TIDMJHD

RNS Number : 4464B

James Halstead PLC

03 October 2022

3 October 2022

JAMES HALSTEAD PLC

PRELIMINARY ANNOUNCEMENT OF AUDITED RESULTS

FOR THE YEARED 30 JUNE 2022

Key Figures

-- Revenue at GBP291.9 million (2021: GBP266.4 million)

- up 9.6%

-- Underlying profit before tax GBP51.1 million (2021: GBP51.3

million) - down 0.4 %

-- Earnings per 5p ordinary share of 9.7p (2021: 9.6p) -

up 1%

-- Final dividend per ordinary share proposed of 5.5p -

unchanged

-- One-for-one bonus issue on 14 January 2022

-- Cash GBP52.1 million (2021: GBP83.3 million)

Mr Mark Halstead, Chief Executive, commenting on the results,

said :

"A solid performance for a year that started in a positive way,

as the large challenges of the last two years looked set to

dissipate, only to be faced by a set of new obstacles with both

energy and materials costs escalating".

Enquiries:

James Halstead:

Mark Halstead, Chief Executive Telephone: 0161 767 2500

Gordon Oliver, Finance Director

Hudson Sandler:

Nick Lyon Telephone: 020 7796 4133

Nick Moore

Panmure Gordon (NOMAD & Joint Broker):

Dominic Morley Telephone: 020 7886 2500

WH Ireland (Joint Broker):

Ben Thorne Telephone: 020 7220 1666

CHAIRMAN'S STATEMENT

Results

Revenue for the year at GBP291.9m (2021: GBP266.4m) is 9.6%

ahead of the comparative year.

Underlying operating profit is GBP51.1 million (2021: GBP51.3m)

- 0.4 % below last year. The reported profit for the year of

GBP52.2m differed from this due to the one-off effect of insurance

pay-outs in respect of the breakdown of one of the major production

lines at our Radcliffe manufacturing plant in September 2019.

As I wrote in our trading update on 1 August 2022, the second

half of the year has been, on the one hand, a period of full

production for our factories in the UK but also with its

challenges. The optimism at the start of the year on the decline of

Covid-19, related supply problems and greater availability of

labour was offset by a myriad of shortages/cost increases following

the invasion of the Ukraine. Transport, fuel and energy increases

were immediately obvious and whilst a significant issue during the

spring/summer period, we have been mindful that the autumn/winter

period may bring deeper problems. The most obvious effect on our

business has been our decision to increase stockholdings as we

sought to mitigate the risks associated with the potential

inability to manufacture. This, in our view, seemed judicious and

hopefully is over-cautious. In the event that the crisis does not

escalate, then it is likely we will temporarily suspend some

production for a period to bring stock levels back to normal.

Trading margins during the year decreased but are acceptable

given the flood of cost increases that we have in part passed on.

As I noted in the last two years' trading updates, this period was

again not normal. For example, in some flooring projects that have

been severely delayed, we have honoured the prices originally

quoted to preserve the volume needed to feed our production lines.

In other instances, we have re-priced to find volume still goes

elsewhere and in many cases we have re-priced again and retained

the business. This is the nature of our industry with over-capacity

of supply and at least one global competitor has fallen into

receivership on the back of facing similar issues. Whilst some

other industries have priced daily on the back of this difficult

situation, we have walked a more cautious path and I commend our

teams that collectively have been successful in managing the

challenges we face.

There have been some positives in the midst of a generally

difficult trading environment. The general boycott in Russian trade

has eased the widespread shortage of shipping containers that has

prevailed since Covid-19 disrupted normal shipping routes.

Similarly, with Russian bound supplies of certain raw materials

facing export restrictions there was, at times, more availability

to our factories as these were diverted back into the European

market. Overall it was a difficult period for manufacturing.

