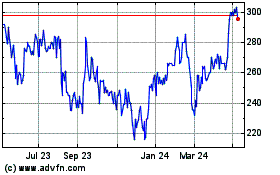

TIDMLSL

RNS Number : 8106N

LSL Property Services PLC

27 September 2023

27 September 2023

LSL Property Services plc ("LSL" or "Group")

HALF YEAR RESULTS TO 30 JUNE 2023

SIGNIFICANT STRATEGIC PROGRESS MADE TOWARDS CREATING A SIMPLER,

HIGHER MARGIN PLATFORM BUSINESS

LSL reports its results for the six month period ended 30 June

2023 during which it made significant strategic progress towards

creating a higher margin, higher cash converting business that will

perform more consistently through market cycles. The Group has a

strong balance sheet with a net cash position of GBP36.3m at 30

June 2023, and the Board has maintained the interim dividend at 4p

per share.

David Stewart, Group Chief Executive commented:

"It has been a period of significant strategic progress to

simplify the Group and create a more focused business that will

perform more consistently through market cycles. I'm proud of how

the team has worked tirelessly to reshape LSL while navigating

significant macroeconomic headwinds and thank them for their focus

and dedication - it is a significant achievement.

"During the period we have successfully executed the transition

of Estate Agency to a Franchise business. We have similarly focused

our Financial Services Division to become an exclusively

business-to-business service provider, completing the transfer of

each of our direct-to-consumer businesses to Pivotal Growth. In

August, we also announced the acquisition of TenetLime, which adds

up to 278 advisers to our network, subject to FCA approval.

"Our strong balance sheet continues to provide opportunities to

consider value-enhancing M&A and invest in organic growth

initiatives in our core segments, whilst maintaining our interim

dividend at 4p per share."

STRATEGIC PROGRESS

-- Focusing of our Financial Services Division exclusively on

business-to-business services , reducing costs and operating a

scalable platform business

-- Sale of our four direct-to-consumer financial service advice

businesses to Pivotal Growth, our joint venture with Pollen Street

Capital was completed in April 2023

-- Announced acquisition of TenetLime network in August 2023,

subject to FCA approval, adding up to 278 advisers to our Financial

Services network

-- Conversion of entire owned estate agency network of 183

branches to franchisees announced on 4 May 2023 . LSL is now one of

the leading providers of estate agency franchise services in the

UK, supplying services to a network of over 300 branches

-- Disposal of Marsh & Parsons in January 2023 for GBP29m

gross proceeds(1) , boosting further LSL's already strong balance

sheet, which at 30 June 2023 included Net Cash of GBP36.3m (H1

2022: GBP30.7m)

FINANCIAL HIGHLIGHTS

The strategic transformation of the Group means that our

financial results are less directly comparable against the same

period in 2022. Our key financial highlights are:

H1 financial metrics 2023 2022 Var

------- ------

Group Revenue (GBPm) 72.5 110.2 (34)%

Group Underlying Operating

Profit from continuing

operations(2,3) (GBPm) 4.3 14.7 (71)%

Group Underlying Operating

Profit from total operations(2,3)

(GBPm) 3.3 14.2 (76)%

Group Underlying Operating

margin (%) 3% 9% (560)bps

Exceptional Gains (GBPm) 8.6 - nm

Exceptional Costs (GBPm) (4.3) (2.0) (116)%

Group statutory operating

profit (GBPm) 7.2 9.9 (27)%

Profit before tax (GBPm) 7.1 8.9 (20)%

Loss from discontinued

operations(3) (42.9) (1.7) nm

------------------------------------- ------- ------ ---------

Basic Earnings per Share(4)

(pence) 5.0 7.3 (32)%

Adjusted Basic Earnings

per Share(4) (pence) 2.7 10.7 (75)%

Net Cash(5) at 30 June

(GBPm) 36.3 30.7 18%

Interim Dividend (pence) 4.0 4.0 -

------------------------------------- ------- ------ ---------

Notes:

1 Refer to note 8 and 18 to the Financial Statements

2 Group (and Divisional) Underlying Operating Profit is before

exceptional items, contingent consideration assets &

liabilities, amortisation of intangible assets and share-based

payments. Refer to note 5 of the Financial Statements for

reconciliation of Group and Divisional Underlying Operating Profit

to statutory operating (loss)/profit for continuing, discontinued

and total operations

3 Following the conversion of the entire owned estate agency

network to franchises in H1 2023, this was classified as a

discontinued operation and is now presented as such in the

Financial Statements. Refer to notes 2 and 6 to the Financial

Statements

4 Refer to note 7 to the Financial Statements for the calculation

5 Refer to note 5 to the Financial Statements for the calculation

nm not meaningful

-- Group Statutory Operating Profit was GBP7.2m (H1 2022: GBP9.9m)

-- Group Underlying Operating Profit from continuing

operations(1,2) was GBP4.3m (H1 2022: GBP14.7m)

-- Group Underlying Operating Profit from total operations was

GBP3.3m (H1 2022: GBP14.2m), broadly in line with our expectations

as reported in the pre-close trading update on 7 August 2023

-- Group Underlying Operating Loss from discontinued operations

was GBP1.0m (H1 2022: GBP0.5m loss)

-- Unallocated central costs reduced by 14% to GBP3.5m (H1 2022: GBP4.0m)

-- Net Exceptional gains(3) of GBP4.3m were recognised during

the first half of the year, including the net gain on disposals of

GBP7.2m partly offset by re-structuring activity and non-recurring

corporate costs of GBP2.9m

-- Net Cash(4) of GBP36.3m at 30 June 2023

-- Agreed new RCF of GBP60m, extending maturity two years to May

2026, with existing mainstream UK lenders, providing further

financial flexibility to the Group

DIVISIONAL PERFORMANCE

Financial Services Division

-- Financial Services Network business traded resiliently in

difficult market conditions and more heavily weighted than usual to

product transfers, reporting Underlying Operating Profit(2) of

GBP5.5m (H1 2022: GBP7.5m)

-- Performance of independent mortgage broker firms that are

members of LSL's FS Network was particularly strong , increasing

share of the purchase and remortgage market from 6.2% to 6.6%. The

combined distribution of LSL's previously owned direct-to-consumer

businesses, which are now owned by Pivotal Growth but still members

of the LSL network, and LSL's mortgage club, was stable at 3.8%.

Overall share(5) of the UK purchase and remortgage market was 10.4%

(H1 2022: 10.1%)

-- LSL's network protection sales were robust despite the market

conditions and the squeeze on household incomes, with revenue

unchanged compared to H1 2022

-- The challenging market background led to caution by network

members on adviser levels, and adviser numbers fell by 5% during

the period (from 2,867 to 2,718). However, the recruitment pipeline

at 30 June was the highest since September 2021, which will benefit

future periods, as will the acquisition of TenetLime, following FCA

approval

-- Share of losses of Pivotal Growth was GBP0.2m (H1 2022:

GBP0.2m loss), reflecting the smaller UK mortgage market and

continuing investment to build the business. Following the transfer

of LSL assets, Pivotal Growth has achieved critical mass with over

300 advisers, the majority of which operate within our Financial

Services network

Surveying & Valuation Division

-- Surveying & Valuation Division performance was impacted

by significant reductions in valuation instructions across the

market due to the interest rate environment significantly

increasing the proportion and volume of Product Transfers (which do

not require a lender valuation) and the disproportionate impact of

higher interest rates on specialist markets such as buy-to-let and

equity release. As a result, Underlying Operating Profit (2) fell

to GBP3.4m (H1 2022: GBP13.1m)

