TIDMOSB

Closing of Canterbury Finance No.4 plc Transaction

LEI: 213800ZBKL9BHSL2K459

OSB GROUP PLC ("OSB" or the "Group")

Closing of Canterbury Finance No.4 plc (the "Transaction")

OSB GROUP PLC ("OSB") today announces that it has closed the

Canterbury Finance No.4 securitisation. The fully retained

transaction securitises GBP1.7bn of prime Buy-to-Let mortgage

assets originated by OneSavings Bank, and will generate GBP1.4bn of

AAA rated senior bonds for the Group, for utilisation as collateral

for Bank of England repo funding facilities and the Term Funding

Scheme with additional incentives for SMEs (TFSME) scheme, as well

as to act as collateral for commercial repo transactions with

investment bank counterparties.

Commenting on the Transaction, Andy Golding, CEO of OSB Group,

said:

"This transaction, our first structured finance trade of the

year, significantly increases the contingent wholesale funding

options available to us, as well as giving us the opportunity to be

more efficient in our drawings from the Bank of England under the

TFS and TFSME schemes. The transaction provides further evidence of

our sophisticated approach to liability management. I would like to

thank our transaction advisors and counterparties for supporting us

on this transaction."

Enquiries:

OneSavings Bank plc

Alastair Pate t: 01634 838 973

Brunswick Group

Robin Wrench/Simone Selzer t: 020 7404 5959

About OSB GROUP PLC

OSB began trading as a bank on 1 February 2011 and was admitted

to the main market of the London Stock Exchange in June 2014

(OSB.L). OSB joined the FTSE 250 index in June 2015. On 4 October

2019, OSB acquired Charter Court Financial Services Group plc

(CCFS) and its subsidiary businesses. On 30 November 2020, OSB

GROUP PLC became the listed entity and holding company for the OSB

Group. The Group provides specialist lending and retail savings and

is authorised by the Prudential Regulation Authority, part of the

Bank of England, and regulated by the Financial Conduct Authority

and Prudential Regulation Authority. The Group reports under two

segments, OneSavings Bank and Charter Court Financial Services.

OneSavings Bank

OneSavings Bank primarily targets market sub-sectors that offer

high growth potential and attractive risk-adjusted returns in which

it can take a leading position and where it has established

expertise, platforms and capabilities. These include private rented

sector Buy-to-Let, commercial and semi-commercial mortgages,

residential development finance, bespoke and specialist residential

lending, secured funding lines and asset finance.

OSB originates mortgages organically via specialist brokers and

independent financial advisers through its specialist brands

including Kent Reliance for Intermediaries and InterBay Commercial.

It is differentiated through its use of highly skilled, bespoke

underwriting and efficient operating model.

OSB is predominantly funded by retail savings originated through

the long-established Kent Reliance name, which includes online and

postal channels as well as a network of branches in the South East

of England. Diversification of funding is currently provided by

securitisation programmes and the Term Funding Schemes.

OneSavings Bank plc LEI: 213800WTQKOQI8ELD692

Important disclaimer

This document should be read in conjunction with the documents

distributed by OneSavings Bank plc (OSB) through the Regulatory

News Service ('RNS'). This document is not audited and contains

certain forward-looking statements, beliefs or opinions, including

statements with respect to the business, strategy and plans of OSB

and its current goals and expectations relating to its future

financial condition, performance and results. Such forward-looking

statements include, without limitation, those preceded by, followed

by or that include the words 'targets', 'believes', 'estimates',

'expects', 'aims', 'intends', 'will', 'may', 'anticipates',

'projects', 'plans', 'forecasts', 'outlook', 'likely', 'guidance',

'trends', 'future', 'would', 'could', 'should' or similar

expressions or negatives thereof. Statements that are not

historical facts, including statements about OSB's, its directors'

and/or management's beliefs and expectations, are forward-looking

statements. By their nature, forward-looking statements involve

risk and uncertainty because they relate to events and depend upon

circumstances that may or may not occur in the future. Factors that

could cause actual business, strategy, plans and/or results

(including but not limited to the payment of dividends) to differ

materially from the plans, objectives, expectations, estimates and

intentions expressed in such forward-looking statements made by OSB

or on its behalf include, but are not limited to: general economic

and business conditions in the UK and internationally; market

related trends and developments; fluctuations in exchange rates,

stock markets, inflation, deflation, interest rates and currencies;

