ounces of gold. WRE has focussed its exploration

efforts on shallow (200 to 1,200m depth) deposits close to

well-established infrastructure. Its tenement interests comprise 10

prospecting rights (six granted licences and four renewal

applications), which are grouped into five projects. This includes

a joint venture (the Jelani Resources JV) with Avgold Limited, a

subsidiary of Harmony Gold Mining Company Limited. Such JV project

has a non-code compliant independently estimated resource of 6.02

million ounces of gold at an average grade of 6.47 g/t.

WRE was established by well-known Australian explorer, Mark

Creasy, in 2002, with whom the Company has on 12 May 2023 entered

into a one year unsecured loan agreement for a principal amount of

GBP0.3m. Further details of the proposed WRE transaction and its

conditions precedent are set out in the Company's announcement of

15 May 2023 and Note 23 to the full annual report and financial

statements.

Bernard Olivier

Chief Executive Officer

28 June 2023

Financial Statements

Lexington Gold Ltd

Consolidated statement of profit or loss and other comprehensive

income

for the Year Ended 31 December 2022

(Audited)

2022 2021

US$'000 US$'000

CONTINUING OPERATIONS

Other income -

Operating expenses (708) (1,022)

Operating loss (708) (1,022)

Fair value loss on derivative liability (149) -

Finance cost (67) -

Loss before taxation (924) (1,022)

Income tax charge - -

-------- ---------

Loss for the year (924) (1,022)

======== =========

Attributable to:

-------- ---------

Equity owners of the parent (924) (1,021)

Non-controlling interest - (1)

-------- ---------

Other comprehensive income

Loss for the year (924) (1,022)

Items that may be reclassified to profit

or loss:

Foreign exchange loss on translation

of discontinued operations - 1

-------- ---------

Total comprehensive loss for the year (924) (1,021)

======== =========

Attributable to :

Equity owners of the parent (924) (1,020)

Non-controlling interest - (1)

-------- ---------

Total comprehensive loss for the year (924) (1,021)

======== =========

Loss per share attributable to the owners

of the parent during the year

Basic and diluted loss per share from

continuing operations (US cents/share) (0.35) (0.39)

The above Consolidated statement of profit or loss and other

comprehensive income should be read in conjunction with the

accompanying notes in the Company's full Annual Report and

Financial Statements.

Lexington Gold Ltd

Consolidated statement of financial position

as at 31 December 2022

(Audited)

2022 2021

US$'000 US$'000

Assets

Non-current assets

Exploration and evaluation assets 4,556 3,764

--------- ---------

Total non-current assets 4,556 3,764

--------- ---------

Current assets

Trade and other receivables 74 45

Cash and cash equivalents 424 953

--------- ---------

Total current assets 498 998

Total assets 5,054 4,762

========= =========

Equity

Share capital 851 787

Share premium 60,163 59,096

Share option reserve 651 555

Foreign currency translation reserve (2) (2)

Accumulated loss (57,674) (56,750)

--------- ---------

Total equity attributable to equity

owners of the parent 3,989 3,686

Non-controlling interest 970 970

--------- ---------

Total equity 4,959 4,656

--------- ---------

Current liabilities

Trade and other payables 95 106

Total current liabilities 95 106

--------- ---------

Total equity and liabilities 5,054 4,762

========= =========

The above Consolidated statement of financial position should be

read in conjunction with the accompanying notes in the Company's

full Annual Report and Financial Statements.

Lexington Gold Ltd

Consolidated statement of cash flows

for the Year Ended 31 December 2022

(Audited)

2022 2021

US$'000 US$'000

Cash flows from operating activities

Cash utilised by operations (684) (678)

Net cash flows utilised in operating

activities (684) (678)

-------- ---------

Cash flows from investing activities

Payments for exploration (792) (1,265)

Net cash flows utilised by investing

activities (792) (1,265)

-------- ---------

Cash flows from financing activities

Proceeds from issue of shares 579 -

Share issue cost (26) -

Proceeds from convertible loans 416 -

Net cash flows generated from financing

activities 969 -

-------- ---------

Net (decrease)/increase in cash and cash

equivalents (507) (1,943)

======== =========

Movement in cash and cash equivalents

Net foreign currency exchange losses (22) 1

At the beginning of the year 953 2,895

Net decrease in cash and cash equivalents (507) (1,943)

-------- ---------

Cash and cash equivalents at the end

of the year 424 953

======== =========

The above Consolidated statement of cash flows should be read in

conjunction with the accompanying notes in the Company's full

Annual Report and Financial Statements.

