TIDMMAB1

RNS Number : 2130I

Mortgage Advice Bureau(Holdings)PLC

20 March 2018

MORTGAGE ADVICE BUREAU (HOLDINGS) PLC

("MAB" or "the Group")

20 March 2018

Final Results for the year ended 31 December 2017

Mortgage Advice Bureau (Holdings) PLC (AIM: MAB1.L) is pleased

to announce its final results for the year ended 31 December

2017.

Financial highlights

-- Ninth consecutive year of strong revenue

and profit growth

-- Revenue up 17% to GBP108.8m (2016: GBP92.8m)

-- Gross profit up 17% to GBP25.9m (2016:

GBP22.1m)

-- Gross margin maintained at 23.8% (2016:

23.9%)

-- Overheads ratio of 10.9% (2016: 11.1%)

-- Reported profit before tax of GBP14.5m

(2016: GBP15.2m(1) )

-- Profit before exceptional gain and tax

up 16% to GBP14.5m (2016: GBP12.5m(2) )

-- Profit margin before exceptional gain and

tax maintained at 13.4% (2016: 13.5%(2)

)

-- Basic EPS of 23.8p (2016: 25.6p(1) )

-- Adjusted EPS up 17% to 23.8p (2016: 20.3p(2)

)

-- Continued high operating profit to headline

cash conversion(3) of 120% (2016: 128%)

-- Continued high operating profit to adjusted

cash conversion(4) of 109% (2016: 111%)

-- Proposed final dividend of 11.9p making

proposed total ordinary dividends for the

year of 21.4p (2016: 18.3p), up 17% (payout

ratio of 90%)

-- Strong financial position with significant

surplus on regulatory capital requirement

-- Total cash balances of GBP22.6m (31 Dec

2016: GBP18.7m)

-- Unrestricted cash balances of GBP13.2m

(31 Dec 2016: GBP10.8m)

Operational highlights

-- Average number of Advisers in 2017 up 14%

to 1,008 (2016: 888)

-- Adviser numbers up 13% to 1,078 at 31 December

2017 (2016: 950)

-- Revenue per Adviser up 3%(5)

-- Market share up 13% to 4.6% (2016: 4.1%)

-- Gross mortgage completions up 18.5% to

GBP11.9bn (2016: GBP10.0bn)

Post period end

-- Adviser numbers have increased to 1,096

at 16 March 2018

--- -------------------------------------------------

-- Stephen Smith joins MAB Board as a Non-Executive

Director

--- -------------------------------------------------

-- MAB receives 'Best Mortgage Broker' award

at Mortgage Strategy 2018 Awards

--- -------------------------------------------------

2017 2016 Change

----------------------------- --------- ----------- ------

Revenue GBP108.8m GBP92.8m +17%

----------------------------- --------- ----------- ------

Gross profit GBP25.9m GBP22.1m +17%

----------------------------- --------- ----------- ------

Gross profit margin 23.8% 23.9%

----------------------------- --------- ----------- ------

Profit before tax GBP14.5m GBP15.2m(1)

----------------------------- --------- ----------- ------

Profit before exceptional

gain and tax GBP14.5m GBP12.5m(2) +16%

----------------------------- --------- ----------- ------

PBT margin 13.4% 13.5%(2)

----------------------------- --------- ----------- ------

Adjusted EPS 23.8p 20.3p(2) +17%

----------------------------- --------- ----------- ------

Basic EPS 23.8p 25.6p(1)

----------------------------- --------- ----------- ------

Proposed final dividend

per share 11.9p 10.5p +13%

----------------------------- --------- ----------- ------

Proposed total ordinary

dividends per share 21.4p 18.3p +17%

----------------------------- --------- ----------- ------

Operating profit to headline

cash conversion(2) 120% 128%

----------------------------- --------- ----------- ------

Operating profit to adjusted

cash conversion(3) 109% 111%

----------------------------- --------- ----------- ------

(1) Includes exceptional gain of GBP2.7m profit on disposal of

49% stake in Capital Private Finance Limited in 2016.

(2) Excludes exceptional gain of GBP2.7m profit on disposal of

49% stake in Capital Private Finance Limited in 2016.

(3) Headline cash conversion is cash generated from operating

activities adjusted for movements in non-trading items including

loans to Appointed Representative firms ("ARs") and loans to

associates totalling GBP0.7m in 2017 (2016: GBP0.4m) as a

percentage of operating profit.

(4) Adjusted cash conversion is headline cash conversion

adjusted for increases in restricted cash balances of GBP1.5m in

2017 (2016: GBP2.1m) and additional cash balances (2017: GBPnil;

2016: GBPnil) held due to the timing of the weekly AR commission

payment in relation to the period end, as a percentage of operating

profit.

(5) Based on Average number of Advisers

Peter Brodnicki, Chief Executive commented:

"I am delighted to report another set of excellent results.

Strong growth in revenue, up 17% to GBP108.8m has translated into

strong growth in adjusted EPS up 17% to 23.8p. Accordingly, the

Board is pleased to propose the payment of an increased final

dividend of 11.9p per share, making total proposed ordinary

dividends for the year of 21.4p, up 17% on the prior year.

"MAB continues to deliver on its strategy in all market

conditions whilst maintaining a strong financial position. Our

mortgage completions increased by 18.5% and our market share

increased by 13%. Achievements across the business continue to be

recognised by a number of industry awards, including being named

Best Mortgage Broker at the 2018 Mortgage Strategy Awards.

"We are focused on delivering sustainable long-term growth and

providing the best possible solutions and outcomes for our

customers. We plan to continue growing our market share and

mortgage completions, whilst leading the evolution of intermediary

distribution that we expect to see over the next five years."

Outlook

UK Finance's estimate for gross mortgage lending in 2017 of

GBP258bn, implies market growth of 5% since 2016. UK Finance

recently increased its estimate for gross mortgage lending in 2018

to GBP260bn, as well as publishing a first estimate for 2019 of

GBP271bn. Gross mortgage lending is therefore expected to be

relatively flat for 2018 and show a 4% increase for 2019.

Adviser numbers have increased since the year end to 1,096 at 16

March 2018. We remain confident about our planned growth in adviser

numbers in 2018 and beyond, both organically and from new ARs.

We are confident that our strategy, driven by our customers and

their changing expectations, will continue to drive growth in MAB's

market share year on year and deliver attractive returns to

investors. The Board's expectations for the year remain

unchanged.

For further information please contact:

Mortgage Advice Bureau (Holdings) Plc Tel: +44 (0) 1332 525007

Peter Brodnicki - Chief Executive

David Preece - Chief Operating Officer

Lucy Tilley - Finance Director

Zeus Capital Tel: +44 (0)20 3829 5000

Martin Green

Nicholas How

Pippa Underwood

Canaccord Genuity Tel: +44 (0)20 7523 8350

Andrew Buchanan

Richard Andrews

Media Enquiries:

investorrelations@mab.org.uk

Analyst presentation

There will be an analyst presentation to discuss the results at

08:30am today at Canaccord Genuity Limited, 88 Wood Street, London,

EC2V 7QR.

