Sabre Insurance Group PLC Trading Update (5905Q)

October 19 2023 - 1:00AM

UK Regulatory

TIDMSBRE

RNS Number : 5905Q

Sabre Insurance Group PLC

19 October 2023

19 October 2023

Sabre Insurance Group plc

Trading Update

Strong premium growth and healthy capital position

Sabre Insurance Group plc (the "Group" or "Sabre"), one of the UK's

leading motor insurance underwriters, today provides an update on

trading for the period from 1 July 2023 to 30 September 2023.

Financial highlights Nine months ended Year ended

30 September 31 December

------------------------------------ ---------------------- --------- -------------

2023 2022 % change 2022

------------------------------------ ---------- ---------- --------- -------------

Gross written premium GBP162.2m GBP135.7m 19.5% GBP171.3m

Gross written premium - Motor GBP140.5m GBP105.2m 33.6% GBP134.9m

Vehicle

Gross written premium - Motorcycle GBP10.7m GBP20.9m (48.8%) GBP23.1m

Gross written premium - Taxi GBP11.0m GBP9.6m 14.6% GBP13.3m

Post-dividend solvency capital

ratio 191% 163% 154%

------------------------------------ ---------- ---------- --------- -------------

Business highlights for the first nine months of 2023

* Strong performance from our core Motor Vehicle book

* Gross written premiums ('GWP') up 34% year-to-date

and up 61% versus Q3 2022

* In recent weeks, premium run-rate has been over 80%

up year-on-year

* Increase in policy count, while maintaining continued

focus on profitability as a target and volume as an

output. Core Motor Vehicle policy count 222k at 30

September 2023 (30 June 2023: 211k)

* Significant rate increases mitigating the impact of

claims inflation and ensuring margins return towards

historical levels for business written in recent

months

* Increase in solvency capital ratio reflects return

towards historical levels of underwriting

profitability on core Motor Vehicle business and

profitable growth

* Good performance from Motorcycle book

* Ongoing focus on margin over volume - with rate

increases expected to drive improved loss ratio

performance for 2023 vs 2022

* Policy count and premium growth impacted by the

cessation of trading with MCE Insurance, offset by

increase in sales through our alternate channel.

Motorcycle policy count 45k at 30 September 2023 (30

June 2023: 48k)

* Taxi book performance improving as planned

* Taxi market remains challenging, significant

underwriting actions starting to show improved loss

ratio performance but have reduced premium run-rate

vs 2022. Taxi policy count 13k at 30 September 2023

(30 June 2023: 14k)

* Underwriting performance across the portfolio in Q3

supports expectation of an improvement in the

combined operating ratio for H2 vs H1 2023. Expect

combined operating ratio for 2023 at the higher end

of 85% - 90% on a discounted basis in-line with

previous guidance

* Post-dividend solvency capital ratio as at 30

September 2023 of 191 % (30 September 2022: 163%)

* Expect to have sufficient capital to allow the Board

flexibility in determining an appropriate dividend

distribution at year-end in-line with our policy - an

ordinary dividend payout ratio of 70% of adjusted

profit after tax and a distribution of surplus

capital through special dividends

Market trends

* Growth in our GWP and policy count despite price

increases suggests market pricing correction has

continued through Q3, with Sabre continuing to see

the benefits of acting early with respect to pricing

* Claims inflation for 2023 continues at around 10%,

however rate increases applied are sufficient to

cover slightly higher levels of inflation and improve

loss ratios towards historical norms, from which we

expect to see the benefit in 2024

Full-year premium guidance raised; profitability reaffirmed

* Premium in recent months has been above expectations,

therefore we increase our overall 2023 full-year

gross written premium year-on-year growth expectation

to 20% - 25%

* Reiterate profitability guidance provided at

half-year, expect discounted combined operating ratio

for the full-year 2023 at the upper end of the 85% -

90% range

* Premium growth and momentum in underwriting margin

improvements will earn through in 2024, which we

expect to result in further improvement in combined

operating ratio in-line with previous guidance

Geoff Carter, Chief Executive Officer of Sabre, commented:

" Having stuck firmly to our 'profitability over volume' strategy

through four-years of persistent market under-pricing and periods

of very high inflation, we are now starting to show the benefits

of our strategy as market pricing continues to correct.

We have been able to increase prices at a level to cover high on-going

inflation whilst also returning anticipated profitability on written

business towards our historical levels - in recent months core Motor

Vehicle business has been written at an assessed sub-80% undiscounted

combined operating ratio - which we have achieved at the same time

as writing total GWP considerably higher than our expectations. This

should contribute to continued improvement in the financial-year

combined operating ratio for 2024, as business written in recent

months starts to earn through and the impact of Taxi business written

earlier in 2023 subsides.

It is also pleasing to see Motorcycle now performing at around the

required level and Taxi performance improving as planned.

Our success so far this year is evident in the high premium levels

and very strong solvency position which will allow sufficient headroom

for further growth whilst allowing the Board flexibility in determining

an appropriate dividend distribution at year-end in-line with our

policy.

I would like to thank all our people and shareholders, who have

supported Sabre through an extended and challenging market, as we

look to a bright and exciting future." Investor enquiries 01306 747 272

Sabre Insurance Group pl investor.relations@sabre.co.uk

c

Geoff Carter / Adam Westwood

Media enquiries 020 7353 4200

Teneo sabre@teneo.com

James Macey White / Eleanor

Pomeroy

LEI Code: 2138006RXRQ8P8VKGV98

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFFWFWAEDSEDS

(END) Dow Jones Newswires

October 19, 2023 02:00 ET (06:00 GMT)

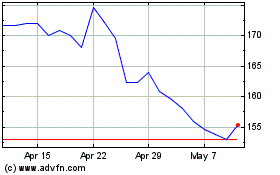

Sabre Insurance (LSE:SBRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

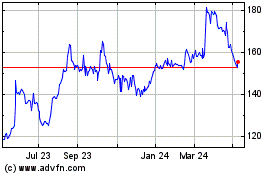

Sabre Insurance (LSE:SBRE)

Historical Stock Chart

From Apr 2023 to Apr 2024