Duke Royalty Limited Trading Update (2549B)

June 01 2023 - 1:00AM

UK Regulatory

TIDMDUKE

RNS Number : 2549B

Duke Royalty Limited

01 June 2023

1 June 2023

Duke Royalty Limited

("Duke Royalty", "Duke" or the "Company")

Trading Update

Duke Royalty, a provider of alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and North America, is pleased to provide the following

trading and operational update for its fourth financial quarter

ending 31 March 2023 ("Q4 FY23") as well as guidance on trading for

its first quarter of financial year 2024, ending 30 June 2023 ("Q1

FY24").

Financial Highlights:

-- Recurring cash revenue for Q4 FY23 reached a new record of

GBP5.7 million, an increase of 21% over Q4 FY22, and an increase on

the prior quarter Q3 FY23

-- Q4 FY23 total cash revenue was GBP5.8 million

-- 0.70p interim dividend paid out in January 2023

Overview of quarterly revenue growth:

Recurring Cash Revenue* Total Cash Revenue**

Q4 FY22 GBP4.7 million GBP6.7 million

------------------------ ---------------------

Q1 FY23 GBP5.1 million GBP5.1 million

------------------------ ---------------------

Q2 FY23 GBP5.3 million GBP5.3 million

------------------------ ---------------------

Q3 FY23 GBP5.6 million GBP5.6 million

------------------------ ---------------------

Q4 FY23 GBP5.7 million GBP5.8 million

------------------------ ---------------------

* Recurring cash revenue excludes buyback premium receipts and

cash gains from equity sales

** Total cash revenue is monthly cash distributions from Duke's

royalty partners plus cash gains received from the sales of equity

assets and buyback premiums

Operational Highlights:

-- During the quarter, Duke closed and drew down on the credit

facility with Fairfax Financial Holdings Limited. The new credit

facility is a 225 bps improvement in interest cost alongside an

increase in the facility size to GBP100 million, replacing Duke's

previous GBP55 million term and revolving facilities

-- In Q4 FY23 Duke completed a new US$8.75 million royalty

investment into Instor Solutions, Inc. a California-based product

reseller and service provider for work related to the build-out and

migration of data centres

-- Duke also made a follow-on investment of GBP1.75 million into

its existing royalty partner, InTec Business Solutions Limited

("Intec"), to facilitate InTec's acquisition of Frog IT Services

Limited, a profitable specialist provider of IT support and

cloud-based services to small and medium sized customer

Financial Forecast for Q1 FY24:

-- Based on current trading, Duke expects to achieve recurring

cash revenue of GBP6.0 million in Q1 FY24, delivering an average

monthly revenue of GBP2.0 million for the first time in the

Company's history, a significant milestone

-- The GBP6.0 million of cash revenue would represent an 18%

year on year increase (Q1 FY23: GBP5.1 million) and an increase on

Q4 FY23

Neil Johnson, CEO of Duke Royalty, said:

"We are pleased to announce yet another quarter of strong

financial performance and another interim dividend for our

shareholders, despite the macroeconomic uncertainties. We continue

to maintain a close relationship with our portfolio companies and

are reassured of their resilience to trading in challenging market

conditions.

"With the forthcoming quarter looking robust in terms of

recurring cash revenue, we have confidence in continuing to deliver

in the months to come and our pipeline remains strong. The current

climate serves to accentuate the attractive qualities of royalty

finance, and our supportive model has demonstrated its ability to

help partners weather macroeconomic turbulence."

***ENDS***

For further information, please visit www.dukeroyalty.com or

contact:

Neil Johnson / Charles

Cannon Brookes / Hugo

Duke Royalty Limited Evans +44 (0) 1481 730 613

Cenkos Securities

plc

(Nominated Adviser Stephen Keys / Callum

and Joint Broker) Davidson / Michael Johnson +44 (0) 207 397 8900

Canaccord Genuity

(Joint Broker) Adam James / Harry Rees +44 (0) 207 523 8000

SEC Newgate (PR) Elisabeth Cowell / Alice +44 (0) 20 3757 6882

Cho / Matthew Elliott dukeroyalty@secnewgate.co.uk

About Duke Royalty

Duke Royalty Limited provides alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and abroad. Duke Royalty's experienced team provide

financing solutions to private companies that are in need of

capital but whose owners wish to maintain equity control of their

business. Duke Royalty's royalty investments are intended to

provide robust, stable, long term returns to its shareholders. Duke

Royalty is listed on the AIM market under the ticker DUKE and is

headquartered in Guernsey.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFLAEIILVIV

(END) Dow Jones Newswires

June 01, 2023 02:00 ET (06:00 GMT)

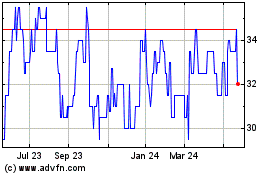

Duke Capital (AQSE:DUKE.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

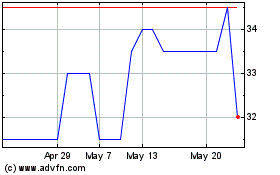

Duke Capital (AQSE:DUKE.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025