-- Self-help cost measures were put in place in the Surveying

& Valuation Division , including a modest reduction in the

number of employed surveyors since the year end, achieved by way of

voluntary redundancy. However, our principal focus remains to

retain sufficient capacity to meet the requirements of more normal

market conditions, which means that the business continues to carry

material excess costs over the current level of demand, with a

consequent impact on profitability in H2

Estate Agency Division

-- Estate Agency performance reflects the market-wide reduction

of 18% in house sales and the conversion of the 183 owned branches

to franchisees which was announced on 4 May 2023. Underlying

Operating Profit from continuing operations (1,2) for the Division

was GBP0.6m (H1 2022: GBP0.4m loss). We expect Estate Agency to

report a profit in H2

-- Operating margins following the strategic change have been

above 25% , with the transformation and cost programme ahead of

schedule

ECONOMIC AND MARKET ENVIRONMENT

-- Market conditions during H1 were challenging, with the

expected improvements in consumer confidence hindered by stubbornly

high inflation and interest rate increases

-- The mortgage lending market(5) remained suppressed in H1,

purchase lending fell by 30% compared to H1 2022, while remortgage

lending decreased by 21%. We estimate there was a 28% increase in

product transfer cases. LSL's total lending was 4% lower than H1

2022, reflecting an increased market share in each of the purchase,

remortgage and product transfer markets, and more heavily weighted

than usual to product transfers. LSL's share of the total purchase

and remortgage market was 10.4%(5) (H1 2022: 10.1%)

-- Total market mortgage approvals(6) were 31% lower than H1

2022, with the shift to product transfer business particularly

affecting our Surveying business. Total jobs performed by our

Surveying & Valuation Division fell by 27%, which reflects a

small increase in market share(5)

-- Total UK HMRC recorded transactions were 18% lower in H1 2023

at 482k (H1 2022: 591k). Our Estate Agency national market share

remained broadly flat at 1.9%(7) (H1 2022: 2.0%)

-- The unexpectedly high interest rate rise in June has been

followed by a further increase in product transfer mortgages and

reduced levels of purchase and remortgage activity. The more

specialised equity release and buy-to-let segments continue to lag

materially behind 2022. The effect of these market developments is

most pronounced in Surveying, with a lesser impact on Financial

Services

OUTLOOK

As we noted in our Trading Update issued on 7 August, changes in

the supply and demand of mortgage products have had a significant

impact on parts of our business, most notably in Surveying but also

Financial Services. Since then, trading has stabilised, and the

recent decision to hold base rates unchanged is expected to provide

further stability and the steadying of market sentiment. The Board

currently expects Underlying Operating Profit for FY 2023 to be in

line with its expectations as revised at the time of the Trading

Update on 7 August.

The independent mortgage broker business model continues to

demonstrate resilience and agility, with LSL members increasing

their share in each of the sub-segments of the mortgage market

during H1, as well as performing strongly in protection advice. Our

Estate Agency Franchise business is performing well and is expected

to contribute a profit in the second half of the year, which

represents an improvement under current market conditions when

compared to our expectations for the previous, predominantly

wholly-owned model.

The Group has made significant progress to date in 2023, and

although market conditions remain challenging, our strong balance

sheet gives the ability to invest for future growth. LSL remains

very well-positioned to benefit when market conditions improve, and

the Board remains confident of our profitability over the business

cycle.

H1 non-financial metrics 2023 2022 Var

UK Lending Market excl.

Product Transfers (GBPbn) 110.5 150.6 (27)%

LSL Lending Market Share(5) 10.4% 10.1% +30bps

LSL Network Advisers at

June 30 2,718 2,930 (7)%

------------------------------------ ------ ------ --------

Mortgage Approvals Market

excl. AVMs ('000s) 537 776 (31)%

LSL Surveying Jobs Market

Share(6) 39.4% 37.1% +230bps

LSL Operational Surveyors

at June 30 510 497 3%

------------------------------------ ------ ------ --------

UK Residential Transactions

('000s)(7) 482 591 (18)%

LSL Exchanges Market Share(7) 1.9% 2.0% (10)bps

Number of operational territories 308 318 (3)%

------------------------------------ ------ ------ --------

Notes:

1 Following the conversion of the entire owned estate agency

network to franchises in H1 2023, this was classified as a

discontinued operation and is now presented as such in the

Financial Statements. Refer to notes 2 and 6 to the Financial

Statements

2 Group Underlying Operating Profit is including discontinued

operations, before exceptional costs, contingent consideration

assets & liabilities, amortisation of intangible assets and

share-based payments (as set out in note 5 to the Financial

Statements)

3 Refer to note 8 to the Financial Statements

4 Refer to note 5 to the Financial Statements for the calculation

5 Mortgage lending excluding product transfers - New mortgage

lending by purpose of loan, UK (BOE) - Table MM23

6 Number of Approvals for lending secured on dwellings, BoE via UK Finance

7 Number of residential property transaction completions with

value GBP40,000 or above, HMRC

For further information, please contact:

David Stewart, Group Chief Executive

Officer

Adam Castleton, Group Chief Financial

Officer

------------------------------------

LSL Property Services plc investorrelations@lslps.co.uk

------------------------------------

Helen Tarbet

------------------------------------

Simon Compton

------------------------------------

George Beale

------------------------------------

Buchanan 0207 466 5000 / LSL@buchanan.uk.com

------------------------------------

Notes on LSL

LSL is one of the largest providers of services to mortgage

intermediaries and estate agent franchisees.

Its c.2,700 advisers represent around 10% of the total purchase

and remortgage market. PRIMIS was named Best Network, 300+

appointed representatives at the 2022 Mortgage Strategy Awards.

Its 61 estate agency franchisees operate in 308 territories

making it one of the leading providers of estate agency franchise

services in the UK with leading local brands.

LSL is also one of the UK's largest providers of surveying and

valuation services, supplying seven out of the ten largest lenders

in the UK. e.surv was named Best Surveying Firm at the 2022

Mortgage Finance Gazette Awards.

For further information please visit LSL's website:

lslps.co.uk

GROUP CHIEF EXECUTIVE'S REVIEW

The first six months of the year mark a period of significant

progress by the Group in its transformation to a higher margin,

lower capital intensity business that will perform more

consistently through market cycles. We have delivered significant

restructuring in both our Financial Services Network and our Estate

Agency Divisions which are now exclusively focused on

business-to-business services with a significantly lower cost base.

We estimate that this transformation has resulted in annual cost

savings of c.GBP140m.

Through this transformation, we have strengthened our balance

sheet and enhanced our financial flexibility, with disposal

proceeds and put in place a new bank facility.

Against a difficult market backdrop of rapidly increasing

interest rates and higher mortgage costs which reduced the number

of housing transactions, our financial performance was adversely

affected. However, our strong financial position will allow us to

take advantage of opportunities arising from market disruption. For

example, in August we announced the acquisition of TenetLime,

subject to FCA approval, and we will continue to assess other

opportunities to grow our Financial Services Network business.

I would like to thank all my colleagues for their continued hard

work and exceptional support in the transformation of the

Group.

Strategic priorities and developments

The Group has made substantial progress implementing the

strategy we set out in 2020 to simplify the business, reduce our

exposure to future housing market cycles, and focus investment on

high-growth areas, notably our Financial Services Network

business.

Whilst our Estate Agency Division has successfully gained market

share over recent years, its high fixed cost base meant that it

remained exposed to even relatively small changes in the number of

housing transactions, giving rise to a cyclical business model that

was constraining shareholder value.

The Board undertook a detailed review that considered a range of

options and concluded that the optimum strategy would be to convert

our owned estate agency network to franchises. Operating a

franchise network offers significant advantages, including:

-- A higher-margin business with a significantly smaller fixed

cost base, resulting in improved and substantially less volatile

earnings through housing market cycles

-- The continued distribution of related products and services,

including long-term provision of financial services

-- The potential to grow network footprint without significant

additional investment by supporting the expansion of franchisees

and recruiting new franchisees.

-- The opportunity to benefit from the entrepreneurship and

agility of independent franchisees, resulting in a more productive,

flexible and resilient business model

We decided to dispose of our Marsh & Parsons London estate

agency, in view of its size and the relatively low penetration of

financial services products. This plan was completed on 26 January

2023 when we announced its sale to Dexters London Limited for gross

proceeds of GBP29m(1) . Marsh & Parsons contributed an

Underlying Operating Profit of GBP1.6m in the 2022 financial

year.

The conversion of the remaining owned estate agency network of

183 branches to franchises was announced on 4 May 2023. This

represented the culmination of a major programme of work with the

newly franchised branches being supplemented by the existing

network of 120 franchise branches, making LSL one of the largest

providers of property franchise services in the UK. The new

franchise agreements were negotiated with existing LSL franchisees

and experienced senior members of the LSL Estate Agency management

team, and we believe they are well-placed to be successful.

