UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 25, 2024

| | IGC PHARMA, INC. (Exact name of registrant as specified in charter) | |

| | | |

| Maryland | 001-32830 | 20-2760393 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | |

| | 10024 Falls Road, Potomac, Maryland 20859 (Address of principal executive offices) (Zip Code) | |

| | | |

| | (301) 983-0998 (Registrant’s telephone number, including area code) | |

(Former Name or Former Address, if Changed since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $.0001 par value | IGC | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company ☐.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On September 25, 2024, IGC Pharma, Inc. (“IGC” or the “Company”) entered into the 2024 Share Purchase Agreement (the “2024 SPA”) with Moran Global Strategies, Inc., a Virginia corporation (“MGS”), which is owned by James Moran, a director of IGC, relating to the sale and issuance by our company to the investors of an aggregate of 588,235 shares of our common stock, for a total purchase price of $200,000. or $0.34 per share, subject to the terms and conditions set forth in the 2024 SPA. The investment is subject to customary closing conditions, including NYSE approval. The 2024 SPA is attached as Exhibit 10.1. After giving effect to the purchase, we will have approximately 75,953,296 shares of common stock outstanding. As per the 2024 SPA, the investor will receive piggyback registration rights subject to certain restrictions.

The Purchase Agreement contains certain representations, warranties, and covenants. In addition, both parties have agreed to indemnify each other for losses arising out of breaches of their respective representations, warranties, and covenants and for certain liabilities related to each party’s business, subject to customary limitations.

The foregoing description of the 2024 Stock Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to Exhibit 10.1 hereto, which is incorporated by reference. Except for the historical information contained herein, this report contains forward-looking statements that involve risk and uncertainties, such as statements related to the anticipated closing of the offering. The risks and uncertainties involved include the risks detailed from time to time in our filings with the Securities and Exchange Commission, including our annual report on Form 10-K and quarterly reports on Form 10-Q.

|

Item 3.02

|

Unregistered Sales of Equity Securities

|

The disclosure set forth in Item 1.01 is incorporated herein by reference.

If and when the shares are issued, they will be issued pursuant to the exemption contained under Section 4(a)(2) of the Securities Act of 1933, as amended.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

* Certain schedules or similar attachments to this exhibit have been omitted in accordance with Item 601(a)(5) of Regulation S-K.

The registrant hereby agrees to furnish supplementally to the Securities and Exchange Commission upon request a copy of any omitted schedule or attachment to this exhibit.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

IGC Pharma, Inc.

|

|

| |

|

|

|

| |

|

|

|

|

Dated: September 26, 2024

|

By:

|

/s/ Ram Mukunda

|

|

| |

|

Name: Ram Mukunda

|

|

| |

|

Title: CEO

|

|

false

0001326205

0001326205

2024-09-25

2024-09-25

Exhibit 10.1

SHARE PURCHASE AGREEMENT WITH MORAN GLOBAL STRATEGIES INC.

STOCK PURCHASE AGREEMENT (this “Agreement”) dated as signed by and between IGC Pharma, Inc., a Maryland corporation (the “Company”), and Investor as identified in Exhibit B (the “Investor”).

WHEREAS, the Investor desires to purchase from the Company, and the Company desires to sell and issue to the Investor, shares in IGC (the “Shares”) Common Stock, par value $0.0001 per share, (“Common Stock”) upon the terms and conditions set forth in this Agreement; and

NOW, THEREFORE, in consideration of the mutual terms, conditions and other agreements set forth herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the parties hereto hereby agree to the sale and purchase of the Shares as set forth herein.

For purposes of this Agreement, the terms set forth below shall have the corresponding meanings provided below.

“Affiliate” shall mean, with respect to any specified Person, (i) if such Person is an individual, the spouse, heirs, executors, or legal representatives of such individual, or any trusts for the benefit of such individual or such individual's spouse and/or lineal descendants, or (ii) otherwise, another Person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, the Person specified. As used in this definition, “control” shall mean the possession, directly or indirectly, of the sole and unilateral power to cause the direction of the management and policies of a Person, whether through the ownership of voting securities or by contract or another written instrument.

“Business Day” shall mean any day on which banks located in New York are not required or authorized by law to remain closed.

