TIDMWCW

RNS Number : 8219U

Walker Crips Group plc

31 July 2020

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain

31 July 2020

News Release

Walker Crips Group plc

("Walker Crips", the "Company" or the "Group")

Final results for the year ended 31 March 2020

Walker Crips Group plc, the investment management and wealth

management services, pensions administration and regulation

technology Group, announces audited results for the year ended 31

March 2020.

Highlights

The Group reports improved year-on-year income and profits.

-- Annual revenues up 3% to GBP31.4 million (2019: GBP30.5 million).

-- Operating profits up 172.5% to GBP1.09 million (2019: GBP0.40

million) and up 65% to GBP0.717 million (2019: GBP0.434 million)

excluding exceptional items.

-- Profit before tax up 97% to GBP963,000 (2019: GBP489,000) and

up 13% to GBP588,000 (2019: GBP521,000) excluding exceptional

items.

-- IAS 17 consistent EBITDA up 21% to GBP1.93 million (2019: GBP1.59 million)*.

-- Underlying cash generated from operations increased by 18.6%

to GBP1.85 million (2019: GBP1.56 million)*.

-- Cash and cash equivalents increased by GBP1.8 million to GBP8.6 million.

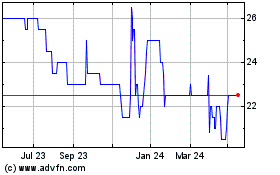

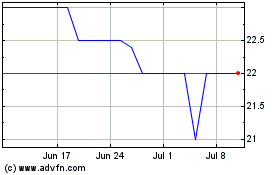

-- Assets Under Management, with the COVID-19 impact on global

markets, particularly affecting the final month of the year,

declined by 15% to GBP2.8 billion (2019: GBP3.3 billion).

-- Non-broking income as a percentage of total income increased to 74.3% (2019: 71.6%).

-- The pandemic headwinds of lower market levels and lower

interest rates are now negatively impacting income and the

underlying mix.

-- No final dividend proposed (2019: 0.33 pence) in view of the pandemic headwinds.

-- Liquid resources remain strong and we look forward with

confidence to continuing to implement strategic priorities

including ongoing focus on cost control.

* Fully explained in the Chairman's statement

For further information, please contact:

Four Broadgate

Roland Cross/Anthony Cornwell Tel: +44 (0)20 3697 4200

Cantor Fitzgerald Europe Tel: +44 (0) 20 7894 7625

Will Goode / Philip Davies

Chairman's statement

Confident in our continued success

An increase in year-on-year profits for the Group has been

overshadowed by the tragic and profound impact of the coronavirus

pandemic just before the year end, forcing the precautionary

suspension of the final dividend. Nevertheless, the Group's

emphasis on technology facilitated a rapid and effective response

to the practical challenges posed by the lockdown.

Overview of 2019/2020

Against a backdrop of largely buoyant market conditions, most of

the Group's businesses performed well until the very last month of

last year, and I am pleased to report an increase in full year

profit before tax of GBP474,000, or 97% on the prior year. However,

the sudden onset of the pandemic and the terrible effects it has

wrought on the economy and capital markets has marred what was a

reasonably good year for the Group. With Management's focus now

firmly on the future, the Group is repositioning itself for the

changes and challenges ahead.

Operating profit for the year of GBP1.092 million (2019:

GBP402,000) and profit before tax for the year of GBP963,000 (2019:

GBP489,000) both benefited from the recovery of a longstanding

disputed insurance claim of GBP209,000 and from the reassessment of

deferred cash consideration due on acquired client relations of

GBP166,000, both of which have been reported as exceptional items.

Adjusting for exceptional items, earnings growth remains strong,

with operating profit increasing by 65% to GBP717,000 (2019:

GBP434,000) and profit before tax increasing by 13% to GBP588,000

(2019: GBP521,000). The reconciliation of these IFRS and

alternative performance measures ('APMs') can be found in CEO's

statement below.

The reported results this year are also impacted by the adoption

of IFRS 16 'Leases' with effect from 1 April 2019 and because the

modified retrospective approach is used they are not comparable to

those reported in the prior year under the previous accounting

standard IAS 17. To provide a meaningful comparison we have

presented an EBITDA based APM, which reports operating profits

before exceptional items adjusted for depreciation, amortisation

and lease charges for both 2019 and 2020 on an IAS 17 consistent

basis.

On this basis the Group's EBITDA for the year increased 21% to

GBP1.93m (2019: GBP1.59m). The reconciliations of EBITDA to

operating profit before exceptional items for 2020 and 2019 are

presented in CEO's statement below. In the year to 31 March 2022

EBITDA figures will be presented on an IFRS 16 consistent

basis.

The encouraging momentum that I reported in the first half of

the year continued in the second half. Although we experienced a

decline in broking commission for the year of GBP572,000, these

revenue losses were more than offset by an increase of GBP1.35

million in management fees, as clients continue to switch from

commission-based to fixed fee tariffs.

Total non-broking income, which benefited from the full-year

impact of the rollout of new tariffs on management fees, the impact

of higher interest rates on managed client deposits, a continued

strong performance in our arbitrage trading book, notwithstanding a

mark to market loss on year-end positions reflecting market

declines in March 2020, improved Walker Crips Structured

Investments ("WCSI") results offset by lower revenues from short

term lending and net investment revenue, comprised 74.3% of Group

revenues versus 71.6% in the previous year. It should be noted,

however, that the full year's benefit of increased interest margins

on managed deposits arising from previous base rate rises will be

more than reversed by the two reductions to base rates in March

this year, taking them to historic lows as part of the Bank of

England's extraordinary response to the pandemic.

Total Assets Under Management and Administration ("AUMA")

averaged GBP5.0 billion during the year, compared with GBP5.1

billion for the previous year, helped by positive market

performance and strong growth from the private client teams, offset

by the loss of a team of associates (with approximately GBP240

million in assets) at the start of the year.

AUMA were impacted by the collapse in equity markets in March

and ended the year down 14% at GBP4.3 billion, but have since

recovered along with markets to GBP4.8 billion by 30 June 2020.

Discretionary and Advisory Assets Under Management were similarly

impacted by the global market decline, ending the year at GBP2.8

billion (31 March 2019: GBP3.3 billion).

Commission paid to self-employed associates increased by 1.0%

during the year, significantly lower than the 3% growth in

revenues, reflecting the changing mix of revenues towards other

non-sharing parts of the business and resulting in an improvement

in the gross margin to GBP21.6 million (31 March 2019: GBP20.8

million). Administrative expenses rose by GBP0.6 million (2.7%)

during the year, significantly lower than the 3% growth in revenues

and resulting in an improvement in operating profit margin

excluding exceptional items to 2.3% (31 March 2019: 1.4%).

Management focus on the cost base is paying off, with the growth in

administrative expenses largely accounted for by an increase in

regulatory fees and levies of GBP0.3 million, effectively doubling

from the previous year. Following the onset of the pandemic,

Management implemented an immediate cost-reduction initiative,

including the acceptance of a temporary pay cut by all Group and

subsidiary Directors. Further actions are being discussed and

readied, subject to developments in market conditions.