Notes to the consolidated financial information

1. General Information

Lexington Gold Ltd (the "Company", "Lexington Gold" or

"Lexington") and its subsidiaries (together, "the Group") is

focused on the exploration and development of its four diverse gold

projects, covering a combined area of approximately 1,675 acres in

North and South Carolina, USA.

The Company is a limited liability company incorporated and

domiciled in Bermuda. The address of its registered office is

Clarendon House, 2 Church Street, Hamilton, HM 11, Bermuda.

The Company is quoted on the Alternative Investment Market

("AIM") of the London Stock Exchange.

2. Basis of preparation and significant accounting policies

The principal accounting policies applied in the preparation of

the consolidated financial information are consistent with those

set out in the full Annual Report and Financial Statements. These

policies have been consistently applied to all the years presented

unless otherwise stated.

(a) Going concern basis of accounting

For the year ended 31 December 2022, the Group recorded a loss

of US$0.9 million and had net cash outflows from operating

activities of US$0.7 million. An operating loss is expected in the

year subsequent to the date of the financial statements. The

ability of the entity to continue as a going concern is dependent

on the Group generating positive operating cash flows and/or

securing additional funding through the raising of debt or equity

to fund its projects.

These conditions indicate a material uncertainty that may cast a

significant doubt about the entity's ability to continue as a going

concern and, therefore, that it may be unable to realise its assets

and discharge its liabilities in the normal course of business.

The financial statements have been prepared on the basis that

the entity is a going concern, which contemplates the continuity of

normal business activity, realisation of assets and settlement of

liabilities in the normal course of business for the following

reasons:

-- The Company secured additional funding by way of a US$150,000

unsecured loan facility on 14 March 2023;

-- The Directors are confident that they will be able to raise

additional funds to satisfy its immediate cash requirements;

and

-- The Directors have the ability to reduce expenditure in order to preserve cash if required.

Should the entity not be able to continue as a going concern, it

may be required to realise its assets and discharge its liabilities

other than in the ordinary course of business, and at amounts that

differ from those stated in the financial statements. The full

Annual Report and Financial Statements does not include any

adjustments relating to the recoverability and classification of

recorded asset amounts or liabilities that might be necessary

should the entity not continue as a going concern.

(b) Basis of preparation

The consolidated financial information set out above does not

constitute the Group's financial statements for the years ended 31

December 2022 or 31 December 2021 but is derived from those

financial statements. The auditors have reported on the 2022 and

2021 financial statements which carried unqualified audit reports.

The 2022 financial statements included reference to a matter to

which the auditors drew attention by way of emphasis, namely the

existence of material uncertainty related to going concern as

outlined in Note 2(a) above. The auditor's opinion was not modified

in respect of such matter. The 2021 financial statements included a

similar emphasis of matter regarding the existence of material

uncertainty related to going concern and the auditor's opinion was

similarly not modified in respect of such matter.

While the financial information included in this announcement

has been compiled in accordance with, inter alia, International

Financial Reporting Standards ("IFRS"), this announcement does not

in itself contain sufficient information to comply with IFRS.

The full consolidated financial statements have been prepared in

accordance with IFRS, interpretations of the International

Financial Reporting Interpretations Committee ("IFRIC") and Bermuda

Companies Act, 1981. The consolidated financial statements have

also been prepared under the historical cost convention, as

modified by:

-- Share options measured at fair value; and

-- Financial assets and liabilities at fair value through profit or loss.

**ENDS**

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FZGZVVRGGFZM

(END) Dow Jones Newswires

June 29, 2023 02:00 ET (06:00 GMT)

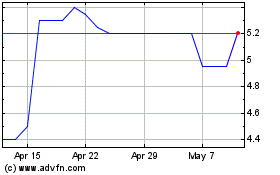

Lexington Gold (LSE:LEX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Lexington Gold (LSE:LEX)

Historical Stock Chart

From Dec 2023 to Dec 2024