TIDMWCW

RNS Number : 7593U

Walker Crips Group plc

27 November 2019

27 November 2019

Walker Crips Group plc

("Walker Crips", the "Company" or the "Group")

Results for the six months ended 30 September 2019

Walker Crips Group plc today announces its interim results for

the six months ended 30 September 2019

Walker Crips Group plc is a long-established business delivering

investment management, stockbroking and wealth management services

to UK retail and intermediary clients. We continue to embed

technology in our core services to enhance our customers'

experience, broaden our product offerings, empower our staff and

pursue business efficiencies.

HIGHLIGHTS

-- Group revenues increased by 3.3% to GBP15.6 million (2018: GBP15.1 million).

-- Profit before tax GBP620,000 (2018: GBP213,000).

-- Operating profit before exceptional item GBP408,000 (2018: GBP188,000).

-- Operating profit GBP617,000 inclusive of GBP209,000 exceptional (2018: GBP188,000).

-- Assets under Management and Administration GBP5.1 billion (31 March 2019: GBP5.0 billion).

-- Interim dividend increased to 0.60 pence per share (2018

interim dividend: 0.58 pence per share).

David Gelber, Chairman of Walker Crips Group plc, says:

"Against the ongoing uncertainty surrounding the terms for the

United Kingdom's exit from the EU, I report that nervousness of

markets has resulted in continued lower levels of volume driven

broking commission revenue during the period. However, we are

making progress implementing our strategy and the resulting

increase in investment management fee income, interest margin on

managed deposits and revenue from our trading book has driven an

encouraging increase in operating profit before exceptional item of

GBP408,000 (2018: GBP188,000).

"Revenues from the Investment Management division increased by

2.7% during the period to GBP14.51 million (2018: GBP14.13

million), with an increase of 7.4% in management fee revenues from

GBP9.4 million to GBP10.1 million, partly offsetting a decrease of

19.1% in commission income from GBP4.7 million to GBP3.8

million.

"Assets under Management and Administration remain marginally

above our targeted milestone of GBP5 billion.

"The improved results for the first half year are an important

step in the right direction as the business and newly shaped

leadership team looks to build on our core investment management,

wealth management and technology competencies."

For further information, please contact:

Walker Crips Group plc Tel: +44 (0)20 3100 8000

Khadeeja Paul, Media Relations

Four Communications Tel: +44 (0)20 3697 4200

Mark Knight

walkercrips@fourcommunications.com

Cantor Fitzgerald Europe Tel: +44 (0)20 7894 7000

Philip Davies/Will Goode

Further information on Walker Crips Group is available on the

Company's website: www.wcgplc.co.uk

Chairman's Statement

Introduction

Against the ongoing uncertainty surrounding the terms for the

United Kingdom's exit from the EU, I report that nervousness of

markets has resulted in continued lower levels of volume-driven

broking commission revenue during the period. However, we are

making progress implementing our strategy and the resulting

increases in investment management fee income, interest margin on

managed deposits and revenue from our trading book has driven an

encouraging increase in operating profit before exceptional item of

GBP408,000 (2018: GBP188,000). Profit before tax for the six months

is GBP620,000 (2018: GBP213,000), having benefitted from the

recovery of a longstanding disputed insurance claim of GBP209,000

referenced below (note 6).

Trading

Total revenue in the period increased by 3.3% to GBP15.58

million (2018: GBP15.07 million), reflecting the net impact of the

changing components of our income stream supported by higher

structured investment and investor immigration revenues.

Non-broking income as a proportion of total income is now 76%

(2018: 69%), reflecting the impact of declining trading volumes and

increasing recurring fees, arbitrage profits and interest margin.

Our arbitrage trading desk exploited several timing differences in

international markets to produce increased gains during the period

without any material increase in exposure.

Assets under Management and Administration at 30 September 2019

were GBP5.1 billion (31 March 2019: GBP5.0 billion).

Management continue to focus on managing the cost base, given

upward pressures on salaries and other operating expenses. It is

therefore disappointing to report that pre-exceptional item

administrative expenses of GBP10.49 million have increased by 5.5%

compared to GBP9.94 million in the prior period. Not all of this is

within our control, with notable drivers including a substantial

increase of GBP195,000 in our contribution to the Financial

Services Compensation Scheme and an GBP11,000 adverse operating

expense impact due to the adoption of IFRS 16 (together with a

further GBP81,000 included within finance costs) (see below and

note 1). The reported exceptional item mitigates these increases in

the period, but is viewed as non-recurring because it represents a

disputed insurance recovery of GBP209,000 relating to a historic

claim expensed in prior periods that was resolved in the period

following arbitration proceedings (note 6).

Dividend

The Board has approved an interim dividend of 0.60 pence per

share (2018: 0.58 pence per share) payable on 20 December 2019 to

those shareholders on the register at the close of business on 6

December 2019. The Board will continue to set the final dividend in

light of the Group's business performance, capital headroom, market

outlook and cash flow considerations.

Investment Management

Revenues from the Investment Management division increased by

2.7% during the period to GBP14.51 million (2018: GBP14.13

million), with an increase of 7.4% in management fee revenues from

GBP9.4 million to GBP10.1 million partly offsetting a decrease of

19.1% in commission income from GBP4.7 million to GBP3.8 million.

The fall in commission income principally reflects lower trading

volumes, but is also partly explained by clients switching from

commission-based to fixed fee tariffs.

Wealth Management

Our clients continue to require and request fee-based wealth

management advice. Our York Wealth Management division has seen

overall turnover increase by 11% to GBP755,000 (2018: GBP680,000).

The Wealth team are continuing with their strategy of securing

clients under an ongoing service proposition, which has seen

recurring revenues increase by 17% to GBP567,000 and Assets under

Management by 10% to just short of GBP197 million. Part of this

success was taking full ownership of the previous joint venture

with a local firm of Accountants, JWP Creers, securing over

GBP70,000 of recurring annual revenue and Assets under Management

of approximately GBP11 million. In line with our continued

investment in technology, we have implemented a new back office

system that will further streamline business processes and improve

client communication.

Our pension management team, following a full review of our SIPP

fee tariffs, now have a fully transparent and competitive product

supported by robust back office systems, leaving us ideally placed

to expand our client base. Our SSAS client book remains consistent

and we see growth in this market through our introducers and

potential acquisition of smaller competitors. Recurring revenue has

remained stable, increasing slightly to GBP300,000 compared to the

prior period.

Acquisition

As referred to above, the Group acquired full ownership of JWP

Creers Wealth Management Limited on 1 April 2019, which was

previously a joint venture. This completed on 1 April 2019 for cash

consideration of GBP47,000. JWP Creers Wealth Management Limited

has changed its name to Walker Crips Ventures Limited.