At a divisional level, Investment Management saw an 7.5%

increase in fees and other revenues to GBP21.5 million (2019: GBP20

million), offset by the fall in commission income noted above such

that overall revenues of the division increased by 2.4% year on

year to GBP29.6 million (2019: GBP2.9 million). There were notably

strong performances by the London and York-based private client

teams. The impact of the pandemic on markets, and indirectly on

fees, has translated into current fee income falling broadly in

line with industry benchmarks and Management's expectations.

Encouragingly, commissions have, so far, been more resilient than

originally budgeted. Management is not budgeting for a rise in base

rates in the foreseeable future and the recent cuts in base rates

is projected to result in a decline in annual revenues of GBP1.5

million compared to the year ended 31 March 2020.

The York-based Wealth Management division has seen an overall

revenue increase of GBP0.09 million on the previous year. During

the year, two teams within the York division transferred to the

Investment Management division to gain better operational

efficiencies. The Wealth Management team took full ownership of the

previous joint venture with a local firm of Accountants, JWP

Creers, securing over GBP70,000 of recurring annual revenue and

Assets Under Management of approximately GBP11 million on 1 April

2019 for a cash consideration of GBP47,000. JWP Creers Wealth

Management Limited has changed its name to Walker Crips Ventures

Limited and the trade and operations of the company were integrated

into Walker Crips Wealth Management Limited.

The Structured Investments team ("WCSI") delivered improved

revenue in the second half to the year, following sluggish volumes

in the first half. Market conditions towards the end of the year

were favourable, with rising volatility prompting an improvement in

the product terms available to clients. For the year as a whole,

revenues, despite some mark to market losses reported at year end

(majority of which have since been recovered) were up 27.6% to

GBP1.85 million (2019: GBP1.45 million). WCSI added structured

deposits to its product line-up, though market conditions

constrained the issuance in the short-term and this was not

launched in the year. WCSI has continued to build its relationships

with leading credit institutions, adding new issuers during the

year and further diversifying potential credit risk.

The Group's balance sheet remains stable, with reported net

assets of GBP22,644,000, up GBP923,000 from the prior year,

including a GBP601,000 increase due to the adoption of IFRS 16 on 1

April 2019 (see note 35), profit for the year and the payment of

dividends of GBP396,000.

The Group's cash generated by operations during the year was

GBP3.5 million compared to an operating cash out-flow of GBP0.6

million in the prior year. Adjusting for exceptional items, the

anomalies in the timing of working capital payments around

reporting dates and the 2020 lease liability and interest payments

that are now reported as financing activities following the

adoption of IFRS 16 'Leases' (see above), underlying operating cash

generated improved by 18.6% to GBP1.85 million (2019: GBP1.56

million). Reconciliations of the underlying cash generated APMs to

operating cash per the cashflow statement are presented below in

CEO's statement. After cash deployed in investing activities and

dividends paid in the year, cash and cash equivalents increased a

healthy GBP1.820 million to GBP8.609 million at year end.

We have navigated the COVID-19 reality by implementing the

Group's business continuity plan, to protect the Group's

operations, its clients, its shareholders and its staff. The Board

of Directors has invested in technology and infrastructure to

enable the vast majority of staff to work from home to abide by

government guidelines. Operations have been smooth and unaffected

by the disruptions thanks to the Group's state-of-the-art

systems.

Without doubt, the COVID-19 pandemic caused significant

disruption to the financial services industry and the true

financial impact on the UK and Global economy and, in particular,

on the Group is as yet an unknown. However, it is encouraging to

see the regulated financial services sector has so far demonstrated

good governance, control, and risk management and mitigation

procedures to limit the overall impact. It is also encouraging to

see majority of our clients view this short term disruption as an

opportunity.

As part of the post-COVID-19 recovery, the Group plans to

implement future cash generating strategies such as further

expansion of the Group's Software as a Service offering and an

Investment Manager recruitment drive. These strategies are now more

important than ever, and the Board sees revenue-generating

expansion as the best path to recovery and the Group's future

growth beyond these exceptional times.

As the UK emerges from the lockdown, we look forward into

settling to the new normality in an improving post-COVID-19 economy

and environment, with more streamlined business processes, to give

the Group the best chance possible of a quick bounce back.

The continuing negative impact of the pandemic post year end,

both in the form of market declines and reduced interest margins on

managed deposits noted above, has prompted a renewed management

focus on forecasting cash flows. The results of these forecasts

have been integrated into the Group's renewed corporate strategy,

its dividend policy and cost management initiatives. The balance

sheet, cash generation and liquidity enables us to weather these

market impacts and continue to invest in our strategic initiatives,

as further evidenced by the stress testing performed in support of

our viability statement and going concern assessment. However, in

view of the present uncertainty and as explained further below, the

Board considers it prudent to cease the payment of dividends at

this time.

Strategy

I am pleased that the Group has been able to adjust so well to

the rapid changes in working practices occurring as a result of the

pandemic and, in the light of the pandemic, the Group's focus on

technology has been more than justified. However, it is still

incumbent on Management to take the Group's technology services to

the next level, and this is an even greater focus in the Group's

strategy.

EnOC, our technology subsidiary, was incorporated in 2018 to

deliver our "Software as a Service" (SaaS) business. EnOC aims to

close the technology gap by engineering out complexities. During

the year, EnOC Pro Platform (www.enoc.pro) was launched; a cloud

service that helps industry practitioners address the

administration of the new SM&CR regulatory regime. This service

seeks to disrupt the established regulation technology space by

providing a comprehensive and user-friendly solution on a low-cost

subscription basis. The SaaS business is now reported as a separate

business segment, though it is too early to report on the traction

and support the product will receive, as financial services

businesses look to streamline and improve their compliance

solutions.

Walker Crips Investment Management (WCIM) has renewed its

corporate strategy with an emphasis on growing the core investment

management business by organic growth and attracting new advisors,

which is entirely realistic and appropriate for the times. I note

that the strategy also makes the most of the talents of its new

management team (which I discuss below).

In line with the strategy of continued investment in technology,

a new back office system was implemented during the year for Walker

Crips Wealth Management that will streamline business processes and

improve client communication. The pension management team,

following a full review of SIPP fee tariffs, now has a fully

transparent and competitive product supported by robust back office

systems, leaving us ideally placed to expand our client base. The

SSAS client book remains consistent and we expect growth in this

market through our introducers and potential acquisition of smaller

competitors.

Walker Crips Structured Investments recruited senior staff from

major competitors, and built new relationships with

product-providers in preparation for increased activity. These

plans were delayed temporarily by the very extreme market

conditions for structured products, both in terms of price levels

and increased volatility, which impacted on the ability of

providers to create products. However, we expect WCSI to resume a

growth path if calmer market conditions continue to prevail.

Dividend

During the year, the Board approved an interim dividend of 0.60

pence per share (2019: 0.58 pence per share) payable on 20 December

2019 to those shareholders on the register at the close of business

on 6 December 2019.

