TIDMTHG

RNS Number : 3663D

THG PLC

21 June 2023

21 June 2023

THG PLC

AGM Trading Statement

Strong profitability progression with cash generation ahead of

expectations in H1 2023

FY 2023 guidance unchanged

THG PLC ("THG" or the "Group") provides the following update on

trading ahead of its Annual General Meeting (AGM) later today.

The Group has had a strong Q2 2023, with a continued successful

focus on profitability and cash generation. A significant increase

in H1 2023 profitability is expected, with Adjusted EBITDA in the

range of GBP44m to GBP47m (H1 2022: GBP32.3m), and continuing[1]

Adjusted EBITDA in the range of GBP47m to GBP50m. Guidance for FY

2023 remains unchanged as disclosed at the time of the FY 2022

results in April, with Adjusted EBITDA expected to be in line with

the company consensus[2].

Free cash flow performance for the 12 months to 30 June 2023 is

ahead of expectations and anticipated to be a c. GBP40m outflow.

The Group remains well on track to deliver free cash flow

neutrality[3] for the full year, with adjusting items materially

lower than the prior year.

THG Nutrition has had a particularly strong start to the year,

with the pricing decision to support consumers through exceptional

market-wide inflationary conditions in FY 2022 now paying

dividends. Commodity prices continue to ease, with further margin

benefits expected in H2 2023.

In THG Beauty, our online retail platforms have focussed on

profitable sales in markets where our localised infrastructure can

deliver economies of scale. We expect further sales momentum in the

second half of the year, supported by beauty manufacturing as the

temporary industry-wide de-stocking comes to an end.

THG Ingenuity continues to make good progress on building its

client base across higher value enterprise accounts and its network

of global strategic alliances and remains on track to add GBP1bn

incremental GMV to the platform across Technology, Digital and

Operational services during FY 2023. In addition to partnerships

with BigCommerce, AutoStore, PwC and Elastic Path announced to

date, Ingenuity has recently partnered with Commercehub, one of the

world's largest commerce networks, to extend Ingenuity's

marketplace solution and create a complementary, managed

marketplace offering.

For the Group, Adjusted EBITDA margin accretion into FY 2024 and

beyond will be driven by annualised commodity pricing benefits,

ongoing automation efficiencies and operating leverage, in addition

to normalised capital expenditure, underpinning positive free cash

flow guidance for FY 2024.

Corporate Governance

THG also announces that it has been notified that Founder and

Chief Executive Officer Matthew Moulding has today transferred the

Special Share held by him and, as a result, all rights of the

Special Share have now ceased in accordance with THG's articles of

association. The Special Share will be cancelled by THG.

The Group's intention in relation to moving to a premium listing

remains as stated in its FY 2022 results in April, with timing

subject to the final outcome of the FCA's review for reform of the

listing regime.

In a separate announcement today, the Board has also made

changes to its composition with the addition of Helen Jones as

independent Non-Executive Director, in addition to Iain McDonald

stepping down from the Remuneration Committee to focus on his

Sustainability and Nomination Committee commitments.

For further information please contact:

Investor enquiries:

Greg Feehely, SVP Investor Relations Investor.Relations@thg.com

Kate Grimoldby, Director of Investor

Relations and Strategic Projects

Media enquiries:

Powerscourt - Financial PR adviser Tel: +44 (0) 20 7250

1446

Victoria Palmer-Moore/Nick Dibden/Nick thg@powerscourt-group.com

Hayns

THG PLC

Viki Tahmasebi Viki.tahmasebi@thg.com

ENDS

Notes to editors

THG is a vertically integrated, digital-first consumer brands

group, retailing its own brands in beauty and nutrition, plus

third-party brands, via its complete digital commerce solution,

Ingenuity, to an online and global customer base. THG's business is

operated through the following divisions:

THG Beauty: The globally pre-eminent digital-first brand owner,

retailer, and manufacturer in the prestige beauty market, combining

its prestige portfolio of eight owned brands across skincare,

haircare, and cosmetics. It is a global route to market for over

1,300 third-party premium brands through its portfolio of websites,

including Lookfantastic, Dermstore, Cult Beauty and Mankind and the

beauty subscription box brand GLOSSYBOX.

THG Nutrition: A group of digital-first Nutrition brands, which

includes the world's largest online sports nutrition brand

Myprotein, and its family of brands (Myvegan, Myvitamins, MP

Activewear and MyPRO), with a vertically-integrated business model,

supported by global THG production facilities.

THG Ingenuity: Ingenuity provides a complete digital commerce

solution for consumer brand owners across its three pillars of

technology, digital and operations. Being part of the THG group, a

global digital brand owner in Beauty & Nutrition, Ingenuity is

uniquely placed to bring relevant, practical, and international

expertise in every area of commerce.

[1] Continuing Adjusted EBITDA excludes the discontinued

OnDemand and ProBikeKit businesses. During H1 2023, the variance

between reported Adjusted EBITDA and continuing Adjusted EBITDA is

expected to be c. GBP3m. This reflects good progress in exiting the

THG OnDemand business and the disposal of ProBikeKit.

[2] As dated 19.06.23 and available at Analyst Consensus - The

Hut Group (THG)

[3] Group free cash flow is calculated after working capital,

net capital expenditure, adjusting items, tax and financing (prior

to debt capital repayments and deferred consideration on

acquisitions).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTPPUGAQUPWPPU

(END) Dow Jones Newswires

June 21, 2023 02:00 ET (06:00 GMT)

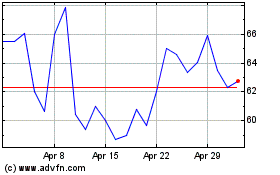

Thg (LSE:THG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Thg (LSE:THG)

Historical Stock Chart

From Apr 2023 to Apr 2024