Technology

EnOC, our technology subsidiary, aims to close the technology

gap by engineering out complexities. During the period EnOC Pro

Platform (www.enoc.pro) was launched, which is a cloud service that

helps industry practitioners address the administration of the new

SM&CR regulatory regime. This service seeks to disrupt the

established regulation technology space by providing a

comprehensive and user-friendly solution on a low-cost subscription

basis. It is too early to report on the traction and support the

product will receive as financial services businesses look to

streamline and improve their compliance solutions.

IFRS 16 accounting treatment

The Group has adopted IFRS 16 "Leases" from 1 April 2019. The

first-time adoption of the accounting standard has had the impact

of increasing the Group's net assets by GBP601,000 and the reported

expenses for the period of GBP92,000. All long-term lease

commitments are now recognised as "right-of-use assets" and

corresponding liabilities as "lease liabilities" on the statement

of financial position. Note 1 provides a comprehensive explanation

of the impact of this new financial reporting standard.

Directors, Account Executives and Staff

I would like to thank all my fellow directors, investment

managers and advisers and members of staff for their continued

commitment to the highest levels of client service, support and

diligence during the period.

I am very pleased to confirm the appointment of Nick Hansen(*)

as CEO of Walker Crips Investment Management Limited ("WCIM"), our

main operating subsidiary. Nick built and has led our successful

Structured Products business since 2007. As he embarks on the

challenges ahead of growing the core business, his progress will be

enhanced by the simultaneous appointment of Chris Darbyshire(*) ,

as Chief Investment Officer. Chris brings his extensive industry

experience to a new era of leadership at the heart of the Group's

activities.

I am also very pleased to confirm the promotion of Sanath

Dandeniya to Group Finance Director. Sanath, Finance Director of

WCIM, steps into the place of Rodney Fitzgerald on the Parent

Board.

With these management appointments, we believe that we now have

in place a new generation of skilled senior management team, with

the energy and skills to manage and grow our business into the

future.

Outlook

Assets under Management and Administration remain marginally

above our targeted milestone of GBP5 billion and the growing

diversity of our service offerings has stood our revenue base in

good stead with a further increase during the period.

The improved results for the first half year are an important

step in the right direction as the business looks to build on its

in-house strengths and capabilities. With healthy liquid resources

and a new senior management team, we look forward with confidence

to continuing to implement strategic priorities.

David Gelber

Chairman

27 November 2019

Walker Crips Group plc

* Awaiting approval from the FCA

Walker Crips Group plc

Condensed Consolidated Income Statement

For the six months ended 30 September 2019

Unaudited Unaudited Audited

September September March

2019 2018 2019

Notes GBP'000 GBP'000 GBP'000

------------------------------------ ------ ----------------- ------------------ ---------

Revenue 2 15,581 15,072 30,458

Commission and fees paid (4,686) (4,955) (9,673)

Share of after tax profit from

joint venture - 9 14

------------------------------------- ------ ----------------- ------------------ ---------

Gross profit 10,895 10,126 20,799

Administrative expenses (10,487) (9,938) (20,365)

Exceptional items 6 209 - (32)

------------------------------------- ------ ----------------- ------------------ ---------

Operating profit 617 188 402

Investment revenue 94 27 90

Finance costs (91) (2) (3)

------------------------------------- ------ ----------------- ------------------ ---------

Profit before tax 620 213 489

Taxation (118) (41) (156)

------------------------------------- ------

Profit for the period attributable

to equity holders of the Parent

Company 502 172 333

------------------------------------- ------ ----------------- ------------------ ---------

Earnings per share 3

Basic 1.18p 0.41p 0.78p

Diluted 1.18p 0.41p 0.78p

------------------------------------- ------ ----------------- ------------------ ---------

Walker Crips Group plc

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 September 2019

Unaudited Unaudited Audited

September September March

2019 2018 2019

GBP'000 GBP'000 GBP'000

Profit for the period 502 172 333

--------------- --------------- -------------

Total comprehensive income for the

period attributable to equity holders

of the Parent Company 502 172 333

--------------- --------------- -------------

Walker Crips Group plc

Condensed Consolidated Statement of Financial Position

As at 30 September 2019

Unaudited Unaudited Audited

September September March

2019 2018 2019

Notes GBP'000 GBP'000 GBP'000

---------------------- ------------------- ----------------

Non-current assets

Goodwill 4,413 4,388 4,388

Other intangible assets 7,036 7,550 7,262

Property, plant and equipment 2,010 2,705 2,520

Right-of-use assets 1 5,048 - -

Interest in Joint Venture - 40 44

Investments - fair value through profit

or loss 7 51 52 51

------------------- ----------------

18,558 14,735 14,265

---------------------- ------------------- ----------------

Current assets

Trade and other receivables 23,823 30,362 35,785

Investments - fair value through profit

or loss 8 963 1,667 1,005

Cash and cash equivalents 7,552 5,016 6,916

------------------- ----------------

32,338 37,045 43,706

---------------------- ------------------- ----------------

Total assets 50,896 51,780 57,971

---------------------- ------------------- ----------------

Current liabilities

Trade and other payables (21,921) (27,910) (34,095)

Current tax liabilities (314) (78) (178)

Deferred tax liabilities (303) (237) (317)

Bank overdrafts (3) (115) (127)

Provisions (183) (461) (484)

Lease liabilities 1 (1,067) - -

---------------------- ------------------- ----------------

(23,791) (28,801) (35,201)

---------------------- ------------------- ----------------

Net current assets 8,547 8,244 8,505

---------------------- ------------------- ----------------

Non-current liabilities

Deferred cash consideration (47) (137) (47)

Lease liabilities 1 (3,833) - -

Dilapidation provision (542) (543) (542)

Landlord contribution to leasehold

improvements 1 - (492) (460)

---------------------- ------------------- ----------------

(4,422) (1,172) (1,049)

---------------------- ------------------- ----------------

Net assets 22,683 21,807 21,721

---------------------- ------------------- ----------------

Equity

Share capital 10 2,888 2,888 2,888

Share premium account 3,763 3,818 3,763

Own shares (312) (312) (312)

Retained earnings 11,621 10,745 10,659

Other reserves 4,723 4,668 4,723

Equity attributable to equity holders of the

Parent Company 22,683 21,807 21,721

---------------------- ------------------- ----------------

Walker Crips Group plc

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 September 2019

Unaudited Unaudited Audited

September September March

2019 2018 2019

Notes GBP'000 GBP'000 GBP'000

------------------------- ------------------------- ---------

Operating activities

Cash generated / (used) by operations 11 1,463 (2,251) (631)