Those analysts wishing to attend are asked to contact

investorrelations@mab.org.uk

Copies of this final results announcement are available at

investor.mortgageadvicebureau.com

Chief Executive's Review

I am delighted to report another period of strong revenue and

profit growth, with our market share increasing by 13% to 4.6%

(2016: 4.1%) and our mortgage completions increasing by 18.5% to

GBP11.9bn. Our fintech developments are progressing well and serve

to enhance our high-quality business model. Our strategy remains

focused on securing further growth through technology, lead

generation and specialisation which will increase our market share

and the number of mortgage completions in all market conditions,

enabling us to continue to deliver strong returns to our

investors.

We are just over a year into our three-year plan that is focused

on building solutions for the future; this will ensure MAB is able

to maintain and build upon its leading position in the intermediary

sector. We continue to invest in our core business model with our

plans for 2020 and beyond designed to secure sustainable long-term

growth whilst continuing to deliver strong results in the

meantime.

Market environment

Activity overall in the housing market has remained steady over

the last year and was not noticeably affected by the general

election in early June. The current house purchase market remains

predominantly comprised of those moving home due to

non-discretionary lifestyle factors, first time buyers and serious

investors. The residential remortgage market has seen 14% growth by

loan value on 2016, mostly ahead of the widely anticipated increase

in the Bank of England base rate and with strong competition

amongst lenders for new business.

Despite increases in first time buyer transactions, housing

transaction volumes overall have remained relatively flat as the

number of amateur landlords has reduced. Mortgage transactions by

both volume and value have increased by 4% and 5% respectively in

2017 driven by both remortgages and first time buyers. UK Finance

predicts a relatively flat market for gross mortgage lending for

2018, with a 4% increase for 2019 as the Government continues to

manage the UK's exit from the EU. UK Finance also predict that

housing transactions will remain flat over the next two years.

Intermediary market share(1) has remained broadly stable at just

over 70%. MAB and its ARs growth is not directly reliant on

increasing housing transactions, property prices, or intermediary

market share as our continued year on year growth demonstrates.

Intermediaries previously had limited access to the product

switching market, where customers change products with their

existing lender. However, the vast majority of lenders now provide

intermediaries with full access to their switching products. The UK

Finance industry data on gross mortgage lending currently excludes

product switches with the same lender, but we expect UK Finance to

confirm the size of the product switching market later on this

year. Whilst it is still relatively early to assess the impact of

this increased access to product switches, we expect product

switches will typically deliver lower overall income per

transaction compared to a remortgage, with this mostly offset by

switches having a much lower dropout to completion. In addition, we

expect product switches to deliver banked income in a shorter

timeframe.

Looking ahead, we expect client fees to become increasingly

dependent upon the type and complexity of the mortgage transaction,

as well as the delivery channel. This will lead to a broader spread

of client fees on mortgage transactions, which, by their nature,

are our lowest margin revenue stream.

Recent RICS(2) commentary on house prices suggests that on a

national level, house prices have resumed a modest growth

trajectory. However, the national figure conceals diverging trends

across different parts of the UK, with London and, to a lesser

extent, the South East, East Anglia and the North East experiencing

pressure on prices, whereas house prices are quite firmly on an

upward trend in other areas, including the North West, Northern

Ireland and Wales.

(1) excluding Buy-To-Let, where intermediaries have a higher

market share, and product switches with the same lender

(2) Royal Institution of Chartered Surveyors

Delivering on our strategy

Fintech developments

We continue developing our technology solutions which are at the

centre of our plans to further enhance our unique business model.

This will enable us to increase our market share and gross mortgage

completions both by delivering what our customers will rightly

start to expect and by enabling our AR partners and advisers to

continue competing at the highest level. These fintech developments

will play an ever-increasing role in customer acquisition and

conversion, as well as retention, by allowing advisers to identify

future engagement opportunities with their customers more

accurately and efficiently.

We are embracing fintech developments to enhance both face to

face advice and our newer fast-growing and highly scalable

telephony advice model. This will enable us to access a wider range

of lead sources and provide greater choice to the consumer in how

they research, receive advice and transact. As a result, we believe

MAB's proportion of telephone advice is likely to increase,

complementing the face to face advice that remains highly valued by

consumers. Both these channels will continue to be supported by

increasingly streamlined digital processes.

To allow us to capitalise fully upon our fintech developments we

will consider investments in selected technology propositions where

these can accelerate the development of our customer proposition

and lead generation solutions. In addition, we expect our IT

capital expenditure and IT costs to increase by a modest

amount.

Driving income opportunities

MAB is focused on securing long term sustainable growth and

providing the best possible solutions and outcomes to its

customers. Against the backdrop of a changing consumer landscape,

we will look to increase the range of services offered to our

customers by adopting new developments in technology and working

closely with lenders.

One of our key objectives is to maximise protection

opportunities by achieving even higher levels and consistency of

protection advice. To help facilitate this we were delighted to

appoint Andy Walton to the new role of Proposition Director,

Protection last year.

Our plans for direct-to-consumer marketing are progressing well,

and we expect to be in a controlled testing phase during Q2 2018.

Whilst MAB will use a range of media to target as many channels as

possible, we expect to see the degree of digital content grow in

line with the increasingly digital solutions that will be bought to

all stages of the client journey.

We invested a further GBP0.2m in on-line conveyancing business,

Sort Group Limited, towards the end of 2017, increasing our

ownership from 33.25% to 43.25%. Every mortgage requires

conveyancing and this further investment reflects the importance we

place on technology in delivering a seamless and fully integrated

end-to-end service for MAB's customers across their entire purchase

and remortgage processes. Our plans with Sort Group Limited include

developing a far closer association between conveyancing and

mortgages to provide a more seamless service for consumers as well

as enhancing lead generation. Sort Group Limited has two main

trading subsidiaries, Sort Limited and Sort Legal Limited. Whilst

Sort Limited had a record year and continues to grow strongly, Sort

Legal Limited is a major new initiative that brings ownership of

legal services into Sort Group Limited, considerably increasing its

distribution and capacity. As a result of this, Sort Limited

results were offset by the start-up costs in Sort Legal Limited

during 2017.

Our joint venture in Australia, MAB Broker Services, is trading

in line with our expectations. We continue to review progress and

are in the early stages of implementation of a structure similar to

our UK network partner initiative in Australia, having identified

potential key partners.

MAB continually looks for where the biggest growth sectors may

be for intermediaries in the future. We believe that lending into

retirement represents one of the clear growth opportunities and, as

such, are in the early stages of building the foundations of

solutions for this market; equity release being one of these

solutions, a market which is currently dominated by specialist

intermediaries.

Summary

We are just over a year into our three-year plan that is focused

on building solutions for the future; this will ensure MAB is able

to maintain and build upon its leading position in the intermediary

sector. We continue to invest in our core business model with our

plans for 2020 and beyond designed to secure sustainable long-term

growth whilst continuing to deliver strong results in the meantime.

From a resource and technology perspective we have been focussed on

being ready for GDPR for quite some time, and consider ourselves to

be well positioned and prepared for GDPR.

As technology allows us to have more consistent and targeted

interaction with our customers and when artificial

intelligence/machine learning allows us to identify how different

consumer groups behave and the services they require, this will

give us opportunities in the medium and long term to identify

future new revenue sources and ensure continued and diversified

growth.

Having made a number of key strategic investments, MAB continues

to consider further investments where there is a close alignment

with our strategic objectives. Whilst our investments to date have

been relatively modest in size, we will consider making larger

investments to help accelerate the development of our customer

proposition, lead generation and distribution. However, given our

strong financial position and prospects for growth, we do not

expect any such investment to adversely affect our payout ratio or

the future growth in dividends.