“Person” shall mean an individual, entity, corporation, partnership, association, limited liability company, limited liability partnership, joint-stock company, trust, or unincorporated organization.

“Transfer” shall mean any sale, transfer, assignment, conveyance, charge, pledge, mortgage, encumbrance, hypothecation, security interest or other disposition, other than to an Affiliate, or to make or effect any of the above.

| |

2.

|

Sale and Purchase of Shares.

|

2.1. Subscription for Shares by Investor. Subject to the terms and conditions of this Agreement, the Investor hereby agrees to purchase the Shares from the Company, and the Company hereby agrees to issue and sell the Shares to the Investor, in the aggregate number of Shares as set out in Exhibit A. The purchase price for the Shares is as set out in Exhibit A. The investor acknowledges that the purchase price per share is at or above the closing price of IGC, as reflected by NYSE.com, on the day immediately prior to this purchase. The aggregate purchase price is as set out in Exhibit A (the “Consideration”).

| |

2.2.

|

Closing; Deliveries.

|

(a) The closing of the acquisition of the Shares (the “Closing”) shall take place at the offices of Olshan Frome Wolosky LLP, counsel to the Company, at 1325 Avenue of the Americas, New York, New York 10019, or at such other place as the parties may mutually agree on such date and time on which the parties may mutually agree (the “Closing Date”).

(b) At or promptly after the Closing, the Company shall deliver to the Investor, against delivery by the Investor of the Consideration (as provided below), shares of IGC’s Common Stock representing the number of Shares purchased by the Investor as set forth above. The Consideration shall be paid by wire transfer of immediately available funds in accordance with wire transfer instructions provided by the Company in Exhibit A.

| |

3.

|

Representations, Warranties and Acknowledgments of the Investor.

|

The Investor hereby represents, warrants, and acknowledges to the Company as follows:

| |

3.1.

|

Execution, Delivery and Performance.

|

The Investor has full right, power, and authority to execute and deliver this Agreement and to perform its obligations hereunder and this Agreement has been duly authorized, executed and delivered by it and is valid, binding, and enforceable against it in accordance with its terms.

None of the execution, delivery and performance of this Agreement by the Investor will conflict with or result in a breach of any terms or provisions of, or constitute a default under, any material contract, agreement, or instrument to which the Investor is a party or by which the Investor is bound.

| |

3.3.

|

Investment Representations.

|

(a) The Investor understands that the offering and sale of the Shares is intended to be exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), by virtue of the provisions of Section 4(a)(2) of the Securities

Act and Regulation D and/or Regulation S adopted thereunder. The Investor is acquiring the Shares solely for purposes of investment and with no present intention to distribute such Shares. The Investor is an “accredited investor,” as defined in Rule 501 of Regulation D, and it has such knowledge and experience in financial and business affairs as to be capable of evaluating the merits and risks of an investment in the Company pursuant to the terms of this Agreement.

(b) The Investor understands that (i) the purchase of the Shares is a speculative investment which involves a high degree of risk of loss of the Investor's investment therein, (ii) there are substantial restrictions on the transferability of the Shares under the terms hereof and the provisions of the Securities Act and (iii) following the Closing there may not be an active public market for the Shares and, accordingly, it may not be possible to liquidate its investment in the Company in case of emergency, or otherwise.

| |

3.4.

|

Access to Information; Reliance.

|

The Investor has been provided an opportunity to ask questions of, and has received answers thereto satisfactory to it from, the Company and its representatives concerning the Company and the Investor's investment therein, and the Investor has been provided with such information as it has requested from the Company concerning the same. The Investor has sought independent legal, investment and tax advice to the extent that it has deemed necessary or appropriate in connection with its decision to invest in the Company.

| |

3.5.

|

Investor Information.

|

The information concerning the Investor set forth on the signature page hereof is true and correct. The Investor shall promptly notify the Company and provide the Company with corrected information should any of such Investor information cease to be correct following the date hereof.

| |

3.6.

|

Involvement in Certain Legal Proceedings.

|

The Investor:

(a) has not filed or had filed against it a petition under the federal bankruptcy laws or any state insolvency law, or had a receiver, fiscal agent or similar officer appointed by a court for its business or property or any partnership, corporation or business association in which it was a general partner or executive officer at or within five years before the time of such filing;

(b) has not been convicted in a criminal proceeding, and is not a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

(c) has not been the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any federal or state authority or court of competent jurisdiction, permanently or temporarily barring, limiting or enjoining it from engaging in, or otherwise limiting its ability to engage in or be associated with any Person engaged

in, any type of business practice, conduct or employment (including without limitation in connection with the purchase or sale of any security or commodity); and

(d) has not been found by a court of competent jurisdiction in a civil action or by the Securities and Exchange Commission (the “SEC”) or the Commodity Futures Trading Commission to have violated any federal or state securities law or federal commodities law, and the judgment in such civil action or finding by such Commission has not been subsequently reversed, suspended or vacated.

| |

4.

|

Representations and Warranties of the Company.

|

The Company represents and warrants to the Investor as follows:

| |

4.1.

|

Execution, Delivery and Performance.

|

The Company has the corporate power and authority to execute and deliver this Agreement and to perform its obligations hereunder. This Agreement has been duly authorized, executed and delivered by the Company and is valid, binding, and enforceable against the Company in accordance with its terms.

| |

4.2.

|

Shares Duly Authorized.

|

The Shares to be issued to the Investor pursuant to this Agreement, when issued and delivered in accordance with the terms of this Agreement, will be duly and validly issued and will be fully paid and nonassessable.

None of the execution, delivery and performance of this Agreement by the Company will conflict with the Company's Certificate of Incorporation or By-laws, as amended to date, or result in a breach of any terms or provisions of, or constitute a default under, any material contract, agreement or instrument to which the Company is a party or by which the Company is bound.

As of the date hereof and as of the Closing Date, the Company has approximately 75,636,419 shares issued and outstanding, and zero Company warrants and options as of the date of this agreement. In addition, Investor acknowledges that the current management shall be issued shares pursuant to the employee equity incentive plans that will cause dilution in the number of shares outstanding.

Except as set forth in the SEC Documents (defined below), the Company (a) has no material debts or obligations of any kind or nature whatsoever, secured or unsecured, contingent or absolute, present or past, or of any other kind; (b) has no material federal or state

income, withholding or other taxes due or owing; (c) has no material employment or other agreements, oral or written, presently in force; (d) has no legal proceedings, judgments or investigations pending, contemplated or threatened against or affecting it; (e) owes no material fees, salaries or expenses to any person or other entity; and (f) has never been involved in any bankruptcy, receivership or other such action.

| |

4.6.

|

Materials to be Supplied.

|

All materials supplied and to be supplied to the Investor by the Company are true, accurate and complete documents, including, but not limited to, the Certificate of Incorporation and By-laws of the Company, as amended to date, and any and all other documents.

(a) The Company acknowledges that true, accurate and complete copies of the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2024, and Quarterly Reports on Form 10-Q for the quarter ended June 30, 2024 (the “SEC Documents”) are on file at www.sec.gov. None of the SEC Documents nor any other form, statement, notice, report, or document filed by the Company with the SEC prior to the date hereof contained, as of their respective dates, any untrue statement of a material fact or omitted to state a material fact necessary in order to make the statements contained therein not misleading.

(b) The Company acknowledges that nothing has occurred with respect to which the Company would be required to file any report on Form 8-K. Between and until the Closing, the Company will provide to the Investor copies of any and all reports filed by the Company with the SEC and any and all reports or notices delivered to the stockholders of the Company concurrently with the filing or delivery thereof.

(c) The shares of the Common Stock are listed and traded on the NYSE-American.

| |

4.8.

|

Financial Statements.

|

The balance sheets, and statements of operations, cash flows and shareholders' equity contained in the SEC Documents have been prepared in accordance with generally accepted accounting principles applied on a basis consistent with prior periods (and, in the case of unaudited financial information, on a basis consistent with year-end audits). The financial statements included in the Company's Annual Report on Form 10-K filed with the SEC are as audited by, and include the related opinions of Manohar Chowdhry and Associates, the Company's current independent registered public accounting firm. The financial information included in the Company's Quarterly Reports on Form 10- Q filed with the SEC are unaudited but reflect all adjustments (including normally recurring accounts), which the Company considers necessary for a fair presentation of such information.