Tax received - - 66

Net cash generated / (used) by operating

activities 1,463 (2,251) (565)

------------------------- ------------------------- ---------

Investing activities

Purchase of property, plant and equipment (193) (296) (382)

Sale of investments held for trading - 207 789

Sale of investments held at fair value 140 - -

through profit and loss

Consideration paid on acquisition of client

lists (53) (2) (111)

Consideration paid on acquisition of 21 - -

subsidiary net of cash acquired

Deferred consideration paid on acquisition

of subsidiary - (600) (600)

Dividends received 10 6 23

Interest received 73 21 67

Net cash used by investing activities (2) (664) (214)

------------------------- ------------------------- ---------

Financing activities

Dividends paid (141) (549) (796)

Interest paid (10) (2) (3)

Repayment of lease liabilities (469) - -

Repayment of lease interest (81) - -

Net cash used by financing activities (701) (551) (799)

------------------------- ------------------------- ---------

Net increase / (decrease) in cash and cash

equivalents 760 (3,466) (1,578)

Net cash and cash equivalents at beginning

of period 6,789 8,367 8,367

Net cash and cash equivalents at end of

period 7,549 4,901 6,789

========================= ========================= =========

Cash and cash equivalents 7,552 5,016 6,916

Bank overdrafts (3) (115) (127)

7,549 4,901 6,789

========================= ========================= =========

Walker Crips Group plc

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 September 2019

Own

Share Share premium shares Total

capital account held Capital redemption Other Retained earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Equity as at 31

March 2018 2,861 3,674 (312) 111 4,557 11,122 22,013

--------------------- --------------------- --------------------- --------------------- --------------------- --------------------- ---------------------

Total

comprehensive

income for the

period - - - - - 172 172

--------------------- --------------------- --------------------- --------------------- --------------------- --------------------- ---------------------

Contributions by

and distributions

to owners

Dividends paid - - - - - (549) (549)

Issue of shares

on acquisition

of intangibles

and as deferred

consideration 27 144 - - - - 171

--------------------- --------------------- --------------------- --------------------- --------------------- --------------------- ---------------------

Total

contributions by

and

distributions to

owners 27 144 - - - (549) (378)

--------------------- --------------------- --------------------- --------------------- --------------------- --------------------- ---------------------

Equity as at 30

September 2018 2,888 3,818 (312) 111 4,557 10,745 21,807

--------------------- --------------------- --------------------- --------------------- --------------------- --------------------- ---------------------

Total

comprehensive

income for the

period - - - - - 161 161

--------------------- --------------------- --------------------- --------------------- --------------------- --------------------- ---------------------

Contributions by

and distributions

to owners

Dividends paid - - - - - (247) (247)

Reclassification

of premium on

shares issued - (55) - - 55 - -

Total

contributions by

and

distributions to

owners - (55) - - 55 (247) (247)

--------------------- --------------------- --------------------- --------------------- --------------------- --------------------- ---------------------

Equity as at 31

March 2019 2,888 3,763 (312) 111 4,612 10,659 21,721

--------------------- --------------------- --------------------- --------------------- --------------------- --------------------- ---------------------

Total

comprehensive

income for the

period - - - - - 502 502

--------------------- --------------------- --------------------- --------------------- --------------------- --------------------- ---------------------

Contributions by

and distributions

to owners

Dividends paid - - - - - (141) (141)

Effect of

adoption of IFRS

16 (see note 1) - - - - - 601 601

Total

contributions by

and

distributions to

owners - - - - - 460 460

--------------------- --------------------- --------------------- --------------------- --------------------- --------------------- ---------------------

Equity as at 30

September 2019 2,888 3,763 (312) 111 4,612 11,621 22,683

--------------------- --------------------- --------------------- --------------------- --------------------- --------------------- ---------------------

Walker Crips Group plc

Notes to the condensed consolidated financial statements for the

six months ended 30 September 2019

1. Basis of preparation and significant accounting policies

Basis of preparation

The Group's consolidated financial statements are prepared in

accordance with International Financial Reporting Standards as

adopted by the EU (IFRS). These condensed financial statements are

presented in accordance with IAS 34 Interim Financial

Reporting.

The condensed consolidated financial statements have been

prepared on the basis of the accounting policies and methods of

computation set out in the Group's consolidated financial

statements for the year ended 31 March 2019 except for those that

relate to new standards and interpretations effective for the first

time for periods beginning on or after 1 April 2019.

The condensed consolidated financial statements should be read

in conjunction with the Group's audited financial statements for

the year ended 31 March 2019. The interim financial information is

unaudited and does not constitute statutory accounts as defined in

section 434 of the Companies Act 2006. The Group's financial

statements for the year ended 31 March 2019 have been reported on

by the auditors and delivered to the Registrar of Companies. The

report of the auditors was unqualified and did not draw attention

to any matters by way of emphasis. They also did not contain a

statement under section 498 (2) or (3) of the Companies Act 2006.

The interim financial information has neither been audited nor

reviewed pursuant to guidance issued by the Audit Procedures

Board.

Changes in reporting standards and interpretations

This is the first set of the Group's financial statements where

IFRS 16 "Leases" has been applied. This new standard was adopted on

1 April 2019. Under the transition method chosen, comparative

information is not restated. Changes to significant accounting

policies are described further below in this note.

IFRS 16 "Leases"

This note explains the impact of the adoption of IFRS 16 on the

Group's interim financial statements and discloses the new

accounting policy that has been applied from 1 April 2019.

IFRS 16 provides a single lessee accounting model by removing

the IAS 17 classification of leases as either operating or finance

leases. The standard introduces a single, on-balance sheet

accounting model, which requires:

-- recognition of a right-of-use asset and corresponding lease

liability with respect to all lease arrangements in which the Group

is the lessee, except for short term leases and leases of low value

assets.

-- recognition of a depreciation charge on the right-of-use

asset on a straight-line basis over the shorter of the expected

life of the asset and the lease term.

-- recognition of an interest charge arising from the unwinding

of the discounted lease liability over the lease term.

Transition method and practical expedients utilised

The Group has adopted IFRS 16 retrospectively from 1 April 2019

but has not restated comparatives for prior year ending 31 March

2019, as permitted under the specific transitional provisions in

the standard. The reclassifications and the adjustments arising

from the new leasing rules are therefore recognised in the opening

statement of financial position on 1 April 2019.

