false

0000889348

0000889348

2024-11-13

2024-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 13, 2024

| CPI

AEROSTRUCTURES, INC. |

| (Exact Name of Registrant as Specified in Charter) |

| New York |

|

001-11398 |

|

11-2520310 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 91 Heartland Boulevard, Edgewood, New York |

|

11717 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (631) 586-5200

| N/A |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| ☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| ☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| ☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common stock, $0.001 par value per share |

|

CVU |

|

NYSE American |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

On November 13, 2024, CPI Aerostructures, Inc. (the “Company”)

entered into a Fourteenth Amendment (the “Fourteenth Amendment”) to that certain Amended and Restated Credit Agreement

with the lenders named therein (the “Lenders”) and BankUnited, N.A. as Sole Arranger, Administrative Agent and Collateral

Agent, dated as of March 24, 2016 (as amended from time to time, the “Credit Agreement”).

Under the Fourteenth Amendment, the parties amended the Credit Agreement

by: (i) extending the maturity date of the Company’s existing revolving line of credit (the “Revolving Credit Loans”)

to August 31, 2026; (ii) reducing the Base Rate Margin (as defined in the Credit Agreement) from 3.50% to 2.0%; (iii) resetting the aggregate

maximum principal amount of all Revolving Credit Loans to $16,890,000 from January 1, 2025 through March 31, 2025, $16,140,000 from April

1, 2025 through June 30, 2025, $15,390,000 from July 1, 2025 through September 30, 2025, $14,640,000 from October 1, 2025 through December

31, 2025, $13,890,000 from January 1, 2026 through March 31, 2026, $13,140,000 from April 1, 2026 through June 30, 2026, and $12,390,000

from July 1, 2026 onward and for payments to be made by the Company to comply therewith (if any such payments are necessary), on the first

day of each such period; and (iv) requiring the Company, if it does not deliver to BankUnited, N.A. by December 31, 2025, a commitment

letter with banks and terms and conditions reasonably acceptable to the Lenders for refinancing the obligations under the Credit Agreement,

to make a payment by January 31, 2026, equal to 2% of the aggregate outstanding principal amount of the Revolving Credit Loans as of December

31, 2025, with 50% of such payment applied to reduce the aggregate outstanding principal and the remaining 50% retained by the Lenders

as an amendment fee with respect to the Fourteenth Amendment.

The foregoing description is qualified in its entirety by reference

to the Fourteenth Amendment, a copy of which is attached to this Form 8-K as Exhibit 10.1 and incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits:

| * |

Certain exhibits and schedules to this exhibit have been omitted

in accordance with Regulation S-K Item 601(a)(5). The Company agrees to furnish supplementally a copy of all omitted exhibits

and schedules to the Securities and Exchange Commission upon its request.

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: November 13, 2024 |

CPI AEROSTRUCTURES, INC. |

| |

|

| |

By: |

/s/ Philip Passarello |

|

| |

|

Philip Passarello |

|

| |

|

Chief Financial Officer |

|

CPI AEROSTRUCTURES, INC. 8-K

Exhibit

10.1

Execution Version

FOURTEENTH

AMENDMENT

TO AMENDED AND RESTATED CREDIT AGREEMENT

FOURTEENTH AMENDMENT TO

AMENDED AND RESTATED CREDIT AGREEMENT (this “Amendment”) entered into as of November 13, 2024 by and among

CPI AEROSTRUCTURES, INC. (the “Borrower”), BANKUNITED, N.A., a national banking association, as Sole Arranger, Agent

and a Lender, DIME COMMUNITY BANK, a New York banking corporation, as a Lender, and the other financial institutions from time to time

parties thereto as lenders (collectively, the “Lenders” and each a “Lender”), and BANKUNITED, N.A.,

a national banking association, as administrative agent and collateral agent for the Lenders thereunder (in such capacities, the “Administrative

Agent” and the “Collateral Agent,” respectively and each an “Agent”).

