TIDMEVA

For a PDF version of the announcement please click here: https://

mma.prnewswire.com/media/1571448/Preliminary_Financial_Results_2020.pdf

THE DIRECTORS OF EVRIMA PLC CONSIDER THIS ANNOUNCEMENT TO CONTAIN INSIDE

INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF REGULATION (EU) NO. 594/2014 OF

THE EUROPEAN PARLIAMENT AND THE COUNCIL OF 16 APRIL 2014 ON MARKET ABUSE AS IT

FORMS PART OF RETAINED EU LAW AS DEFINED IN THE EUROPEAN UNION (WITHDRAWAL) ACT

2018. BY PUBLICATION OF THIS ANNOUNCEMENT, THE INFORMATION SET OUT WITHIN IT IS

DEEMED NOW TO BE IN THE PUBLIC DOMAIN.

Evrima plc

AQSE: EVA

("Evrima" or the "Company"; formerly Sport Capital Group plc)

Preliminary Financial Results for the Year Ended 31st December 2020

Chairman's Statement

The Company presents below its preliminary results for the year from 1st

January to 31st December 2020 ("Pleliminary Results") as presaged in the

regulatory announcement issued on 5th July 2021. It is emphasised that the

financial statements appearing below are unaudited and that the audited

financial statements for the same period which the Directors anticipate

announcing later this month ("Final Results") are accordingly liable to

possible changes from the Preliminary Results presented today. Publication of

the Preliminary Results as set out in the financial statements which follow has

been approved by Evrima's statutory auditors, PKF Littlejohn LLP, whose

appointment to their role the Company announced on 23rd April 2021.

The Preliminary Results presented today have been prepared on same basis and

applying the same accounting principles and conventions as were the financial

results for the year 1st January to 31st December 2019 with which they are

compared, for earlier finacial reporting periods, the unaudited interim

financial statements for the interm period to 30th June 2020 and as will be

applied to the forthcoming Final Results

Financial Highlights

The loss for the year after taxation was £(207,745) (2019: £(63,171)) resulting

in a basic loss per share of (0.18) pence (2019: (0.053) pence) and a diluted

loss per share of (0.17) pence (2019: (0.050) pence). Cash at bank at the end

of December 2019 was £163,607 (2019: £11,845) and shareholders' funds stood at

£461,138 (2019: £206,483).

Reasons for the Delay in Publication of the Final Results

In the course of their work on the year ended 31st December 2020, the auditors

became aware of certain items in the past years' statutory accounts, the

previous accounting treatment of which could, in the auditors' view, require

minor adjustments to be made to those prior years' accounts. Readers' attebtion

is drawn to Note 9 headed "Prior Year Adjustment" of the selected notes to the

unaudited financial statements for the year ended 31 December 2020 below. The

Directors wish to state that, to the best of their knowledge and belief, any

prior year adjustements are of a character to affect neithet or the Company's

cash position as it is shown in the Preliminary Results for last year appearing

below nor its future ability to implement its investment strategy; nor lead to

any emphasis of matter, modification or qualification of the auditors' opinion

when the audit is finaised and the Final Results in respect of the year ended

31st Decmber 2020 are published.

When the Final Results are announced and the Annual Report containing the

Company's statutory accounts is posted to shareholders, these will contain the

customary report on financial 2020, a strategic review of the last financial

year, a discussion of significant post- balance sheet developments (most of

which latter will have been the subject of earlier regulatory announcements by

the Company) and the Directors' outlook for the remainder of the current

financial year.

Simon Grant-Rennick,

Executive Chairman,

11th July 2021

Unaudited Statement of Comprehensive Income

for the year ended 31 December 2020

Unaudited

2020

2019

as

restated

Notes £

£

TURNOVER

20,141

20,180

Cost of

sales

-

(348)

GROSS

PROFIT

20,141

19,832

Administrative

expenses

(256,075)

(62,120)

OPERATING LOSS

5 (235,934)

(42,288)

Gain/loss on revaluation of investments 69,769 -

(166,165)

(42,288)

Interest payable and similar 6 (5,959) (10,000)

expenses

LOSS BEFORE TAXATION (172,124) (52,288)

Tax on loss

7 (35,621)

(10,883)

LOSS FOR THE FINANCIAL YEAR (207,745) (63,171)

OTHER COMPREHENSIVE

INCOME

-

-

TOTAL COMPREHENSIVE INCOME FOR

THE YEAR (207,745) (63,171)

Earnings per share expressed

in pence per share: 8

Basic

-0.18

-0.05

Diluted

-0.17

-0.05

Unaudited Statement of Financial Position

31 December 2020

Unaudited

2020

2019

2018

as

restated

Notes £

£

£

FIXED ASSETS

Investments

10

344,976

65,250

57,410

Investment property

11

-

204,436

204,436

344,976

269,686

261,846

CURRENT ASSETS

Debtors

12

68,895

40,214

50,203

Cash at

bank

163,607

11,845

9,776

232,502

52,059

59,979

CREDITORS

Amounts falling due within 13 (116,340) (115,262) (116,171)

one year

NET CURRENT ASSETS/(LIABILITIES)

116,162

(63,203)

(56,192)

TOTAL ASSETS LESS CURRENT

LIABILITIES 461,138 206,483 205,654

NET

ASSETS

461,138

206,483

205,654

CAPITAL AND RESERVES

Called up share capital

15

229,668

119,234

97,990

Share premium

16

673,448

321,482

293,726

Other reserves

16

24,000

24,000 9,000

Retained earnings

16 (465,978)

(258,233)

(195,062)

SHAREHOLDERS'

FUNDS

461,138

206,483

205,654

The preliminary financial statements were approved by the Board of Directors

and authorised for issue on 11th July 2021 and were signed on its behalf by:

..........................................................................