The company and our strategy

James Halstead is a group of companies involved in the

manufacture and supply of flooring for commercial and domestic

purposes, based in Bury UK. James Halstead plc has been listed on

the London Stock Exchange for nearly 75 years.

The group was established in 1914 and continues to operate out

of the original premises in Bury. In its factories in Bury and

Teesside it manufactures resilient flooring for distribution in the

UK and worldwide.

The company's strategy is to constantly develop its brand

identity and its reputation for quality, product innovation,

durability and availability, thereby enhancing and maintaining

goodwill with the aim of achieving repeat business. Our focus is to

work with stockists who in turn distribute those bulk deliveries

whilst promoting and representing the products to the end users and

specifiers who will purchase the stock from those stockists.

This approach is designed to increase and secure revenue streams

and drive profitability and cash flow which enables the

continuation of dividends thereby creating shareholder wealth. In

the normal course of business one key element of the company ethos

is having dedicated sales personnel to present our product to our

customers' clientele.

Over many years our strategy has also included a policy of

continual investment in both process improvement and in product

development to improve output efficiency and product offering.

Corporate governance and corporate social responsibility and the

environment

The board has over many years recognised its responsibility

towards good corporate governance. It is part of our character and,

I believe, contributes to our ability to deliver long-term

shareholder value. Increasingly companies are, quite rightly,

tasked with demonstrating that their environmental credentials and

supply chain management are supported by social and sustainability

dimensions with appropriate stewardship.

We can say, with some pride, that almost 100% of our electric

usage is now derived from renewables. Our bi-annual Sustainability

Report was published in 2021 and we have this report independently

audited to further under-line our credentials. (Available to

download on our website).

PVC polymer is one of our main raw materials and we began

recycling waste into our processes in the 1950s and have continued

to use waste PVC as part of the process of manufacturing in ever

increasing volumes. For many years we have funded waste collection

with Recofloor - our UK joint venture that collects post

installation waste PVC within our industry. We are also founder

members of the European PVC recycling venture, the AgPr, which

funds the recycling of post-consumer PVC waste and diverts waste

from landfill back into the manufacturing process.

An important point to note about PVC is that it has evolved and

it is no longer just derived from petrochemicals. It is

increasingly produced from biomass. Indeed, many of the by-products

of PVC manufacturing are indispensable to the medical and food

industries. PVC manufacture has the lowest consumption of primary

energy of any of the major commodity plastics and our PVC flooring

is made with over 80% renewable materials. Our recycling

initiatives further reduce our footprint on the environment.

As part of our focus on the future and the footprint of our

industry we are major partners in industry wide bodies. We are, for

example, active members of the ERFMI (the European Resilient

Flooring Manufacturing Institute). ERFMI activities range from

involvement in the EU carbon neutral strategy through to funding

new recycling initiatives to extend the ability of PVC to be

recovered and recycled.

The UK may have left the European Union but our work on

standards, the circular economy, sustainability and meaningful

recycling is both Europe wide and globally focused and is

progressing at pace. In no way has "Brexit" lessened our

involvement as Europeans in the flooring industry.

Dividend

Our cash balances stand at GBP52.1 million (2021: GBP83.3

million) with the major reason for the reduction being, obviously,

increased stock. The inventory at the year end is GBP112.3 million

(2021: GBP60.7 million) which is about 85% higher than the prior

year comparative.

Also of note regarding the cash flow for the year is taxation

paid of GBP9.9 million (2021: GBP9.9 million) - unchanged and

equity dividends paid of GBP32.3 million (2021: GBP34.1 million) -

down 5.3%.

Having this large investment in our stockholdings and with the

challenges facing our companies in terms of cash flow, the Board do

not propose to increase the final dividend which will remain at the

level of last year and will be paid in December 2022.

The interim dividend of 2.25p (2021: 4.25p) was paid in June

2022.

Acknowledgements

As is customary, I would like to thank our staff for their

continued efforts in achieving this year's result.

