TIDMBEG

Begbies Traynor Group PLC

22 January 2024

More than 47,000 UK businesses start 2024 on the edge of

collapse after critical financial distress jumps over 25% again

-- The levels of 'critical' financial distress jumped

dramatically in Q4 2023, up 25.9% on the prior quarter (Q3 2023:

37,772), leaving more than 47,000 businesses near collapse in the

UK at the start of 2024.

-- This represents the second consecutive period where critical

financial distress has grown by around a quarter.

-- 539,900 UK businesses are now in 'significant' financial

distress, 12.9% higher than Q3 2023 and 5.6% higher yoy (Q4 2022:

511,093).

-- Every sector of the 22 covered by Red Flag Alert saw critical

financial distress increase on the prior period, of the 22, 18 saw

at least double-digit growth.

-- In Q4 2023, critical financial distress grew rapidly in the

Construction (+32.6%), Health & Education (+41.3%), Real Estate

& Property Services (+24.7%) and Support Services (+23.6%)

sectors.

-- Serious concerns grow over the Construction and Real Estate

sectors which still represent nearly 30% of all businesses in

critical financial distress.

As we start 2024, the latest Begbies Traynor "Red Flag Alert"

report, which has provided a snapshot of British corporate health

for over 15 years, highlights the speed at which critical financial

distress is growing in the UK after the second consecutive quarter

of c.25% growth.

The rapid growth across every sector in the economy means 47,477

businesses are starting the new year in a precarious financial

position. Historically, a significant percentage of the businesses

identified by Red Flag Alert as being in critical financial

distress will enter insolvency over the course of the next

year.

Across every sector monitored by Red Flag Alert, the levels of

critical financial distress grew quarter-on-quarter in Q4 2023,

highlighting how the current economic backdrop is having a

detrimental impact on every corner of the UK economy. The key

sectors driving this increase continue to be the Construction, Real

Estate & Property and Support Services sectors, up 32.6%, 24.7%

and 23.6% respectively, alongside Health & Education

(+41.3%).

This worrying picture for UK businesses can also be seen in the

growing number of businesses in significant financial distress, up

nearly 13% in Q4 2023 versus the prior quarter. As at 31 December

2023, well over half a million companies (539,900) were affected.

The sectors driving this increase were Construction (+15.3%),

Health & Education (+19.2%), Real Estate & Property

Services (+21.3%) and Support Services (+9.1%).

Julie Palmer, Partner at Begbies Traynor, said: "After a

difficult year for British businesses that was characterised by

high interest rates, rampant inflation, weak consumer confidence

and rising and unpredictable input costs, we are now seeing this

perfect storm impacting every corner of the economy.

"Now that the era of cheap money is firmly a thing of the past,

hundreds of thousands of businesses in the UK, who loaded up on

affordable debt during those halcyon days, are now coming to terms

with the added burden this will have on their finances.

"For some, a better-than-expected Christmas may kick these

concerns down the road for a little longer, but the rapid growth in

the levels of critical financial distress point to an economy that

is waking up to the danger of debt ladened businesses in a higher

rates environment.

"As we saw in the previous quarter, the strain being placed on

companies has extended well beyond the consumer facing businesses

with bellwether sectors, like construction and real estate, now in

serious jeopardy as over 15,000 businesses face high risk of

failure.

"Sadly, for tens of thousands of British businesses who should

be looking ahead to 2024 with some degree of optimism, the new year

will bring a fight for survival as the debt storm that has been

brewing for years looks like it is breaking across the

country."

Ric Traynor, Executive Chairman of Begbies Traynor, commented:

"As we start the new year, the UK economy is in a difficult

position after a challenging 12 months for British businesses who

had to grapple with a number of unrelenting macro-economic

pressures that made the lives of business leaders difficult.

"As a result, we are seeing insolvency rates starting to

accelerate in the UK and our own empirical data highlights how this

trend is likely to speed up in 2024 as the environment takes its

toll on businesses.

"Later this year, we could see some respite for companies as

inflation looks like it may reach more palatable levels which in

turn should result in interest rates starting to climb down from

current heightened levels.

"Unfortunately, there are no signs of an easy fix and, with

geo-political uncertainty continuing to rise and a hike in the

national wage around the corner, the backdrop is hardly improving

for an economy that is still firmly in recovery mode

post-pandemic.

"For many businesses, I fear soldiering on in this environment

will prove to be one step too far and I expect thousands of

debt-laden businesses to start to fail this year."

