Amplify ETFs Announces the BlackSwan Growth & Treasury Core ETF (SWAN) Has Surpassed $250M in Assets

April 28 2020 - 5:00AM

Business Wire

Fund has delivered in both risk-off and risk-on

environments

Amplify ETFs has announced the BlackSwan Growth & Treasury

Core ETF (NYSE: SWAN) has surpassed $250 million in assets under

management, as it has continued to buffer against significant

losses while seeking uncapped upside to the S&P 500 Index. The

Fund has generated a positive total return of 3.85% year-to-date

(as of 4/24/20), outperforming the S&P 500 Total Return Index

by 15.51% amid significant market volatility in 2020.

“This year investors have been grappling with unprecedented

uncertainty in equity markets due to the growing impact of the

COVID-19 outbreak,” said Christian Magoon, Founder and CEO of

Amplify ETFs. “SWAN has delivered what it was designed to do during

choppy equity markets: help investors mitigate significant losses.

While the BlackSwan ETF’s 22.03% return in 2019 showed the

strategy’s upside potential in positive equity markets, SWAN’s

performance this year demonstrates its downside protection.”

SWAN is a low-cost, simple and powerful strategy comprised of

two inversely-correlated asset classes: U.S. Treasury securities

and S&P 500 long-term call options.

To learn more about SWAN, visit the ETF’s website.

About Amplify ETFs Amplify believes the ETF structure

empowers investors through efficiency, transparency and

flexibility. Since its first ETF launch in 2016, Amplify has sought

to build ETFs powered by investment strategies from leading index

providers and asset managers within unique market segments.

The outbreak of COVID-19 has negatively affected the worldwide

economy, individual countries, individual companies and the market

in general. The future impact of COVID-19 is currently unknown, and

it may exacerbate other risks that apply to the Fund.

Past performance does not guarantee future results. Short-term

performance may often reflect conditions that are likely not

sustainable, and thus such performance may not be repeated in the

future.

SWAN Performance Quarter End as of 3/31/20

Cumulative (%)

Annualized (%)

1 Mo.

3 Mo.

6 Mo.

YTD

Since Inception

(11/6/18)

1 Yr.

Since Inception

(11/6/18)

Fund NAV

-1.38%

0.06%

3.81%

0.06%

19.27%

12.87%

13.41%

Closing Price

-1.02%

0.36%

3.80%

0.36%

20.01%

13.14%

13.92%

S&P 500 TR Index

-12.35%

-19.60%

-12.31%

-19.60%

-2.83%

-6.98%

-2.03%

Fund Inception Date: 11/6/2018

The performance data quoted represents past performance. Past

performance does not guarantee future results. The investment

return and principal value of an investment will fluctuate so that

an investor's shares, when sold or redeemed, may be worth more or

less than their original cost and current performance may be lower

or higher than the performance quoted. Short-term performance, in

particular, is not a good indication of the fund’s future

performance, and an investment should not be made based solely on

returns. For performance data current to the most recent month-end

please call 855-267-3837. Brokerage commissions will reduce

returns. The Fund’s gross expense ratio is 0.49%

The Fund’s investment objective and strategy differs

substantially from the market indices, which are included for

comparison purposes only.

The Standard & Poor's (S&P) 500 Total Return Index is an

unmanaged, market-capitalization-weighted index of the 500 largest

U.S. publicly traded companies by market value, and assumes

distributions are reinvested back into the index. It does not

include fees or expenses. It is not possible to invest directly in

an index. The S&P 500 is a registered trademark of Standard

& Poor’s Financial Services LLC, a subsidiary of The

McGraw-Hill Companies, Inc.

Carefully consider the Fund’s investment objectives, risk

factors, charges and expenses before investing. This and additional

information can be found in the Funds’ statutory and summary

prospectus, which may be obtained by calling 855-267-3837 or by

visiting AmplifyETFs.com. Read the prospectus carefully before

investing.

Investing involves risk, including the possible loss of

principal. Shares of any ETF are bought and sold at market price

(not NAV), may trade at a discount or premium to NAV and are not

individually redeemed from the Fund. The Fund's return may not

match or achieve a high degree of correlation with the return of

the underlying Index. To the extent the Fund utilizes a sampling

approach, it may experience tracking error to a greater extent than

if the Fund had sought to replicate the Index. The use of

derivative instruments, such as options contracts, can lead to

losses because of adverse movements in the price or value of the

underlying asset, index or rate, which may be magnified by certain

features of the derivatives. Investing in options, including LEAP

Options, and other instruments with option-type elements may

increase the volatility and/or transaction expenses of the Fund. An

option may expire without value, resulting in a loss of the Fund’s

initial investment and may be less liquid and more volatile than an

investment in the underlying securities. Investments in debt

securities typically decrease in value when interest rates rise.

This risk is usually greater for longer-term debt securities. The

Fund is non-diversified, meaning it may concentrate its assets in

fewer individual holdings than a diversified fund.

Diversification does not assure a profit or protect against a

loss in a declining market.

Amplify ETFs are distributed by Foreside Fund Services, LLC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200428005222/en/

Sales Contact: Amplify ETFs 855-267-3837 info@amplifyetfs.com or

Media Contact: Gregory FCA for Amplify ETFs Caitlyn Foster,

610-228-2056 amplifyetfs@gregoryfca.com

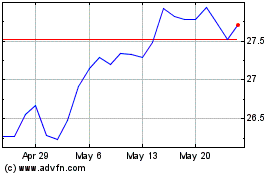

Amplify Blackswan Growth... (AMEX:SWAN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Amplify Blackswan Growth... (AMEX:SWAN)

Historical Stock Chart

From Jan 2024 to Jan 2025