With the sudden onset of the coronavirus pandemic, this year we

witnessed a once-in-a-century event and its terrifying personal and

economic consequences. While the effect on capital markets has

somewhat lessened of late, the impact of the reduction in base

rates creates increased uncertainties for the Group as it lies

beyond Management's control. Under these conditions, with the

likelihood of the Group reporting losses in the short-term,

Management has decided to take a conservative approach to expenses

and cash flows for the foreseeable future. This is absolutely a

time for shoring up the Group's finances and for resizing costs and

dividend distributions to the expected decline in revenues and

profitability. I am pleased to be able to say that, leading by

example, the Board and subsidiary Directors have all accepted

voluntary reductions in pay on a temporary basis. My deepest

sympathies go out to those staff who have lost relatives, friends

and loved ones. Given the extraordinary impact of the pandemic, the

Board has concluded that it would be inappropriate to recommend a

full-year dividend. The Board will review the Group's dividend

policy when there is greater clarity about the future impact of the

pandemic.

Our people, culture and governance

By setting the right example at the top, the Board has

prioritised good culture and conduct across all who represent the

Group. We continue to encourage professionalism and the right

behaviours in all we do. The end result is a unified emphasis on

achieving the right outcomes for clients. The new Senior Managers

& Certification Regime ("SM&CR") came into force on 9

December 2019. We have embraced and adopted it as part of our

culture of accountability rather than treating it as another

regulatory burden. Indeed, we have already built our own SM&CR

system within our new company, EnOC Technologies Limited, and have

expanded it to include not just the regulatory requirements, but

also our internal policies, governance and controls. Corporate

governance and stewardship as reported against the UK Corporate

Governance regime provides assurance to external parties who rely

on sound management of the business and its risks.

I would like to thank all my fellow Directors, investment

managers and advisers and members of staff for their continued

commitment to the highest levels of client service, support and

diligence during the period. Sanath Dandeniya's promotion to Group

Finance Director has introduced fresh impetus and innovation in our

finance function and operations. The appointments of Nick Hansen*,

as CEO of Walker Crips Investment Management, and Chris Darbyshire,

as Chief Investment Officer have reinvigorated our main operating

subsidiary's senior Management and service offerings. I would like

to take this opportunity to thank Rodney Fitzgerald again for his

outstanding and selfless contribution to the Group, both as Group

Finance Director (1999-2019) and Group CEO (2007-2017), and to wish

him well in his retirement.

This will be my final Annual Report since, as announced at last

year's Annual General Meeting, I will be stepping down as Chairman

at the forthcoming AGM, having served your company in this role for

the past 13 years. I have, however, agreed to the Board's request

to continue as a Non-Executive Director for up to 12 months, and

Martin Wright will take on the role of Chairman. I would like to

pay tribute now to all our loyal employees and Directors for the

support they have given me during some very difficult times such as

the 2008 financial crisis and the current COVID-19 pandemic. Walker

Crips has been in existence for well over 100 years and I am

confident we will see the present crisis through and continue in

our prime goal of offering excellent service to all our

clients.

Outlook

I cannot remember a more difficult time for the Group or,

indeed, the investment Management industry. The improved results

for the year were an important indicator that the Group was heading

in the right direction before the pandemic hit, and I am pleased

that Management has risen to the current challenge, and is already

taking the difficult decisions that will support the Group's

continued progress, its staff and clients.

Liquid resources remain strong despite the impact of the

pandemic and we look forward with confidence to continuing to

implement strategic priorities.

D. M. Gelber

Chairman

31 July 2020

*awaiting approval from the FCA

CEO's statement

Focussing on our customers for 106 years

Our three-pronged strategy continues to give direction to the

Group whilst the world and the financial markets look to recover

from the COVID-19 pandemic.

Reflection

We are pleased with the results for the year ending 31 March

2020, but first, I wish to address the tragic events caused by the

COVID-19 pandemic. Some of us have lost family and friends to the

virus; to those people we send our heartfelt condolences,

recognising that in all the analyses of financial impact, above all

it is the human cost that is hardest to bear. In February, our CIO

was already identifying the epidemic (as it was then) as a

potential game-changer for markets and businesses in general. We

then activated our business continuity plan on 12 March, ahead of

the government's lockdown of 23 March, giving us a head-start in

winding down office-based activities and implementing the working

from home (WFH) regime. The adaptability of our people and the

readiness of our technology enabled our transition to WFH nearly

seamlessly. I am proud of how our members responded to this crisis,

how we kept the Company functioning normally, and how we continued

to engage with our clients and ensuring that they did not suffer

any interruption in quality of service during a potentially chaotic

time. Everyone played their part, demonstrated patience and

tenacity, and got on with the business at hand.

While I am delighted with the way our members responded to the

challenge, we cannot avoid the fact that our financial performance

is a function of events in capital markets. Absent a significant

improvement in market conditions, our revenues will be materially

impacted for the current accounting year ending 31 March 2021.

Management has taken swift action to resize our cost-base, to help

mitigate the impact on earnings of the forecast decline in

revenues.

The Company Directors of the Group and subsidiary boards agreed

to a 20% temporary reduction in salary in light of market

conditions. Management is closely monitoring costs, and will take

proportionate action, while continuing to pursue our strategy to

grow the business.

The year ahead

Firstly, I wish to thank David Gelber for his decade-long

service to Walker Crips as Group Chairman. David has led us with

wise counsel and patient advice. His dedication to the company, and

tirelessly giving of his time and support to the executive board,

is greatly valued. Whilst it was his intention to retire at the

forthcoming AGM, we are grateful that he has agreed to stay on as

Non-Executive Director for up to 12 months. I also wish to thank,

in advance, Martin Wright who will be taking over as Group Chairman

immediately after the AGM. Martin knows the company well, and we

look forward to his guidance and counsel as we navigate the

opportunities and the challenges ahead.

Turning now to the Company's performance over the past year, and

our plans for the future. Investment Management (WCIM) has had a

good year but it was overshadowed by the challenges and threats

posed by COVID-19. Nevertheless, the changes made by the new WCIM

leadership team of Nick Hansen, CEO, and Chris Darbyshire, CIO,

have put WCIM on a much better footing. The combining and enlarging

of the private client department, and the focus on the associate

teams will yield positive results over the next twelve months.

Chris has brought a wealth of expertise across different asset

classes and provided clear investment strategies. I am particularly

impressed with his market insights, especially as the COVID-19

crisis evolved. I know that the business will thrive under his

investment acumen. Nick has bolstered WCIM's commercial focus on

organic revenue growth, a strategy aimed at ensuring WCIM is

financially self-sustaining, and we remain committed to growing our

business through attracting the highest quality investment advisers

and network associates and providing them with systems and services

that helps reduce the admin burden and allows them to focus on

clients.

The Wealth Management (WCWM) division has continued to grow,

even during these challenging times. The consistent and uniform

process implemented by Dominic Martin over two years ago is

starting to bear fruit and the fact that it is scalable, makes me

optimistic for what WCWM will achieve over the next twelve

months.

The Pensions team is also weathering the COVID-19 storm, ably

led by Wendy Eastwood, ensuring that our SSAS and SIPP clients are

well supported and kept in touch with regular updates. Our

collectives team (BPAM) continues to add new clients and new asset

inflows. Geoff Wright and his team run a tight ship, and they are

passionately focussed on good customer outcomes.

Historically, our approach toward diversification has served the

Group well. International Equity Arbitrage generated record

profits, Tier 1 Investor Visa continues its 100% success rate for

its clients since 2013, and Structured Investments is always in

demand by the IFA community. We will seek out good opportunities to

add to this growing list of successful diversification, to add to

the breadth of our revenue streams.