There is no fact relating to the Company that the Company has not disclosed to the Investor in writing which materially and adversely affects nor, insofar as the Company can now foresee, will materially and adversely affect, the condition (financial or otherwise) of the Company. No representation or warranty by the Company herein and no information disclosed in the disclosure schedules and exhibits hereto by the Company contains any untrue statement of a material fact or omits to state a material fact necessary to make the statements contained herein or therein not misleading.

Pursuant to exemptions, set out in the NYSE American company handbook, in no event shall the Company be obligated to issue a number of Shares under this Agreement equal to more than 19.9% of its outstanding shares of Common Stock, determined immediately prior to the Closing, and the Company agrees not to issue shares of Common Stock in any other related transaction or series of transactions (whether an additional financing or an acquisition transaction in consideration, in whole or part, for Common Stock) that would be integrated herewith and counted together so as to exceed such threshold.

| |

6.

|

Piggy-Back Registration Rights.

|

| |

6.1.

|

Participation in Registrations.

|

Subject to Section 6.2 and the other provisions of this Section 6, if the Company shall determine to register any Common Stock pursuant to the Securities Act, the Company will use its best efforts to include in such registration such number of Shares as it reasonably believes (or, if such offering shall be an underwritten public offering of securities, as the underwriter (the “Underwriter”) advises the Company in writing) can be sold in such offering without adversely affecting its (or the Underwriter's) ability to effect an orderly distribution of such securities (the “Registrable Shares”).

| |

6.2.

|

Underwritten Offerings.

|

In the event a registration giving rise to the Investor's rights pursuant to Section 6.1 relates to an underwritten offering of securities, the Investor's right to registration pursuant to Section shall be conditioned upon its (a) participation in such underwriting, (b) inclusion of the Registrable Shares therein and (c) execution of all Underwriting Documents requested by the Underwriter with respect thereto. In the event the Underwriter determines that the aggregate number of shares proposed for inclusion in such offering (the “Aggregate Amount”) exceeds the number of shares that it would be advisable to include in such offering (the “Recommended Amount”), the number of Registrable Shares may be reduced on a pro rata basis by the Company to the extent necessary to bring the Aggregate Amount down to the Recommended Amount.

The Company shall bear all of the expenses incurred in connection with an offering of the type described in this Section 6, including, without limitation, SEC filing fees and the fees (up to a maximum aggregate amount of $2,500) of separate counsel retained with respect thereto by the Investor.

The Company and the Investor will indemnify the other party hereto against all claims, losses, damages and liabilities (or actions in respect thereof) arising out of or based on any untrue statement (or alleged untrue statement) of a material fact contained in any prospectus or other document (including any related registration statement, notification or the like) incident to any registration of the type described in Section 6.1, or any omission (or alleged omission) to state in any such document a material fact required to be stated therein or necessary to make the statements therein not misleading, and will reimburse such indemnified party for any legal and any other expenses reasonably incurred in connection with investigating and defending any such claim, loss, damage, liability or action, provided that no party will be eligible for indemnification hereunder to the extent that any such claim, loss, damage, liability or expense arises out of or is based on any untrue statement or omission based upon written information furnished by such party for use in connection with such registration.

| |

6.5.

|

Cooperation by Holder.

|

The Investor shall furnish to the Company or the Underwriter, as applicable, such information regarding the Investor and the distribution proposed by it as the Company may reasonably request in connection with any registration or offering referred to in this Section 6. The Investor shall cooperate as reasonably requested by the Company in connection with the preparation of the registration statement with respect to such registration, and for so long as the Company is obligated to file and keep effective such registration statement, shall provide to the Company, in writing, for use in the registration statement, all such information regarding the Investor and its plan of distribution of the Shares included in such registration as may be reasonably necessary to enable the Company to prepare such registration statement, to maintain the currency and effectiveness thereof and otherwise to comply with all applicable requirements of law in connection therewith.