This programme allowed us to realise significant cost reductions

immediately with further savings to be made over time, although the

net impact on 2023 Underlying Operating Profit(3) from total

operations was expected to be neutral. The recent deterioration in

market conditions will increase the advantage of the franchise

model in H2. We expect the change will be accretive to Group

profits through housing market cycles from the beginning of 2024

onwards. Average operating profit margins from Estate Agency

franchises since the conversion have been over 25%.

Franchising the owned branches allows us to rationalise central

functions. These changes will continue during 2023 and 2024,

delivering incremental phased benefits. We estimate that this

change in business model, combined with the sale of Marsh &

Parsons, eliminates over GBP110m of a cost base of c.GBP125m that

supported the Estate Agency Division, with the largest reduction

taking place immediately.

The first half of 2023 also saw us complete the disposal of our

four direct-to-consumer financial services brokerages: RSC, Group

First, Embrace Financial Services ("EFS") and First2Protect, to

Pivotal Growth, our joint venture. The disposal of these

direct-to-consumer financial services businesses collectively will

allow us to realise further cost reductions of c.GBP32m, in

addition to those gained through the restructure of Estate Agency,

with a total annualised cost reduction of c.GBP140m.

The transfer of these businesses to Pivotal Growth continues the

steps taken to simplify the Group in line with our strategy to

focus financial services activity on business-to-business services,

through LSL's PRIMIS mortgage network through which we distribute

over 10% of all new mortgages in the UK.

We also believe that Pivotal Growth is better placed to increase

the value of these businesses, whilst the transactions have

substantially increased the number of Pivotal Growth advisers and

established a significant presence in the new build and estate

agency sectors and provided additional capability in the general

insurance market. LSL will retain the ability to capitalise on

opportunities in direct-to-consumer financial services through its

47.8% equity share in Pivotal Growth.

More recently, in August 2023 we announced the acquisition of

TenetLime from the Tenet Group, subject to FCA approval, in a deal

that would add up to 278 advisers working in 157 firms to our

Financial Services Network business.

Alongside our strategic change activities, a significant

programme of work was also completed during H1 as part of the

preparation for the implementation of the FCA's Consumer Duty on 31

July 2023. Our teams have engaged closely with members of the

PRIMIS network and collaborated with industry bodies as part of

this delivery. The Board and relevant governance committees have

also monitored the progress of this work to ensure readiness for

this implementation. We believe that the Consumer Duty initiative

will provide long term benefits to the financial services industry

as a whole, by raising industry standards and improving customer

confidence.

Following completion of these strategic projects, our Estate

Agency and Financial Services businesses are now well-placed to

deliver margins that are structurally higher than delivered

historically, whilst significantly reducing their exposure to

future housing and mortgage market cycles.

Divisional Performance Review

The first half of 2023 was a period of significant change for

LSL. Given the significantly challenging economic and market

backdrop, I am pleased to confirm that the Group traded resiliently

and profitably, maintaining, and improving its position in key

markets.

The restructuring activity undertaken does mean that our

financial results are less directly comparable against the same

period in 2022.

Financial Services Network & Financial Services Other

The Financial Services Network business is at the heart of the

Group's growth strategy, and I am pleased to report continuing

growth in market share and resilient financial performance.

It is in more challenging market conditions that the advantages

of the small independent client-focused broker business model are

best demonstrated. The services provided by our Financial Services

Network help our member firms respond quickly to changing market

conditions, by providing added-value solutions to clients and

maximising the income opportunities available.

Evidence for this can be seen in the market share gains

achieved. Our advisers increased their share of each of the

purchase, remortgage and product transfer markets, with total

mortgage completion lending reducing only slightly to GBP19.6bn (H1

2022: GBP20.5bn) whilst recording a record market share(2) of 10.4%

(H1 2022: 10.1%). Also encouraging has been the robust performance

in protection cases, with the Network increasing by 1% to c.64k

with average premium also up by 2%.

The rise in mortgage rates has resulted in an increase in lower

margin product transfer cases, as lenders remain conservative with

respect to new borrowers, and this has naturally had some impact on

Revenue and Profits. Financial Services Network Revenue totalled

GBP19.6m (H1 2022: GBP20.5m) and Underlying Operating Profit(3) was

GBP5.5m (H1 2022: GBP7.5m).

Financial Services Other performance was in-line with our

expectations as we continue to re-focus our Mortgage Gym and DLPS

technology businesses with work ongoing to adapt and develop their

technology capability for deployment across our Financial Services

Network.

Financial Services highlights include:

-- Total Financial Services Division reported revenue was

GBP28.0m (H1 2022: GBP39.8m), with core Financial Services Network

Revenue down 4% year-on-year despite a significant change in market

dynamics towards lower margin Product Transfers with insurance

related product revenues +1%

-- Financial Services Other revenue was 56% below H1 2022. After adjusting for disposal of the direct-to-consumer businesses, revenue in the remaining businesses was 3% below last year

-- Network Underlying Operating Profit(3) was GBP5.5m (H1 2022:

GBP7.5m), impacted by the increase in lower margin product

transfers which were 48% higher than H1 2022

-- Total Financial Services Division Underlying Operating

Profit(3) was GBP3.8m (H1 2022: GBP6.1m), which included GBP0.6m

losses within the D2C businesses, impacted particularly by the

lower purchase market, prior to their sale to Pivotal Growth

-- Total lending of GBP19.6bn, down 4% (H1 2022: GBP20.5bn) with

41% of mortgage businesses being lower margin Product Transfers (H1

2022: 27%), the increased proportion being driven by cost of living

and affordability criteria

-- Gross purchase and remortgage completion lending reduced by

23% to GBP11.5bn (H1 2022: GBP15.1bn)

-- Further increase in share of UK purchase and remortgage

market to 10.4%(2) (H1 2022: 10.1%), reflecting strength of Network

mortgage advisers in remortgages

-- Product transfer volumes deliver significantly lower margin

than purchase and remortgage activity, resulting in overall margin

reduction, with gross revenues generated by the Financial Services

Network business (including the TMA mortgage club) 8% lower than H1

2022 at GBP134.2m (H1 2022: GBP146.1m)

-- Gross revenue per adviser(4) down 1% with completions per

adviser +16% above H1 2022 driven by the material increase in

margin dilutive product transfer volumes

-- Total LSL advisers reduced by 7% to 2,718 (H1 2022: 2,930) as

network firms remained cautious about growing adviser numbers

during a time of economic and political uncertainty, instead

focusing on productivity

-- We expect adviser numbers to start to increase as a result of

the largest adviser pipeline at 30 June 2023 since September 2021

and the TenetLime acquisition

Surveying & Valuation

The Surveying & Valuation market has been particularly

affected by reduced appetite on the part of lenders, with the most

significant impacts being felt in equity release and buy-to-let

instructions, sectors where both supply and demand have been

reduced by the rapid rise in interest rates. I can, however, report

that the Group increased further its share of lender valuations(5)

, which is a testament to the quality of service provided by our

team.

Surveying & Valuation Revenue fell to GBP35.5m (H1 2022:

GBP50.5m) and Surveying & Valuation Underlying Operating Profit

to GBP3.4m (H1 2022: GBP13.1m). Self-help measures were put in

place, including a modest reduction in the number of employed

surveyors. However, our principal focus remains to retain

sufficient capacity to meet the requirements of more normal market

conditions, which means that we continue to carry material excess

costs over the current level of demand, with a consequent

anticipated impact on profitability in H2.

We have identified medium-term opportunities to increase our

diversification and reduce reliance on lender valuations and our

exposure to mortgage market cycles, by growing our revenue streams

from new products such as direct-to-consumer services. H1 2023

income of GBP1.8m for these revenue streams grew slightly, in

difficult markets, and have increased 100% since H1 2019.