3-pronged strategy for growth

1. Core Investment Management & Advisory Business

-- This is our largest revenue generating division, providing

clients with investment, wealth, pensions, collectives advice and

the creation of structured investments for clients, IFAs and

counterparties;

-- We continue to invest significantly in our core business,

always enhancing our systems and processes to deliver efficiencies,

cost savings and improved services to our Investment Managers via

our in-house developed client management system thereby enabling

them to provide high quality tailored service to clients;

-- The profitability for FY20/21 is expected to be impacted due

to lower market volumes and sustained low, or zero, interest

rates;

-- We continue to grow AUM&A, the major driver of revenue in the form of recurring fees;

-- We have been increasing the creation and deployment of

automated processes, reducing risk and increasing scalability and

efficiency;

-- We continue to be focussed on driving down non-variable costs

and we endeavour to operate on an OpEx (Operational Expenditure)

rather than a CapEx (Capital Expenditure) basis;

-- Our York office has concluded the migration of our backoffice

systems to a cloud platform and we have already started seeing

efficiencies which will translate to improvement in revenues;

-- Our collectives investment management team maintained their

performance levels while facing compression of margin

pressures;

-- We continue to look for good quality investment and wealth

managers, either individually or as teams; and

-- The business is in strong financial standing, and we are able

to weather the economic crisis arising from the COVID-19

pandemic.

2. Alternative Investments

-- This subset of our core investment management division is

where we create innovative and higher margin new business

lines;

-- Our Tier 1 (Investor) Visa investment business continues to

perform well, attracting ultra high net worth individuals from the

Far East to invest in the UK. Our assessment process is vigorous

and thorough and has provided assurance to the UK Home Office with

100% success rate since 2013;

-- Our Short Term Lending associate increased its investment

mandate from GBP44 million to GBP70 million; and

-- Our international equity arbitrage business generates

significant returns on our modest principal trading book.

3. Software as a Service (SaaS)

-- The EnOC Pro Platform is live and its Senior Managers &

Certification Regime (SM&CR) tool is being used by our own

group of companies and also by a number of external companies;

-- A number of SaaS systems are currently being developed and

the next to be deployed will be an HR system, which is a logical

extension of the SM&CR tool;

-- The objective of EnOC is to provide enterprise level systems

to companies of all sizes, from the very large to the very small.

Our pricing model is on a subscription basis without minimum

amounts and without long term lock-in contracts, accessible to even

the smallest of companies and scalable to the largest. EnOC's ethos

is to close the technology gap between those who can afford large

systems, and those who cannot, between those who can build their

own systems, and those who do not have the resources to do so;

removing the barriers to entry;

-- EnOC was born in the cloud and will remain a cloud service,

for all the benefits it brings to the service and to our partners;

and

-- We must and we will Create > Innovate > Rejuvenate > Eliminate > Repeat.

Conclusion

Our core objectives of shareholder value, customer service,

operational effectiveness and efficiency, remain; and only by

emphasising and investing in technology as the delivery mechanism

will our core objectives be achieved. COVID-19 has made it

startlingly clear how much we depend on technology.

We have been fortunate that we have been building our own

technology for nearly 20 years, and that we have been early

adopters of cloud-based technology. We transitioned to an online

workforce overnight with maximum operational resilience and

minimum, or no, risk to clients. The world has changed

significantly over the past several months and we have shown that

we are able to adapt and change along with it.

Dependence on technology will only increase. We will prioritise

and increase our investment into the development of our own

technology, continue to innovate and create regulatory and

operational technologies for ourselves, for our partners and for

the industry via the EnOC Pro Platform www.enoc.pro .

I wish to thank the Non-Executive Directors for keeping the

Executives on the straight and narrow, Sanath Dandeniya for holding

the purse strings and for being my sounding board, and the

Directors for the leadership of their teams.

And finally, I echo the Chairman's words, that we are proud of

our Investment Managers, Advisors and our staff, for their

resilience, for their can-do attitude, but most of all for their

unwavering focus on ensuring that our clients continue to be well

looked after.

Reconciliation of

Reconciliation of profit operating profit to

before tax to profit operating profit

before tax and exceptional

items before exceptional items

2020 2019 2020 2019

GBP000 GBP000 GBP000 GBP000

--------------------------- ------------- -------------- ------------------------- ------------- --------------

Profit before tax 963 489 Operating profit 1,092 402

Exceptional items

Exceptional items (Note10) (375) 32 (Note10) (375) 32

Profit before tax and 588 521 Operating profit before 717 434

exceptional items tax and exceptional

items

--------------------------- ------------- -------------- ------------------------- ------------- --------------

Underlying cash generated IAS17 consistent EBITDA

by the Group

2020 2019 2020 2019

GBP000 GBP000 GBP000 GBP000

--------------------------- ------------- -------------- ------------------------- ------------- --------------

Net cash inflow / 3,483 (631) Operating profit before 717 434

(outflow) from operations tax and exceptional

items

Amortisation /

Working capital (160) 2,163 depreciation (Note32) 1,199 1,151

Lease liability payments RoUA(*) depreciation

under IFRS16 (1,101) - charge (Note 32) 867 -

IAS 17 operating lease

Exceptional items (Note10) (375) 32 charge (Note 35) (855) -

Underlying cash generated

in the period 1,847 1,564 IAS17 consistent EBITDA 1,928 1,585

--------------------------- ------------- -------------- ------------------------- ------------- --------------

* Right of use assets.

Charity

We are pleased to be supporting Twining, the mental health

charity. Twining provides employment support to people with mental

health conditions, which is a great need at the best of times, but

during the COVID-19 pandemic, the demand from people who need

support from Twining has increased exponentially. Twining provides

practical advice and coaching about finding work, and also

supporting people who are in work but are facing challenges. They

understand that people with mental health problems face unique work

barriers, preventing them from getting into, and staying at, work.

Twining believes that with the right support, these barriers can be

overcome and people can enjoy a healthy working life.

The Group, our Investment Managers, Advisors and staff, support

Twining financially, but we are also very pleased to be able to

support them technologically. Twining is doing a very good thing,

helping people in need, and if you are also able to support them,

please visit www.twiningenterprise.org.uk.