WHEREAS, the Borrower,

the Agent and each Lender are parties to that Amended and Restated Credit Agreement dated as of March 24, 2016, as amended by that First

Amendment and Waiver to Amended and Restated Credit Agreement dated as of May 9, 2016, as further amended by that Second Amendment to

Amended and Restated Credit Agreement dated as of July 13, 2017, as further amended by that Third Amendment and Waiver to Amended and

Restated Credit Agreement dated as of August 15, 2018, as further amended by that Fourth Amendment dated as of December 20, 2018, as

further amended by that Fifth Amendment to Amended and Restated Credit Agreement dated as of June 25, 2019, as further amended by that

Sixth Amendment and Waiver to Amended and Restated Credit Agreement dated as of August 24, 2020, as further amended by that Consent,

Waiver and Seventh Amendment to Amended and Restated Credit Agreement dated as of May 11, 2021, as further amended by that Waiver and

Eighth Amendment to Amended and Restated Credit Agreement dated as of October 28, 2021 (the “Eighth Amendment”), as

further amended by that Consent, Waiver and Ninth Amendment to Amended and Restated Credit Agreement dated as of April 12, 2022, as further

amended by that Consent, Waiver and Tenth Amendment to Amended and Restated Credit Agreement dated as of August 17, 2022, as further

amended by that Eleventh Amendment to Amended and Restated Credit Agreement dated as of November 9, 2022, as further amended by that

Twelfth Amendment to Amended and Restated Credit Agreement dated as of March 23, 2023 and as further amended by that Thirteenth Amendment

to Amended and Restated Credit Agreement dated as of February 20, 2024 (collectively, the “Agreement”);

WHEREAS, the Borrower

has requested that the Agent and each Lender amend certain provisions of the Agreement including to extend the maturity date of the Loans;

and

WHEREAS, the Agent

and each Lender are willing to accede to such request to amend certain provisions of the Agreement, subject to the terms and conditions

hereinafter set forth.

NOW, THEREFORE, in

consideration of the premises and the agreements hereinafter set forth and for other good and valuable consideration, the parties hereto

hereby agree as follows:

1.

All capitalized terms used herein, unless otherwise defined herein, have the same meanings provided therefor in the Agreement.

This Amendment constitutes a Loan Document.

2.

Subject to the terms and conditions hereof, the Agreement is hereby amended as follows:

(a) Section 1.1 of the Agreement (Defined Terms) is amended by deleting the following definitions “Aggregate Revolving Credit

Maximum Amount,” “Applicable Margin” and “Revolving Credit Termination Date,” and substituting

the following therefor:

“Aggregate

Revolving Credit Maximum Amount”: shall mean the principal amount of up to (a) $19,800,000 from January 1, 2024 through March

31, 2024, (b) $19,080,000 from April 1, 2024 through June 30, 2024, (c) $18,360,000 from July 1, 2024 through September 30, 2024, (d)

$17,640,000 from October 1, 2024 through December 31, 2024, (e) $16,890,000 from January 1, 2025 through March 31, 2025, (f) $16,140,000

from April 1, 2025 through June 30, 2025, (g) $15,390,000 from July 1, 2025 through September 30, 2025, (h) $14,640,000 from October

1, 2025 through December 31, 2025, (i) $13,890,000 from January 1, 2026 through March 31, 2026, (j) $13,140,000 from April 1, 2026 through

June 30, 2026 and (k) $12,390,000 thereafter.

“Applicable

Margin”: means from time to time with respect to Revolving Credit Loans and Term Loans and the fees payable under Section 3.5(a),

the following percentages per annum:

| Base

Rate Margin |

Commitment

Fee |

| 2.00%

from November 1, 2022 through August 31, 2026 |

0.50%

through the Revolving Credit Termination Date |

“Revolving

Credit Termination Date”: August 31, 2026.

(b) Section 2.3 of the Agreement (Repayment of Revolving Credit Loans) is amended by deleting the last sentence thereof and substituting

the following therefor:

“Without limitation

of the foregoing, the Borrower shall repay the Revolving Credit Loans on each of April 1, 2024, July 1, 2024, October 1, 2024, January

1, 2025, April 1, 2025, July 1, 2025, October 1, 2025, January 1, 2026, April 1, 2026 and July 1, 2026 in an amount equal to the difference,

if greater than zero, of the aggregate principal amount of all outstanding Revolving Credit Loans at such time minus the amount of the

Aggregate Revolving Credit Maximum Amount at such time.”

(c) Schedule

4.18 of the Agreement is hereby amended by deleting the same and substituting the attached Schedule 4.18 therefor.

(d) Schedule 7.2 of the Agreement is hereby amended by deleting the same and substituting the attached Schedule 7.2 therefor.

(e) Schedule

7.3 of the Agreement is hereby amended by deleting the same and substituting the attached Schedule 7.3 therefor.