policies of the Bank of England, the European Central Bank and

other G8 central banks; the ability to access sufficient sources of

capital, liquidity and funding when required; changes to OSB's

credit ratings; the ability to derive cost savings; changing

demographic developments, and changing customer behaviour,

including consumer spending, saving and borrowing habits; changes

in customer preferences; changes to borrower or counterparty credit

quality; instability in the global financial markets, including

Eurozone instability, the potential for countries to exit the

European Union (the EU) or the Eurozone, and the impact of any

sovereign credit rating downgrade or other sovereign financial

issues; technological changes and risks to cyber security; natural

and other disasters, adverse weather and similar contingencies

outside OSB's control; inadequate or failed internal or external

processes, people and systems; terrorist acts and other acts of war

or hostility and responses to those acts; geopolitical, pandemic or

other such events; changes in laws, regulations, taxation,

accounting standards or practices, including as a result of an exit

by the UK from the EU; regulatory capital or liquidity requirements

and similar contingencies outside OSB's control; the policies and

actions of governmental or regulatory authorities in the UK, the EU

or elsewhere including the implementation and interpretation of key

legislation and regulation; the ability to attract and retain

senior management and other employees; the extent of any future

impairment charges or write-downs caused by, but not limited to,

depressed asset valuations, market disruptions and illiquid

markets; market relating trends and developments; exposure to

regulatory scrutiny, legal proceedings, regulatory investigations

or complaints; changes in competition and pricing environments; the

inability to hedge certain risks economically; the adequacy of loss

reserves; the actions of competitors, including non-bank financial

services and lending companies; and the success of OSB in managing

the risks of the foregoing.

Accordingly, no reliance may be placed on any forward-looking

statement and no representation, warranty or assurance is made that

any of these statements or forecasts will come to pass or that any

forecast results will be achieved. Any forward-looking statements

made in this document speak only as of the date they are made and

it should not be assumed that they have been revised or updated in

the light of new information of future events. Except as required

by the Prudential Regulation Authority, the Financial Conduct

Authority, the London Stock Exchange PLC or applicable law, OSB

expressly disclaims any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained in this document to reflect any change in OSB's

expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is based.

For additional information on possible risks to OSB's business,

please see the "Risk Review" section of the OSB 2018 Annual Report

and Accounts. Copies of this are available at www.osb.co.uk and on

request from OSB.

Nothing in this document and any subsequent discussion

constitutes or forms part of a public offer under any applicable

law or an offer to purchase or sell any securities or financial

instruments. Nor does it constitute advice or a recommendation with

respect to such securities or financial instruments, or any

invitation or inducement to engage in investment activity under

section 21 of the Financial Services and Markets Act 2000. Past

performance cannot be relied on as a guide to future performance.

Nothing in this document is intended to be, or should be construed

as, a profit forecast or estimate for any period.

Liability arising from anything in this document shall be

governed by English law, and neither the Company nor any of its

affiliates, advisors or representatives shall have any liability

whatsoever (in negligence or otherwise) for any loss howsoever

arising from any use of this document or its contents or otherwise

arising in connection with this document. Nothing in this document

shall exclude any liability under applicable laws that cannot be

excluded in accordance with such laws.

Certain figures contained in this document, including financial

information, may have been subject to rounding adjustments and

foreign exchange conversions. Accordingly, in certain instances,

the sum or percentage change of the numbers contained in this

document may not conform exactly to the total figure given.

(END) Dow Jones Newswires

July 06, 2021 07:55 ET (11:55 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

Osb (LSE:OSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

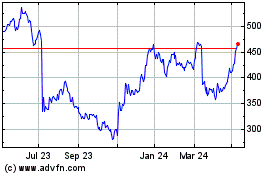

Osb (LSE:OSB)

Historical Stock Chart

From Apr 2023 to Apr 2024