S. K. W. Lam

Chief Executive Officer

31 July 2020

Consolidated income statement

year ended 31 March 2020

2020 2019

Note GBP'000 GBP'000

-------------------------------------------------------------------------- ----- --------- ---------

Revenue 5 31,422 30,458

Commission and fees paid 7 (9,771) (9,673)

Share of change in net assets of joint venture 8 (11) 14

-------------------------------------------------------------------------- ----- --------- ---------

Gross profit 21,640 20,799

Administrative expenses 9 (20,923) (20,365)

Exceptional items 10 375 (32)

-------------------------------------------------------------------------- ----- --------- ---------

Operating profit 1,092 402

Investment revenue 11 76 90

Finance costs 12 (205) (3)

-------------------------------------------------------------------------- ----- --------- ---------

Profit before tax 963 489

Taxation 14 (245) (156)

-------------------------------------------------------------------------- ----- --------- ---------

Profit for the year attributable to equity holders of the Parent Company 718 333

-------------------------------------------------------------------------- ----- --------- ---------

Earnings per share

-------------------------------------------------------------------------- ----- --------- ---------

Basic 16 1.69p 0.78p

Diluted 16 1.69p 0.78p

-------------------------------------------------------------------------- ----- --------- ---------

Consolidated statement of comprehensive income

year ended 31 March 2020

2020 2019

GBP'000 GBP'000

---------------------------------------------------------------------------------------------- -------- --------

Profit for the year 718 333

---------------------------------------------------------------------------------------------- -------- --------

Total comprehensive income for the year attributable to equity holders of the Parent Company 718 333

---------------------------------------------------------------------------------------------- -------- --------

Consolidated statement of financial position

as at 31 March 2020

Group Group

2020 2019

Note GBP'000 GBP'000

------------------------------------------------------------- ----- --------- ---------

Non-current assets

Goodwill 17 4,388 4,388

Other intangible assets 18 6,701 7,262

Property, plant and equipment 19 2,330 2,520

Right-of-use assets 20 4,362 -

Investment in joint ventures 8 - 44

Investments - fair value through profit or loss 21 51 51

------------------------------------------------------------- ----- --------- ---------

17,832 14,265

------------------------------------------------------------- ----- --------- ---------

Current assets

Trade and other receivables 22 24,515 35,785

Investments - fair value through profit or loss 21 638 1,005

Cash and cash equivalents 23 8,609 6,916

------------------------------------------------------------- ----- --------- ---------

33,762 43,706

------------------------------------------------------------- ----- --------- ---------

Total assets 51,594 57,971

------------------------------------------------------------- ----- --------- ---------

Current liabilities

Trade and other payables 27 (22,750) (34,095)

Current tax liabilities (424) (178)

Deferred tax liabilities 24 (335) (317)

Bank overdrafts 25 - (127)

Provisions 28 (178) (484)

Lease liabilities 29 (969) -

------------------------------------------------------------- ----- --------- ---------

(24,656) (35,201)

------------------------------------------------------------- ----- --------- ---------

Net current assets 9,106 8,505

------------------------------------------------------------- ----- --------- ---------

Long-term liabilities

Deferred cash consideration 38 (15) (47)

Lease liabilities 29 (3,620) -

Dilapidation provision 28 (659) (542)

Landlord contribution to leasehold improvements - (460)

------------------------------------------------------------- ----- --------- ---------

(4,294) (1,049)

------------------------------------------------------------- ----- --------- ---------

Net assets 22,644 21,721

------------------------------------------------------------- ----- --------- ---------

Equity

Share capital 30 2,888 2,888

Share premium account 30 3,763 3,763

Own shares 31 (312) (312)

Retained earnings 31 11,582 10,659

Other reserves 31 4,723 4,723

------------------------------------------------------------- ----- --------- ---------

Equity attributable to equity holders of the Parent Company 22,644 21,721

------------------------------------------------------------- ----- --------- ---------

The financial statements of Walker Crips Group plc (Company

registration no: 01432059) were approved by the Board of Directors

and authorised for issue on 31 July 2020.

Signed on behalf of the Board of Directors

S. S. Dandeniya FCCA, Director

31 July 2020

Consolidated statement of cash flows

year ended 31 March 2020

2020 2019

Note GBP'000 GBP'000

---------------------------------------------------------- ----- -------- --------

Operating activities

Cash generated / (used) by operations 32 3,483 (631)

Tax received 18 66

---------------------------------------------------------- ----- -------- --------

Net cash generated / (used) by operating activities 3,501 (565)

---------------------------------------------------------- ----- -------- --------

Investing activities

Purchase of property, plant and equipment (321) (382)

Sale of investments held for trading 101 789

Consideration paid on acquisition of client lists (21) (111)

Consideration paid on acquisition of subsidiary (1) -

Deferred consideration paid on acquisition of subsidiary - (600)

Dividends received 11 17 23

Interest received 48 67

---------------------------------------------------------- ----- -------- --------

Net cash used by investing activities (177) (214)

---------------------------------------------------------- ----- -------- --------

Financing activities

Dividends paid (396) (796)

Interest paid 12 (7) (3)

Repayment of lease liabilities* (944) -

Repayment of lease interest* (157) -

---------------------------------------------------------- ----- -------- --------

Net cash used by financing activities (1,504) (799)

---------------------------------------------------------- ----- -------- --------

Net increase / (decrease) in cash and cash equivalents 1,820 (1,578)

Net cash and cash equivalents at beginning of period 6,789 8,367

---------------------------------------------------------- ----- -------- --------

Net cash and cash equivalents at end of period 8,609 6,789

---------------------------------------------------------- ----- -------- --------

Cash and cash equivalents 8,609 6,916

Bank overdrafts - (127)

---------------------------------------------------------- ----- -------- --------

8,609 6,789

---------------------------------------------------------- ----- -------- --------

* Total repayment of lease liabilities under IFRS 16 in the period was GBP1,101,000.

Consolidated statement of changes in equity

year ended 31 March 2020

Share Own

Share premium shares Capital Retained Total

capital account held redemption Other earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------------- -------- -------- -------- ----------- -------- --------- --------

Equity as at 31 March 2018 2,861 3,674 (312) 111 4,557 11,122 22,013

-------------------------------------------- -------- -------- -------- ----------- -------- --------- --------

Total comprehensive income for the year - - - - - 333 333

-------------------------------------------- -------- -------- -------- ----------- -------- --------- --------

Contributions by and distributions to

owners

Dividends paid - - - - - (796) (796)

Issue of shares on acquisition of

intangibles and

as deferred consideration 27 89 - - 55 - 171

-------------------------------------------- -------- -------- -------- ----------- -------- --------- --------

Total contributions by and distributions to

owners 27 89 - - 55 (796) (625)

-------------------------------------------- -------- -------- -------- ----------- -------- --------- --------

Equity as at 31 March 2019 2,888 3,763 (312) 111 4,612 10,659 21,721

-------------------------------------------- -------- -------- -------- ----------- -------- --------- --------

Comprehensive income for the year - - - - - 718 718

Effect of adoption of IFRS 16 (see note 35) - - - - - 601 601

-------------------------------------------- -------- -------- -------- ----------- -------- --------- --------

Total comprehensive income for the year - - - - - 1,319 1,319

-------------------------------------------- -------- -------- -------- ----------- -------- --------- --------

Contributions by and distributions to

owners

Dividends paid - - - - - (396) (396)

-------------------------------------------- -------- -------- -------- ----------- -------- --------- --------

Total contributions by and distributions to

owners - - - - - (396) (396)

-------------------------------------------- -------- -------- -------- ----------- -------- --------- --------

Equity as at 31 March 2020 2,888 3,763 (312) 111 4,612 11,582 22,644

-------------------------------------------- -------- -------- -------- ----------- -------- --------- --------

Notes to the accounts

year ended 31 March 2020

1. General information

Walker Crips Group plc ("the Company") is the Parent Company of

the Walker Crips group of companies ("the Group"). The Group is a

public limited company incorporated in the United Kingdom under the

Companies Act 2006. The Group is registered in England and Wales.

The address of the registered office is Old Change House, 128 Queen

Victoria Street, London EC4V 4BJ.

The significant accounting policies have been disclosed below.

The accounting policies for the Group and the Company are

consistent unless otherwise stated.