(f) Except

as amended herein, all other provisions of the Agreement and the other Loan Documents shall remain in full force and effect and are hereby

ratified and confirmed.

3. Each

Lender and the Borrower agree that as of November 8, 2024, the aggregate outstanding principal amount of the Revolving Credit Loans as

evidenced by Revolving Credit Notes is $17,640,000.08.

4. The

Borrower hereby represents and warrants to each Lender that:

(a) Each

and every of the representations and warranties set forth in the Agreement is true as of the date hereof and with the same effect as

though made on the date hereof and is hereby incorporated herein in full by reference as if fully restated herein in its entirety.

(b) No Default or Event of Default and no event or condition which, with the giving of notice or lapse of time or both, would constitute

a Default or Event of Default, now exists or would exist after giving effect hereto.

(c) There are no defenses or offsets to the Borrower’s obligations under the Agreement, the Notes or the other Loan Documents

or any of the other agreements in favor of the Lenders referred to in the Agreement.

(d) The WHEREAS clauses set forth hereinabove are true and correct.

5. It is expressly understood and agreed that all collateral security for the Loans and other extensions of credit set forth in the

Agreement prior to the amendment provided for herein is and shall continue to be collateral security for the Loans, obligations and other

extensions of credit provided in the Agreement (as herein amended) and the other Loan Documents.

6. The amendments set forth herein are limited precisely as written, based on the facts specified, and shall not be deemed to (a)

be a consent with respect to or a waiver of any term or condition of the Agreement, the other Loan Documents or any of the documents

referred to therein, or (b) prejudice any right or rights which either Lender may now have or may have in the future under or in connection

with the Agreement, the other Loan Documents or any documents referred to therein. Whenever the Agreement is referred to in this Amendment,

the other Loan Documents or any of the instruments, agreements or other documents or papers executed and delivered in connection therewith,

it shall be deemed to mean the Agreement as modified by this Amendment.

7. The

Borrower agrees to pay on demand, and the Agent may charge any deposit or loan accounts of the Borrower, all expenses (including reasonable

attorneys’ fees) incurred by the Lenders in connection with the negotiation and preparation of this Amendment and all instruments,

agreements and other documents executed or delivered in connection herewith.

8. In

consideration of the accommodations provided by the Agent and the Lenders under this Amendment, the Borrower and the Guarantors (by virtue

of their undersigned consent), on behalf of themselves and for each of their direct and indirect Affiliates, successors, predecessors

and assigns, and their present and former legal representatives, employees, agents, and attorneys, and their trustees, successors and

assigns (collectively, the “Releasors”), hereby knowingly, voluntarily, intentionally, unconditionally and irrevocably

waive, release and forever discharge (the “Release”) the Agent and the Lenders and the Agent and the Lenders’

Affiliates and subsidiaries (collectively, the “Lender Parties”) from and against any and all rights, claims, counterclaims,

demands, suits, actions or causes of action against the Agent or either Lender or the other Lender Parties, whether known or unknown,

contingent or absolute, liquidated or unliquidated or otherwise, arising out of the Agent or the Lenders’ or the other Lender Parties’

actions or inactions in connection with the Loans prior to the execution and delivery of this Amendment prior to the execution and delivery

of this Amendment, as well as any and all rights of setoff, defenses, claims, counterclaims, demands, suits, actions, and causes of action,

in each case in connection with the Loans prior to the execution and delivery of this Amendment, and any other bar to the enforcement

of the Agreement, the Notes or any of the other Loan Documents which shall have accrued prior to the execution and delivery of this Amendment.

In any litigation arising from or related to an alleged breach of the Release, the Release may be pleaded as a defense, counterclaim

or cross claim and shall be admissible into evidence without foundation testimony whatsoever. The Releasors expressly covenant and agree

that the Release shall be binding in all respects upon their respective successors, assigns and transferees including, without limitation,

any trustee in bankruptcy, and shall inure to the benefit of the successors and assigns of the Agent, the Lenders and the other Lender

Parties.

