TIDMMTL

RNS Number : 5642G

Metals Exploration PLC

20 July 2023

METALS EXPLORATION PLC

QUARTERLY UPDATE TO 30 JUNE 2023

Metals Exploration plc (AIM: MTL) ("Metals Exploration", the

"Company" or the "Group"), a gold producer in the Philippines, is

pleased to announce its quarterly results for Q2 2023.

Finance and corporate

Ø Record half-year and quarterly gold sales:

-- H1 2023 - 46,186 ounces sold at an average realised gold

price of US$1,939 per ounce (H1 2022: 30,676 ounces at an average

US$1,878 per ounce)

-- Q2 2023 - 24,744 ounces sold at an average realised gold

price of US$1,984 per ounce (Q1 2023: 21,442 ounces at an average

US$1,887 per ounce).

Ø Record half-year and quarterly gold revenue:

-- H1 2023 - US$89.6 million (H1 2022: US$57.6 million).

-- Q2 2023 - US$49.1 million (Q1 2023: US$40.5 million).

Ø Record half-year and quarterly positive free cash flow:

-- H1 2023 - US$41.9 million (H1 2022: US$13.6 million).

-- Q2 2023 - US$24.1 million (Q1 2023: US$17.8 million).

Ø Elevation of mezzanine debt to secured status is progressing

to execution stage, however uncertainty remains over the interest

rate, as well as the date of its application, which will be applied

to the outstanding loan in the period prior to completion of the

elevation.

Ø Mezzanine debt repayments of US$20.7 million in Q2 2023 (Q1

2023 - US$14.3 million).

Ø Net debt as at 30 June 2023 was US$48.3 million (31 March

2023: US$69.0 million).

Mining Operations

Ø No lost time injuries occurred during the period - over 20

million hours worked without a reportable injury .

Ø Mining production of ore and waste was above forecast at

3.49Mt (Q1 2023: 2.74Mt), with a total of 566Kt of ore mined in Q2

2023 (Q1 2023: 282Kt).

Processing Operations

Ø Record half-year gold production of 45,533 ounces (H1 2022:

31,348 ounces) recovered from 1.07Mt at a head grade of 1.48g/t (H1

2022: 1.02Mt at a head grade of 1.09g/t).

Ø Q2 2023 gold production of 24,235 ounces (Q1 2023: 21,299

ounces) recovered from 522Kt at a head grade of 1.66g/t (Q1 2023:

546Kt at a head grade of 1.30g/t).

Ø Record half-year gold recovery of 89.8% (H1 2022: 87.7%)

Ø Q2 2023 gold recovery of 86.9% (Q1 2023: 93.4%).

FY2023 Production Guidance Update

Ø Operations in H1 2023 have exceeded expectations with head

grade, tonnes milled and recovery rates all above forecast.

Although the head grade for H2 2023 is forecast to drop, the

Company has updated its FY2023 production guidance as follows:

-- FY2023 updated gold production forecast: 78,000 - 81,000

ounces (previous guidance: 68,000 - 72,000 ounces).

-- FY 2023 updated AISC forecast: US$1,120 - US$1,200 per ounce

(previous guidance: US$1,250 - US$1,300 per ounce).

Darren Bowden, CEO of Metals Exploration, commented :

"This was an excellent quarter at Runruno with record

performances in a number of key metrics, leading to a first half

that has exceeded our expectations operationally. The Company's

cash flows remain strong, and we continue to make substantial debt

repayments, whilst also looking to finalise the mezzanine debt

position as soon as is practicable.

"Given Runruno's strong performance in the first half of the

year, we are delighted to announce that we have updated our

production guidance, as well as our forecast all-in sustaining

costs - increasing our production range and further reducing our

costs.

"This has been an excellent first half of 2023 for the Company

and we expect the second half of this year to continue to deliver

our strategy both from an operational and a corporate

perspective."

Production and Finance Summary

Runruno Project

Report Quarter Quarter FY 2023 FY 2022

---------- ---------- ---------- ----------

FY 2023 Actual Actual Actual Actual

---------- ---------- ---------- ----------

PHYSICALS Units Q2 2023 Q2 2022 6 Months 6 Months

------------- ---------- ----------

Mining

------------- ---------- ----------

Ore Mined Tonnes 565,767 509,825 848,023 1,289,123

-------------- ---------- ----------

Waste Mined Tonnes 2,928,776 2,467,685 5,385,929 5,619,472

-------------- ---------- ----------

Total Mined Tonnes 3,494,543 3,002,244 6,233,952 6,965,979

-------------- ---------- ----------

Au Grade Mined g/tonne 1.62 1.18 1.59 1.10

-------------- ---------- ----------

Strip Ratio 5.01 4.77 6.08 4.28

---------- ----------

Processing

------------- ---------- ----------

Ore Milled Tonnes 522,307 510,214 1,068,391 1,017,258

-------------- ---------- ----------

Au Grade g/tonne 1.66 1.16 1.48 1.09

-------------- ---------- ----------

S(2) Grade % 1.55 1.10 1.41 0.98

-------------- ---------- ----------

Au Milled (contained) Ounces 27,894 19,087 50,701 35,742

-------------- ---------- ----------

Recovery % 86.9 86.6 89.8 87.7

-------------- ---------- ----------

Au Recovered/Poured Ounces 24,235 16,529 45,533 31,348

-------------- ---------- ----------

Sales

------------- ---------- ----------

Au Sold Ounces 24,744 14,992 46,186 30,676

-------------- ---------- ----------

Au Price US$/oz 1,984 1,858 1,939 1,878

-------------- ---------- ----------

FINANCIALS (Unaudited)

