Watkin Jones plc Trading Update (4346G)

July 19 2023 - 1:00AM

UK Regulatory

TIDMWJG

RNS Number : 4346G

Watkin Jones plc

19 July 2023

For immediate release 19 July 2023

Watkin Jones plc

('Watkin Jones' or the 'Group')

Trading Update

Watkin Jones today provides the following trading update for the

year ending 30 September 2023.

At the time of the interim results on 23 May, we announced the

forward sale of our PBSA scheme in Bristol and noted that we had

five other forward sales targeted for completion in FY23, two of

which were under offer. Since then, we have completed the announced

forward sale of Titanic Quarter in Belfast. In the period since the

interim results, market conditions have become more challenging. In

particular, the recent increases in interest rates and prevailing

economic uncertainty have impacted negatively on market liquidity.

As a result, there is now a greater degree of risk over these

transactions completing by the year end.

We have also reviewed our balance sheet against this more

challenging macro-economic backdrop and increased cost of funding.

We continue to explore the sale of a limited number of non-core

assets on our balance sheet and consider it prudent to reassess the

carrying value of certain assets with the expectation that this

will result in an impairment charge of c. GBP10m.

Our schemes in build continue to progress in line with

expectations. In the event that we do not complete any new forward

sales in the balance of the year, and taking into account the

impairment charge referenced above, we would not expect to

materially improve on the Underlying PBIT recorded in H1 of GBP2m.

Our current expectation is that these challenging market conditions

will persist into FY24, and against this more cautious backdrop,

our FY24 PBIT is likely to be in the range of GBP15m to GBP20m.

In line with recent announcements from other developers, we

expect to increase our exceptional provision for remedial works for

legacy properties by an additional GBP30m to GBP35m. This

represents our current best estimate, primarily reflecting our

intention to sign the Government's Responsible Actors Scheme, and

our obligation to reimburse funds under the scheme, as well as an

update to cost estimates on remedial works for properties provided

for in FY22. The cash cost of this is expected to be spread over

the next five years. We are reviewing details of the Welsh

Developers Pact and await further information on the scope of the

Scottish Safer Buildings Accord to understand any implications for

the Group.

Watkin Jones remains a UK market leader in residential for rent

development, focused on sectors with a very attractive long term

growth outlook. The strength of our balance sheet and agility of

the business allow us to remain proactive in the market. At 30 June

2023 our gross and net cash position was GBP68m and GBP36m

respectively.

- Ends -

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No 596/2014 as it

forms part of UK Domestic Law by virtue of the European Union

(Withdrawal) Act 2018 ("UK MAR")

For further information:

Watkin Jones plc

Alex Pease, Interim Chief Executive Officer Tel: +44 (0) 20 3617 4453

Sarah Sergeant, Chief Financial Officer www.watkinjonesplc.com

Peel Hunt LLP (Nominated Adviser & Joint Corporate Broker) Tel: +44 (0) 20 7418 8900

Mike Bell / Ed Allsopp www.peelhunt.com

Jefferies Hoare Govett (Joint Corporate Broker) Tel: +44 (0) 20 7029 8000

James Umbers/David Sheehan / Paul Bundred www.jefferies.com

Media enquiries:

Buchanan

Henry Harrison-Topham / Jamie Hooper Tel: +44 (0) 20 7466 5000

watkinjones@buchanan.uk.com www.buchanan.uk.com

Notes to Editors

Watkin Jones is the UK's leading developer and manager of

residential for rent, with a focus on the build to rent, student

accommodation and affordable housing sectors. The Group has strong

relationships with institutional investors, and a reputation for

successful, on-time-delivery of high quality developments. Since

1999, Watkin Jones has delivered 48,000 student beds across 143

sites, making it a key player and leader in the UK purpose-built

student accommodation market, and is increasingly expanding its

operations into the build to rent sector. In addition, Fresh, the

Group's specialist accommodation management business, manages over

22,000 student beds and build to rent apartments on behalf of its

institutional clients. Watkin Jones has also been responsible for

over 80 residential developments, ranging from starter homes to

executive housing and apartments.

The Group's competitive advantage lies in its capital-light

business model, which enables it to offer an end-to-end solution

for investors, delivered entirely in-house with minimal reliance on

third parties, across the entire life cycle of an asset.

Watkin Jones was admitted to trading on AIM in March 2016 with

the ticker WJG.L. For additional information please visit

www.watkinjonesplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUWSWROAUBAAR

(END) Dow Jones Newswires

July 19, 2023 02:00 ET (06:00 GMT)

Watkin Jones (LSE:WJG)

Historical Stock Chart

From Mar 2024 to Apr 2024

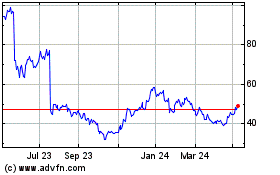

Watkin Jones (LSE:WJG)

Historical Stock Chart

From Apr 2023 to Apr 2024