2. Basis of preparation

The financial information set out in these financial statements

does not constitute the Group's statutory accounts for the years

ended 31 March 2020 and 2019. The statutory accounts for 31 March

2020 to which these non-statutory accounts relate have not been

delivered to the registrar of companies.

The auditor's report has been signed and was unqualified.

This preliminary announcement is based on the Group financial

statements which are prepared in accordance with IFRS.

Going concern

The financial statements of the Group have been prepared on a

going concern basis. At 31 March 2020, the Group had net assets of

GBP22.6 million (31 March 2019: GBP21.7 million), net current

assets of GBP9.1 million (31 March 2019: GBP8.5 million) and cash

and cash equivalents of GBP8.6 million (31 March 2019: GBP6.8

million (net of overdraft)). The Group reported an operating profit

of GBP1.09 million for the year ended 31 March 2020 inclusive of

exceptional income of GBP375,000 (31 March 2019: GBP402,000

inclusive of exceptional costs of GBP32,000) and net cash inflows

from operating activities of GBP3.5 million (31 March 2019: net

cash outflows from operating activities of GBP565,000).

The Directors consider the going concern basis to be appropriate

following their assessment of the Group's financial position and

its ability to meet its obligations as and when they fall due. In

making the going concern assessment the Directors have taken into

account the following:

-- The capital structure and liquidity of the Group, noting the

capital comprises equity, the balance sheet now reflects lease

liabilities arising on the adoption of IFRS 16 and the level of

liquid resources remains strong.

-- Its base case and stressed cash flow forecasts over the

financial reporting periods ending 31 March 2021 and 31 March

2022.

-- The principal risks facing the Group and its systems of risk management and internal control.

-- Improved operating cashflow during the year to 31 March 2020,

noting the reported figure also benefits from the impact of

adopting IFRS 16 in respect of leased assets for which the

resulting liability repayments and interest cost in the year were

GBP944,000 and GBP157,000 respectively.

-- the uncertainty caused by the COVID-19 outbreak and the

immediate measures, including suspension of certain discretionary

spends, cost cutting and use of the Government job retention

scheme, to mitigate the impact on the business.

Key assumptions that the Directors have made in preparing the

base case cash flow forecasts are that:

-- Revenues prudently reflect the impact of (i) continued low

base rates of 10 basis points on income for managing client

deposits and (ii) lower fee income expectation as a result of the

lower UK equity market levels. The base case assumption is for the

FTSE100 index to remain at 5700 range until December 2020 and

recovering to 7000 range and increasing modestly thereon. Overall

revenue growth expectation for future years set conservatively at

2% to 3.3% from the COVID-19 impacted lower starting point.Base

case costs prudently reflect only the actions Management has taken

to date in response to the impact of COVID-19 on the business for

the remainder of the present reporting year, with any further cost

savings delayed until the year to 31 March 2022.

Key stress scenarios that the Directors have considered

include:

-- A 'bear stress scenario': representing a further 10% fall in

income compared to the base case scenario in reporting period

ending 31 March 2021 and 31 March 2022.

-- A remote 'severe or reverse stress scenario': representing a

20% fall in commission income and 15% fall in fee income compared

to the base case for each forecast period.

-- Both stress scenarios assume no mitigating actions.

Liquidity and regulatory capital resource requirement exceeded

the minimum threshold in both the base and bear scenarios. However,

in the severe stress scenario, although the Group has positive

liquidity throughout the period, negatively impact our capital

prudential capital ratio is such that it falls below the regulatory

requirement in June 2022. The Directors consider this scenario to

be remote in view of the prudence built into the base case planning

and that further mitigations available to the Directors are not

reflected therein. Such mitigating actions within Management

control include reduction in propriety risk positions, delayed

capital expenditure, further reductions in discretionary spend and

additional reduction in employee headcount. Other mitigating

actions which may be possible include seeking shareholder support,

sale of assets and stronger cost reductions.

The Directors have also considered the wider operational

consequences and ramifications of the COVID-19 pandemic. As

explained in the Chief Executive's report our business

infrastructure has proved resilient in protecting the safety of our

employees and maintaining our high levels of client service in the

'working from home' mode of operations. The Government lockdown

restrictions have caused some disruptions, however, the Group's

advanced IT systems, along with greater use of cloud-based

technology, have allowed all operations to run at 100% capacity. We

continue to review our approach in line with latest developments

and government guidance. Our stress testing demonstrates the

Group's financial resilience and operating flexibility.

Following the assessment of the Group's financial position and

its ability to meet its obligations as and when they fall due,

including the financial implications of the pandemic, the Directors

are not aware of any material uncertainties that cast significant

doubt on the Group's ability to continue as a going concern.

Standards and interpretations affecting the reported results or

the financial position

The accounting policies adopted are consistent with those of the

previous financial year with the exception of IFRS 16 "Leases". The

Group has applied the modified retrospective approach and has not

restated comparative amounts for the period prior to initial

adoption. The impact of adopting this new standard is outlined in

note 3.

The Group does not expect any other standards issued by the

IASB, but not yet effective, to have a material impact on the

Group.

3. Significant accounting policies

Basis of consolidation

The Group financial statements consolidate the financial

statements of the Group and companies controlled by the Group (its

subsidiaries) made up to 31 March each year. The Group controls an

entity when it is exposed to, or has rights to, variable returns

from its involvement with the entity and has the ability to affect

those returns through its powers to direct relevant activities of

the entity. Subsidiaries are fully consolidated from the date on

which control is obtained and no longer consolidated from the date

that control ceases; their results are in the consolidated

financial statements up to the date that control ceases.

Entities where the interest is 49% or less are assessed for

potential treatment as a Group company against the control tests

outlined in IFRS 10, being power over the investee, exposure or

rights to variable returns and power over the investee to affect

the amount of investors' returns.

All intercompany balances, income and expenses are eliminated on

consolidation.

Business combinations

The acquisition of subsidiaries is accounted for using the

acquisition method. The cost of the acquisition is measured at the

aggregate of the fair values, at the date of exchange, of assets

given, liabilities incurred or assumed, and equity instruments

issued by the Group in exchange for control of the acquiree. The

acquiree's identifiable assets, liabilities and contingent

liabilities that meet the conditions for recognition under IFRS 3

"Business Combinations" are recognised at their fair value at the

acquisition date.

Interests in joint ventures

A joint venture is a contractual arrangement whereby the Group

and other parties undertake an economic activity that is subject to

joint control; that is when the strategic financial and operating

policy decisions relating to the activities require the unanimous

consent of the parties sharing control.

The Group's share of the assets, liabilities, income and

expenses of jointly controlled entities are accounted for in the

consolidated financial statements under the equity method. In the

current year, there was no longer an asset classified as a joint

venture investment.

Goodwill

Goodwill arising on consolidation represents the excess of the

cost of acquisition over the Group's interest in the fair value of

the identifiable assets and liabilities of a company or jointly

controlled entity at the date of acquisition. Goodwill is initially

recognised as an asset at cost and is subsequently measured at cost

less any accumulated impairment losses. Goodwill is not amortised

but is reviewed for impairment at least annually. Any impairment is

recognised immediately in profit or loss and is not subsequently

reversed in future periods.