The Investor's rights pursuant to Section 6.1 shall not apply to any registrations on any registration form which does not permit secondary sales or does not include substantially the same information as would be required to be included in a registration statement covering the offering and sale of the Shares. Moreover, the rights described in Section 6.1 shall not be available to the Investor if, in the opinion of counsel to the Company, all of the Shares then held by the Investor could be sold without registration in a transaction complying with Rule 144 under the Securities Act.

| |

7.

|

Transfer Restrictions.

|

| |

7.1.

|

Securities Act Restrictions.

|

Notwithstanding anything to the contrary in this Agreement, the Investor shall not Transfer any of the Shares unless and until the Company has received an opinion of counsel reasonably satisfactory to it that the Shares may be sold pursuant to an exemption from registration under the Securities Act, the availability of which is established to the reasonable satisfaction of the Company, or a registration statement relating to the Shares has been filed by the Company and declared effective by the SEC.

| |

7.2.

|

Restrictions in Connection with Underwritten Offerings.

|

Notwithstanding anything to the contrary in this Agreement, the Investor shall not Transfer any of the Shares for such time before or following the effective date of a registration statement with respect to a public offering of securities of the Company as shall be reasonably requested by an underwriter of such securities and agreed to by the Company.

| |

7.3.

|

Non-Compliant Transfers.

|

Any Transfer or purported Transfer of Shares made in violation of the provisions of this Section 7 shall be null and void and without effect.

| |

8.

|

Conditions to Closing of the Investor.

|

The obligations of the Investor to affect the transactions contemplated by this Agreement are subject to the fulfillment at or prior to the Closing Date of the conditions listed below.

| |

8.1.

|

Representations and Warranties.

|

The representations and warranties made by the Company in Section 4 shall be true and correct in all material respects at the time of Closing as if made on and as of such date.

All authorizations, approvals or permits, if any, of any governmental authority or regulatory body that are required in connection with the lawful issuance of the Shares by the Company pursuant to this Agreement, shall have been duly obtained by the Company and shall be effective on and as of the Closing Date.

| |

8.3.

|

Corporate Proceedings.

|

All corporate and other proceedings required to be undertaken by the Company in connection with the transactions contemplated hereby shall have occurred, and all documents and instruments incident to such proceedings shall be reasonably satisfactory in substance and form to the Investors.

| |

9.

|

Conditions to Closing of the Company.

|

The obligations of the Company to effect the transactions contemplated by this Agreement are subject to the fulfillment at or prior to the Closing Date of the conditions listed below.

| |

9.1.

|

Representations and Warranties.

|

The representations and warranties made by the Investor in Section 3 shall be true and correct in all material respects at the time of Closing as if made on and as of such date.

| |

9.2.

|

Corporate Proceedings.

|

All corporate and other proceedings required to be undertaken by the Investor in connection with the transactions contemplated hereby shall have occurred, and all documents and instruments incident to such proceedings shall be reasonably satisfactory in substance and form to the Company.

All notices, requests, demands and other communications provided in connection with this Agreement shall be in writing and shall be deemed to have been duly given at the time when hand delivered, delivered by express courier, or sent by facsimile (with receipt confirmed by the sender's transmitting device) in accordance with the contact information provided below or such other contact information as the parties may have duly provided by notice.

The Company:

IGC Pharma, Inc.

10224, Falls Road

Potomac, Maryland 20854

Telephone: (301) 983-0998

Attention: Claudia Grimaldi, Vice President

cgrimaldi@igcpharma.com

With a copy to:

Olshan Frome Wolosky LLP

1325 Avenue of the Americas

New York, New York 10019

Telephone: (212) 451-2300

Attention: Kenneth Schlesinger, Esq.

KSchlesinger@olshanlaw.com

The Investor:

As per the contact information provided in Exhibit B.

| |

10.2.

|

Survival of Representations and Warranties.

|

Each party hereto covenants and agrees that the representations and warranties of such party contained in this Agreement shall survive (a) any investigation made by the Company or the Investor and (b) the Closing.

This Agreement contains the entire agreement between the parties hereto in respect of the subject matter contained herein and supersedes all prior agreements and understandings of the parties, oral and written, with respect to the subject matter contained herein.