In addition, I feel I must note the death of HM Queen Elizabeth

II. The brand 'Polyflor' was created in 1950, just prior to start

of her reign. Her Majesty's service over the years since has no

doubt been the rock on which the reputation of the United Kingdom

has been built and helped in the growth of our exports over the

last 70 years.

Our thanks also to the UK Contract Flooring Association for

their members' accolades with Polyflor being awarded the 2022

Manufacturer of the Year, as well as the Healthcare Installation of

the Year (Kitwood House Care Home in Cheshire) and International

Installation of the Year (Live Sport Offices, Prague).

Outlook

Trading from the year-end to date has been positive. Post year

end, prices have been increased and demand has remained strong.

Sales volume is higher and we have continued to pass on cost

increases. Costs, most particularly energy, have continued to rise.

The fall in the value of sterling, most markedly against the US

dollar, in recent days will no doubt have implications to certain

input costs but equally, given our level of exports, will have some

positives.

We cannot forecast the effects of energy costs on the myriad of

materials and goods that are needed to undertake mass volume

manufacture but with the vast array of skills, knowledge and

entrepreneurs within our collective, each challenge should be

overcome.

In the light of current demand, with the accumulated industry

experience at our disposal, I, and the Board, remain confident of

progress over the medium term, notwithstanding the short term

challenges I have highlighted in my statement.

Anthony Wild

Chairman

CHIEF EXECUTIVE'S REVIEW

As noted by the Chairman, it has been a mixed year. For the

largest input costs to our manufacturing we have had to accept

price increases. Be it energy or raw materials it has been a

constant adverse situation. The simple idea that these costs are

passed on is complicated.

(a) Complicated by the project related nature of quotations and

the time from quotation to supply of the stock, reality of losing

business at high prices or maintaining it at a loss.

(b) Complicated by the fact that at least two generations that

have never seen inflation of this scale and who are partly in

denial as to its reality, duration and implications.

(c) Complicated by the possibility that this may yet affect the

continuous production we have enjoyed over many, many years.

These challenges are faced by many of our European competitors

and inevitably there is a degree of margin erosion which

manufacturers from all types of industry face.

Reviewing the businesses in more detail:

Objectflor / Karndean and James Halstead France, our European

operations

In Germany sales growth of near 12% came largely from cost

surcharges and price increases as costs increased during the year.

In one of the most competitive markets for flooring, volumes were

maintained. The year was one of two halves with the earlier part

facing stock shortages due to adverse shipping conditions. There

were key product launches that were delayed by both the

availability of complete stock ranges and difficulties in supply of

marketing materials to support launches. The stock situation

improved as the year progressed.

In France sales were increased by 18%, volumes also increased

though by a lesser percentage. Investments in regional sales teams

were key to the sales growth. Stock levels have grown, once again

largely planned in the expectation of supply problems.

Polyflor Pacific - encompassing Australia, New Zealand and

Asia

In Australia, sales were some 6% ahead of the prior year with

increases in profitability that resulted from increased margin due

to favourable product mix and staff costs savings compared to the

prior year. The staff savings were the result of difficulties in

recruitment leaving vacancies for periods of time. The favourable

product mix was due to higher margin domestic flooring sales having

taken a larger proportion of sales than commercial flooring. This

was, no doubt, in part because Covid-19 restrictions were in place

for a long part of the first half financial year. Freight costs, as

with all markets, were greater. Stock levels increased.

In New Zealand sales were lower than the comparative year. This

market had the longest Covid restrictions of our major markets.

Operational restrictions impacted the economy and the building

sector in particular. Supplying New Zealand was challenging with

shipments of flooring from the UK taking up to 8 months from order

due to sea freight complexities such as shortages of shipping

containers in Europe and severe congestion in ports such as

Singapore. The supply of flooring into nationwide social housing

contracts continues to be an important source of revenue and will

continue as backlogs in the roll-out programme alleviate. One

negative was the supply of cushion vinyl from European

manufacturers which was severely disrupted. Nevertheless, it is

pleasing to report increased market share and customer satisfaction

- largely due to our company having stock

and offering service levels far better than competitors. Stock levels have been increased.