The Group elected to apply the practical expedient to not

reassess whether a contract is, or contains, a lease at the date of

initial application. Contracts entered into before the transition

date that were not identified as leases under IAS 17 and IFRIC 4

were not reassessed. The definition of a lease under IFRS 16 was

applied only to contracts entered into or changed on or after 1

April 2019.

IFRS 16 provides for certain optional practical expedients,

including those related to the initial adoption of the standard.

The Group applied the following practical expedients when applying

IFRS 16 to leases previously classified as operating leases under

IAS 17:

-- Apply a single discount rate to a portfolio of leases with

reasonably similar characteristics.

-- Exclude initial direct costs from the measurement of

right-of-use assets at the date of initial application for leases

where the right-of-use asset was determined as if IFRS 16 had been

applied since the commencement date.

-- Reliance on previous assessments on whether leases are

onerous as opposed to preparing an impairment review under IAS 36

as at the date of initial application.

-- Applied the exemption not to recognise right-of-use assets

and liabilities for leases with less than 12 months of lease term

remaining as of the date of initial application.

-- The use of hindsight in determining the lease term where the

contract contains options to extend or terminate the lease.

Adjustments recognised on adoption of IFRS 16

As a lessee, the Group previously classified leases as operating

or finance leases based on its assessment of whether the lease

transferred substantially all of the risks and rewards of

ownership. Under IFRS 16, the Group recognises right-of-use assets

and lease liabilities for most leases. However, the Group has

elected not to recognise right-of-use assets and lease liabilities

for some leases of low value assets based on the value of the

underlying asset when new or for short-term leases with a lease

term of 12 months or less.

On adoption of IFRS 16, the Group recognised right-of-use assets

and lease liabilities in relation to leases of property, software

and hire of equipment, which had previously been classified as

operating leases. The lease liabilities were measured at the

present value of the remaining lease payments, discounted using the

Group's incremental borrowing rate as at 1 April 2019. The Group's

incremental borrowing rate is the rate at which a similar borrowing

could be obtained from an independent creditor under comparable

terms and conditions. The incremental borrowing rates used by the

Group to measure lease liabilities at 1 April 2019 are listed in

the table below

Incremental Borrowing

Rate

Leased property 3.23%

----------------------

Hire of equipment 2.87%

----------------------

Software licenses 2.87%

----------------------

In the context of transition to IFRS 16, right-of-use assets of

GBP5,501,000 and lease liabilities of GBP5,370,000 were recognised

as at 1 April 2019. Of these lease liabilities, GBP1,061,000 was

due within one year and were captured within current liabilities in

the statement of financial position. In addition, the Group has

decided not to apply the new IFRS 16 guidance to leases whose lease

term will end within 12 months of the date of initial application.

In such cases, the leases are accounted for as short-term leases

and the lease payments associated with them are recognised as an

expense from short term leases.

The following table reconciles the minimum lease commitments

disclosed in the Group's 31 March 2019 annual financial statements

to the amount of lease liabilities recognised on 1 April 2019:

As at

1 April

2019

GBP'000

Operating lease commitments disclosed as at 31 March

2019 (see note 30 of the Annual Report and Accounts

2019) 7,214

Less: Service & Maintenance element included within

lease commitments (997)

---------

Adjusted operating lease commitments 6,217

=========

Discounted using the lessee's incremental borrowing

rate of at the date of initial application 5,237

Add: finance lease liabilities recognised as at 1

April 2019 142

Less: short-term leases recognised on a straight-line

basis as expense (9)

---------

Lease liability recognised as at 1 April 2019 5,370

=========

Of which were due:

Current lease liabilities 1,061

Non-current lease liabilities 4,309

---------

5,370

=========

The Group's leasing activities

The Group leases various offices, software and equipment that

were recognised as right-of use assets on the application of IFRS

16. Group's lease contracts are typically made for fixed periods of

2 to 10 years and extension and termination options are included in

a number of property and software leases across the Group. These

terms are used to maximise operational flexibility in terms of

managing contracts.

The extensions to leases are exercisable only by the Group and

not by the respective lessor. Lease terms are negotiated on an

individual basis and contain a wide range of different but

comparable terms and conditions. The lease agreements do not impose

any covenants, but leased assets may not be used as security for

borrowing purposes.

Prior to the implementation of IFRS 16, payments made under

operating leases (net of any incentives received from the lessor)

were charged to profit or loss on a straight-line basis over the

period of the lease. From 1 April 2019, leases are recognised as a

right-of-use asset and a corresponding liability at the date at

which the leased asset is available for use by the Group. Each

lease payment is allocated between the liability and finance cost.

The finance cost is charged to profit or loss over the lease period

so as to produce a constant periodic rate of interest on the

remaining balance of the liability for each period. The

right-of-use assets are depreciated over the shorter of the asset's

useful life and the lease term on a straight-line basis.

Assets and liabilities arising from a lease are initially

measured on a present value basis. Lease liabilities include the

net present value of the following lease payments:

-- fixed payments (including in-substance fixed payments), less

any lease incentives receivable;

-- variable lease payment that are based on an index or a rate;

-- amounts expected to be payable by the lessee under residual value guarantees;

-- the exercise price of a purchase option if the lessee is

reasonably certain to exercise that option; and

-- payments of penalties for terminating the lease, if the lease

term reflects the lessee exercising that option.

The Group, as permitted under IFRS 16 has used the incremental

borrowing rate, being the rate that the Group estimates that it

would have to pay to borrow funds necessary to obtain an asset of

similar value in a similar economic environment with similar terms

and conditions.

Right-of-use assets are measured at cost comprising the

following:

-- the amount of the initial measurement of lease liability;

-- any lease payments made at or before the commencement date

less any lease incentives received;

-- any initial direct costs; and

-- restoration costs.

Payments associated with short-term leases and leases of

low-value assets are recognised on a straight-line basis as an

expense in profit or loss. Short-term leases are leases with a

lease term of 12 months or less. Low-value assets comprise IT

equipment and small items of office furniture.

The Group does not have any leasing activities acting as a

lessor.

Impact on Financial Statements on adoption

Right-of use assets were initially measured at the amount equal

to the lease liability, adjusted by the amount of any prepaid or

accrued lease payments relating to that lease recognised in the

balance sheet as at 31 March 2019. There were no onerous lease

contracts that would have required an adjustment to the

right-of-use assets at the date of initial application.