Our plans for the future also include broadening the Executive

Board due to the growth and widening range of opportunities for

MAB.

Business Review of the year

I am pleased to report further strong growth in revenue of 17%

to GBP108.8m with profit before tax (and exceptional gain in 2016)

rising by 16% to GBP14.5m. MAB's gross mortgage lending increased

by 18.5% to GBP11.9bn in 2017 (2016: GBP10.0bn) with the average

number of Advisers increasing by 14%. MAB's overall share of UK new

mortgage lending increased by 13% to 4.6% (2016: 4.1%).

Industry data and trends

Mortgage lending activity in 2017 grew by 5% to GBP258bn (2016:

GBP246bn). UK Finance recently increased its estimate for gross

mortgage lending for 2018 to GBP260bn, as well as publishing a

first estimate for 2019 of GBP271bn; gross mortgage lending growth

is therefore expected to be relatively flat for 2018 and show a 4%

increase for 2019. We are confident that our strategy, driven by

our customer's future direction of travel, will continue to drive

growth in our market share and mortgage completions year on year

and deliver attractive returns to investors.

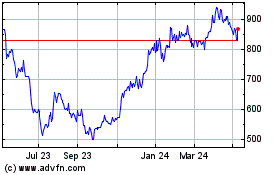

UK property transactions by volume for 2017 were c. 1% lower

than in 2016. The spike in buy-to-let ("BTL") transactions ahead of

the stamp duty changes in April 2016 is evident in the graph

below.

http://www.rns-pdf.londonstockexchange.com/rns/2130I_2-2018-3-19.pdf

Source: HM Revenue and Customs

UK property inflation of 4.8%(1) and an increase in remortgage

volumes of 11% and first time buyer transactions of 8% more than

offset the slight reduction in UK property transactions and the 10%

reduction in BTL transactions, leading to an increase in UK

mortgage lending of 5% overall, as illustrated in the graph

below.

(1) Land Registry House Price Index

http://www.rns-pdf.londonstockexchange.com/rns/2130I_1-2018-3-19.pdf

Source: UK Finance Regulated Mortgage Survey (excludes product

transfers with the same lender), Bank of England, UK Finance BTL

data (used for further analysis)

UK gross mortgage lending in 2017 for home-owner purchases

(including first time buyers) and remortgages grew by 9% and 14%

respectively. UK gross mortgage lending in 2017 for BTL purchases

and BTL remortgages reduced by 28% and 4% respectively.

Just over 70% of UK mortgage transactions (excluding BTL, where

intermediaries have a higher market share, and product switches

with the same lender) were via an intermediary in 2017, which is

broadly stable compared to 2016 and MAB expects intermediary market

share to remain broadly stable going forward.

Financial review

We measure the development, performance and position of our

business against a number of key indicators.

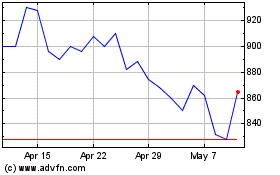

http://www.rns-pdf.londonstockexchange.com/rns/2130I_-2018-3-19.pdf

Revenue

Revenue increased by 17% to GBP108.8m (2016: GBP92.8m). A key

driver of revenue is the average number of Advisers during the

period. Our business model continues to attract forward thinking

ARs who are seeking to expand and grow their own market share.

Average adviser numbers increased by 14% to 1,008 (2016: 888) due

to a combination of expansion by existing ARs and the recruitment

of new ARs.

The Group generates revenue from three core areas, summarised as

follows:

Income source 2017 2016 Increase

---------------------------------- ------ ----- ---------

GBPm GBPm

---------------------------------- ------ ----- ---------

Mortgage procuration fees 46.8 39.4 19%

---------------------------------- ------ ----- ---------

Protection and General Insurance

Commission 42.8 36.4 18%

---------------------------------- ------ ----- ---------

Client Fees 17.5 15.6 12%

---------------------------------- ------ ----- ---------

Other Income 1.7 1.4 22%

---------------------------------- ------ ----- ---------

Total 108.8 92.8 17%

---------------------------------- ------ ----- ---------

MAB's revenue, in terms of proportion, is split as follows:

Income source 2017 2016

---------------------------------- ----- -----

Mortgage procuration fees 43% 42%

---------------------------------- ----- -----

Protection and General Insurance

Commission 39% 39%

---------------------------------- ----- -----

Client Fees 16% 17%

---------------------------------- ----- -----

Other Income 2% 2%

---------------------------------- ----- -----

Total 100% 100%

---------------------------------- ----- -----

All income sources continued to grow strongly with the average

number of Advisers in the year increasing by 14%. We have seen an

increase in average revenue per adviser of 3%, demonstrating the

anticipated return to growth in productivity following the lull in

activity in the housing and mortgage markets surrounding the EU

referendum in 2016.

With MAB's gross mortgage completions increasing by 18.5% in

2017, mortgage procuration fees increased by 19%; and protection

and general insurance commission grew by 18%. Client fees, which

are not linked to the mortgage value, grew by 12%, reflecting an

increase in remortgaging and product switching where fees are

generally lower. Looking ahead, we expect to see a broader spread

of client fees on mortgage transactions, which, by their nature,

are our lowest margin revenue stream.

Gross profit margin

Gross profit margin was broadly maintained at 23.8% (2016:

23.9%). The Group typically receives a slightly reduced margin as

its existing ARs grow their revenue organically through increasing

their Adviser numbers. In addition, larger new ARs typically join

the Group on lower than average margins due to their existing

scale, which therefore impacts upon the Group's gross margin.

Going forward, we expect to see some further erosion of gross

profit margin due to the continued growth of our existing ARs and

the addition of new larger ARs.

Overheads

Overheads as a percentage of revenue were 10.9% (2016: 11.1%).

This reduction in underlying overheads as a percentage of revenue

demonstrates the scalable nature of the cost base. Certain costs,

primarily those relating to compliance, which represent

approximately 40% of our cost base, are closely correlated to the

growth in the number of Advisers, due to the high standards we

demand and the requirement to maintain regulatory spans of control.

The remainder of MAB's costs typically rise at a slower rate than

revenue which will, in part, counter the expected erosion of gross

margin as the business continues to grow.

As a result of MAB's IT plans, we expect our amortisation on IT

capital expenditure and IT costs to increase by a modest

amount.

Profit before tax and margin thereon

Profit before tax rose by 16% to GBP14.5m (2016: GBP12.5m,

excluding an exceptional GBP2.7m profit on disposal of 49% stake in

Capital Private Finance Limited) with the margin thereon being

13.4% (2016: 13.5%).

Net finance revenue

Net finance revenues of GBP0.04m (2016: GBP0.07m) reflect

continued low interest rates.

Taxation

The effective rate of tax fell to 17.2% (2016: 18.4%),

principally due to the tax deduction arising following the exercise

of the first tranche of employee share options since IPO. Going

forward we expect our effective tax rate to be marginally below the

prevailing UK corporation tax rate subject to the continued

availability of tax credits for MAB's research and development

expenditure on our continued development of MIDAS Pro, MAB's

proprietary software, and further tax deductions arising from the

exercise of share options.

Earnings per share and dividend

Adjusted earnings per share rose by 17% to 23.8 pence (2016:

20.3 pence(1) ).