For the purpose of impairment testing, goodwill is allocated to

each of the Group's cash-generating units expected to benefit from

the synergies of the combination. Cash-generating units to which

goodwill has been allocated are tested for impairment annually, or

more frequently when there is an indication that the unit may be

impaired. On disposal of a company or jointly controlled entity,

the attributable amount of goodwill is included in the

determination of the profit or loss on disposal.

Intangible assets

(a) Client lists

Client lists are recognised when it is probable that future

economic benefits will flow to the Group and the cost of the asset

can be measured reliably whilst the risk and rewards have also

transferred into the Group's ownership.

Intangible assets classified as client lists are recognised when

acquired as part of a business combination or when separate

payments are made to acquire clients' assets by adding teams of

Investment Managers.

The cost of acquired client lists and businesses generating

revenue from clients and Investment Managers are capitalised. These

costs are amortised on a straight-line basis over their expected

useful lives of three to twenty years. The amortisation period and

amortisation method for intangible assets are reviewed at least

each financial year end. All intangible assets have a finite useful

life.

Amortisation of intangible fixed assets is included within

administrative expenses in the consolidated income statement.

At each statement of financial position date, the Group reviews

the carrying amounts of its intangible assets to determine whether

there is any indication that those assets have suffered an

impairment loss. If any such indication exists, the recoverable

amount of the asset is estimated in order to determine the extent

of the impairment loss (if any). Where the asset does not generate

cash flows that are independent from other assets, the Group

estimates the recoverable amount of the cash-generating unit to

which the asset belongs.

During the year, a review of the Group's intangible assets

resulted in the revision of the Useful Economic Life ("UEL") of an

acquired client list. The Truro client list, which had an estimated

UEL of 16.25 years as at 31 March 2019, was revised to 11.25 years.

As it was a change in accounting estimate, this revision and the

resultant change in annual amortisation for this intangible asset

was applied prospectively, beginning with a new annual amortisation

charge for this asset in the current financial year.

The revised amortisation charge in respect of this intangible

asset was GBP143,000 in the current year and the annual charge

expected for the remaining UEL of the asset. The charge in prior

year was GBP99,000.

(b) Software Licenses

Computer software which is not an integral part of the related

hardware is recognised as an intangible asset when the Group is

expected to benefit from future use of the software and the costs

are reliably measured and amortised using the straight line method

over a useful life of up to five years.

Own shares held

Own shares consist of treasury shares which are recognised at

cost as a deduction from equity shareholders' funds. Subsequent

consideration received for the sale of treasury shares is also

recognised in equity with any difference being taken to retained

earnings. No gain or loss is recognised on sale of treasury

shares.

Shares to be issued

Shares to be issued represent the Group's best estimate of the

Ordinary Shares in the Group which are likely to be issued,

following business combinations or the acquisition of client

relationships which involve deferred payments in the Group's

shares. Where shares are due to be issued within a year, the sum is

included in current liabilities. Shares to be issued are dependent

on the achievement of pre-defined targets and are treated as a

liability until they are allotted and issued. There were no

transactions recognised in relation to this in the current

year.

Revenue recognition

Revenue is measured at a fair value of the consideration or

receivable and represents gross commissions, interest receivable

and fees in the course of ordinary investment business, net of

discounts, VAT and sales related taxes.

Revenues recognised under IFRS 15

Revenue from contracts with customers:

-- gross commissions on stockbroking activities are recognised

on those transactions whose trade date falls within the financial

year, with the execution of the trade being the performance

obligation at that point in time;

-- in Walker Crips Investment Management, fees earned from

managing various types of client portfolios are accrued daily over

the period to which they relate with the performance obligation

fulfilled over the same period;

-- fees in respect of financial services activities of Walker

Crips Wealth Management are accrued evenly over the period to which

they relate with the performance obligation fulfilled over the same

period;

-- fees earned from structured investments are recognised on the

date the underlying security of the structured investment is traded

and settled, with the execution of the trade being the performance

obligation at that point in time; and

-- fees earned from software offering, Software as a Service

"SaaS", are accrued evenly over the period to which they relate

with the performance obligation fulfilled over the same period.

Other incomes:

-- interest is recognised as it accrues in respect of the financial year;

-- dividend income is recognised when:

-- the Group's right to receive payment of dividends is established;

-- when it is probable that economic benefits associated with

the dividend will flow to the Group;

-- the amount of the dividend can be reliably measured; and

-- gains or losses arising on disposal of trading book

instruments and changes in fair value of securities held for

trading purposes are both recognised in profit and loss.

The Group does not have any long-term contract assets in

relation to customers of any fixed and/or considerable lengths of

time which require the recognition of financing costs or incomes in

relation to them.

Operating expenses

Operating expenses and other charges are provided for in full up

to the statement of financial position date on an accruals

basis.

Exceptional items

To assist in understanding its underlying performance, the Group

identifies certain items of pre-tax income and expenditure and

discloses them separately in the Consolidated income statement.

Such items would include:

1. profits or losses on disposal, closure or impairment of assets or businesses;

2. corporate transaction and restructuring costs;

3. changes in the fair value of contingent consideration; and

4. non-recurring items considered individually for

classification as exceptional by virtue of their nature or

size.

The separate disclosure of these items allows a clearer

understanding of the Group's trading performance on a consistent

and comparable basis, together with an understanding of the effect

of non-recurring or large individual transactions upon the overall

profitability of the Group. The exceptional items arising in the

current period are explained in note 10 and all fall under category

4 above. The related tax effect is also quantified and disclosed in

note 14.

Deferred income

Income received from clients in respect of future periods to the

transaction or reporting date are classified as deferred income

within creditors until such time as value has been received by the

client.

Foreign currencies

The individual financial statements of each of the Group's

companies are presented in pounds sterling, which is the functional

currency of the Group and the presentation currency of the

consolidated financial statements.

In preparing the financial statements of the individual

companies, transactions in currencies other than the entity's

functional currency (foreign currencies) are recorded at the rates

of exchange prevailing on the dates of the transactions. At each

statement of financial position date, monetary assets and

liabilities that are denominated in foreign currencies are

re-translated at the rates prevailing on the balance sheet date.

Exchange differences arising on the settlement of monetary items,

and on the re-translation of monetary items, are included in the

consolidated income statement for the period. Where consideration

is received in advance of revenue being recognised, the date of the

transaction reflects the date the consideration is received.

Impairment of non-financial assets

At each balance sheet date, the Group reviews the carrying

amounts of its tangible and intangible assets to determine whether

there is any indication that those assets have suffered an

impairment loss. For the purposes of assessing impairment, assets

are grouped at the lowest levels for which there are separately

identifiable cash flows (cash-generating units). If there is an

indication of possible impairment, the recoverable amount of any

affected asset (or group of related assets) is estimated and

compared with its carrying amount. If the estimated recoverable

amount is lower, the carrying amount is reduced to its estimated

recoverable amount, and an impairment loss is recognised

immediately in profit or loss.

Property, plant and equipment

Fixtures and equipment are stated at historical cost less

accumulated depreciation and provision for any impairment.