The following illustrates the impact on the income statement on

the adoption of IFRS 16:

30 September 2019 Rents Finance costs Depreciation Other adjustments 30 September 2019

as reported under IAS 17

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------------------------- -------------------------- -------------------------- -------------------------- -------------------------

Revenue 15,581 - - - - 15,581

Commission and

fees paid (4,686) - - - - (4,686)

Share of after - - - - - -

tax profit from

joint venture

-------------------------- -------------------------- -------------------------- -------------------------- -------------------------- -------------------------

Gross profit 10,895 - - - - 10,895

Administrative

expenses (10,487) (420) - 423 * 8 ** (10,476)

Exceptional

items 209 - - - - 209

-------------------------- -------------------------- -------------------------- -------------------------- -------------------------- -------------------------

Operating

profit 617 (420) - 423 8 628

Investment

revenue 94 - - - - 94

Finance costs (91) - 81 - - (10)

-------------------------- -------------------------- -------------------------- -------------------------- -------------------------- -------------------------

Profit before

tax 620 (420) 81 423 8 712

Taxation (118) - - - - (118)

Profit for the

period

attributable

to equity

holders of the

Parent Company 502 (420) 81 423 8 594

-------------------------- -------------------------- -------------------------- -------------------------- -------------------------- -------------------------

* This depreciation is the net effect of the depreciation

charges relating to the new right-of-use assets and the existing

depreciation treatment of items adjusted for as a result of the

application of IFRS 16.

** This adjustment relates to the revised treatment of

irrecoverable VAT on certain rental invoices as a result of the

application of IFRS 16.

The recognised right-of-use assets relate to the following types

of assets:

30 September 2019 1 April 2019

GBP'000 GBP'000

Property 4,680 5,041

Equipment 85 95

Computer software 283 365

Total right-of-use assets 5,048 5,501

================== =============

The change in accounting policy affected the following items in

the statement of financial position on 1 April 2019:

-- Property, plant and equipment - decrease by GBP435,000

regarding the net book value of dilapidation provisions;

-- Right-of-use assets - increase by GBP5,501,000;

-- Prepayments - decrease by GBP239,000 regarding rental prepayments;

-- Accrued expenses - decrease by GBP621,000 regarding the rent-free period;

-- Current liabilities - decrease by GBP63,000 regarding the landlord contribution;

-- Non-current Lease liabilities - decrease by GBP460,000

regarding the landlord contribution;

-- Current liabilities - increase by GBP1,061,000 regarding

lease liabilities within one year;

-- Non-current Lease liabilities - increase by GBP4,309,000

regarding lease liabilities after one year.

The net impact on retained earnings on 1 April 2019 was an

increase of GBP601,000.

The table below presents the impact of adopting IFRS 16 on the

statement of financial position as at 1 April 2019:

As at 1 April 2019

GBP'000

Right-of-Use Assets on 1 April 2019 (based on lease liabilities) 5,370

Adjustments:

Derecognition of Landlord Contribution (523)

Reclassification of Property Plant and Equipment 435

Reclassification of prepaid expenses 219

-------------------

Total right-of-use Assets on 1 April 2019 after all adjustments 5,501

===================

As at 1 April 2019

GBP'000

Irrecoverable VAT reversal of prepayments (20)

Reduction in accrued expenses (derecognition of rent-free period) 621

Net increase in retained earnings 601

===================

Included in profit or loss for the period are GBP453,000 of

depreciation of right-of-use assets and GBP81,000 of finance

expenses on lease liabilities. Short-term lease costs of GBP9,000

were expensed in the period.

The lease liabilities outstanding as at 30 September 2019 were

as follows:

GBP'000

Current lease liabilities 1,067

Non-current lease liabilities 3,833

4,900

=====================

Judgements and estimates

IFRS 16 requires certain judgements and estimates to be made and

those significant judgements are explained below.

-- Following a review of all leases, the Group has opted to use

single discount rates for leases with reasonably similar

characteristics. The discount rates used, which are listed within

the above disclosure, have had an impact on the right of use assets

values, lease liabilities on initial recognition and lease finance

costs included within the income statement.

-- IFRS 16 defines a lease term as the non-cancellable period of

a lease, together with the options to extend or terminate a lease,

if the lessee is reasonably certain to exercise the lease options

available at the time of reporting. Where a lease includes the

option for the Group to extend the lease term, the Group has

exercised the judgement, based on current information, that such

leases will be extended to the full length available, and this is

included in the calculation of the value of the right of use assets

and lease liabilities on initial recognition and valuation at the

reporting date.

Significant accounting policies

Revenue recognition

Revenue is measured at a fair value of the consideration or

receivable and represents gross commissions, interest receivable

and fees in the course of ordinary investment business, net of

discounts, VAT and sales related taxes.

Revenues recognised under IFRS 15

Revenue from contracts with customers:

- Gross commissions on stockbroking activities are recognised on

those transactions whose trade date falls within the financial

year, with the execution of the trade being the performance

obligation at that point in time.

- In Walker Crips Investment Management, fees earned from

managing various types of client portfolios are accrued daily over

the period to which they relate with the performance obligation

fulfilled over the same period.

- Fees in respect of financial services activities of Walker

Crips Wealth Management are accrued evenly over the period to which

they relate with the performance obligation fulfilled over the same

period.

- Fees earned from structured investments are recognised on the

date the underlying security of the structured investment is traded

and settled, with the execution of the trade being the performance

obligation at that point in time.

Other incomes:

- Interest is recognised as it accrues in respect of the financial year.

- Dividend income is recognised when:

o the Group's right to receive payment of dividends is

established;

o when it is probable that economic benefits associated with the

dividend will flow to the Group; and

o the amount of the dividend can be reliably measured.

- Gains or losses arising on disposal of trading book

instruments and changes in fair value of securities held for

trading are both recognised in profit and loss.

The Group does not have any long-term contract assets in

relation to customers of any fixed and/or considerable lengths of

time which require the recognition of financing costs or incomes in

relation to them.

Going Concern

As both the net asset base and cash position remain healthy, the

directors are satisfied that the Group has sufficient resources to

continue in operation for the foreseeable future, a period of at

least 12 months from the date of this report. Accordingly, they

also conclude in accordance with guidance from the Financial

Reporting Council, that the use of the going concern basis for the

preparation of the financial statements continues to be

appropriate.

Interests in joint ventures

The Group's share of the assets, liabilities, income and

expenses of jointly controlled entities are accounted for in the

consolidated financial statements under the equity method.

Income from the sale or use of the Group's share of the output

of jointly controlled assets, and its share of the joint venture

expenses, are recognised when it is probable that the economic

benefits associated with the transactions will flow to/from the

Group and their amount can be measured accurately.

Exceptional items

To assist in understanding its underlying performance, the Group

identifies certain items of pre-tax income and expenditure and

discloses them separately in the consolidated income statement.

