China ETFs Tumble to Start 2014 - ETF News And Commentary

January 08 2014 - 7:01AM

Zacks

The Chinese financial markets saw a weak start to 2014

following a slowdown in manufacturing and service activities as

well as a lack of liquidity. The latest indicators suggest that the

world’s second largest economy is losing steam again after showing

six months of stability.

The Chinese manufacturing index (PMI) declined to 50.9 in December

from 52.5 in November, indicating the lowest level in four months

while the service sector index also slipped to the four-month low

of 54.6 in December from 56 in November (read: Best ETF Strategies

for 2014).

In addition, an official audit report showed that China’s local

government debt soared 70% over the past three years to 17.9

trillion yuan ($2.95 trillion) at the end of June 2013. One of the

main reasons of growing local government debt is rapidly rising

shadow banking.

The local government debt is well below the debt level of many

other developed nations like the U.S., U.K., France, Japan, Germany

and Spain. However, the pace at which the local debt has risen

could be a major drawback to Chinese stability.

Further, China could face another cash crunch at the end of this

month as the demand for cash from firms and depositors would

increase ahead of the Chinese New Year holiday (see: all the

Emerging Asia Pacific ETFs here).

Market Impact

The slew of negative news sent the Chinese stocks and the related

ETFs lower in the first few trading sessions of 2014. Large cap

focused China ETFs stole the show with the ultra-popular

iShares FTSE China 25 Index Fund

(FXI) plunging close to

6.1% on the first three trading sessions of 2014.

Other China large cap focused funds –

iShares MSCI China

Index Fund (MCHI),

SPDR S&P China ETF

(GXC) and

iShares FTSE China ETF

(FCHI) – also saw rough

trading sessions. MCHI and FCHI are down nearly 5% each while GXC

lost 4.5% to start the year.

Global X China Financials ETF

(CHIX) has seen

horrendous trading over the past three days, losing about 6.7%

while China A-Shares ETFs –

PEK,

CHNA and

ASHR – fell 4.6%, 1.5%

and 4.7%, respectively (read: China A-Shares ETFs Explained).

What Lies Ahead?

In order to curb financial risk, China is seeking tighter controls

on the shadow banking system and has issued new regulations to

limit growth on unregulated loans. However, the restrictions on

risky lending means less credit in the economy and in turn lower

GDP growth.

As such, 2013 GDP growth might fall to less than 7% from the

expected 7.6%. This could have serious consequences on the economy

and social stability.

In fact, even in the fourth quarter, Reuters estimates the economy

to grow 7.6%, down from 7.8% growth in the third quarter. This

would drag down full-year GDP growth to the lowest level in 14

years.

On a positive note, the central bank aims to maintain relatively

steady monetary conditions as it pushes financial reforms. The

implementation of several social and economic reforms over the next

five years will reinvigorate the economy (read: China ETFs Jump on

Government Reform Afterglow).

Chinese growth in 2014 would further be supported by improving

economic fundamentals in the developed markets like the

U.S. and Europe, which are the two main export destinations of

China, as well as higher domestic demand (read: Buy these China

ETFs as Outlook Brightens).

Moreover, China has $3.5 trillion in foreign exchange reserves and

double-digit fiscal revenue growth that could cushion against

a slowdown, should it happen.

Bottom Line

It seems that the current fundamentals are not working in favor of

China growth prospects for the near term but long-term reforms

could definitely bear fruit over the course of the year. Further,

given the fact that China has abundant resources to fight the

broad-based downturn, investors could definitely take the

opportunity of beaten down prices and could beef up China ETFs in

their portfolio for capital appreciation in the months

ahead.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

DB-HRVST CSI300 (ASHR): ETF Research Reports

ISHARS-F CHINA (FCHI): ETF Research Reports

ISHARS-CHINA LC (FXI): ETF Research Reports

ISHARS-MS CH IF (MCHI): ETF Research Reports

MKT VEC-CHINA (PEK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

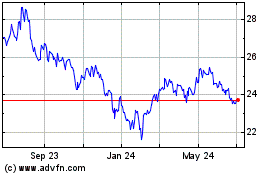

Xtrackers Harvest CSI 30... (AMEX:ASHR)

Historical Stock Chart

From Dec 2024 to Jan 2025

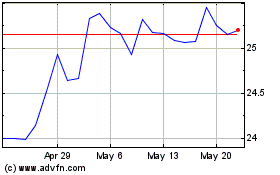

Xtrackers Harvest CSI 30... (AMEX:ASHR)

Historical Stock Chart

From Jan 2024 to Jan 2025