This Agreement, and the rights and obligations of a party hereunder, may not be assigned or Transferred by the Investor without the prior written consent of the Company.

| |

10.5.

|

Binding Effect; Benefits.

|

This Agreement and all the provisions hereof shall be binding upon and inure to the benefit of the parties hereto and their respective successors and permitted assigns; nothing in this Agreement, expressed or implied, is intended to confer on any persons other than the parties hereto, or their respective successors and permitted assigns, any rights, remedies, obligations or liabilities under or by reason of this Agreement.

| |

10.6.

|

Amendment; Waivers.

|

All modifications or amendments to this Agreement shall require the written consent of the Company and the Investor. No waiver of any breach, noncompliance or nonfulfillment of any of the provisions of this Agreement shall be effective unless set forth in a written instrument executed by the party against whom such waiver is sought; and no waiver of any such breach, noncompliance or nonfulfillment shall be construed to be a waiver of any other or subsequent breach, noncompliance or nonfulfillment.

| |

10.7.

|

Applicable Law; Disputes.

|

This Agreement shall be governed by and construed in accordance with the laws of the State of New York without giving effect to the conflict of law provisions thereof, and the parties hereto irrevocably submit to the exclusive jurisdiction of the United States District Court for the Southern District of New York, or, if jurisdiction in such court is lacking, the Supreme Court of the State of New York, New York County, in respect of any dispute or matter arising out of or connected with this Agreement.

| |

10.8.

|

Further Assurances.

|

Each party hereto shall do and perform or cause to be done and performed all such further acts, and shall execute and deliver all such other agreements, certificates, instruments and documents, as any other party hereto reasonably may request in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

This Agreement may be executed in any number of counterparts, each of which shall be deemed to be an original and all of which taken together shall constitute one and the same instrument.

SIGNATURE PAGE FOLLOWS

IN WITNESS WHEREOF, each of the Company and the Investor has caused this Agreement to be executed as of the date below.

|

For IGC Pharma, Inc.

|

For Investor(s) as set out in Exhibit B.

|

| |

|

| |

|

|

/s/ Claudia Grimaldi

|

/s/ James Moran

|

| |

|

|

Claudia Grimaldi

|

Name: James Moran

|

|

Vice President & CCO

|

Authorized Signatory

|

| |

|

| |

|

|

Date: September 25, 2024

|

Date: September 25, 2024

|

EXHIBIT A

|

Consideration

|

$200,000

|

|

Purchase price (previous day market price)

|

$0.34

|

|

Total of the Shares to be delivered

|

588,235

|

Wire transfer information for “The Consideration”

|

Name of Bank

|

|

|

Address

|

|

|

Phone number of Bank

|

|

|

Name of Account Address of Company

|

IGC Pharma, Inc.

10224 Falls Road, Potomac, MD 20854

|

|

Account number

|

|

|

Swift Code

|

|

|

Purpose of wire

|

Share subscription

|

EXHIBIT B

|

Name of Investor:

|

Moran Global Strategies, Inc. (MGS)

|

|

Address of Investor:

|

1023 Queen St., Alexandria, VA 22314

|

|

Authorized Signatory name:

|

James Moran

|

|

USA Passport Number:

|

|

v3.24.3

Document And Entity Information

|

Sep. 25, 2024 |

| Document Information Line Items |

|

| Entity Registrant Name |

IGC PHARMA, INC.

|

| Trading Symbol |

IGC

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001326205

|

| Document Period End Date |

Sep. 25, 2024

|

| Entity Emerging Growth Company |

false

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-32830

|

| Entity Tax Identification Number |

20-2760393

|

| Entity Address, Address Line One |

10024 Falls Road,

|

| Entity Address, City or Town |

Potomac

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20859

|

| City Area Code |

(301)

|

| Local Phone Number |

983-0998

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $.0001 par value

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

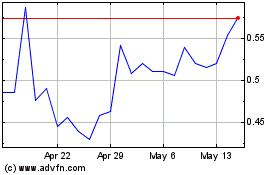

IGC Pharma (AMEX:IGC)

Historical Stock Chart

From Nov 2024 to Dec 2024

IGC Pharma (AMEX:IGC)

Historical Stock Chart

From Dec 2023 to Dec 2024