Such items would include:

1. profits or losses on disposal, closure or impairment of assets or businesses;

2. corporate transaction and restructuring costs;

3. changes in the fair value of contingent consideration; and

4. non-recurring items considered individually for

classification as exceptional by virtue of their nature or

size.

The separate disclosure of these items allows a clearer

understanding of the Group's trading performance on a consistent

and comparable basis, together with an understanding of the effect

of non-recurring or large individual transactions upon the overall

profitability of the Group.

Goodwill

Goodwill arising on consolidation represents the excess of the

cost of acquisition over the Group's interest in the fair value of

the identifiable assets and liabilities of a subsidiary or jointly

controlled entity at the date of acquisition. Goodwill is initially

recognised as an asset at cost and reviewed for impairment at least

annually. Any impairment is recognised immediately in the income

statement and is not subsequently reversed in future periods.

Operating expenses

Operating expenses and other charges are provided for in full up

to the statement of financial position date on an accruals

basis.

Intangible assets

At each period end date, the Group reviews the carrying amounts

of its intangible assets to determine whether there is any

indication that those assets have suffered an impairment loss. If

any such indication exists, the recoverable amount of the asset is

estimated in order to determine the extent of the impairment loss

(if any). Where the asset does not generate cash flows that are

independent from other assets, the Group estimates the recoverable

amount of the cash generating unit to which the asset belongs.

Financial instruments

Initial recognition and measurement

Financial assets and financial liabilities are recognised when

the Group becomes a party to the contractual provisions of the

instrument.

At initial recognition, the Group measures a financial asset or

financial liability at its fair value plus or minus transaction

costs. Transaction costs of financial assets and financial

liabilities carried at fair value through profit or loss ("FVPL")

are expensed in the statement of comprehensive income. Immediately

after initial recognition, an expected credit loss allowance

("ECL") is recognised for financial assets measured at amortised

cost, which results in an accounting loss being recognised in

profit or loss when an asset is newly originated.

The Group does not use hedge accounting.

a) Financial assets

Classification and subsequent measurement

The Group classifies its financial assets in the following

measurement categories:

- Fair value through profit or loss ("FVPL"); or

- Amortised cost.

Financial assets are classified as current or non-current

depending on the contractual timing for recovery of the asset.

i) Debt instruments

Classification and subsequent measurement of debt instruments

depend on:

- The Group's business model for managing the asset; and

- The cash flow characteristics of the asset.

Business model: The business model reflects how the Group

manages the assets in order to generate cash flows. That is,

whether the Group's objective is solely to collect the contractual

cash flows from the assets, to collect both the contractual cash

flows and cash flows arising from the sale of assets, or solely or

mainly to collect cash flows arising from the sale of assets.

Factors considered by the Group include past experience on how the

contractual cash flows for these assets were collected, how the

assets' performance is evaluated, and how risks are assessed and

managed.

Cash flow characteristics of the asset: Where the business model

is to hold assets to collect contractual cash flows, the Group

assesses whether the financial instruments' contractual cash flows

represent solely payments of principal and interest ("the SPPI

test"). In making this assessment, the Group considers whether the

contractual cash flows are consistent with a basic lending

instrument.

Based on these factors, the Group classifies its debt

instruments into one of two measurement categories:

1. Amortised cost: Assets that are held for collection of

contractual cash flows where those cash flows represent solely

payments of principal and interest ("SPPI"), and that are not

designated at FVPL, are measured at amortised cost. Amortised cost

is the amount at which the financial asset is measured at initial

recognition minus the principal repayments, plus or minus the

cumulative amortisation using the effective interest rate method of

any difference between that initial amount and the maturity amount,

adjusted by any ECL recognised. The effective interest rate is the

rate that exactly discounts estimated future cash payments or

receipts through the expected life of the financial asset to the

gross carrying amount. Interest income from these financial assets

is included within investment revenues using the effective interest

rate method.

2. FVPL: Assets that do not meet the criteria for amortised cost

or Fair value through other comprehensive income ("FVOCI") are

measured at fair value through profit or loss. Interest income is

included within investment revenues using the effective interest

rate method.

Reclassification

The Group reclassifies debt instruments when and only when its

business model for managing those assets changes. The

reclassification takes place from the start of the first reporting

period following the change.

Impairment

The Group assesses on a forward-looking basis the ECL associated

with its debt instruments held at amortised cost. The Group

recognises a loss allowance for such losses at each reporting date.

On initial recognition, the Group recognises a 12-month ECL. At the

reporting date, if there has been a significant increase in credit

risk, the loss allowance is revised to the lifetime expected credit

loss.

The measurement of ECL reflects:

- An unbiased and probability weighted amount that is determined

by evaluating a range of possible outcomes;

- The time value of money; and

- Reasonable and supportable information that is available

without undue cost or effort at the reporting date about past

events, current conditions and forecasts of future economic

conditions.

ii) Equity instruments

Investments are recognised and derecognised on a trade date

basis where a purchase or sale of an investment is under a contract

whose terms require delivery of the instrument within the timeframe

established by the market concerned, and are initially measured at

fair value.

The Group subsequently measures all equity investments at fair

value through profit and loss. Changes in the fair value of

financial assets at FVPL are recognised in revenue within the

consolidated income statement.

iii) Trade and other receivables

Trade and other receivables are recognised initially at fair

value and subsequently measured at amortised cost using the

effective interest method, less loss allowance.

For trade receivables, the Group applies the simplified approach

permitted by IFRS 9, which requires lifetime ECL to be recognised

from initial recognition of the receivables.

iv) Cash and cash equivalents

Cash and cash equivalents includes cash on hand, deposits held

at call with financial institutions, other short-term, highly

liquid investments with original maturities of three months or less

that are readily convertible to known amounts of cash and which are

subject to an insignificant risk of changes in value, and bank

overdrafts. Bank overdrafts are shown within current liabilities in

the statement of financial position.

Derecognition

Financial assets are derecognised when the rights to receive

cash flows from the financial assets have expired or have been

transferred and the Group has transferred substantially all the

risks and rewards of ownership.

b) Financial liabilities

Classification and subsequent measurement

Financial liabilities are classified and subsequently measured

at amortised cost.

Financial liabilities are derecognised when they are

extinguished.

Trade and other payables

Trade payables represent liabilities for goods and services

provided to the Group prior to the end of financial year which are

unpaid. The amounts are unsecured and are usually paid within 30

days of recognition. Trade and other payables are presented as

current liabilities unless payment is not due within 12 months

after the reporting period. They are recognised initially at their

fair value and subsequently measured at amortised cost using the

effective interest method.