This was the first full year of our Malaysian business (which

also covers the South Eastern markets of Indonesia, Singapore,

Thailand, Vietnam and the Philippines) and we can be satisfied with

the progress made to date. The start of the year was again hampered

by various lockdowns and travel movements across the territories,

but as the year progressed, we saw the order book and sales grow,

with sales across the region 153% ahead of last year.

The order book remains healthy, and we have every expectation

that sales will continue to grow. At the end of the financial year,

we strengthened the sales team further by employing salespeople

directly in Vietnam and Thailand to support the distributors, and

similar plans are in place for the Philippines before the end of

2022.

Polyflor and Riverside Flooring, based in UK

We continue to see growth in the heterogeneous ranges

manufactured at Teesside, and a falloff in certain of the 'older'

ranges manufactured in Radcliffe. Overall volumes were maintained.

Output was increased as we returned to a situation of being able to

run all production lines, albeit with continued absenteeism levels

that are above the "normal" levels that existed prior to the

Covid-19 pandemic.

The increase in energy and raw material costs have put pressure

on our margins and whilst we have a proportion of our energy

consumption on forward contracts, costs continue to rise to

unprecedented levels. The recent announcement by the government,

whilst welcome, will only limit the increase, not reduce it.

Availability of raw materials has improved, but costs remain high.

The impact of rising energy costs on the production costs has been

a significant issue.

We have made several price increases during the year across our

ranges and across all markets to pass on these increases. This

continues to be the case after the year end.

Stocks in the UK also increased, both in manufactured and

merchanted goods. Delays in product launches earlier in the year

compounded the issue as we waited for marketing material, such as

shade cards and display boards. This was another fallout of the

Ukraine war due to the lack of wood pulp and related materials.

Polyflor Nordic comprising Polyflor Norway based in Oslo and

Falck Design based in Sweden

The markets have been re-organised to bring both Norway and

Sweden under one reporting structure. In Norway sales are 17% ahead

of the prior year largely supported by price increases. Net profit

rose by just under 6%. Heterogeneous flooring (supplied by

Riverside) grew and there has been investment in additional staff

in internal sales and regional sales areas. In Sweden, sales

increased 37% and the volume of product supplied from our UK

factories increased by near 50%. It must be noted that the prior

year comparatives were subdued by Covid-19 but nevertheless this is

a good result for both countries.

Polyflor Canada, based in Toronto

A record year for sales and a significant increase in net profit

against a generally sluggish economy. Our market share is still

embryonic in this market but with the shadow of Covid-19 having

crippled travel for much of the financial year this was a

creditable performance. Our Canadian business is very largely

project based and these have faced delays in funding and progress

but the business is well placed for further growth.

Rest of the World

Our products are sold in many markets across the globe and the

preceding sections cover some of the key markets where we have a

local presence and warehousing. These markets have been long

established for the sales of our flooring and there has also been

significant growth in several other markets when compared to last

year. Spain was up 30%, South America up 48% and the Middle East up

59%. In some instances the comparative for 2021 was affected by the

impact of the Covid-19 virus (most notably in Spain). It is

pleasing to see these markets have recovered, this has been hard to

achieve with the cost of international freight and equally as

problematical have been delays and difficulties in available

shipping. The markets that did not grow in the year were Africa and

North Asia.

The North Asia markets have experienced a challenging year due

to the increase in Covid-19 cases and the "zero-Covid" policy

adopted across China. This meant our local warehouse in China,

which became operational last year supplying smaller and local

orders, as well as being able to support other Asian markets, could

not despatch products. Several larger Asian projects, which are

shipped direct, have been delayed. Latterly we have started to see

some improvement but sales for 2022 fell by 28% against the

previous year.