The Board is pleased to propose a final dividend for the year

ended 31 December 2017 of 11.9 pence per share (2016: 10.5 pence

per share), amounting to a cash cost of GBP6.0m. Following payment

of the dividend, the Group will continue to maintain significant

surplus regulatory reserves. This proposed final dividend

represents circa 90% of the Group's post-tax profits for H2 2017

and reflects our ongoing intention to distribute excess capital.

MAB requires circa 10% of its profit after tax to fund increased

regulatory capital and other regular capital expenditure.

The record date for the final dividend is 27 April 2018 and the

payment date is 22 May 2018. The ex-dividend date will be 26 April

2018.

Cash flow and cash conversion

The Group's operations produce positive cash flow. This is

reflected in the net cash inflow from operating activities of

GBP14.5m (2016: GBP13.4m).

Headline cash conversion (1) was:

2017 120%

------------------ -----------------

2016 128%

------------------ -----------------

Adjusted cash conversion (2) was:

-------------------------------------

2017 109%

------------------ -----------------

2016 111%

------------------ -----------------

The Group's operations are capital light with our most

significant ongoing capital investment being in computer equipment.

Only GBP0.1m of capital expenditure on office and computer

equipment was required during the period (2016: GBP0.3m). Group

policy is not to provide company cars, and, other than on IT as

indicated above, no significant capital expenditure is foreseen in

the coming year. All development work on MIDAS Pro is treated as

revenue expenditure.

The Group had no bank borrowings at 31 December 2017 (2016:

GBPnil) with unrestricted bank balances of GBP13.2m (31 December

2016: GBP10.8m).

The Group has a regulatory capital requirement amounting to 2.5%

of regulated revenue. At 31 December 2017 this regulatory capital

requirement was GBP2.5m (31 December 2016: GBP2.1m), with the Group

having a surplus of GBP9.5m.

The following table demonstrates how cash generated from

operations was applied:

GBPm

Unrestricted bank balances at the beginning of the year 10.8

Cash generated from operating activities excluding movements in restricted balances and dividends

received from associates 14.8

Issue of shares 0.5

Dividends received from associates 0.4

Dividends paid (10.7)

Tax paid (2.2)

Capital expenditure (including new website) (0.2)

Investments in associates (0.2)

Unrestricted bank balances at the end of the period 13.2

-------------------------------------------------------------------------------------------------- ------

The Group's treasury strategy is to reduce risk by spreading

deposits over a number of institutions rather than to seek marginal

improvements in returns.

(1) Excludes the exceptional gain of GBP2.7m profit on disposal

of 49% stake in Capital Private Finance Limited in 2016.

(2) Headline cash conversion is cash generated from operating

activities adjusted for movements in non-trading items including

loans to Appointed Representative firms ("ARs") and loans to

associates totalling GBP0.7m in 2017 (2016: GBP0.4m) as a

percentage of operating profit.

(3) Adjusted cash conversion is headline cash conversion

adjusted for increases in restricted cash balances of GBP1.5m in

2017 (2016: GBP2.1m) and additional cash balances (2017: GBPnil;

2016: GBPnil) held due to the timing of the weekly AR commission

payment in relation to the period end, as a percentage of operating

profit.

Outlook

UK Finance's estimate for gross mortgage lending in 2017 of

GBP258bn, implies market growth of 5% since 2016. UK Finance

recently increased its estimate for gross mortgage lending in 2018

to GBP260bn, as well as publishing a first estimate for 2019 of

GBP271bn. Gross mortgage lending is therefore expected to be

relatively flat for 2018 and show a 4% increase for 2019.

Adviser numbers have increased since the year end to 1,096 at 16

March 2018. We remain confident about our planned growth in adviser

numbers in 2018 and beyond, both organically and from new ARs.

We are confident that our strategy, driven by our customers and

their changing expectations, will continue to drive growth in MAB's

market share year on year and deliver attractive returns to

investors. The Board's expectations for the year remain

unchanged.

INDEPENT AUDITOR'S REPORT TO THE MEMBERS OF MORTGAGE ADVICE

BUREAU (HOLDINGS) PLC

Opinion

We have audited the financial statements of Mortgage Advice

Bureau (Holdings) plc (the "parent company") and its subsidiaries

(the 'group') for the year ended 31 December 2017 which comprise

the consolidated statement of comprehensive income, the

consolidated statement of financial position and the company

statement of financial position, the consolidated statement of

changes in equity and the company statement of changes in equity,

the consolidated statement of cash flows and the notes to the

financial statements, including a summary of significant accounting

policies.

The financial reporting framework that has been applied in the

preparation of the group financial statements is applicable law and

International Financial Reporting Standards (IFRSs) as adopted by

the European Union. The financial reporting framework that has been

applied in the preparation of the parent company financial

statements is applicable law and United Kingdom Accounting

Standards, including Financial Reporting Standard 102 The Financial

Reporting Standard in the United Kingdom and Republic of Ireland

(United Kingdom Generally Accepted Accounting Practice).

In our opinion:

-- the financial statements give a true and fair view of the

state of the group's and of the parent company's affairs as at 31

December 2017 and of the group's profit for the year then

ended;

-- the group financial statements have been properly prepared in

accordance with IFRSs as adopted by the European Union;

-- the parent company financial statements have been properly

prepared in accordance with United Kingdom Generally Accepted

Accounting Practice; and

-- the financial statements have been prepared in accordance

with the requirements of the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditor's responsibilities for the audit of the financial

statements section of our report. We are independent of the group

and the parent company in accordance with the ethical requirements

that are relevant to our audit of the financial statements in the

UK, including the FRC's Ethical Standard as applied to listed

entities, and we have fulfilled our other ethical responsibilities

in accordance with these requirements. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide

a basis for our opinion.

Conclusions relating to going concern

We have nothing to report in respect of the following matters in

relation to which the ISAs (UK) require us to report to you

where:

-- the directors' use of the going concern

basis of accounting in the preparation

of the financial statements is not appropriate;

or

-- the directors have not disclosed in the

financial statements any identified material

uncertainties that may cast significant

doubt about the group's or the parent company's

ability to continue to adopt the going

concern basis of accounting for a period

of at least twelve months from the date

when the financial statements are authorised

for issue.

Key audit matters

Key audit matters are those matters that, in our professional

judgment, were of most significance in our audit of the financial

statements of the current period and include the most significant

assessed risks of material misstatement (whether or not due to

fraud) we identified, including those which had the greatest effect

on: the overall audit strategy, the allocation of resources in the

audit; and directing the efforts of the engagement team. These

matters were addressed in the context of our audit of the financial

statements as a whole, and in forming our opinion thereon, and we

do not provide a separate opinion on these matters

Key audit Key audit matter Audit response

matters description

------------- ----------------------- ------------------------------------------------------------

Revenue Revenue comprises We responded to this

recognition of commissions, risk by performing the

(Note 3) client fees and following procedures:

other income. * We have checked the effectiveness of the

Revenue is processed reconciliation between revenue and cash banked.

in the operating

system upon receipt

of third party * We have checked on a sample basis that the third

reports once party reports have been properly accounted for in

transactions order to verify the completeness of revenue.

have been exchanged

or completed

and is then accounted * Using third party reports, we have recalculated the

for when it is majority of the mortgage related fees independently.

matched with

cash received

in the bank on * We have performed cut-off tests by verifying back to

a monthly basis. third party reports.