Deferred tax

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amounts of assets and liabilities

in the financial statements and the corresponding tax bases used in

the computation of taxable profits, and is accounted for using the

balance sheet liability method. Deferred tax liabilities are

generally recognised for all taxable temporary differences and

deferred tax assets are recognised to the extent that is probable

that taxable profits will be available against which deductible

temporary differences can be utilised.

Principal risks and uncertainties

Under the Financial Conduct Authority's Disclosure and

Transparency Rules, the Directors are required to identify those

material risks to which the company is exposed and take appropriate

steps to mitigate those risks. The principal risks and

uncertainties faced by the Group are discussed in detail in the

Annual Report for the year ended 31 March 2019.

Related party transactions

No transactions took place in the period that would materially

or significantly affect the financial position or performance of

the Group.

2. Segmental analysis

Investment

management Wealth management Total

Revenue GBP'000 GBP'000 GBP'000

6m to 30

September

2019 14,515 1,066 15,581

---------------------------------- -------------------------- ------------------------------ ---------------

6m to 30

September

2018 * 14,135 937 15,072

---------------------------------- -------------------------- ------------------------------ ---------------

Year to 31

March 2019 27,857 2,601 30,458

---------------------------------- -------------------------- ------------------------------ ---------------

Operating Unallocated Operating

profit Costs Profit

GBP'000 GBP'000 GBP'000 GBP'000

6m to 30

September

2019 1,161 56 (600) 617

---------------------------------- -------------------------- ------------------------------ ---------------

6m to 30

September

2018 * 832 14 (658) 188

---------------------------------- -------------------------- ------------------------------ ---------------

Year to 31

March 2019 1,013 348 (959) 402

---------------------------------- -------------------------- ------------------------------ ---------------

* During the year, a business segment was transferred from

Wealth Management to Investment Management and prior year

comparatives (income of GBP281,000 and operating profits of

GBP89,000) have been adjusted to improve comparability.

Timing of revenue recognition

The following table presents operating income analysed by the

timing of revenue recognition of the operating segment providing

the service:

Investment Management Wealth Management Total

6m to 30

September

2019 GBP'000 GBP'000 GBP'000

Revenue from

contracts

with

customers

Products and

services

transferred

at a point in

time 4,595 193 4,788

Products and

services

transferred

over time 8,314 873 9,187

Other revenue

Products and

services

transferred

at a point in

time 362 - 362

Products and

services

transferred

over time 1,244 - 1,244

14,515 1,066 15,581

------------------------------ -------------------------------- -----------------------------

6m to 30

September

2018 (*)

Revenue from

contracts

with

customers

Products and

services

transferred

at a point in

time 5,270 152 5,422

Products and

services

transferred

over time 7,433 785 8,218

Other revenue

Products and

services

transferred

at a point in

time 188 - 188

Products and

services

transferred

over time 1,244 - 1,244

13,135 937 15,072

------------------------------ -------------------------------- -----------------------------

Year to 31

March 2019

Revenue from

contracts

with

customers

Products and

services

transferred

at a point in

time 10,360 459 10,819

Products and

services

transferred

over time 15,477 2,082 17,559

Other revenue

Products and

services

transferred

at a point in

time 234 60 294

Products and

services

transferred

over time 1,786 - 1,786

27,857 2,601 30,458

------------------------------ -------------------------------- -----------------------------

* During the year, a business segment was transferred from

Wealth Management to Investment Management and prior year

comparatives (income of GBP281,000 and operating profits of

GBP89,000) have been adjusted to improve comparability.

Contract assets Contract liabilities

March

September 2019 September 2018 March 2019 September 2019 September 2018 2019

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Brought

forward 4,623 4,005 4,346 (4) (3) (15)

Amounts

included in

contract

liabilities

that was

recognised

as revenue

during the

period - - - 4 3 15

Settlement

of contract

assets

brought

forward (4,623) (4,005) (4,346) - - -

Cash

received in

advance of

performance

and not

recognised

as revenue

during the

period - - - (3) (15) (4)

Amounts

included in

contract

assets that

was

recognised

as revenue

during the

period 4,679 4,346 4,623 - - -

At 30

September 4,679 4,346 4,623 (3) (15) (4)

------------------------ ------------------------ ------------------------ ------------------------- ------------------------- ------------------------

3. Earnings per share

The calculation of basic earnings per share for continuing

operations is based on the post-tax profit for the period of

GBP502,000 (2018: GBP172,000) and on 42,577,328 (2018: 42,443,034)

ordinary shares of 6 2/3p, being the weighted average number of

ordinary shares in issue during the period. There is no dilution

applicable to the current period.

4. Dividends

The interim dividend of 0.60 pence per share (2018: 0.58 pence

per share) is payable on 20 December 2019 to shareholders on the

register at the close of business on 6 December 2019. The interim

dividend has not been included as a liability in this interim

report.

5. Total revenue

Six months ended Six months ended Year ended

30 September 2019 30 September 31 March 2019

2018

GBP'000 GBP'000 GBP'000

Revenue from Contracts with Customers 13,975 13,640 28,378

Other revenue 1,606 1,432 2,080

Investment revenues 94 27 90

15,675 15,099 30,548

-------------------- ------------------ ----------------

The Group's income can also be categorised as follows for the

purpose of measuring a Key Performance Indicator; the ratio of

non-broking income to total income.

Six months ended % Six months % Year %

30 September 2019 ended ended

30 September 31 March

2018 2019

Income GBP'000 GBP'000 GBP'000

Broking 3,780 24 4,653 31 8,667 28

Non-Broking 11,895 76 10,446 69 21,881 72

15,675 100 15,099 100 30,548 100

------------------- -------- -------------- -------- ------------ --------

6. Exceptional items

As a result of their materiality, the Directors in prior periods

decided to disclose certain amounts separately in order to present

results which were not distorted by significant non-recurring

events.

Six months Six months Year ended

ended ended 30 September 31 March

30 September 2018 2019

2019

GBP'000 GBP'000 GBP'000

Changes in the value of

deferred

consideration - - (102)

Transaction cost in

relation

to a launch of a public

issuance - - 134

Insurance recovery of (209) - -

historical

claim against the Group

(209) - 32

-------------------------------- ----------------------------------- --------------

During the period to 30 September 2019, the Group received

GBP209,000 in respect of a disputed insurance recovery. This

related to an historic claim expensed in prior periods that was

resolved in the current period, following arbitration

proceedings.

During the year to 31 March 2019, cash consideration payable for

acquired client relationships over a number of years is estimated

at the outset based on the expected number of clients and

associated revenue which will be acquired. Each year these amounts

are re-assessed based on the actual values of these metrics and

accordingly, an exceptional credit, being one-off and exceptional

in nature and size, was recorded in the year representing the

reversal of an over-estimation of GBP102,000 of such

consideration.

