Polar Capital Holdings PLC Issue of Equity (3135Z)

May 20 2021 - 5:36AM

UK Regulatory

TIDMPOLR

RNS Number : 3135Z

Polar Capital Holdings PLC

20 May 2021

20 May 2021

Polar Capital Holdings plc

Issue of Equity

Polar Capital Holdings plc ("Polar Capital" or the "Company")

announces that today 1,333,921 ordinary shares of 2.5 pence in the

Company have been allotted and issued, each fully paid, under its

block listing facility (Crystallisation of Preference Shares) in

respect of the previously announced crystallisation of the

Healthcare Opportunities Fund and the Polar Capital Global

Healthcare Trust plc (RNS Number 6491D on 11 October 2018), and the

partial crystallisation of the North American Fund (RNS Number

0949U on 20 November 2019). These shares will rank pari passu in

all respects with the Company's existing shares in issue.

This issue comprises the fourth and final allotment of shares in

respect of the Healthcare Opportunities Fund and the Polar Capital

Global Healthcare Trust plc (1,218,022 shares) and the third

allotment of shares in respect of the North American Fund (115,899

shares).

The Company's current issued share capital is 98,779,934

ordinary shares and following this allotment, the total number of

ordinary shares allotted and in issue will be 100,113,855.

Background

As set out at the time of the Company's admission to AIM, Polar

Capital has structured its fund management operations in such a way

that the fund management teams are placed in separate business

units. Each business unit is a separate profit centre and the fund

managers responsible receive an annual payment which comprises a

share of their unit's core operating profit (operating profit

before performance fees and related distributions) and performance

fees.

In addition, each fund management team is offered the prospect

of an interest in the capital of the Company through the purchase

of an individual class of preference shares in Polar Capital

Partners Limited, a wholly owned subsidiary of the Company. These

preference shares have been structured in such a way as to become

convertible upon the occurrence of certain events known as

crystallisation events into cash or, at the option of the Company,

ordinary shares in the Company at a ratio that is intended to be

earnings enhancing for the Group.

Upon the occurrence of a crystallisation event the fund managers

concerned cease to be eligible to receive their share of the

business unit's core operating profit and simultaneously going

forward receive a reduced interest in their performance fees.

For further information please contact:

Polar Capital +44 (0)20 7227 2700

Gavin Rochussen (Chief Executive)

John Mansell (Executive Director)

Samir Ayub (Finance Director)

Numis Securities Limited - Nomad and Joint Broker +44 (0)20 7260 1000

Charles Farquhar

Stephen Westgate

Kevin Cruickshank (QE)

Peel Hunt LLP - Joint Broker +44 (0)20 3597 8680

Andrew Buchanan

Rishi Shah

Camarco +44 (0)20 7757 4995

Ed Gascoigne-Pees

Jennifer Renwick

Monique Perks

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEFLFVIESIIFIL

(END) Dow Jones Newswires

May 20, 2021 06:36 ET (10:36 GMT)

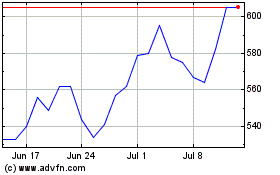

Polar Capital (LSE:POLR)

Historical Stock Chart

From Apr 2024 to May 2024

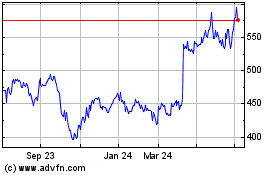

Polar Capital (LSE:POLR)

Historical Stock Chart

From May 2023 to May 2024