------------------------- ------------- ---------- ----------

Revenue

------------- ---------- ----------

Gold Sales (US$000's) 49,093 27,849 89,552 57,622

-------------- ---------- ----------

Operating Costs

- Summary

------------- ---------- ----------

Mining (US$000's) 5,223 6,972 10,466 13,307

-------------- ---------- ----------

Processing (US$000's) 8,580 6,926 17,813 14,296

-------------- ---------- ----------

G&A (US$000's) 2,950 2,616 5,901 5,316

-------------- ----------

Total Operating

Costs (US$000's) 16,753 16,515 34,181 32,919

-------------- ----------

Excise Duty (US$000's) 1,975 1,099 3,610 2,317

-------------- ---------- ----------

UK/Philippine G&A (US$000's) 2,980 3,102 4,661 4,783

-------------- ---------- ----------

Total Direct Production

Costs (US$000's) 21,708 20,716 42,452 40,019

-------------- ---------- ----------

Net Cash Income (US$000's) 27,385 7,133 47,100 17,603

-------------- ---------- ----------

Total Capital Costs (US$000's) 3,334 1,775 5,206 4,039

-------------- ---------- ----------

Total non-cash

costs (US$000's) 7,512 3,009 15,364 7,682

-------------- ---------- ----------

Free Cashflow ( US$000's) 24,051 5,358 41,894 13,564

-------------- ---------- ----------

Cash Cost / oz

Sold - C1 US$/oz 723 938 818 960

-------------- ---------- ----------

Cash Cost / oz

Sold - AISC US$/oz 1,058 1,336 1,110 1,323

-------------- ---------- ----------

Note: AISC includes all UK Corporate costs.

Review of Operations

Stable operations were maintained during H1 2023, which in

combination with a sustained period of higher grade material, and

higher gold prices, has produced a record H1 revenue of US$89.6

million (H1 2022: US$57.6 million). Gold sales for Q2 2023 were

US$49.1 million (Q1 2023: US$40.5 million), at an average realised

gold price of US$1,984 per ounce (Q1 2023: average gold price of

US$1,887 per ounce); producing a positive free cash flow of US$24.1

million (Q1 2023: US$17.8 million).

Finance

The process of elevating the status of the mezzanine loans to

that of secured debt is continuing. The mechanics to achieve this

requires new securities to be created across several jurisdictions.

The due diligence work sought by the RHL Group as part of the

elevation has been completed and the documentation to achieve all

aspects of the elevation is largely agreed. The process of

executing these documents is expected to begin shortly, but is

likely to take several weeks to complete, as the process involves

the notarisation and legalisation of multiple documents.

As previously advised, the October 2020 debt restructuring

agreements envisage the interest rate applicable to the mezzanine

debt being reduced from 15% to 7% once the senior debt is repaid

and the elevation of the mezzanine debt to "new" senior debt is

complete.

The majority mezzanine lender, MTL Luxemburg, Nick Candy's

investment vehicle (holding 70.7% of the mezzanine debt), has

confirmed in writing that, subject to completion of the elevation

documents within a reasonable period, the interest rate on its

portion of the mezzanine debt will reduce to 7% per annum from 15%

per annum as from 3 November 2022 (being the date that the Company

could have fully repaid the Senior Facility, but for the

requirements of the elevation).

The minority 29.3% mezzanine lender, the RHL Group, has not

confirmed the same in writing; however, the Company is hopeful the

RHL Group will apply the 7% interest rate from 3 November 2022 and

that this will be formalised once the elevation documents are

completed within a reasonable period.

Total mezzanine debt payments of US$20.75 million were made

during Q2 2023 (Q1 2023: US$14.30 million).

The net debt position of the Group as at 30 June 2023 was

US$48.3 million (Q1 2023: US$64.4 million). Cash holdings at 30

June 2023 were US$1.0 million (31 March 2023: US$4.6 million).

Mining Operations

Mining production of ore and waste for Q2 2023 was above

forecast at 3.49Mt (Q1 2023: 2.74Mt), with a total of 566Kt of ore

mined in Q2 2023 (Q1 2023: 282kt).

An exploration programme in Stages 4 and 5 commenced in Q1 2023,

with the objective of identifying new gold resources both in and

near-to the current pit-shell design. To date, this drilling has

not produced any material gold discoveries.

Process Plant

Record gold production in H1 2023 of 45,533 ounces (H1 2022:

30,676) was achieved from a half-year record recovery rate of 89.8%

(H1 2022: 87.7%), with all aspects of the process plant performing

adequately.