In conclusion

Given the circumstances we can only be pleased with the results

for the year. The hard work, dedication and experience of our

subsidiary directors and management has been a key factor in this

achievement.

However, the challenges have not lessened.

Mark Halstead

Chief Executive

Audited Consolidated Income Statement

for the year ended 30 June 2022

Year Year

ended ended

30.06.22 30.06.21

GBP'000 GBP'000

Revenue 291,860 266,362

Cost of sales (178,355) (154,722)

----------- -----------

Gross profit 113,505 111,640

Selling and distribution costs (50,316) (46,335)

Administration expenses (10,931) (13,532)

Operating profit 52,258 51,773

Finance income 42 48

Finance cost (237) (553)

Profit before income tax 52,063 51,268

Income tax expense (11,735) (11,407)

Profit for the year attributable to equity shareholders 40,328 39,861

----------- -----------

Earnings per ordinary share of 5p:

-basic 9.7p 9.6p

-diluted 9.7p 9.6p

All amounts relate to continuing operations.

The earnings per ordinary share of 5p for the year ended 30 June

2021 have been restated for the effect of the one-for-one bonus

issue on 14 January 2022.

Audited Consolidated Statement of Comprehensive Income

for the year ended 30 June 2022

Year Year

ended ended

30.06.22 30.06.21

GBP'000 GBP'000

Profit for the year 40,328 39,861

----------- -----------

Other comprehensive income net of tax:

Items that will not be reclassified subsequently to the income statement:

Remeasurement of the net defined benefit liability 7,090 12,708

----------- -----------

7,090 12,708

----------- -----------

Items that could be reclassified subsequently to the income statement if specific

conditions

are met

Foreign currency translation differences 926 (615)

Fair value movements on hedging instruments (111) 1,089

815 474

----------- -----------

Other comprehensive income for the year 7,905 13,182

----------- -----------

Total comprehensive income for the year 48,233 53,043

=========== ===========

Attributable to equity holders of the

company 48,233 53,043

=========== ===========

Items in the statement above are disclosed net of tax.

Audited Consolidated Balance Sheet

as at 30 June 2022

As at As at

30.06.22 30.06.21

GBP'000 GBP'000

Non-current assets

Property, plant and equipment 36,671 37,242

Right of use assets 5,634 6,015

Intangible assets 3,232 3,232

Retirement benefit obligations 6,144 -

Deferred tax assets 234 254

---------- ------------------

51,915 46,743

---------- ------------------

Current assets

Inventories 112,279 60,684

Trade and other receivables 51,171 42,949

Derivative financial instruments 2,166 848

Cash and cash equivalents 52,144 83,261

---------- ------------------

217,760 187,742

---------- ------------------

Total assets 269,675 234,485

---------- ------------------

Current liabilities

Trade and other payables 84,507 65,551

Derivative financial instruments 517 92

Current income tax liabilities 2,097 1,160

Lease liabilities 2,166 2,948

89,287 69,751

---------- ------------------

Non-current liabilities

Retirement benefit obligations - 4,357

Other payables 453 447

Deferred tax liabilities 2,929 -

Lease liabilities 3,548 3,236

Preference shares 200 200

---------- ------------------

7,130 8,240

---------- ------------------

Total liabilities 96,417 77,991

---------- ------------------

Net assets 173,258 156,494

---------- ------------------

Equity

Equity share capital 20,837 10,408

Equity share capital (B shares) 160 160

---------- ------------------

20,997 10,568

Share premium account - 4,122

Capital redemption reserve - 1,174

Currency translation reserve 5,912 4,986

Hedging reserve 941 1,052

Retained earnings 145,408 134,592

Total equity attributable to shareholders of the parent 173,258 156,494

---------- ------------------

Audited Consolidated Cash Flow Statement

for the year ended 30 June 2022

Year Year

ended ended

30.06.22 30.06.21

GBP'000 GBP'000

Profit for the year attributable to equity shareholders 40,328 39,861

Income tax expense 11,735 11,407

---------- ----------

Profit before income tax 52,063 51,268

Finance cost 237 553

Finance income (42) (48)