Surveying & Valuation highlights include:

-- Revenue of GBP35.5m (H1 2022: GBP50.5m) was 30% down compared

to prior year, but as the half progressed, volumes strengthened,

with the exit run rate at the end of June on an upward trajectory

as we increased our market share during the period(5)

-- The total number of jobs performed during the period was

212,000 which was 27% lower than in H1 2022, with Q1 36% lower and

Q2 improving to 17% lower

-- Underlying Operating Profit(3) of GBP3.4m (H1 2022: GBP13.1m)

with Q2 materially higher than Q1 and exiting the half with June

in-line with prior year, benefiting from improving trading and the

benefit of cost actions taken during the period

-- Income per job reduced by 4% to GBP168 (H1 2022: GBP175), due

to volume within the higher margin specialist sector

disproportionately impacted by the change in market conditions

Estate Agency

The comparative performance of Estate Agency was significantly

impacted by the completion of the strategic restructuring projects

during the first half of 2023. We announced on 4 May that the

entire owned estate of 183 branches would be converted to

franchises. This announcement followed the disposal in January of

our London estate agent, Marsh & Parsons, for gross

consideration of GBP29m(1) .

Trading within the business was impacted by the market-wide fall

of 18% in house sales and by the temporary disruption and

additional costs arising from the conversion of the owned branches

to franchisees. Against this backdrop, we experienced only a very

small reduction in national market share(8) which reduced slightly

to 1.9% (H1 2022: 2.0%).

On a reported continuing basis, Estate Agency and Franchise

business revenue was GBP9.0m (H1 2022: GBP19.9m) and Underlying

Operating Profit(3) from continuing operations was GBP0.6m (H1

2022: GBP0.4m loss). The revenue comparison primarily reflects the

disposal of Marsh & Parsons in the period, and the conversion

of owned branches to franchises announced towards the end of the

period. Estate Agency and Franchise business revenue including

discontinued operations was GBP41.3m, and Underlying Operating Loss

from total Estate Agency operations was GBP(0.3)m (H1 2022: GBP1.0m

loss).

Estate Agency highlights include:

-- Following the conversion of 183 owned branches to franchisees

LSL is one of the leading providers of estate agency franchise

services in the UK, supplying services to a network of just over

300 branches

-- Disposal of London estate agent, Marsh & Parsons, for gross consideration of GBP29.0m(1)

-- Annualised cost reduction of c.GBP110m due to disposals and franchising of 183 branches

-- Underlying Operating Profit on continuing operations(3,7) of

GBP0.6m (H1 2022: GBP0.4m loss) in a reduced purchase market with

May and June c.GBP1m ahead of operating profit from same period in

prior year after the franchising of the branch Network

-- Estate Agency national market share(8) reduced slightly to 1.9% (H1 2022: 2.0%)

-- Strong lettings performance with c.10% increase in average income per managed property

Pivotal Growth Joint Venture

The first half of 2023 also saw us complete the disposal of our

four direct-to-consumer financial services brokerages: RSC, Group

First, EFS and First2Protect, to Pivotal Growth, our joint venture.

The disposal of our direct-to-consumer financial services

businesses collectively will enable us to realise further cost

reductions of c.GBP32m, in addition to those gained through the

restructure of Estate Agency. Following the transfer of these

businesses, Pivotal Growth has now achieved critical mass with over

300 advisers, improving its ability to win new distribution

agreements and making it a more compelling proposition for future

acquisition partners.

Strong balance sheet

Our balance sheet remains strong as at 30 June 2023, including

in a Net Cash(9) balance of GBP36.3m, supported by proceeds

received of GBP35.4m during the period for disposals made. The

strength of our balance sheet together with continuing strong cash

generation over the financial year enables us to continue to invest

with confidence throughout the economic cycle. During the remainder

of 2023, we will continue to invest in capability and technology,

consider potential acquisition targets to build our Financial

Services Network business, as well as support Pivotal Growth in its

acquisition of D2C brokerages.

To provide further flexibility to our balance sheet, during

February 2023 we agreed a new banking facility with a maturity date

of May 2026, arranged on materially the same terms, replacing the

previous GBP90m with a GBP60m revolving credit facility with major

mainstream UK lenders, available on request at any time, subject to

meeting drawdown requirements of the facility.

The Board will continue to actively review its capital

allocation policy considering economic conditions and the risk of

further deterioration, whilst noting the greater resilience of its

restructured Group.

Dividend

The Board has considered the interim dividend considering the

Group's policy to pay out 30% of Group Underlying Operating

Profit(3) after finance and normalised tax charges, such that

dividend cover is held at approximately three times earnings over

the business cycle. This policy was designed to provide clarity to

shareholders and ensure the Group retained a strong balance sheet

for all market conditions.

As part of our strategic shift and the associated

rationalisation of certain businesses such as the sales of Marsh

& Parsons and First2Protect during the period, we have built

significant Net Cash balances, which at 30 June 2023, stood at

GBP36.3m. Considering this very strong cash position and reflecting

the Board's confidence in the future prospects of the Group, the

Board has declared an interim dividend of 4.0 pence per share,

unchanged from last year.

The ex-dividend date for the interim dividend is 5 October 2023

with a record date of 6 October 2023 and a payment date of 10

November 2023. Shareholders can elect to reinvest their cash

dividend and purchase additional shares in LSL through a dividend

reinvestment plan. The election date is 20 October 2023.

Living Responsibly

The Board is clear that success is about more than just profits

and our Living Responsibly programme is at the centre of our

sustainability strategy. Put simply, our objective is to have a

positive effect on the communities in which we operate, whether

that is measured by the impact we have on the environment, the

opportunities we provide to colleagues, the way we serve our

customers or the work we undertake in our communities.

In our ESG and our Living Responsibly reports published in April

2023, we set out some of the steps we have taken to limit our

environmental impact, help ensure LSL is a supportive and inclusive

workplace, and provide support to good causes.

It is vital that our Living Responsibly programme has real

substance and is reflected in everything we do. We are helped in

achieving this by a number of independent colleague forums and

working groups which provide additional insight in key areas. Steps

taken in 2023 include the establishment of LSL Voices, a colleague

driven initiative to provide help and support to colleagues right

across the Group. Further information on this important development

is included in our Living Responsibly Report. I am grateful to the

very many colleagues who have willingly given their time and energy

to support this work. I am also pleased to report that all

colleagues receive at least the Real Living Wage.

I am equally grateful for the hard work and commitment of all

our colleagues during what has been a hugely challenging period.

They have helped ensure LSL is well-positioned to thrive in all

market conditions and would like to take this opportunity to thank

them for their effort and support.

Outlook

As we noted in our Trading Update issued on 7 August, changes in

the supply and demand of mortgage products have had a significant

impact on parts of our business, most notably in Surveying but also

Financial Services. Since then, trading has stabilised, and the

recent decision to hold base rates unchanged is expected to provide

further stability and the steadying of market sentiment. The Board

currently expects Underlying Operating Profit for FY 2023 to be in

line with its expectations as revised at the time of the Trading

Update on 7 August.

The independent mortgage broker business model continues to

demonstrate resilience and agility, with LSL members increasing

their share in each of the sub-segments of the mortgage market

during H1, as well as performing strongly in protection advice. Our

Estate Agency Franchise business is performing well and is expected

to contribute a profit in the second half of the year, which

represents an improvement under current market conditions when

compared to our expectations for the previous predominantly

wholly-owned model.

The Group has made significant progress to date in 2023, and

although market conditions are more challenging than previously

expected, our strong balance sheet gives the ability to invest for

future growth. LSL remains very well-positioned to benefit when

market conditions improve, and the Board remains confident of our

profitability over the business cycle.