9. If

any of the Borrower or the Guarantors shall (a) file with any bankruptcy or similar court or be the subject of any petition under any

Debtor Relief Law; (b) be the subject of an order for relief under any Debtor Relief Law; (c) file or be the subject of a petition seeking

any reorganization, arrangement, composition, readjustment, liquidation, dissolution, or similar relief under any present or future Debtor

Relief Law; (d) seek, consent to or acquiesce in the appointment of a trustee, receiver, conservator or liquidator; or (e) be the subject

of an order, judgment or decree entered by a court of competent jurisdiction approving a petition filed against any of the Borrower or

the Guarantors for any reorganization, arrangement, composition, readjustment, liquidation, dissolution, or similar relief under any

present or future Debtor Relief Law, then the Agent shall thereupon be entitled to relief from any automatic stay imposed by Section

362 of the United States Bankruptcy Code or from any other stay or suspension of remedies of the rights and remedies otherwise available

to the Agent under the Agreement or any other Loan Documents, and each of the Borrower and the Guarantors specifically acknowledges that

“cause” exists for such relief within the meaning of Section 362(d) of the United States Bankruptcy Code and agrees not to

oppose any motion by the Agent for relief from the automatic stay imposed by Section 362.

10. This

Amendment shall become effective on such date as all of the following conditions shall be satisfied retroactive to the date set forth

in the first paragraph hereof (the “Effective Date”):

(a) Loan Documents. The Administrative Agent shall have received counterparts of this Amendment (inclusive of all exhibits,

and attachments), executed and delivered by a duly authorized officer of the Borrower and the Guarantors, with a counterpart or a conformed

copy for each Lender.

(b) Secretary’s

Certificate of the Borrower. The Administrative Agent shall have received, with a counterpart for each Lender, a certificate, dated

as of the Effective Date, executed by the Secretary or any Assistant Secretary of the Borrower certifying (i) a copy of the resolutions,

in form and substance satisfactory to the Administrative Agent, of the Board of Directors of the Borrower authorizing the execution,

delivery and performance of this Amendment and (ii) the incumbency and signature of the officers of the Borrower executing this Amendment

and any other Loan Document, which certificate shall be in form and substance satisfactory to the Administrative Agent and shall state

that the resolutions thereby certified have not been amended, modified, revoked or rescinded.

(c) Secretary’s

Certificates of the Guarantors. The Administrative Agent shall have received, with a counterpart for each Lender, a certificate,

dated as of the Effective Date, executed by the Secretary or any Assistant Secretary of each Guarantor certifying (i) a copy of the resolutions,

in form and substance satisfactory to the Administrative Agent, of the Board of Directors of such Guarantor authorizing the execution,

delivery and performance of this Amendment and (ii) the incumbency and signature of the officers of such Guarantor executing this Amendment

and any other Loan Document, which certificate shall be in form and substance satisfactory to the Administrative Agent and shall state

that the resolutions thereby certified have not been amended, modified, revoked or rescinded.

(d) Fees.

The Lenders shall have received all invoiced fees, costs, expenses and compensation required to be paid on the Effective Date (including

reimbursement for or direct payment of the reasonable fees, disbursements and other charges of legal counsel to the Arranger, the Agent

and the Lenders).

(e) Consents,

Licenses and Approvals. All governmental and material third party approvals necessary in connection with the execution, delivery

and performance of the Loan Documents shall have been obtained and be in full force and effect or shall continue to be in full force

and effect.

(f) Litigation. Except as set forth on Schedule 4.6 of the Agreement, there shall be no litigation or administrative proceeding

or proposed or pending regulatory changes in law or regulations applicable to the Borrower or its Subsidiaries, which, if adversely determined

could reasonably be expected to have a Material Adverse Effect or a material adverse effect on the ability of the parties to consummate

the execution, delivery and performance of the Loan Documents and the Borrowings hereunder.

(g) Indebtedness. As of the Effective Date, the Borrower and its Subsidiaries shall not have outstanding Indebtedness for borrowed

money or preferred stock other than (i) Indebtedness under the Loan Documents, (ii) Indebtedness permitted under the Agreement, and Indebtedness

as set forth on Schedule 7.2 of the Agreement.

(h) Documentation. The Lenders shall have received such other documents and other instruments or certificates as they may reasonably

request.

(i) Material Adverse Effect. Since June 30, 2022, there has been no development or event which has had or would reasonably

be expected to have a Material Adverse Effect.

(j) Execution by Lenders. This Amendment shall have been executed and delivered by each Lender hereunder.

