Australia's Fortescue Deepens Debt Repayments -- Update

June 22 2016 - 7:12PM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--Fortescue Metals Group Ltd. said it will repay more of

the large debt pile amassed when expanding its Australian mines,

aided by steady iron-ore prices and an aggressive push to reduce

production costs.

Fortescue, the world's No. 4 exporter of iron ore, borrowed to

build a vast network of mining pits, rail lines and port

infrastructure in Australia's Pilbara region in a decadelong quest

to break the dominance of Vale SA, Rio Tinto PLC and BHP Billiton

Ltd. in iron-ore mining. Over the past three years, the company has

vowed to prioritize repaying those loans, which caused a brush with

lenders in 2012 when iron-ore prices tumbled as Fortescue was

ramping up production.

Fortescue said the US$500 million debt repayment, to be made at

par against its 2019 senior secured term loan, will save the

company US$21 million in interest costs a year. Including the

latest paydown, the company will have repaid US$2.9 billion this

fiscal year through June, cutting annual interest expenses by

US$186 million, it said.

That leaves the miner with US$3.68 billion still to pay on the

loan, which is due in 2019. Fortescue also has roughly US$2.6

billion in borrowings due next decade.

At its peak, the Perth-based company owed around US$13

billion.

"Cashflow generation from our operational performance and cost

reductions have allowed Fortescue to continue to repay debt," Chief

Financial Officer Stephen Pearce in a statement Thursday.

Fortescue's output costs in the first three months of 2016 were

6% lower than the quarter prior and 43% lower than the same period

a year earlier. The company has lowered spending by running its

trucks and processing facilities harder and renegotiating contracts

with suppliers.

Meantime, iron-ore prices have steadied this year, underpinned

by higher steel prices in China--the world's top buyer of the

commodity--and a plateau in supplies from new mines. Iron ore is

selling at roughly US$51.70 a metric ton, up 21% on the start of

the year, according to the Steel Index, a data provider.

Fortescue previously said it intends to review investor payouts

once it has lowered its debt-to-equity ratio below a target of 40%.

Last month, the company estimated its debt-to-equity, or gearing,

stood at 44%.

Mr. Pearce said the miner will continue to evaluate ways to

reduce its indebtedness.

"We remain committed to our debt repayment strategy and the

continued strengthening of Fortescue's balance sheet," he said.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

June 22, 2016 19:57 ET (23:57 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

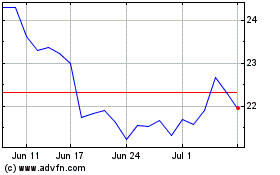

Fortescue (ASX:FMG)

Historical Stock Chart

From Nov 2024 to Dec 2024

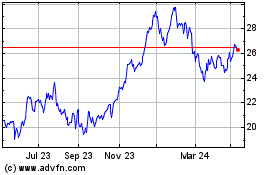

Fortescue (ASX:FMG)

Historical Stock Chart

From Dec 2023 to Dec 2024