As part of the expansion of its short-term lending facility

business, the Group has invested in a planned launch of a listed

bond available to retail investors. This launch has currently been

delayed due to political uncertainty which is impacting investor

sentiment and therefore provisions totalling GBP134,000 have been

made for related costs in the year to 31 March 2019.

7. Non-current investments - fair value through profit or

loss

Investments at

fair value through

profit or loss Total

GBP'000 GBP'000

At 30 September 2018 52 52

--------------------------------- ---------------------------- ----------------------------

Disposals in the period (1) (1)

At 31 March 2019 51 51

--------------------------------- ---------------------------- ----------------------------

Disposals in the period - -

At 30 September 2019 51 51

--------------------------------- ---------------------------- ----------------------------

Investments at fair value through profit or loss

The Group's unregulated collective investment scheme (UCIS)

investments are held in relation to a number of customer

complaints. The fair value is based upon the market price as at 30

September 2019.

The Group's life policy investments are held in relation to a

number of customer complaints. The fair value is based upon the

life company's forecast terminal value.

8. Current investments

As at As at As at

30 September 30 September 31 March

2019 2018 2019

GBP'000 GBP'000 GBP'000

Trading investments

Investments - fair value through

profit or loss 963 1,667 1,005

------------------ ------------------ ------------------------

Trading investments represent investments in equity securities

and collectives that present the Group with opportunity for return

through dividend income, interest and trading gains. The fair

values of these securities are based on quoted market prices.

9. Fair values

The following provides an analysis of financial instruments that

are measured subsequent to initial recognition at fair value,

grouped into Levels 1 to 3 based on the degree to which the fair

value is observable:

- Level 1 fair value measurements are those derived from quoted

prices (unadjusted) in active markets for identical assets or

liabilities. The trading investments fall within this category;

- Level 2 fair value measurements are those derived from inputs

other than quoted prices included within Level 1 that are

observable for the asset or liability, either directly (i.e. as

prices) or indirectly (i.e. derived from prices). The Group does

not hold financial instruments in this category; and

- Level 3 fair value measurements are those derived from

valuation techniques that include inputs for the asset or liability

that are not based on observable market data (unobservable inputs).

The Group's Investments held in non-current assets fall within this

category.

Further IFRS 13 disclosures have not been presented here as the

balance represents 1.892% (2018: 0.582%) of total assets.

The following tables analyse within the fair value hierarchy the

Group's Investments measured at fair value.

Level 1 Level 3 Total

GBP'000 GBP'000 GBP'000

At 30 September 2019

Financial assets held at fair value through profit and loss 963 51 1,014

963 51 1,014

-------------- ----------- ------------

At 30 September 2018

Financial assets held at fair value through profit and loss 1,667 52 1,719

1,667 52 1,719

-------------- ----------- ------------

At 31 March 2019

Financial assets held at fair value through profit and loss 1,005 51 1,056

1,005 51 1,056

-------------- ----------- ------------

There have been no transfers of financial instruments between

levels during the period.

The fair value of UCIS and Life Policy investments have fair

values determined by reference to prices supplied from the

administrator and provider respectively.

In all cases, the unrealised gains or losses in the investments

are recognised within revenue on the income statement.

10. Issue of share capital

During the period to 30 September 2019, no new shares were

issued. During the six-month period ending 30 September 2018,

409,598 new Ordinary Shares were issued and allotted to the sellers

of Barker Poland Asset Management LLP (BPAM) in order to satisfy

the Group's obligation in connection with the payment of year three

deferred consideration. The BPAM business had met the targets

required to trigger a payment by the Group of the full amount of

the third and final payment. During the six-month period ending 31

March 2019, no new shares were issued.

11. Cash generated from operations

Unaudited Unaudited Audited

September September March 2019

2019 2018

GBP'000 GBP'000 GBP'000

Operating profit

for the period 617 188 402

Adjustments

for:

Amortisation of

intangibles 279 274 558

Changes in the

fair value

of deferred

consideration - - (102)

Loss on sale of

tangible fixed

asset - 2 4

Net change in

fair value of

financial

instruments at

fair value

through

profit or loss (71) (22) 91

Share of joint

venture income - (9) (14)

Depreciation of

property,

plant and

equipment 267 301 593

Depreciation 453 - -

of right of

use

assets

Decrease in

debtors 11,736 7,152 1,642

Decrease in

creditors (11,777) (10,137) (3,805)

Change in

working

capital

as a result of

net of effects

of acquiring a

subsidiary

and disposal

of joint

venture:

Derecognition (44) - -

of joint

venture

asset now

fully acquired

Trade and (6) - -

other payables

Trade and 9 - -

other

receivables

Net cash inflow

/ (outflow)

from operations 1,463 (2,251) (631)

=================================== =================================== ==========================

12. Contingent liability

During a prior year, two Group companies, Walker Crips Group plc

("WCG") and Walker Crips Investment Management Limited ("WCIM")

received draft proceedings in respect of a potential claim, from a

former listed corporate client of Keith Bayley Rogers & Co

("KBR") a former subsidiary of the Group. The Directors have heard

nothing further from the former KBR client since then and as there

is no date of expiry for the claim it will remain a contingent

liability.

Directors' Responsibility Statement

The Directors confirm that to the best of their knowledge:

(a) The condensed set of financial statements contained within

the half yearly financial report has been prepared in accordance

with IAS 34 'Interim Financial Reporting' as adopted by the EU;

(b) The half yearly report from the Chairman (constituting the

interim management report) includes a fair review of the

information required by DTR 4.2.7R; and

(c) The half yearly report from the Chairman includes a fair

review of the information required by DTR 4.2.8R as far as

applicable.

On Behalf of the Board

Sean Lam

Chief Executive Officer

27 November 2019

Walker Crips Group plc

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLFVDLSLRFIA

(END) Dow Jones Newswires

November 27, 2019 02:00 ET (07:00 GMT)

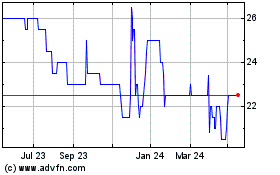

Walker Crips (LSE:WCW)

Historical Stock Chart

From Jan 2025 to Feb 2025

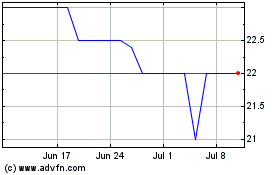

Walker Crips (LSE:WCW)

Historical Stock Chart

From Feb 2024 to Feb 2025