Most commodity producers have had a pretty forgettable start to

2013. Weakness in China, a strong dollar, and sluggish industrial

production figures across the globe have combined to send many

mineral and natural resource prices to fresh lows in the past few

weeks.

While most investors have been focused in on producers of gold,

silver, and industrial metals, we have also seen some wild trading

in the often-overlooked rare earth metal market. This corner of the

mining world, which focuses on the lanthanides on the periodic

table (along with scandium and yttrium), is vital for a number of

industrial uses ranging from hybrid cars and high tech consumer

gadgets, to aerospace components, lasers, and magnets.

Yet despite the crucial nature of many of the commodities on

this list, the prices for rare earths have been quite sluggish.

Readings of rare earth metal price indexes have fallen sharply in

the past few months, and almost 50% over the past year, suggesting

that this volatile space has been a big loser from the slowdown in

key areas and a poor commodity outlook.

Turnaround at hand?

While there has been some rough trading in the space, investors

have seen a bit of a reversal in the past few days thanks to a key

earnings report from Molycorp (MCP). This

important miner handily beat expectations for its latest earnings

release, posting a loss of 15 cents a share, well above estimates

which called for a 46 cent per share loss for the firm (read What

Happened to the Rare Earth Metal ETF?).

In addition to this beat, investors also keyed in on some upbeat

statements from MCP’s management which suggested that better days

could be ahead for not only the company, but the rare earth metal

industry at large. Molycorp President and CEO stated that

‘customers appear to be working down inventories that were built up

in 2011 and 2012 and we are starting to return to more normal

purchasing patterns.’

This statement along with the earnings report helped to push MCP

shares up by double digits in the immediate following session, and

it had a similar impact on other names in the industry as well. So

perhaps investors might finally be seeing the bottom in the rare

earth space, at least for the short-term.

ETF Angle

If you want a broader play on the industry, it could be worth it

to take a look at the only ETF targeting the market, the

Market Vectors Rare Earth/Strategic Metals ETF

(REMX). This fund doesn’t invest in the rare earth metals

themselves but instead focuses on key miners of these strategic

products, giving investors exposure to the industry via that route

(see Time to Buy this Precious Metal ETF?).

Through the first four months of the year, REMX was having a

pretty rough time on solid levels of volume. The ETF lost about a

quarter of its value in the timeframe, marking a pretty horrendous

stretch for a fund that saw relatively decent trading through much

of 2012.

In the past few days though, the fund has added significantly

boosted by a stronger industrial outlook, and of course MCP’s rosy

forecast. Now, REMX is up over 5% in the past five days, and this

includes a modest loss in the Monday trading session.

Why an ETF for Rare Earth Metals?

Some investors might think that a play on MCP alone is the way

to target the industry, especially given its beat for the most

recent quarter. However, this fails to take into account the longer

term trends, as MCP has greatly underperformed REMX over the past

one year period.

Given this and the incredibly rocky trading in the space, an ETF

approach could be a better idea to at least limit the significant

risks in the industry. The fund holds about two dozen companies

from around the globe and it doesn’t put more than 9% in any single

company, so firm specific risks are pretty much diversified away

(also see Rare Earth Metal ETF Jumps on WTO Tensions).

Furthermore, the country profile for REMX suggests that there is

great diversity in the holdings and this cannot be achieved by

average investor on their own. For example, just about a quarter of

the fund is in North American companies, with big chunks going to

Australian, Japanese, and Chinese firms instead.

While this approach may help to reduce some risks, it is worth

noting that the product is likely to see significant volatility as

well. Large caps account for just 6% of assets, while small cap

firms make up nearly 80%, so big swings should be expected (read

Why I Hate Volatility ETFs and Why You Should Too).

Bottom Line

Still, for investors who believe that the rare earth metal space

has bottomed, and especially after the recent MCP leadership

comments, REMX is an excellent choice. The fund is likely to

experience big swings no matter what happens in the future though,

so make sure you have a strong stomach before betting on this

volatile market in the summer months.

However, given the beaten down nature of the segment, many names

could be presenting themselves as a decent value at this time. We

will have to see if the rest of the space can continue the trend

though, and get rare earth metals back on track heading into what

looks to be a crucial stretch for the industry as it struggles to

return to prominence this year.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

MOLYCORP INC (MCP): Free Stock Analysis Report

MKT VEC-RAR ERT (REMX): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

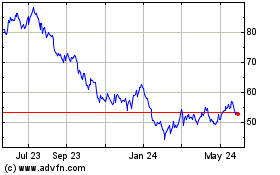

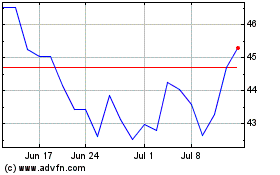

VanEck Rare Earth and St... (AMEX:REMX)

Historical Stock Chart

From Jan 2025 to Feb 2025

VanEck Rare Earth and St... (AMEX:REMX)

Historical Stock Chart

From Feb 2024 to Feb 2025