---------- ----------

Operating profit 52,258 51,773

Depreciation of property, plant and equipment 3,794 3,541

Depreciation of right of use assets 3,139 3,115

Profit on sale of plant and equipment (198) (64)

Defined benefit pension scheme service cost 500 620

Defined benefit pension scheme employer contributions paid (1,970) (4,144)

Change in fair value of financial instruments 703 (90)

Share based payments 6 8

(Increase)/decrease in inventories (50,272) 6,346

(Increase) in trade and other receivables (7,451) (15,573)

Increase in trade and other payables 15,905 20,248

---------- ----------

Cash inflow from operations 16,414 65,780

Taxation paid (9,879) (9,895)

---------- ----------

Cash inflow from operating activities 6,535 55,885

---------- ----------

Purchase of property, plant and equipment (3,248) (2,811)

Proceeds from disposal of property, plant and equipment 280 131

---------- ----------

Cash outflow from investing activities (2,968) (2,680)

---------- ----------

Interest received 42 48

Interest paid (20) (26)

Lease interest paid (143) (173)

Lease capital paid (3,233) (3,010)

Equity dividends paid (32,298) (34,083)

Shares issued 823 51

---------- ----------

Cash outflow from financing activities (34,829) (37,193)

---------- ----------

Net (decrease)/increase in cash and cash equivalents (31,262) 16,012

---------- ----------

Effect of exchange differences 145 (196)

Cash and cash equivalents at start of year 83,261 67,445

Cash and cash equivalents at end of year 52,144 83,261

========== ==========

NOTES

1. The final dividend of 5.5p per ordinary share will be paid, subject to the approval of the

shareholders, on 16 December 2022 to shareholders on the register as at 18 November 2022.

The annual report and accounts will be posted to shareholders on 14 October 2022.

2. The financial information in this statement does not represent the statutory accounts of the

Group. Statutory accounts for the year ended 30 June 2021 have been delivered to the Registrar

of Companies, carrying an unqualified audit report and no statement under section 498 (2)

or (3) of the Companies Act 2006.

3. Statutory accounts for the year ended 30 June 2022 have not yet been delivered to the Registrar

of Companies. They will carry an unqualified audit report and no statement under section 498

(2) or (3) of the Companies Act 2006.

4. Earnings per ordinary share

2022 2021

GBP'000 GBP'000

Profit for the year attributable to equity shareholders 40,328 39,861

-------------- --------------

Weighted average number of shares in issue 416,586,675 416,283,040

-------------- --------------

Dilution effect of outstanding share options 201,425 246,330

Diluted weighted average number of shares 416,788,100 416,529,370

-------------- --------------

Basic earnings per ordinary share 9.7p 9.6p

Diluted earnings per ordinary share 9.7p 9.6p

The figures for the year ended 30 June 2021 have been restated

for the effect of the one-for-one bonus issue on 14 January

2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR ZZGFLMGKGZZZ

(END) Dow Jones Newswires

October 03, 2022 02:00 ET (06:00 GMT)

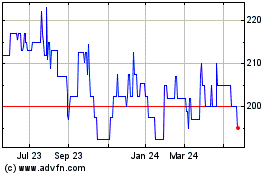

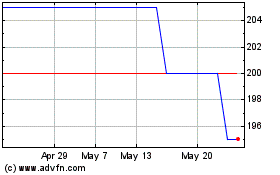

James Halstead (AQSE:JHD.GB)

Historical Stock Chart

From Apr 2024 to May 2024

James Halstead (AQSE:JHD.GB)

Historical Stock Chart

From May 2023 to May 2024