David Stewart

Group Chief Executive Officer

26 September 2023

Notes:

1 Refer to note 8 and 18 to the Financial Statements

2 Mortgage lending excluding product transfers - New mortgage

lending by purpose of loan, UK (BOE) - Table MM23

3 Group (and Divisional) Underlying Operating Profit is before

exceptional items, contingent consideration assets &

liabilities, amortisation of intangible assets and share-based

payments. Refer to note 5 of the Financial Statements for

reconciliation of Group and Divisional Underlying Operating Profit

to statutory operating (loss)/profit for continuing, discontinued

and total operations

4 Gross revenue per adviser is calculated as Financial Services

Network gross revenue (excluding the TMA mortgage club) per active

adviser

5 Number of Approvals for lending secured on dwellings, BoE via UK Finance

6 Full Time Equivalent (FTE)

7 Following the conversion of the entire owned estate agency

network to franchisees in H1 2023, this was classified as a

discontinued operation and is now presented as such in the

financial statements. Refer to notes 2 and 6 to the Financial

Statements

8 Number of residential property transaction completions with

value GBP40,000 or above, HMRC

9 Refer to note 5 to the Financial Statements for the calculation

H1 P&L (GBPm) 2023 2022 Var

------ ------

Divisional Group Revenue

Financial Services Network

(net revenue) 19.6 20.5 (4)%

Financial Services Other 8.4 19.3 (56)%

Financial Services 28.0 39.8 (30)%

Surveying & Valuation 35.5 50.5 (30)%

Estate Agency 9.0 19.9 (55)%

Group Revenue 72.5 110.2 (34)%

------------------------------------ ------ ------ ------

Estate Agency - discontinued

operations 32.3 50.7 (36)%

Group Revenue (incl. discontinued

operations) 104.8 160.9 (35)%

------------------------------------ ------ ------ ------

Divisional Underlying

Operating Profit(1)

Financial Services Network 5.5 7.5 (27)%

Financial Services Other (1.7) (1.3) (30)%

Financial Services 3.8 6.1 (38)%

Surveying & Valuation 3.4 13.1 (74)%

Estate Agency 0.6 (0.4) 248%

Unallocated Central Costs (3.5) (4.0) 14%

Group Underlying Operating

Profit from continuing

operations 4.3 14.7 (71)%

Estate Agency - discontinued

operations (1.0) (0.5) (81)%

Group Underlying Operating

Profit

from total operations 3.3 14.2 (76)%

------------------------------------ ------ ------ ------

H1 P&L (GBPm) 2023 2022 Var

------ ------

Divisional statutory operating

(loss)/profit(1)

Financial Services 9.9 4.9 103%

Surveying & Valuation 1.3 12.9 (90)%

Estate Agency (0.3) (3.1) 90%

Unallocated Central Costs (3.7) (4.7) +21%

Group statutory operating

(loss)/profit 7.2 9.9 (27)%

--------------------------------- ------ ------ ------

Notes:

1 Refer to note 5 of the Financial Statements for reconciliation

of Group and Divisional Underlying Operating Profit to statutory

operating (loss)/profit

FINANCIAL REVIEW

Group Highlights

-- Group Revenue from continuing operations(3) was GBP72.5m (H1

2022: GBP110.2m) on a reported basis. After adjusting for disposals

and discontinued operations in Estate Agency, revenue was 17% below

prior year in a housing market 18% lower and in a smaller lending

market. Including discontinued operations(1) in Estate Agency,

adjusted revenue was GBP104.8m (H1 2022: GBP160.9m)

-- Group Underlying Operating Profit from total operations(2) of

GBP3.3m includes c.GBP2m from losses in businesses disposed of in

the period and a cost-of-living payment for lower-paid staff. Group

Underlying Operating Profit from continued operations was GBP4.3m

(H1 2022: GBP14.7m)

-- Operating costs were c.30% lower in H1 compared to prior

year, exiting the period over 50% lower than prior year, reflecting

an annualised cost reduction of c.GBP140m following the execution

of all the strategic programmes and also very careful cost

management particularly in the Surveying & Valuation Division

where headcount was reduced

-- Loss on discontinued operations(3) of GBP42.9m (net of tax)

in relation to the previously owned network (H1 2022: GBP1.7m),

including exceptional restructuring costs in relation to the

conversion of the Estate Agency network (GBP12.7m) and write down

of associated disposed goodwill (GBP38.1m), offset in part by the

exceptional gain on recognition of intangible franchise agreements

of GBP10.7m. The discontinued operations in Estate Agency

contributed an Underlying Operating Loss of GBP1.0m during the

period

Financial Statements Review

Income Statement

Revenue & Operating profit

Group Revenue from continuing operations for the 6 months to 30

June 2023 of GBP72.5m was 34% below last year (H1 2022: GBP110.2m)

on a reported basis. Like for like revenue(1) after adjusting for

disposals and franchising of the Estate Agency branch Network was

17% below prior year with the housing market 18% lower and a

smaller lending market. Including discontinued operations in Estate

Agency, adjusted revenue was GBP104.8m (H1 2022: GBP160.9m)

reflecting the previously owned network revenues.

Group Underlying Operating Profit from total operations(2,3) for

the 6 months to 30 June 2023 of GBP3.3m (H1 2022: GBP14.2m), after

charging GBP1.0m losses from businesses which were disposed in the

period and a one-off GBP0.9m cost of living award to lower-paid

staff.

On a statutory continuing basis(3) , Group operating profit was

GBP7.2m (H1 2022: GBP9.9m) including the net gain on disposals of

GBP7.2m, offset in part by GBP2.9m of exceptional costs primarily

relating to restructuring activity and corporate costs.

Other operating income

Total other operating income was GBP0.3m (H1 2022: GBP1.1m).

(Loss) / income from joint ventures and associates

Losses from our equity share of Pivotal Growth was GBP0.2m (H1

2022: GBP0.2m loss).

Share-based payments

The share-based payment charge of GBP0.4m (H1 2022: GBP1.5m)

consists of a charge in the period of GBP1.5m, offset by lapses and

adjustments for leavers and options exercised in the period. The

prior year included a higher charge of GBP1.8m, offset by lower

lapse and leaver adjustments.

Amortisation of intangible assets

The amortisation charge for H1 2023 was GBP1.0m (H1 2022:

GBP1.4m) being amortisation of intangible software investment and

amortisation of franchise agreements.

Exceptional items(4)

The exceptional gain of GBP8.6m (H1 2022: GBPnil) relates to the

gain on disposal during the period of the Embrace Financial

Services and First2Protect businesses to Pivotal Growth.

Consideration of GBP9.3m was received on completion of

First2Protect, with contingent consideration to be received in 2025

for Embrace Financial Services based upon 7x 2024 EBITDA

performance.

Exceptional costs of GBP4.3m (H1 2022: GBP2.0m), primarily

related to restructuring activity and corporate transaction costs

of GBP2.9m and the net loss on disposals of Group First, RSC and

Marsh & Parsons of GBP1.4m.

Contingent consideration

There was GBPnil contingent consideration recognised in the

period (H1 2022: GBP0.1m).

Net finance costs

Finance income increased to GBP0.8m (H1 2022: GBPnil) resulting

from increased interest received on funds held on deposit. Net

finance costs amounted to GBP0.9m (H1 2022: GBP1.1m) and related

principally to the unwinding of the IFRS 16 lease liability of

GBP0.4m (H1 2022: GBP0.7m), which reduced as a result of the

disposal of Marsh & Parsons, and commitment and non-utilisation

fees on the revolving credit facility of GBP0.5m (H1 2022:

GBP0.5m).

Profit before tax

Profit before tax was GBP7.1m (H1 2022: profit before tax of

GBP8.9m). The year-on-year movement is primarily due to the lower

Group Underlying Operating Profit offset in part by the net

exceptional gain in the period.

Taxation

The tax charge of GBP2.1m (H1 2022: GBP1.4m) represents an

effective tax rate of 29%, which is slightly higher than the

headline UK tax rate of 25%. Deferred tax assets and liabilities

are measured at 25% (2022: 25%), the tax rate that came into effect

from 1 April 2023.

Discontinued operations(3)

The loss on discontinued operations of GBP42.9m (net of tax) (H1

2022: GBP1.7m), was in relation to the previously owned Estate

Agency network, including exceptional restructuring costs in

relation to the conversion of the Estate Agency network (GBP12.7m)

and write down of associated disposed goodwill (GBP38.1m), offset

by the exceptional gain on recognition of intangible franchise

agreements of GBP10.7m.

Earnings per Share(5)

Basic Earnings per Share from total operations was a loss of

(36.8) pence (H1 2022: 5.6 pence), with diluted Earnings per Share

from total operations being a loss of (36.8) pence (H1 2022: 5.6

pence). Basic Earnings per Share from continuing operations was 5.0

pence (H1 2022: 7.3 pence), with diluted Earnings per Share from

continuing operations of 4.9 pence (H1 2022: 7.3 pence). Basic

Earnings per Share from discontinued operations was a loss of

(41.7) pence (H1 2022: loss of (1.7) pence), with diluted Earnings

per Share from continuing operations being a loss of (41.7) pence

(H1 2022: loss of (1.7) pence). The Adjusted Basic Earnings per

Share from total operations was 2.7 pence (H1 2022: 10.7 pence) and

adjusted diluted Earnings per Share from total operations was 2.7

pence (H1 2022: 10.7 pence).