Depreciation is charged so as to write-off the cost or valuation of

assets over their estimated useful lives using the straight-line

method on the

following bases:

Computer hardware 33(1) /(3) % per annum on cost

Computer software between 20% and 33(1) /(3) % per annum on

cost

Leasehold improvements over the term of the lease under IFRS 16

Furniture and equipment 33(1) /(3) % per annum on cost

Right-of-use assets held under contractual arrangements are

depreciated over the lengths of their respective contractual terms,

as prescribed under IFRS 16.

The gain or loss on the disposal or retirement of an asset is

determined as the difference between the sales proceeds and the

carrying amount of the asset and is recognised in income. The

residual values and estimated useful life of items within property,

plant and equipment are reviewed at least at each financial year

end. Any shortfalls in carrying value are impaired immediately

through profit or loss.

Taxation

The tax expense represents the sum of the tax currently payable

and deferred tax.

The tax currently payable is based on taxable profit for the

year. Taxable profit differs from net profit as reported in the

income statement because it excludes items of income or expense

that are taxable or deductible in other years and it further

excludes items that are never taxable or deductible. The Group's

liability for current tax is calculated using tax rates that have

been enacted or substantively enacted by the statement of financial

position date.

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amounts of assets and liabilities

in the financial statements and the corresponding tax bases used in

the computation of taxable profit. Deferred tax liabilities are

generally recognised for all taxable temporary differences and

deferred tax assets are recognised to the extent that it is

probable that taxable profits will be available against which

deductible temporary differences can be utilised.

The carrying amount of deferred tax assets is reviewed at each

statement of financial position date and reduced to the extent that

it is no longer probable that sufficient taxable profits will be

available to allow all or part of the asset to be recovered.

Deferred tax is calculated at the tax rates that are expected to

apply in the period in which the liability is settled or the asset

is realised based on tax rates that have been enacted or

substantively enacted by the statement of financial position date.

Deferred tax is charged or credited directly to the Income

Statement, except when it relates to items charged or credited to

'Other Comprehensive Income' in which case the deferred tax is also

dealt with in other comprehensive income.

Deferred tax assets and liabilities are offset when the Group

has a legally enforceable right to do so and presented as a net

number on the face of the statement of financial position.

Financial assets and liabilities

Financial assets and liabilities are recognised in the

Consolidated statement of financial position when the Group becomes

a party to the contractual provisions of the instrument.

At initial recognition, the Group measures a financial asset or

financial liability at its fair value plus or minus transaction

costs. Transaction costs of financial assets and financial

liabilities carried at fair value through profit or loss ("FVTPL")

are expensed in the statement of comprehensive income. Immediately

after initial recognition, an expected credit loss allowance

("ECL") is recognised for financial assets measured at amortised

cost, which results in an accounting loss being recognised in

profit or loss when an asset is newly originated.

The Group does not use hedge accounting.

a) Financial assets

Classification and subsequent measurement

The Group classifies its financial assets in the following

measurement categories:

-- Fair value through profit or loss ("FVTPL"); or

-- Amortised cost.

Financial assets are classified as current or non-current

depending on the contractual timing for recovery of the asset.

(i) Debt instruments

Classification and subsequent measurement of debt instruments

depend on:

-- the Group's business model for managing the asset; and

-- the cash flow characteristics of the asset.

Business model: The business model reflects how the Group

manages the assets in order to generate cash flows. That is,

whether the Group's objective is solely to collect the contractual

cash flows from the assets, to collect both the contractual cash

flows and cash flows arising from the sale of assets, or solely or

mainly to collect cash flows arising from the sale of assets.

Factors considered by the Group include past experience on how the

contractual cash flows for these assets were collected, how the

assets' performance is evaluated, and how risks are assessed and

managed.

Cash flow characteristics of the asset: Where the business model

is to hold assets to collect contractual cash flows, the Group

assesses whether the financial instruments' contractual cash flows

represent solely payments of principal and interest ("the SPPI

test"). In making this assessment, the Group considers whether the

contractual cash flows are consistent with a basic lending

instrument.

Based on these factors, the Group classifies its debt

instruments into one of two measurement categories:

Amortised cost: Assets that are held for collection of

contractual cash flows where those cash flows represent solely

payments of principal and interest ("SPPI"), and that are not

designated at FVTPL, are measured at amortised cost. Amortised cost

is the amount at which the financial asset is measured at initial

recognition minus the principal repayments, plus or minus the

cumulative amortisation, using the effective interest rate method,

of any difference between that initial amount and the maturity

amount, adjusted by any ECL recognised. The effective interest rate

is the rate that exactly discounts estimated future cash payments

or receipts through the expected life of the financial asset to the

gross carrying amount. Interest income from these financial assets

is included within investment revenues using the effective interest

rate method.

Fair value through profit or loss ("FVTPL"): Assets that do not

meet the criteria for amortised cost or fair value through other

comprehensive income ("FVTOCI") are measured at fair value through

profit or loss.

Reclassification

The Group reclassifies debt instruments when and only when its

business model for managing those assets changes. The

reclassification takes place from the start of the first reporting

period following the change.

Impairment

The Group assesses on a forward-looking basis the ECL associated

with its debt instruments held at amortised cost. The Group

recognises a loss allowance for such losses at each reporting date.

On initial recognition, the Group recognises a 12-month ECL. At the

reporting date, if there has been a significant increase in credit

risk, the loss allowance is revised to the lifetime expected credit

loss.

The measurement of ECL reflects:

-- an unbiased and probability weighted amount that is

determined by evaluating a range of possible outcomes;

-- the time value of money; and

-- reasonable and supportable information that is available

without undue cost or effort at the reporting date about past

events, current conditions and forecasts of future economic

conditions.

The Group adopts the simplified approach to trade receivables

and contacts assets, which allows entities to recognise lifetime

expected losses on all assets, without the need to identify

significant increases in credit risk (i.e. no distinction is needed

between 12-month and lifetime expected credit losses).

(ii) Equity instruments

Investments are recognised and derecognised on a trade date

basis where a purchase or sale of an investment is under a contract

whose terms require delivery of the instrument within the timeframe

established by the market concerned, and are initially measured at

fair value.

The Group subsequently measures all equity investments at fair

value through profit and loss. Changes in the fair value of

financial assets at FVTPL are recognised in revenue within the

Consolidated Income Statement.

(iii) Cash and cash equivalents

Cash and cash equivalents includes cash in hand, deposits held

at call with financial institutions, other short-term, highly

liquid investments with original maturities of three months or less

that are readily convertible to known amounts of cash and which are

subject to an insignificant risk of changes in value. Bank

overdrafts are shown within current liabilities in the statement of

financial position.

De-recognition

Financial assets are derecognised when the rights to receive

cash flows from the financial assets have expired or have been

transferred and the Group has transferred substantially all the

risks and rewards of ownership.

b) Financial liabilities

Classification and subsequent measurement

Financial liabilities are classified and subsequently measured

at amortised cost.

Financial liabilities are derecognised when they are

extinguished.

Financial liabilities and equity

Financial liabilities and equity instruments are classified

according to the substance of the contractual arrangements entered

into. An equity instrument is any contract that evidences a

residual interest in the assets of the Group after deducting all of

its liabilities.

Trade payables

Trade payables are classified at amortised cost. Due to their

short-term nature, their carrying amount is considered to be the

same as their fair value.

Bank overdrafts

Interest-bearing bank overdrafts are initially measured at fair

value and shown within current liabilities. Finance charges are