Mr S R Grant-Rennick - Director

Unaudited Statement of Changes in Equity

for the year ended 31 December 2020

Called up

share Retained Share Other Total

capital earnings premium reserves equity

£ £ £ £

£

Balance at 1 January 2019

97,990 (195,062) 293,726 9,000 205,654

Changes in equity

Deficit for the year

-

(54,171)

-

- (54,171)

Other comprehensive income

-

-

-

15,000 15,000

Total comprehensive income

-

(54,171)

-

15,000 (39,171)

Issue of share capital

21,244

-

27,756

-

49,000

Balance at 31 December 2019

119,234 (249,233) 321,482 24,000 215,483

Prior year adjustment

-

(9,000)

-

- (9,000)

As restated

119,234 (258,233) 321,482 24,000 206,483

Changes in equity

Deficit for the year

-

(207,745)

-

- (207,745)

Total comprehensive income

-

(207,745)

-

- (207,745)

Issue of share capital

110,434

-

351,966

- 462,400

Balance at 31 December 2020

229,668 (465,978) 673,448 24,000 461,138

Unaudited Statement of Cash Flows

for the year ended 31 December 2020

Unaudited

2020

2019

as

restated

Notes £

£

Cash flows from operating activities

Cash generated from operations

1 (294,522)

(44,091)

Interest

paid

(5,959)

(10,000)

Net cash from operating

activities

(300,481)

(54,091)

Cash flows from investing activities

Purchase of fixed asset

investments

(71,957)

(7,840)

Sale of investment

property

200,000

-

Net cash from investing

activities

128,043

(7,840)

Cash flows from financing activities

Share

issue

324,200

64,000

Net cash from financing

activities

324,200

64,000

Increase in cash and cash equivalents 151,762 2,069

Cash and cash equivalents at

beginning of year 2 11,845 9,776

Cash and cash equivalents at 2 163,607 11,845

end of year

Notes to the Unaudited Statement of Cash Flows

for the year ended 31 December 2020

1. RECONCILIATION OF LOSS BEFORE TAXATION TO CASH GENERATED FROM

OPERATIONS

Unaudited

2020

2019

as

restated

£

£

Loss before taxation (172,124)

(52,288)

Loss on disposal of fixed assets

4,436 -

Gain on revaluation of fixed assets (69,769)

-

Accrued (income)/expenses

91,198 (9,372)

Finance costs

5,959 10,000

(140,300)

(51,660)

Increase in trade and other debtors (64,302)

(894)

(Decrease)/increase in trade and other creditors

(89,920) 8,463

Cash generated from operations (294,522) (44,091)

2. CASH AND CASH EQUIVALENTS

The amounts disclosed on the Statement of Cash Flows in respect of cash and

cash equivalents are in respect of these Statement of Financial Position

amounts:

Year ended 31 December 2020

31/

12/

20

1/1/20

£

£

Cash and cash equivalents

163,607 11,845

Year ended 31 December 2019

31

/12/

19

1/1/19

as

restated

£

£

Cash and cash equivalents

11,845 9,776

3. ANALYSIS OF CHANGES IN NET FUNDS

At 1/1/20

Cash flow At 31/12/20

£

£

£

Net cash

Cash at bank 11,845

151,762 163,607

11,845

151,762

163,607

Total 11,845

151,762 163,607

9. PRIOR YEAR ADJUSTMENT

The 2019 statement of financial position has been restated due to reserve

balances being incorrectly allocated and also certain costs being omitted from

prior year accounts. A third balance sheet is presented as the error occurred

solely in the prior period and affects that year only.

The Directors of the Company, who have issued this RIS announcement after due

and careful enquiry, accept responsibility for its content.

Enquiries:

Company:

Simon Grant-Rennick (Executive Chairman)

simon@evrimaplc.com

+44 7973 25 31 24

Burns Singh Tennent-Bhohi (CEO & Director)

burns@evrimaplc.com

+44 7403 16 31 85

Keith, Bayley, Rogers & Co. Limited (AQSE Corporate Adviser):

Graham Atthill-Beck: +44 (0) 7506 43 41 07; Graham.Atthill-Beck@kbrl.co.uk;

blackpearladvisers@gmail.com

Peterhouse Capital Limited (Corporate Stockbroker):

Lucy Williams: +44 (0) 20 7469 0930

Duncan Vasey: +44 (0) 20 7220 9797 (Direct)

END

(END) Dow Jones Newswires

July 12, 2021 02:00 ET (06:00 GMT)

Evrima (AQSE:EVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

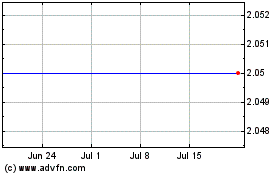

Evrima (AQSE:EVA)

Historical Stock Chart

From Jul 2023 to Jul 2024