Balance Sheet

Goodwill (6)

The carrying value of goodwill is GBP16.9m (31 December 2022:

GBP55.0m(7) , H1 2022: GBP153.7m(7) ). Following the conversion of

the entire owned Estate Agency network to franchises during the

period, and its classification as a discontinued operation, the

goodwill associated with Your Move, Reeds Rains and LSLi owned

branches (GBP38.1m) has been disposed and reduced to GBPnil.

Goodwill previously included within held for sale assets of

GBP17.3m was disposed as part of the sales of Marsh & Parsons

(GBP12.6m), Group First (GBP3.6m) and RSC (GBP1.1m) which completed

in January 2023.

Other intangible assets(8) and property, plant and equipment

Total capital expenditure in the first half of the year amounted

to GBP1.6m (H1 2022: GBP2.2m), primarily reflecting ongoing

investment in Financial Services and Surveying, and a reduction in

Estate Agency following the franchising transformation during the

period. The capital expenditure includes GBP1.1m in intangible

software development, particularly in Financial Services. New

intangible franchise agreements of GBP10.7m were recognised during

the period following the conversion of the entire owned Estate

Agency network to franchises. The fair value of all franchise

agreements(7) was GBP12.2m at 30 June 2023 ((31 December 2022:

GBP1.5m(7) , H1 2022: GBP1.6m(7) ).

Prior year restatements(7)

Franchising of previously owned branches

During the current period, the Group franchised its entire owned

estate agency network (183 branches). In accounting for this

significant transaction, the Group re-examined the accounting

treatment that had been applied to a much smaller transaction in H1

2019, when 39 owned estate agency branches were franchised. The

impact of this was to restate the goodwill associated with these

owned branches written down by GBP5.2m and to recognise a franchise

intangible of GBP2.1m, with the cumulative non-cash impact on

retained earnings at 1 January 2022 of GBP4.0m.

Adjustments to assets held for sale

At 31 December 2022 the Group reported Marsh & Parsons as

held for sale. Marsh & Parsons was written down to its fair

value less cost to sell (FVLCTS), which was calculated as the

initial consideration received less transaction costs (GBP28.9m).

The Group has re-examined the judgements made and has determined

that an adjustment to consideration for debt-like items of GBP2.0m

could have been reliably estimated at 31 December 2022. Rather than

recognising this adjustment as an increase in the loss on disposal

in H1 of 2023, the prior year financial information has been

restated, in accordance with IAS 8.

Financial assets and investments in joint ventures

Financial assets

Financial assets of GBP8.5m at 30 June 2023 (31 December 2022:

GBP1.0m, H1 2022: GBP6.1m) comprise investments in equity

instruments in unlisted companies and contingent consideration

assets. The fair value of units held in The Openwork Partnership

LLP was reassessed at 30 June 2023 as GBP0.5m (31 December 2022:

GBP0.7m, H1 2022: GBP0.8m).

In January 2023, the Group agreed to sell its shares in Yopa for

GBPnil consideration, which was in line with its carrying value as

at 31 December 2022.

In March 2023, the Group agreed to sell its shares in VEM for

GBP0.2m consideration, received on completion, which was in line

with its carrying value as at 31 December 2022.

Contingent consideration assets

During the period, the Group disposed of the Group First, RSC

and EFS businesses to Pivotal Growth, its joint venture, with

contingent consideration receivable in 2025 based upon 7x 2024

EBITDA performance. As at 30 June 2023, this is recorded at GBP8.0m

(31 December 2022: GBPnil, H1 2022: GBPnil).

Joint ventures

In April 2021 the Group established the Pivotal Growth joint

venture and holds a 47.8% interest at 30 June 2023. The joint

venture is accounted for using the equity method and is held on the

balance sheet at GBP9.6m as at 30 June 2023 (31 December 2022:

GBP5.1m, H1 2022: GBP2.3m), representing the Group's equity

investment in Pivotal Growth during the period, less our share of

losses after tax for the period.

Loans to franchisees

As part of the initial support provided to the new franchisees

of the previously owned Estate Agency branches, working capital

loan facility agreements were put in place, of which GBP1.3m had

been drawn down as at 30 June 2023 (31 December 2022: GBPnil, 30

June 2022: GBPnil).

Financial liabilities

Contingent consideration liabilities

Contingent consideration liabilities at 30 June 2023 were

GBP0.03m (31 December 2022: GBP2.3m, H1 2022: GBP2.9m). Contingent

consideration liabilities relate solely to the cost of acquiring

the remaining shares in Direct Life Quote Holdings Limited. The

year-on-year reduction reflects an update to forecasts in both RSC

and Direct Life Quote Holdings Limited, and the full settlement of

the contingent consideration liability of GBP2.3m in RSC ahead of

its disposal in January 2023.

Bank facilities/ Liquidity

In February 2023, LSL agreed an amendment and restatement of our

banking facility, with a GBP60m committed revolving credit

facility, and a maturity date of May 2026, which replaced the

previous GBP90m facility due to mature in May 2024. The terms of

the facility have remained materially the same as the previous

facility. The facility is provided by the same syndicate members as

before, namely Barclays Bank plc, NatWest Bank plc and Santander UK

plc.

In arranging the banking facility, the Board took the

opportunity to review the Group's borrowing requirements,

considering our strong cash position and the Group's aim of

reducing its reliance on the housing market. We therefore reduced

the size of the committed facility and the costs associated with

it. To provide further flexibility to support growth, the facility

retains a GBP30m accordion, to be requested by LSL at any time,

subject to bank approval.

At 30 June 2023, Net Cash(9) was at a record high at a half year

at GBP36.3m (31 December 2022: Net Cash GBP40.1m, H1 2022:

GBP30.7m), providing flexibility to make further investments to

support growth. The net decrease in cash and cash equivalents of

GBP3.8m during H1 2023 included further investment in Pivotal

Growth (GBP4.7m), capital expenditure of GBP1.6m (H1 2022:

GBP2.2m), exceptional costs in relation to divisional restructure

and transformation programmes of GBP3.8m and payment of the 2022

final dividend of GBP7.6m (H1 2021: GBP7.7m dividends paid) and the

settlement of contingent consideration in RSC of GBP2.3m ahead of

its disposal to Pivotal Growth. There were reduced corporation tax

payments (GBPnil) as a result of the loss before tax position (H1

2022: GBP4.1m). Marsh & Parsons and First2Protect businesses

were sold for net consideration received during the period of

GBP26.1m and GBP9.3m respectively, with contingent consideration

for the disposals of Group First, RSC and EFS receivable in 2025

based upon 7x 2024 EBITDA performance. Total cash balances in the

disposed businesses at the point of sale were GBP9.0m.

The Financial Services Network business has a regulatory capital

requirement associated with its regulated revenues. The regulatory

capital requirement was GBP6.1m at 30 June 2023 (31 December 2022:

GBP5.9m, H1 2022: GBP5.9m), with a surplus of GBP24.4m (31 December

2022: GBP24.9m, H1 2022: GBP13.4m).

Treasury and Risk Management

We have an active debt management policy. The Group does not

hold or issue derivatives or other financial instruments for

trading purposes. Further details on the Group's financial

commitments, as well as the Group's treasury and risk management

policies, are set out in our Annual Report and Accounts 2022.

International Accounting Standards (IAS)

The Interim Condensed Consolidated Group Financial Statements

for the period ended 30 June 2023 have been prepared in accordance

with international accounting standards in conformity with the

requirements of the Companies Act 2006 and UK-adopted IAS.