Revenue recognition

is considered

to be a significant

audit risk as No material misstatements

it is a key driver were detected as a result

of return to of our testing.

investors and

there is a risk

that there could

be misstatement

or omission of

amounts recorded

in the system.

------------- ----------------------- ------------------------------------------------------------

Key audit Key audit matter Audit response

matters description

----------- --------------------- ----------------------------------------------------------------

Clawback The clawback

provision provision relates * We have reviewed the methodology applied by

(Note 19) to the estimated management in determining the claw back provision.

value of repaying

commission received

up front on life * Lapse rates, recoveries and unearned indemnity

assurance policies commission values used in calculating the claw back

that may lapse provision have been agreed to system reports, third

in a period of party data and historical data.

up to four years

following inception

of the policies. * Where management applied judgements, we have

The clawback performed a sensitivity analysis.

provision is

considered to

be a significant

audit risk due No material misstatements

to the management were detected as a result

judgement and of our testing.

estimation applied

in calculating

the provision.

The provision

is determined

using a model

which uses a

number of factors

including the

total unearned

commission at

the point of

calculation,

the age profile

of the commission

received, the

group's share

of any clawback,

likely future

lapse rates,

lapse rate history,

and the success

of the in-house

team that focuses

on preventing

lapses and/or

generating new

income at the

point of a lapse.

----------- --------------------- ----------------------------------------------------------------

Our application of materiality

We apply the concept of materiality both in planning and

performing our audit, and in evaluating the effect of

misstatements. We consider materiality to be the magnitude by which

misstatements, including omissions, could influence the economic

decisions of reasonable users that are taken on the basis of the

financial statements.

Based on our professional judgement, we determined materiality

for the group to be GBP700,000 (2016: GBP790,000) which represents

5% of profit before tax. We have used profit before tax as a

benchmark given the importance of profit as a measure for

shareholders in assessing the performance of the Group. We have

then set the performance materiality at 75% (2016:75%) due to few

identified misstatements in the past.

We determined materiality for the parent to be GBP192,000 (2016:

GBP165,000) which represents 5% of net assets. We have used net

assets as the parent acts as a holding company only. We have then

set the performance materiality at 75% (2016:75%) due no identified

misstatements in the past.

We agreed with the audit committee that we would report to the

committee all individual audit differences identified during the

course of our audit in excess of GBP14,000 (2016: GBP16,000) for

the group and GBP4,000 (2016: GBP3,000) for the parent. We also

agreed to report differences below these thresholds that, in our

view warranted reporting on qualitative grounds

An overview of the scope of our audit

Our audit approach was scoped by obtaining an understanding of

the group's activities, the key functions undertaken by the Board

and the overall control environment. Based on this understanding we

assessed those aspects of the group's transactions and balances

which were most likely to give rise to a material misstatement at a

group level.

The audit of the group was conducted by BDO LLP directly at

group level as the group's accounting system records all

transactions as a group with each transaction marked with a company

code to enable financial statements to be produced for each

subsidiary when required.

The audit of the parent company was conducted by BDO LLP after

its financial statements were deconsolidated from the group

accounting system,

Other information

The directors are responsible for the other information. The

other information comprises the information included in the annual

report, other than the financial statements and our auditor's

report thereon. Our opinion on the financial statements does not

cover the other information and, except to the extent otherwise

explicitly stated in our report, we do not express any form of

assurance conclusion thereon.

In connection with our audit of the financial statements, our

responsibility is to read the other information and, in doing so,

consider whether the other information is materially inconsistent

with the financial statements or our knowledge obtained in the

audit or otherwise appears to be materially misstated. If we

identify such material inconsistencies or apparent material

misstatements, we are required to determine whether there is a

material misstatement in the financial statements or a material

misstatement of the other information. If, based on the work we

have performed, we conclude that there is a material misstatement

of this other information, we are required to report that fact. We

have nothing to report in this regard.

Opinions on other matters prescribed by the Companies Act

2006

In our opinion, based on the work undertaken in the course of

the audit:

-- the information given in the strategic

report and the directors' report for the

financial year for which the financial

statements are prepared is consistent with

the financial statements; and

-- the strategic report and the directors'

report have been prepared in accordance

with applicable legal requirements.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the group and

the parent company and its environment obtained in the course of

the audit, we have not identified material misstatements in the

strategic report or the directors' report.

We have nothing to report in respect of the following matters in

relation to which the Companies Act 2006 requires us to report to

you if, in our opinion:

-- adequate accounting records have not been

kept, or returns adequate for our audit

have not been received from branches not

visited by us; or

-- the parent company financial statements

are not in agreement with the accounting

records and returns; or

-- certain disclosures of directors' remuneration

specified by law are not made; or

-- we have not received all the information

and explanations we require for our audit.

Responsibilities of directors

As explained more fully in the directors' responsibilities

statement, the directors are responsible for the preparation of the

financial statements and for being satisfied that they give a true

and fair view, and for such internal control as the directors

determine is necessary to enable the preparation of financial

statements that are free from material misstatement, whether due to

fraud or error.

In preparing the financial statements, the directors are

responsible for assessing the group's and the parent company's

ability to continue as a going concern, disclosing, as applicable,

matters related to going concern and using the going concern basis

of accounting unless the directors either intend to liquidate the

group or the parent company or to cease operations, or have no

realistic alternative but to do so.

Auditor's responsibilities for the audit of the financial

statements

This report is made solely to the company's members, as a body,

in accordance with Chapter 3 of Part 16 of the Companies Act 2006.

Our audit work has been undertaken so that we might state to the

company's members those matters we are required to state to them in

an auditor's report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to

anyone other than the company and the company's members as a body,

for our audit work, for this report, or for the opinions we have

formed.

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an

auditor's report that includes our opinion. Reasonable assurance is

a high level of assurance, but is not a guarantee that an audit

conducted in accordance with ISAs (UK) will always detect a

material misstatement when it exists.

Misstatements can arise from fraud or error and are considered

material if, individually or in the aggregate, they could

reasonably be expected to influence the economic decisions of users

taken on the basis of these financial statements.

A further description of our responsibilities for the audit of

the financial statements is located on the Financial Reporting

Council's website at: www.frc.org.uk/auditorsresponsibilities. This

description forms part of our auditor's report.

Leigh Treacy (Senior Statutory Auditor)

For and on behalf of BDO LLP, Statutory Auditor

London

19 March 2018

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

Consolidated statement of comprehensive income

for the year ended 31 December 2017

Note

2017 2016

GBP'000 GBP'000

----------------------------------------- ---------- --------- ---------

Revenue 3 108,847 92,848

Cost of sales 4 (82,945) (70,700)

----------------------------------------- ---------- --------- ---------

Gross profit 25,902 22,148

Administrative expenses (11,909) (10,296)

Share of profit of associates 13 500 611

----------------------------------------- ---------- --------- ---------

Operating profit 14,493 12,463

Finance income 7 42 73

Exceptional profit on disposal

of asset held for sale 13 - 2,690

Profit before tax 14,535 15,226

Tax expense 8 (2,494) (2,307)

----------------------------------------- ---------- --------- ---------

Profit for the year attributable

to equity holders of parent

company 12,041 12,919

----------------------------------------- ---------- --------- ---------

Other comprehensive income

Other comprehensive income

to be reclassified to

profit or loss in subsequent

periods (net of tax):

Net gain on asset held

for sale - 2,152

Transfer to realised profit - (2,152)

----------------------------------------- --------- --------------------

Net other comprehensive - -

income to be reclassified

to profit and loss in

subsequent periods net

of tax

Other comprehensive income - -

Total comprehensive income

attributable to equity

holders of parent company 12,041 12,919

----------------------------------------- --------- --------------------

Earnings per share attributable to the

owners of the parent company

Basic 9 23.8p 25.6p

----------------------------------------- ---------- --------- ---------

Diluted 9 23.2p 25.2p

----------------------------------------- ---------- --------- ---------

The notes that follow form part of these financial

statements.