Gold produced during Q2 2023 was 24,235 ounces for the quarter

(Q1 2023: 21.299 ounces). Throughput for Q2 2023 was 522Kt (Q1

2023: 546Kt) at a recovery rate of 86.9% (Q1 2023: 93.4%).

Residual Storage Impoundment ("RSI")

Work on the final RSI dam-wall raise is expected to be completed

in Q3 2023. Notwithstanding this, the d am water freeboard remained

well above design minimum levels. Earthworks for the construction

of the RSI final in-rock spillway are well advanced.

Occupational Health & Safety

Runruno continues to record an exceptional safety record with

over 20 million hours worked without a lost-time reportable injury

as at the date of this announcement.

Environment and Compliance

Compliance matters continue to be successfully monitored, and

the mine remains compliant, with no outstanding material

issues.

Community & Government Relations

In conjunction with relevant government agencies, the Company

has largely completed the removal of illegal miners, including

their infrastructure and dwellings, from mine plan Stages 4 and

5.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014, which forms part of United

Kingdom domestic law by virtue of the European Union (Withdrawal)

Act 2018 (as amended). Upon the publication of this announcement,

this inside information is now considered to be in the public

domain.

- END -

For further information please visit or contact:

Metals Exploration PLC

Via Tavistock Communications

Limited +44 (0) 207 920 3150

-------------------------

Nominated & Financial STRAND HANSON LIMITED

Adviser:

-------------------------

James Spinney, James

Dance, Rob Patrick +44 (0) 207 409 3494

-------------------------

Financial Adviser & HANNAM & PARTNERS

Broker:

-------------------------

Matt Hasson, Franck Nganou +44 (0) 207 907 8500

-------------------------

Public Relations: TAVISTOCK COMMUNICATIONS

LIMITED

-------------------------

Jos Simson, Nick Elwes +44 (0) 207 920 3150

-------------------------

Web: www.metalsexploration.com

Twitter: @MTLexploration

LinkedIn: Metals Exploration

Competent Person's Statement

Mr Darren Bowden, a director of the Company, a Member of the

Australasian Institute of Mining and Metallurgy and who has been

involved in the mining industry for more than 25 years, has

compiled, read and approved the technical disclosure in this

regulatory announcement in accordance with the AIM Rules - Note for

Mining and Oil & Gas Companies.

Forward Looking Statements

Certain statements relating to the estimated or expected future

production, operating results, cash flows and costs and financial

condition of Metals Explorations, planned work at the Company's

projects and the expected results of such work contained herein are

forward-looking statements which are based on current expectations,

estimates and projections about the potential returns of the Group,

industry and markets in which the Group operates in, the Directors'

beliefs and assumptions made by the Directors . Forward-looking

statements are statements that are not historical facts and are

generally, but not always, identified by words such as the

following: "expects", "plans", "anticipates", "forecasts",

"believes", "intends", "estimates", "projects", "assumes",

"potential" or variations of such words and similar expressions.

Forward-looking statements also include reference to events or

conditions that will, would, may, could or should occur.

Information concerning exploration results and mineral reserve and

resource estimates may also be deemed to be forward-looking

statements, as it constitutes a prediction of what might be found

to be present when and if a project is actually developed.

These statements are not guarantees of future performance or the

ability to identify and consummate investments and involve certain

risks, uncertainties and assumptions that are difficult to predict,

qualify or quantify. Among the factors that could cause actual

results or projections to differ materially include, without

limitation: uncertainties related to raising sufficient financing

to fund the planned work in a timely manner and on acceptable

terms; changes in planned work resulting from logistical, technical

or other factors; the possibility that results of work will not

fulfil projections/expectations and realize the perceived potential

of the Company's projects; uncertainties involved in the

interpretation of drilling results and other tests and the

estimation of gold reserves and resources; risk of accidents,

equipment breakdowns and labour disputes or other unanticipated

difficulties or interruptions; the possibility of environmental

issues at the Company's projects; the possibility of cost overruns

or unanticipated expenses in work programs; the need to obtain

permits and comply with environmental laws and regulations and

other government requirements; fluctuations in the price of gold

and other risks and uncertainties.

The Company expressly disclaims any obligation or undertaking to

disseminate any updates or revisions to any forward looking

statements contained herein to reflect any change in the Group's

expectations with regard thereto or any change in events,

conditions or circumstances on which any such statements are based

unless required to do so by applicable law or the AIM Rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLUKUVROBUBAAR

(END) Dow Jones Newswires

July 20, 2023 02:00 ET (06:00 GMT)

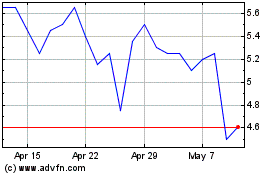

Metals Exploration (LSE:MTL)

Historical Stock Chart

From Apr 2024 to May 2024

Metals Exploration (LSE:MTL)

Historical Stock Chart

From May 2023 to May 2024