Notes:

1 Like for like revenue: GBP66.3m in H1 2023 with statutory

revenue of GBP72.5m less GBP6.2m revenue from businesses disposed

in H1 2023, as compared to GBP79.5m in H1 2022 with statutory

revenue of GBP110.2m less GBP30.7m revenue from businesses disposed

in H1 2023

2 Refer to note 5 of the Financial Statements for reconciliation

of Group and Divisional Underlying Operating Profit to statutory

operating (loss)/profit for continuing, discontinued and total

operations

3 Following the conversion of the entire owned Estate Agency

network to franchisees in H1 2023, this was classified as a

discontinued operation and is now presented as such in the

Financial Statements. Refer to notes 2 and 6 to the Financial

Statements

4 Refer to note 8 of the Financial Statements

5 Refer to note 7 of the Financial Statements for the calculation

6 Refer to note 12 of the Financial Statements

7 Refer to note 18 of the Financial Statements

8 Refer to note 11 of the Financial Statements

9 Refer to note 5 of the Financial Statements for the calculation

Principal Risks and Uncertainties

The principal risks and uncertainties relating to the Group's

operations remain consistent with those disclosed on pages 25 to 28

of the Group's Annual Report and Accounts 2022 (which can be

accessed on the Group's website: www.lslps.co.uk). Having

reconsidered these principal risks and uncertainties, the Board has

concluded that these remain the same as those included within the

Annual Report and Accounts 2022.

Responsibility statement of the Directors in respect of the

half-yearly financial report

We confirm that to the best of our knowledge:

-- The Interim Condensed Consolidated Group Financial Statements

for the period ended 30 June 2023 have been prepared in accordance

with UK adopted International Accounting Standard 34;

-- The interim management report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being

an indication of important events that have occurred during the

first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the financial year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related-party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period; and any changes in the related-party transactions

described in the last annual report that could do so.

By order of the Board

David Stewart Adam Castleton

Director, Group Chief Executive Officer Director, Group Chief

Financial Officer

26 September 2023 26 September 2023

Interim Group Income Statement

for the six months ended 30 June 2023

Unaudited Audited

Six Months Ended Year Ended

30 June Restated* Restated

2023 30 June * 31 December

2022 2022

Continuing operations Note GBP'000 GBP'000 GBP'000

-------- --------- --------------

Revenue 4 72,494 110,173 217,472

Operating expenses:

Employee costs (51,534) (73,616) (145,325)

Depreciation on property, plant and

equipment and right-of-use assets (1,644) (3,851) (7,612)

Other operating costs (15,099) (18,868) (35,083)

Other operating income 264 1,085 1,334

Loss on sale of property, plant and

equipment - (2) -

Share of post-tax loss from joint ventures

and associates (167) (208) (494)

Share-based payments (377) (1,456) (1,860)

Amortisation of intangible assets (987) (1,428) (2,866)

Exceptional gains 8 8,583 - 694

Exceptional costs 8 (4,317) (2,000) (48,316)

Contingent consideration 14 1 115 696

--------------

Group operating profit/(loss) 7,217 9,944 (21,360)

Finance income 752 6 76

Finance costs (884) (1,075) (2,147)

(2,071

Net finance costs (132) (1,069) )

Profit/(loss) before tax from continuing

operations 7,085 8,875 (23,431)

Taxation charge 10 (2,063) (1,384) (3,020)

Profit/(loss) for the period from

continuing operations 5,022 7,491 (26,451)

Discontinued operations

Loss for period from discontinued operations 6 (42,940) (1,718) (36,026)

-------- --------- --------------

(Loss)/profit for the period (37,918) 5,773 (62,477)

-------- --------- --------------

Attributable to:

Owners of the parent (37,842) 5,824 (62,384)

Non-controlling interest (76) (51) (93)

-------- --------- --------------

(37,918) 5,773 (62,477)

-------- --------- --------------

(Loss)/earnings per share from total

operations (expressed as pence per

share):

Basic 7 (36.8) 5.6 (60.8)

Diluted 7 (36.8) 5.6 (60.8)

(Loss)/earnings per share from continuing

operations (expressed as pence per

share):

Basic 7 5.0 7.3 (25.7)

Diluted 7 4.9 7.3 (25.7)

-------- --------- --------------

*See note 18 for details regarding the restatement.

Interim Group Statement of Comprehensive Income

for the six months ended 30 June 2023

Unaudited Audited

Six Months Ended Year Ended

Restated Restated

* *

30 June 30 June 31 December

2023 2022 2022

Note GBP'000 GBP'000 GBP'000

----------- ----------- ------------

Loss/(profit) for the period (37,918) 5,773 (62,477)

Items not to be reclassified to profit

and loss in subsequent periods:

Revaluation of financial assets not

recycled through income statement 13 (116) (370) (5,096)

Tax on revaluation (1) - 130

----------- ----------- ------------

(117) (370) (4,966)

----------- ----------- ------------

Total comprehensive (expense) / income,

net of tax (38,035) 5,403 (67,443)

----------- ----------- ------------

Attributable to:

Owners of the parent (37,959) 5,454 (67,350)

Non-controlling interest (76) (51) (93)

----------- ----------- ------------

(38,035) 5,403 (67,443)

----------- ----------- ------------

*See note 18 for details regarding the restatement.

Interim Group Balance Sheet

as at 30 June 2023

Unaudited Audited

Restated Restated*

30 June * 30 June 31 December

2023 2022 2022

Note GBP'000 GBP'000 GBP'000

--------- ----------- -------------

Non-current assets

Goodwill 12 16,855 153,654 54,997

Other intangible assets 11 26,010 30,389 17,280

Property, plant and equipment 6,295 33,550 15,570

Financial assets 13 8,488 6,095 1,045

Investment in sublease 2,256 - -

Investments in joint venture 16 9,582 2,338 5,068

Contract assets 409 521 431

Loans to franchisees 13 1,335 - -

--------- ----------- -------------

Total non-current assets 71,230 226,547 94,391

--------- ----------- -------------

Current assets

Trade and other receivables 32,032 38,944 26,608

Contract assets 219 424 348

Investment in sublease 2,152 - -

Current tax asset - 3,499 3,063

Cash and cash equivalents 36,300 30,708 36,755

-------------

70,703 73,575 66,774

--------- ----------- -------------

Assets held for sale - - 54,402

--------- ----------- -------------

Total current assets 70,703 73,575 121,176

--------- ----------- -------------

Total assets 141,933 300,122 215,567

--------- ----------- -------------

Current liabilities

Financial liabilities 14 (3,170) (10,462) (6,949)

Trade and other payables (35,777) (58,380) (47,030)

Current tax liabilities (292) - -

Provisions for liabilities 15 (3,987) (870) (660)

--------- ----------- -------------

(43,226) (69,712) (54,639)

--------- ----------- -------------

Liabilities held for sale - - (21,930)

--------- ----------- -------------

Total current liabilities (43,226) (69,712) (76,569)

--------- ----------- -------------

Non-current liabilities

Financial liabilities 14 (5,274) (18,088) (6,277)

Deferred tax liability (2,549) (2,334) (2,392)

Provisions for liabilities 15 (6,890) (3,037) (1,695)

--------- ----------- -------------

Total non-current liabilities (14,713) (23,459) (10,364)

--------- ----------- -------------

Total liabilities (57,939) (93,171) (86,933)

--------- ----------- -------------

Net assets 83,994 206,951 128,634

--------- ----------- -------------

Equity

Share capital 210 210 210

Share premium account 5,629 5,629 5,629

Share-based payment reserve 6,264 5,830 5,331

Shares held by EBT (5,404) (6,814) (5,457)

Treasury shares (3,983) (1,767) (3,983)

Fair value reserve (385) (15,643) (20,239)

Retained earnings 81,986 219,036 146,715

--------- ----------- -------------

Equity attributable to the owners

of the parent 84,317 206,481 128,206

--------- ----------- -------------

Non-controlling interest (323) 470 428

--------- ----------- -------------

Total Equity 83,994 206,951 128,634

--------- ----------- -------------

*See note 18 for details regarding the restatement.