11. If

on or before December 31, 2025 the Borrower shall not have delivered to the Administrative Agent a commitment letter from one or more

banks acceptable to the Lenders providing for the refinancing in full of the Obligations on terms and conditions (including, without

limitations, conditions to effectiveness) acceptable to the Lenders, in each case in their reasonable discretion, the Borrower shall

pay to the Lenders (pro rata), on or before January 31, 2026, an amount equal to 2% of the aggregate outstanding principal amount of

the Revolving Credit Loans as of December 31, 2025, which shall be deemed fully earned and non-refundable as of December 31, 2025, of

which (a) 50% shall be applied to reduce the aggregate then-outstanding principal amount of the Revolving Credit Loans and (b) 50% shall

be retained by the Lenders as an amendment fee with respect to this Amendment.

12. This

Amendment is dated as of the date set forth in the first paragraph hereof and shall be effective (after satisfaction of the conditions

set forth in Section 10 above) on the date of execution by the Agent and the Lenders, retroactive to such date.

13. This

Amendment shall be governed by, and construed and interpreted in accordance with, the laws of the State of New York.

14. This Amendment may be executed in counterparts, each of which shall constitute an original, and each of which taken together shall

constitute one and the same agreement. Delivery of an executed counterpart of a signature page to this Amendment by PDF or other electronic

means shall be effective as delivery of a manually executed original counterpart hereof. Notwithstanding the foregoing, the Borrower

and Guarantors shall execute and deliver four (4) original counterparts of this Amendment to the Administrative Agent on or about the

Effective Date.

[Signature Page to Follow]

SIGNATURE PAGE

Fourteenth Amendment to Amended

and Restated Credit Agreement

IN WITNESS WHEREOF,

the parties hereto have caused this Amendment to be duly executed and delivered by their respective duly authorized officers as of the

date first above written.

| |

CPI AEROSTRUCTURES, INC.,

as Borrower |

|

| |

|

|

|

| |

By: |

/s/ Philip Passarello |

|

| |

|

Philip Passarello |

|

| |

|

Chief Financial Officer |

|

| |

BANKUNITED, N.A.,

as Arranger, Agent and a Lender |

|

| |

|

|

|

| |

By: |

/s/ Brian McGahee |

|

| |

|

Brian McGahee |

|

| |

|

Senior Vice President |

|

| |

BANKUNITED, N.A.,

as Administrative Agent and Collateral Agent |

|

| |

|

|

|

| |

By: |

/s/ Brian McGahee |

|

| |

|

Brian McGahee |

|

| |

|

Senior Vice President |

|

| |

DIME COMMUNITY BANK,

as a Lender |

|

| |

|

|

|

| |

By: |

/s/ JoAnn Bello |

|

| |

|

Name: JoAnn Bello |

|

| |

|

Title: Senior Vice President |

|

Signature Page to Fourteenth Amendment to Amended

and Restated Credit Agreement

Each of the Guarantors indicated

below hereby consent to this Amendment and acknowledge its continuing liability under its respective Guaranty with respect to the Agreement,

as amended hereby, including (without limitation) the Loan Documents executed in connection with the Obligations and all other documents,

instruments and agreements executed pursuant thereto or in connection therewith, without offset, defense of counterclaim, any such offset,

defense or counterclaim as may exist being hereby irrevocably waived by each Guarantor.

| |

GUARANTORS: |

|

| |

|

|

| |

WELDING METALLURGY, INC. |

|

| |

|

|

|

| |

By: |

/s/ Philip Passarello |

|

| |

|

Philip Passarello |

|

| |

|

Chief Financial Officer |

|

| |

COMPAC DEVELOPMENT CORPORATION |

|

| |

|

|

|

| |

By: |

/s/ Philip Passarello |

|

| |

|

Philip Passarello |

|

| |

|

Chief Financial Officer |

|

Guarantor Consent to Fourteenth Amendment to

Amended and Restated Credit Agreement

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

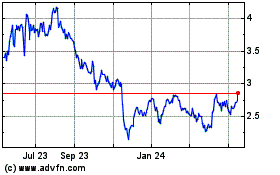

CPI Aerostructures (AMEX:CVU)

Historical Stock Chart

From Jan 2025 to Feb 2025

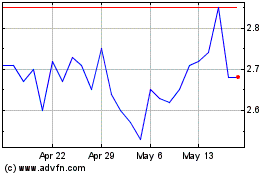

CPI Aerostructures (AMEX:CVU)

Historical Stock Chart

From Feb 2024 to Feb 2025