Top 10 Sector Ranking - Critical Top 10 Sector Ranking - Significant

Financial Financial

Distress (Number of Companies Distress (Number of Companies

in Critical Financial Distress) in Significant Financial Distress)

1. Construction (7,849) 1. Construction (83,332)

2. Support Services (7,096) 2. Support Services (82,431)

3. Real Estate & Property Services 3. Real Estate & Property Services

(6,228) (62,176)

4. Professional Services (4,347) 4. Professional Services (51,412)

5. General Retailers (3,133) 5. Health & Education (35,979)

6. Telecommunications & Information 6. Telecommunications & Information

Technology (2,830) Technology (35,475)

7. Health & Education (2,719) 7. General Retailers (33,622)

8. Media (1,828) 8. Media (21,247)

9. Financial Services (1,373) 9. Financial Services (17,180)

10. Food & Drug Retailers (1,343) 10. Leisure & Cultural Activities

(14,983)

Critical Distress by Region Significant Distress by R egion

1. London (14,221) 1. London (154,312)

2. South East (7,884) 2. South East (92,819)

3. Midlands (5,696) 3. Midlands (66,389)

4. North West (4,951) 4. North West (55,928)

5. Yorkshire (3,303) 5. South West (39,618)

6. South West (3,271) 6. Yorkshire (37,133)

7. East of England (2,960) 7. East of England (34,307)

8. Scotland (2,245) 8. Scotland (26,082)

9. Wales (1,360) 9. Wales (14,591)

10. North East (836) 10. North East (9,577)

11. Northern Ireland (747) 11. Northern Ireland (9,069)

12. Misc (3) 12. Misc (75)

--S--

For further information, contact:

MHP Communications: 07595 461 231

Katie Hunt Charles Hirst Matthew 07827 662 831

Taylor BegbiesCorporate@mhpgroup.com

Notes to Editors

About Red Flag Alert

Red Flag Alert has been measuring and reporting corporate

financial distress since 2004. It has become a benchmark on the

underlying health of companies across every sector and region of

the UK.

Red Flag Alert's algorithm measures corporate distress signals,

drawing on company accounts and factual, legal and financial data

from a wide range of relevant sources, including intelligence from

the UK's leading insolvency business, Begbies Traynor. The

algorithm was refreshed in H1 2023 to enhance the risk factors

analysed in the data. The reported results have been backdated to

ensure the consistency of comparative data.

Algorithms which drive Red Flag Alert have been improved and

updated for the latest report, with companies now measured against

a new scorecard of indicators to give greater insight and accuracy

into the health of businesses. Two years of work by data scientists

analysing eight years of data, taking into consideration pre,

during and post-pandemic insights to find signals and patterns

indicating businesses in distress, combined with AI tools, means

that Red Flag Alert aims soon to be able to predict how many

companies in trouble will go on to fail.

The release refers to the number of companies experiencing

"Significant" or "Critical" problems, which are those that have

been identified by Red Flag Alert's proprietary credit risk scoring

system which screens companies for a sustained or marked

deterioration in key financial ratios and indicators including

those measuring working capital, contingent liabilities, retained

profits and net worth.

Red Flag Alert is commercially available to all businesses, on

an annual subscription basis, to help them better understand risk

and exposure and help subscribers to plan for the future. Further

information about Red Flag Alert can be found at:

www.redflagalert.com

Economically active businesses exclude those that are flagged by

Companies House as being, Non-trading, Listed for Strike off /

Strike off pending, Insolvent or Dissolved. Companies where there

is insufficient information available for RFA to assign a health

rating are also excluded.

About Begbies Traynor Group plc

Begbies Traynor Group plc is a leading professional services

consultancy, providing services from a comprehensive network of UK

and off-shore locations. Our professional team include licensed

insolvency practitioners, accountants, chartered surveyors, bankers

and lawyers. We provide the following services to our client base

of corporates, financial institutions, the investment community and

the professional community:

-- Insolvency

o Corporate and personal insolvency

-- Financial advisory

o Business and financial restructuring; debt advisory; forensic

accounting and investigations

-- Transactional support

o Corporate finance; business sales agency; property agency;

auctions

-- Funding

o Commercial finance broking; residential mortgage broking

-- Valuations

o Commercial property, business and asset valuations

-- Projects and development support

o Building consultancy; transport planning

-- Asset management and insurance

o Commercial property management; insurance broking; vacant

property risk management

Further information can be accessed via the group's website at

www.begbies-traynorgroup.com

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAVFLFLZFLZBBD

(END) Dow Jones Newswires

January 22, 2024 02:00 ET (07:00 GMT)

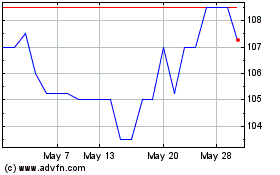

Begbies Traynor (AQSE:BEG.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Begbies Traynor (AQSE:BEG.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024