Consolidated statement of financial position

as at 31 December 2017

2017 2016

Note GBP'000 GBP'000

------------------------------- ------ --------- ---------

Assets

Non-current assets

Property, plant and

equipment 11 2,648 2,720

Goodwill 12 4,114 4,114

Other intangible assets 12 98 9

Investments 13 1,339 1,008

Deferred tax asset 20 925 72

Total non-current assets 9,124 7,923

------------------------------- ------ --------- ---------

Current assets

Trade and other receivables 15 4,426 3,256

Cash and cash equivalents 16 22,551 18,711

------------------------------- ------ --------- ---------

Total current assets 26,977 21,967

------------------------------- ------ --------- ---------

Total assets 36,101 29,890

------------------------------- ------ --------- ---------

Equity and liabilities

Equity attributable to owners

of the parent company

Share capital 21 51 51

Share premium 3,574 3,042

Capital redemption

reserve 20 20

Share option reserve 1,450 380

Retained earnings 13,071 11,680

------------------------------- ------ --------- ---------

Total equity 18,166 15,173

------------------------------- ------ --------- ---------

Liabilities

Non-current liabilities

Contingent consideration 13 - 50

Provisions 19 1,496 1,219

Deferred tax liability 20 51 40

------------------------------- ------ --------- ---------

Total non-current liabilities 1,547 1,309

------------------------------- ------ --------- ---------

Current liabilities

Trade and other payables 17 14,999 12,405

Corporation tax liability 1,389 1,003

------------------------------- ------ --------- ---------

Total current liabilities 16,388 13,408

------------------------------- ------ --------- ---------

Total liabilities 17,935 14,717

------------------------------- ------ --------- ---------

Total equity and liabilities 36,101 29,890

------------------------------- ------ --------- ---------

The notes that follow form part of these financial

statements.

The financial statements were approved by the Board of Directors

on

P Brodnicki L Tilley

Director Director

Consolidated statement of changes in equity

for the year ended 31 December 2017

Capital Share

Share Share redemption option Retained Total

capital premium reserve reserve earnings Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------- ---------- ------------ --------- ----------- -----------

Balance at 1

January 2016 51 3,042 20 157 9,635 12,905

Profit for the

year - - - - 12,919 12,919

--------------------- ---------- ---------- ------------ --------- ----------- -----------

Total comprehensive

income - - - 12,919 12,919

--------------------- ---------- ---------- ------------ --------- ----------- -----------

Transactions

with owners

Share based payment

transactions - - - 223 - 223

Dividends paid - - - - (10,874) (10,874)

--------------------- ---------- ---------- ------------ --------- ----------- -----------

Transactions

with owners - - - 223 (10,874) (10,651)

--------------------- ---------- ---------- ------------ --------- ----------- -----------

Balance at 31

December 2016

and 1 January

2017 51 3,042 20 380 11,680 15,173

Profit for the

year - - - - 12,041 12,041

Total comprehensive

income - - - - 12,041 12,041

--------------------- ---------- ---------- ------------ --------- ----------- -----------

Transactions

with owners

Issue of shares - 532 - - - 532

Share based payment

transactions - - - 333 - 333

Deferred tax

asset recognised

in equity - - - 799 - 799

Reserve transfer - - - (62) 62 -

Dividends paid - - - - (10,712) (10,712)

Transactions

with owners - 532 - 1,070 (10,650) (9,048)

--------------------- ---------- ---------- ------------ --------- ----------- -----------

Balance at 31

December 2017 51 3,574 20 1,450 13,071 18,166

--------------------- ---------- ---------- ------------ --------- ----------- -----------

The notes that follow form part of these financial

statements.

Consolidated statement of cash flows

for the year ended 31 December 2017

Notes 2017 2016

GBP'000 GBP'000

--------------------------------- ------ ---------- ---------

Cash flows from operating

activities

Profit for the year before

tax 14,535 15,226

Adjustments for:

Depreciation of property,

plant and equipment 11 201 193

Amortisation of intangibles 12 14 18

Profit on disposal of asset

held for sale - (2,690)

Share based payments 333 223

Share of profit from associates 13 (500) (611)

Dividends received from

associates 13 353 567

Finance income 7 (42) (73)

--------------------------------- ------ ---------- ---------

14,894 12,853

Changes in working capital

Increase in trade and other

receivables (1,159) (405)

Increase in trade and other

payables 2,594 2,886

Increase in provisions 277 301

Cash generated from operating

activities 16,606 15,635

Income taxes paid (2,151) (2,278)

--------------------------------- ------ ---------- ---------

Net cash generated from

operating activities 14,455 13,357

--------------------------------- ------ ---------- ---------

Cash flows from investing

activities

Purchase of property, plant

and equipment 11 (129) (292)

Purchase of intangibles 12 (103)

Proceeds from sale of associate - 2,694

Acquisitions of associates

and investments 13 (184) (203)

Deferred consideration

on acquisition of associates 13 (50) -

--------------------------------- ------ ---------- ---------

Net cash used in investing

activities (466) 2,199

--------------------------------- ------ ---------- ---------

Cash flows from financing

activities

Interest received 7 31 73

Issue of shares 21 532 -

Dividends paid 10 (10,712) (10,874)

--------------------------------- ------ ---------- ---------

Net cash used in financing

activities (10,149) (10,801)

--------------------------------- ------ ---------- ---------

Net increase in cash and

cash equivalents 3,840 4,755

Cash and cash equivalents

at the beginning of year 18,711 13,956

--------------------------------- ------ ---------- ---------

Cash and cash equivalents

at the end of the year 22,551 18,711

--------------------------------- ------ ---------- ---------

The notes that follow form part of these financial

statements

Notes to the consolidated financial statements

for the year ended 31 December 2017

1 Accounting policies

Basis of preparation

The principal accounting policies adopted in the preparation of

the consolidated financial statements are set out below. The

policies have been consistently applied to all the years

presented.

The consolidated financial statements are presented in Great

British Pounds, which is also the Group's functional currency. All

amounts are rounded to the relevant thousands, unless otherwise

stated.

These financial statements have been prepared under the

historical cost convention and in accordance with International

Financial Reporting Standards, International Accounting Standards

and Interpretations (collectively IFRSs) issued by the

International Accounting Standards Board (IASB) as adopted by the

European Union (EU) (EU "adopted IFRSs") and with those parts of

the Companies Act 2006 that are applicable to companies that

prepare financial statements in accordance with IFRSs.

The preparation of financial statements in compliance with

adopted EU IFRS requires the use of certain critical accounting

estimates. It also requires Group management to exercise judgement

in applying the Group's accounting policies. The areas where

significant judgements and estimates have been made in preparing

the financial statements and their effect are disclosed in note

2.