Interim Group Cash Flow Statement

for the six months ended 30 June 2023

Unaudited Audited

Six Months Ended Year Ended

Restated Restated*

30 June * 30 June 31 December

2023 2022 2022

Note GBP'000 GBP'000 GBP'000

--------- ----------- -------------

Profit / (loss) before tax from continuing

operations 7,085 8,875 (23,431)

Loss before tax from discontinued operations 6 (41,647) (1,511) (34,189)

--------- ----------- -------------

(Loss) / profit before tax (34,562) 7,364 (57,620)

--------- ----------- -------------

Adjustments for:

Exceptional costs 44,422 2,000 87,255

Exceptional gains (8,583) - (694)

Contingent consideration (1) (115) (696)

Depreciation of tangible assets 2,794 5,871 11,629

Amortisation of intangible assets 1,389 2,120 4,249

Share-based payments 432 1,500 1,977

Loss /(profit) on disposal of fixed

assets (2) 2 (8)

Loss/(profit) from joint ventures 167 208 494

Recognition of investments at fair

value through the income statement 180 - (678)

Decrease in contract assets 151 - 378

Finance income (752) (6) (80)

Finance costs 994 1,310 2,497

Operating cash flows before movements

in working capital 6,629 20,254 48,703

--------- ----------- -------------

Movements in working capital

Increase in trade and other receivables (7,066) (5,653) (1,491)

(Decrease) / increase in trade and

other payables (6,663) (5,486) (11,243)

Increase / (decrease) in provisions 158 (59) (799)

(13,571) (11,198) (13,533)

--------- ----------- -------------

Cash (used in) / generated from operations (6,942) 9,056 35,170

Interest paid (244) (1,277) (2,342)

Income taxes paid 0 (4,052) (6,109)

Exceptional costs paid (3,780) - (384)

Net cash generated (used in) / generated

from operating activities (10,966) 3,727 26,335

--------- ----------- -------------

Cash flows generated from / (used

in) in investing activities

Disposal of businesses, net of cash

disposed 26,537 - -

Payment of contingent consideration 14 (2,280) (76) (76)

Investment in joint venture (4,681) (936) (3,952)

Proceeds from sale of financial assets 13 206 - -

Receipt of lease income 116 33 68

Purchase of property, plant and equipment

and intangible assets (1,575) (2,231) (4,907)

Proceeds from sale of property, plant

and equipment - 6 1,304

Franchisee loans granted (1,335) - -

Net cash generated / (expended) on

investing activities 16,988 (3,204) (7,563)

--------- ----------- -------------

Cash flows used in financing activities

Purchase of LSL shares by the EBT - (5,026) (5,026)

Purchase of treasury shares - (1,767) (3,983)

Proceeds from the exercise of share

options 20 263 825

Payments of lease liabilities (2,250) (4,095) (7,170)

Dividends paid (7,601) (7,654) (11,773)

Net cash used in financing activities (9,831) (18,279) (27,127)

--------- ----------- -------------

Net (decrease) / increase in cash

and cash equivalents (3,809) (17,756) (8,355)

--------- ----------- -------------

Cash and cash equivalents at the beginning

of the period / year 40,109 48,464 48,464

--------- ----------- -------------

Cash and cash equivalents at the end

of the period / year 36,300 30,708 40,109

--------- ----------- -------------

The closing cash and cash equivalents for the year ended 31

December 2022 includes GBP3.4m which is presented in assets held

for sale on the Group Balance Sheet. Total cash and cash

equivalents less assets held for sale was GBP36.8m.

*See note 18 for details regarding the restatement.

Interim Group Statement of changes in equity

Unaudited - for the six months ended 30 June 2023

Share- Equity

Share based Shares Fair attributable Non-

Share premium payment held Treasury value Retained to owners of controlling

capital account reserve by EBT Shares Reserve earnings the parent interest Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- -------- -------- ---------- ----------- ------------- -------------- ------------- ---------

At 1 January 2023 210 5,629 5,331 (5,457) (3,983) (20,239) 146,715 128,206 428 128,634

Other comprehensive

(expense) / income

for the period

Loss for the year - - - - - - (37,842) (37,842) (76) (37,918)

Revaluation of

financial assets - - - - - (116) - (116) - (116)

Tax on revaluations - - - - - (1) - (1) - (1)

--------- --------- -------- -------- ---------- ----------- ------------- -------------- ------------- ---------

Total

comprehensive

(expense) /

income for the

period - - - - - (117) (37,842) (37,959) (76) (38,035)

--------- --------- -------- -------- ---------- ----------- ------------- -------------- ------------- ---------

Acquisition of

subsidiary 675 675 (675) -

Exercise of

options - - (43) 53 - - 10 20 - 20

Dividend paid - - - - - - (7,601) (7,601) - (7,601)

Share-based

payments - - 432 - - - - 432 - 432

Tax on

share-based

payments - - 544 - - - - 544 - 544

Fair value

reclassification

following

disposals - - - - - 19,971 (19,971) - - -

At 30 June 2023 210 5,629 6,264 (5,404) (3,983) (385) 81,986 84,317 (323) 83,994

--------- --------- -------- -------- ---------- ----------- ------------- -------------- ------------- ---------

During the six-month period to 30 June 2023 a total of 17,984

share options were exercised relating to LSL's various share option

schemes resulting in the shares being sold by the Trust. LSL

received GBP20,000 on exercise of these options.

Interim Group Statement of changes in equity

Unaudited - for the six months ended 30 June 2022

Share-

Share based

Share premium payment Shares Treasury Fair Retained Equity Non-

capital account reserve held Shares value earnings attributable controlling Total

by EBT Reserve to owners of interest

the parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- ---------- -------- ---------- --------- ---------- -------------- ------------- --------

At 1 January 2022 210 5,629 5,263 (3,063) - (15,273) 224,832 217,598 521 218,119

Prior year

restatements

(net of tax) ,

note 18 - - - - - - (3,959) (3,959) - (3,959)

--------- --------- ---------- -------- ---------- --------- ---------- -------------- ------------- --------

Restated total

equity at the

beginning of the

financial period 210 5,629 5,263 (3,063) - (15,273) 220,873 213,639 521 214,160

Revaluation of

financial assets - - - - - (370) - (370) - (370)

Profit for the

period

(restated) - - - - - - 5,824 5,824 (51) 5,773

--------- --------- ---------- -------- ---------- --------- ---------- -------------- ------------- --------

Total

comprehensive

income for

the period

(restated) - - - - - (370) 5,824 5,454 (51) 5,403

--------- --------- ---------- -------- ---------- --------- ---------- -------------- ------------- --------

Shares

repurchased

into Treasury - - - - (1,767) - - (1,767) - (1,767)

Shares

repurchased

into EBT - - - (5,026) - - - (5,026) - (5,026)

Exercise of

options - - (1,005) 1,275 - (7) 263 - 263

Dividend paid - - - - - - (7,654) (7,654) - (7,654)

Share-based

payments - - 1,500 - - - - 1,500 - 1,500

Tax on

share-based

payments - - 72 - - - - 72 - 72

--------- --------- ---------- -------- ---------- --------- ---------- -------------- ------------- --------

At 30 June 2022

(restated) 210 5,629 5,830 (6,814) (1,767) (15,643) 219,036 206,481 470 206,951

--------- --------- ---------- -------- ---------- --------- ---------- -------------- ------------- --------

During the six-month period to 30 June 2022 a total of 431,336

share options were exercised relating to LSL's various share option

schemes resulting in the shares being sold by the

Trust. LSL received GBP263,000 on exercise of these options.

Group Statement of Changes in Equity

for the year ended 31 December 2022

Share-

Share based

Share premium payment Shares Treasury Fair Retained Equity Non-

capital account reserve held Shares value earnings attributable controlling Total

by EBT Reserve to owners of interest

the parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January

2022 210 5,629 5,263 (3,063) - (15,273) 224,832 217,598 521 218,119

Prior year

restatements

(net of tax),

note 18 - - - - - - (3,959) (3,959) - (3,959)

Restated total

equity at the

beginning of the

financial year 210 5,629 5,263 (3,063) - (15,273) 220,873 213,639 521 214,160

Loss for the year

(restated) - - - - - - (62,384) (62,384) (93) (62,477)

Revaluation of

financial assets - - - - - (5,096) - (5,096) - (5,096)

Tax on

revaluations - - - - - 130 - 130 - 130

Total

comprehensive

income for

the year

(restated) - - - - - (4,966) (62,384) (67,350) (93) (67,443)

Shares

repurchased

into treasury - - - (3,983) - - (3,983) - (3,983)

Shares