Picton Prop Inc Ltd Portfolio Update

September 21 2020 - 1:00AM

UK Regulatory

TIDMPCTN

21 September 2020

PICTON PROPERTY INCOME LIMITED

("Picton", the "Company" or the "Group")

LEI: 213800RYE59K9CKR4497

Portfolio Update

Picton, provides an update on various initiatives across its property portfolio

since its last update in July 2020.

Swiftbox, Rugby - Industrial letting

Following completion of the refurbishment in March 2020, Picton has leased the

entire 100,000 sq ft distribution unit to UPS, the multinational supply chain

and delivery company on a 12 month, short-term lease, with the option to extend

for up to a further six months. The transaction will immediately generate

annual income of GBP0.6 million, which is 4% ahead of ERV.

Bridge Street, Peterborough - Retail disposal

Picton has exchanged contracts on the disposal of a high street retail asset

for GBP3.98 million. The property comprises two retail units, with one let to

TK Maxx who intend to vacate in March 2021 and the other vacant and previously

occupied by New Look.

The Company has reviewed alternative use options and made a pre-application in

respect of converting the upper floors to residential use. It has now agreed

to sell the asset to Peterborough City Council who intend to convert the

building into a new City Library and Community Hub.

Picton will keep the rental income until completion, which is due on or before

22 December 2020. The sale price reflects a significant premium to the

independent 30 June 2020 valuation.

Stanford Building, Long Acre, WC2 - Refurbishment & change of use

The refurbishment is nearing completion and initial interest in the office

upper floors is encouraging.

Earlier this summer, Picton had made a pre-application to Westminster City

Council in respect of converting the 1st floor from retail to office use. It

now intends to make use of the recent changes within The Town and Country

Planning (Use Classes) Regulations 2020 and the introduction of 'Class E', to

effect this change.

Retail & leisure exposure

With effect from September 2020, Stanford Building will be reclassified as a

West End Office, rather than High Street Retail reflecting the now predominant

value within the office element of the building.

Combined with the disposal referred to above and based on the June 2020

valuation, the retail & leisure element of the portfolio will reduce from 18%

to 12% of the total (comprising 7% Retail warehouse and 3% High Street Retail

and 2% Leisure). Industrial will be 49% and Offices 39%.

The Company intends to provide a further update at the time of its interim

results, due November 2020.

Michael Morris, CEO at Picton, commented:

"With the completion of these initiatives, we have reduced the overall

portfolio weighting to retail and secured immediate additional rental income

from a major international logistics business. This goes to show that despite

the challenges of the last few months, our overall portfolio strategy and

approach to asset management and occupier relations continues to deliver."

For further information:

Tavistock

Jeremy Carey/James Verstringhe, 020 7920 3150,

james.verstringhe@tavistock.co.uk

Picton

Michael Morris 0207 011 9980, michael.morris@picton.co.uk

Note to Editors

Picton, established in 2005, is a UK REIT. It owns and actively manages a GBP659

million diversified UK commercial property portfolio, invested across 47 assets

and with around 350 occupiers (as at 30 June 2020). Through an occupier

focused, opportunity led approach to asset management, Picton aims to be one of

the consistently best performing diversified UK focused property companies

listed on the main market of the London Stock Exchange.

For more information please visit: www.picton.co.uk.

ENDS

END

(END) Dow Jones Newswires

September 21, 2020 02:00 ET (06:00 GMT)

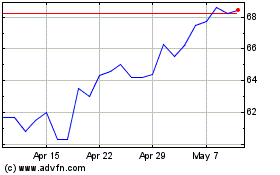

Picton Property Income Ld (LSE:PCTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

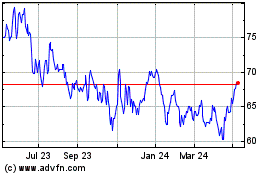

Picton Property Income Ld (LSE:PCTN)

Historical Stock Chart

From Apr 2023 to Apr 2024