The Group's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the Strategic Report as set out earlier in this

announcement. The financial position of the Group, its cash flows

and liquidity position are described in these financial

statements.

The Group made an operating profit of GBP14.5m during 2017

(2016: GBP12.5 million) and had net current assets of GBP10.5m at

31 December 2017 (31 December 2016: GBP8.6m) and equity

attributable to owners of the Group of GBP18.2m (31 December 2016:

GBP15.2m).

After making enquiries, the Directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. Accordingly, they

continue to adopt the going concern basis in preparing the annual

report and accounts.

Changes in accounting policies

New standards, interpretations and amendments effective for the

year ended 31 December 2017

The following new standards, interpretations and amendments are

effective for annual periods beginning on or after 1 January 2017

and have been applied in preparing these financial statements. None

of these new standards or interpretations have a significant impact

on the annual consolidated financial statements of the Group.

-- IAS 7 Disclosure Initiative - Amendments to IAS 7. The

amendments to IAS 7 Statement of Cash Flows are part of the IASB's

Disclosure Initiative and require an entity to provide disclosures

that enable users of financial statements to evaluate changes in

liabilities arising from financing activities, including both

changes arising from cash flows and non-cash changes. On initial

application of the amendment, entities are not required to provide

comparative information for preceding periods. These amendments are

effective for annual periods beginning on or after 1 January 2017,

with early application permitted. Application of the amendments has

had no impact on the Group.

-- IAS 12 Income Taxes Recognition of Deferred Tax Assets for

Unrealised Losses - Amendments to IAS 12. The amendments clarify

that an entity needs to consider whether tax law restricts the

sources of taxable profits against which it may make deductions on

the reversal of that deductible temporary difference related to

unrealised losses. Furthermore, the amendments provide guidance on

how an entity should determine future taxable profits and explain

the circumstances in which taxable profit may include the recovery

of some assets for more than their carrying amount.

Entities are required to apply the amendments retrospectively.

However, on initial application of the amendments, the change in

the opening equity of the earliest comparative period may be

recognised in the opening retained earnings (or in another

component of equity, as appropriate), without allocating the change

between opening retained earnings and other components of equity.

Entities applying this relief must disclose that fact. These

amendments are effective for annual periods beginning on or after 1

January 2017 with early application permitted. If an entity applies

the amendments for an earlier period, it must disclose that fact.

Application of the amendments has had no impact on the Group.

-- Annual Improvements Cycle - 2014-2016

Amendments to IFRS 12 - Disclosure of interest in other

entities. The amendments clarify that the disclosure requirements

in IFRS 12, other than those in paragraphs B10-B16, apply to an

entity's interest in a subsidiary, a joint venture or an associate

(or a portion of its interest in a joint venture or an associate)

that is classified (or included in a disposal group that is

classified) as held for sale. These amendments did not affect the

Group's financial statements.

New standards, interpretations and amendments not yet

effective

The standards and interpretations that are issued, but not yet

effective, up to the date of issuance of the Group's financial

statements are disclosed below. The Group intends to adopt these

standards, if applicable, when they become effective.

-- IFRS 9 Financial Instruments. The group has identified that

the adoption of IFRS 9, which replaces IAS 39 Financial

Instruments: Recognition and Measurement from 1 January 2018, could

impact its consolidated financial statements in one key area:

The Group will need to apply an expected credit loss model when

calculating impairment losses on its trade and other receivables

and its cash and cash equivalents. This may result in increased

impairment provisions and greater judgement due to the need to

factor in forward looking information when estimating the

appropriate amount of provisions. In applying IFRS 9 the Group must

consider the probability of a default occurring over the

contractual life of its trade receivables on initial recognition of

those assets. Under the new model applied to all trade and other

receivables, the amount of impairment losses as at 31 December 2017

is not material, resulting in an immaterial increase in the

impairment provision as at 1 January 2018 under IFRS 9 compared to

IAS 39.

-- IFRS 15 Revenue from Contracts with Customers. This was

issued by the IASB on 28 May 2014 and applies to an entity's first

annual IFRS financial statements for a period beginning on or after

1 January 2018. It sets out the requirements for recognising

revenue that apply to contracts with customers, except for those

covered by standards on leases, insurance contracts and financial

instruments. This standard is not expected to have any impact on

the Group.

-- IFRS 2 Classification and Measurement of Share-based Payment

Transactions - Amendments to IFRS 2. The IASB issued amendments to

IFRS 2 Share-based Payment that address three main areas: the

effects of vesting conditions on the measurement of cash-settled

share-based payment transaction; the classification of a

share-based payment transaction with net settlement features for

withholding tax obligations; and accounting where a modification to

the terms and conditions of a share-based payment transaction

changes its classification from cash-settled to equity-settled.

On adoption, entities are required to apply the amendments

without restating prior periods, but retrospective application is

permitted if elected for all three amendments and other criteria

are met. The amendments are effective for annual periods beginning

on or after 1 January 2018, with early application permitted. These

amendments are not expected to have any impact on the Group.

-- IFRS 16 Leases. IFRS 16 was issued in January 2016 and it

replaces IAS 17 Leases, IFRIC 4 Determining whether an Arrangement

contains a Lease, SIC-15 Operating Leases-Incentives and SIC-27

Evaluating the Substance of Transactions involving the Legal Form

of a Lease. IFRS 16 sets out the principles for the recognition,

measurement, presentation and disclosure of leases and requires

lessees to account for all leases under a single on-balance sheet

model similar to the accounting for finance leases under IAS 17.

The standard includes two recognition exemptions for lessees -

leases of 'low-value' assets (e.g., personal computers) and

short-term leases (i.e., leases with a lease term of 12 months or

less). At the commencement date of a lease, a lessee will recognise

a liability to make lease payments (i.e., the lease liability) and

an asset representing the right to use the underlying asset during

the lease term (i.e., the right-of-use asset). Lessees will be

required to separately recognise the interest expenses on the lease

liability and the depreciation expense on the right-of-use

asset.

Lessees will be also required to remeasure the lease liability

upon the occurrence of certain events (e.g. a change in the lease

term, a change in future lease payments resulting from a change in

an index or rate used to determine those payments). The lessee will

generally recognise the amount of the remeasurement of the lease

liability as an adjustment to the right-of-use asset.

Lessor accounting under IFRS 16 is substantially unchanged from

today's accounting under IAS 17. Lessors will continue to classify

all leases using the same classification principle as in IAS 17 and

distinguish between two types of leases: operating and finance

leases.

IFRS 16 also requires lessees and lessors to make more extensive

disclosures than IAS 17.

IFRS 16 is effective for annual periods beginning on or after 1

January 2019. Early application is permitted, but not before an

entity applies IFRS 15. A lessee can choose to apply the standard

using either a full retrospective or a modified retrospective

approach. The standard's transition provisions permit certain

reliefs. This standard is not expected to have any impact on the

Group.

-- IFRIC Interpretation 23 - Uncertainty over income tax

treatments. The interpretation addresses the accounting for income

taxes when tax treatments involve uncertainty that affects the

application of IAS 12 and does not apply to taxes or levies outside

the scope of IAS 12, nor does it specifically include requirements

relating to interest and penalties associated with uncertain tax

treatments. The interpretation specifically addresses the

following:

-- Whether an entity considers uncertain

tax treatments separately

-- The assumptions an entity makes about

the examination of tax treatments by

taxation authorities

-- How an entity determines taxable profit

(tax loss), tax basis, unused tax losses,

unused tax credits and tax rates

-- How an entity considers changes in facts

and circumstances

An entity must determine whether to consider each uncertain tax

treatment separately or together with one or more uncertain tax

treatments. The approach that better predicts the resolution of the

uncertainty should be followed. The interpretation is effective for

annual reporting periods beginning on or after 1 January 2019, but

certain transition reliefs are available. The Group will apply this

interpretation and it may affect its consolidated financial

statements and the required disclosures.

In addition, the Group may need to establish processes and

procedures to obtain information that is necessary to apply the

Interpretation on a timely basis.

-- IFRS 17 - Insurance contracts. IFRS 17, a comprehensive new

accounting standard for insurance contracts covering recognition

and measurement, presentation and disclosure was issued in May

2017. Once effective, IFRS 17 will replace IFRS 4. IFRS 17 applies

to all types of insurance contracts, regardless of the type of

entities that issue them, as well as to certain guarantees and

financial instruments with discretionary participation features.

The objective of IFRS 17 is to provide an accounting model for

insurance contracts that is more useful and consistent for

insurers.

IFRS 17 is effective for reporting periods beginning on or after

1 January 2021, with comparative figures required. Early

application is permitted, provided the entity also applies IFRS 9

and IFRS 15 on or before the date it first applies IFRS 17. This

standard is not applicable to the Group.

-- Amendments to IFRS 10 and IAS 28: Sale or contribution of

Assets between an Investor and its Associate or Joint Venture. The

amendments address the conflict between IFRS 10, Consolidated

Financial Statements and IAS 28 in dealing with the loss of control

of a subsidiary that is sold or contributed to an associate or

joint venture. The amendments clarify that the gain or loss

resulting from the sale or contribution of assets that constitute a

business, as defined in IFRS 3, between an investor and its

associate or joint venture, is recognised in full. Any gain or loss

resulting from the sale or contribution of assets that do not

constitute a business, however, is recognised only to the extent of

unrelated investors' interests in the associate or joint venture.

The IASB has deferred the effective date of these amendments

indefinitely, but an entity that early adopts the amendments must

apply them prospectively. The Group will apply these amendments

when they become effective.

Current versus non-current classification

The Group presents assets and liabilities in the statement of

financial position based on current/non-current classification. An

asset is current when it is:

-- Expected to be realised or intended to

be sold or consumed in the normal operating

cycle

-- Held primarily for the purpose of trading

-- Expected to be realised within twelve months

after the reporting date

All other assets are classified as non-current.

Assets included in current assets which are expected to be

realised within twelve months after the reporting date are measured

at fair value which is their book value. Fair value for investments

in unquoted equity shares is the net proceeds that would be

received for the sale of the asset where this can be reasonably

determined.

Basis of consolidation

Where the company has control over an investee, it is classified

as a subsidiary. The company controls an investee if all three of

the following elements are present: power over the investee,

exposure to variable returns from the investee, and the ability of

the investor to use its power to affect those variable returns.

Control is reassessed whenever facts and circumstances indicate

that there may be a change in any of these elements of control.

The consolidated financial statements present the results of the

company and its subsidiaries ("the Group") as if they formed a

single entity. Intercompany transactions and balances between group

companies are therefore eliminated in full.

The consolidated financial statements incorporate the results of

business combinations using the acquisition method. In the

statement of financial position, the acquiree's identifiable

assets, liabilities and contingent liabilities are initially

recognised at their fair values at the acquisition date. The

results of acquired operations are included in the consolidated

statement of comprehensive income from the date on which control is

obtained. They are deconsolidated from the date on which control

ceases.

Entities that are not subsidiaries but where the Group has

significant influence (i.e. the power to participate in the

financial and operating policy decisions) are accounted for as

associates. The results and assets and liabilities of the

associates and joint venture are included in the consolidated

accounts using the equity method of accounting.

Property, plant and equipment

Items of property, plant and equipment are initially recognised

at cost. As well as the purchase price, cost includes directly

attributable costs.

Depreciation is provided on all items of property, plant and

equipment at rates calculated to write off the cost of each asset

on a straight line basis over their expected useful lives, as

follows:

Freehold land not depreciated

Freehold buildings 36 years

Fixtures and fittings 20%

Computer equipment 33%

Gains and losses on disposal are determined by comparing the

proceeds with the carrying amount and are recognised in the income

statement. The Directors reassess the useful economic life of the

assets annually.

Goodwill

Goodwill represents the excess of a cost of a business

combination over the Group's interest in the fair value of

identifiable assets under IFRS 3 Business Combinations.

Goodwill is capitalised as an intangible asset with any

impairment in carrying value being charged to the consolidated

statement of comprehensive income. Where the fair value of

identifiable assets, liabilities and contingent liabilities exceed

the fair value of consideration paid, the excess is credited in

full to the consolidated statement of comprehensive income on the

acquisition date.

Other intangible assets

Intangible assets other than goodwill acquired by the Group

comprise licences and the website and are stated at cost less

accumulated amortisation and impairment losses. Amortisation is

charged to the statement of comprehensive income within

administrative expenses on a straight line basis over the period of

the licence agreements. Assets are tested annually for impairment

or more frequently if events or circumstances indicate potential

impairment.

Amortisation, which is reviewed annually, is provided on

licences at 16.7% per annum and the website at 33.3% per annum,

calculated to write off the cost of the asset on a straight line

basis over its expected useful life.

Impairment of non-financial assets

Impairment tests on goodwill and other intangible assets with

indefinite useful economic lives are undertaken annually at the

financial year end. Other non-financial assets are subject to

impairment tests whenever events or changes in circumstances

indicate that their carrying amount may not be recoverable. Where

the carrying value of the asset exceeds its recoverable amount

(i.e. the higher of value in use and fair value less costs to

sell), the asset is written down accordingly.

Where it is not possible to estimate the recoverable amount of

an individual asset, the impairment test is carried out on the

smallest group of assets to which it belongs for which there are

separately identifiable cash flows, its cash generating units

('CGUs'). Goodwill is allocated on initial recognition to each of

the group's CGUs that are expected to benefit from the synergies of

the combination giving rise to the goodwill.

Financial assets

In the consolidated statement of financial position, the Group

classifies its financial assets as loans, trade receivables and

cash and cash equivalents. The classification depends on the

purpose for which the financial assets were acquired. Loans and

trade receivables are non-derivative financial assets with fixed or

determinable payments which arise principally through the Group's

trading activities. These are recognised at original fair value

less appropriate provision for impairment and subsequently measured

at amortised cost.

Impairment provisions are recognised when there is objective

evidence (such as significant financial difficulties on the part of

the counterparty or default or significant delay in payment) that

the Group will be unable to collect all of the amounts, the amount

of such a provision being the difference between the net carrying

amount and the present value of the future expected cash flows

associated with the impaired receivable. For trade receivables,

which are reported net, such provisions are recorded in a separate

allowance account with the loss being recognised within cost of

sales in the consolidated statement of comprehensive income. On

confirmation that the trade receivable will not be collectable, the

gross carrying value of the asset is written off against the

associated provision.