Australia Stocks Rise for Sixth Straight Day, Near 2016 High

July 14 2016 - 2:48AM

Dow Jones News

By Robb M. Stewart

MELBOURNE--Australian shares neared a 2016 high on Thursday, as

a continued recovery by the major banks helped drive the market to

a sixth straight gain and offset weakness in resources stocks.

The local market edged higher after news the economy created

more full-time jobs in June, even as unemployment ticked higher to

5.8%.

Sentiment has perked up in recent sessions after last week's

slide in the wake of Britain's vote to exit the European Union, in

part as investors look to governments and central banks to reassure

markets and provide stimulus. Some economists see room for the

Reserve Bank of Australia to cut further its key cash rate from a

record low 1.75%.

Closing at the highest level since Aug. 11, the S&P/ASX 200

climbed 23.1 points, or 0.4%, to 5411.6. The day's intra-session

high was within a dozen points of the 5427 peak hit in late

May.

It was only the second six-session push higher of 2016 for the

index.

For the day, 3.09 billion shares worth 4.84 billion Australian

dollars (US$3.68 billion) were traded, Commonwealth Securities

said.

The four largest banks added more than 12 points to the ASX 200

index, as their shares each climbed for a fourth day running.

National Australia Bank led banking stocks, rising 1.3%, while

Commonwealth Bank of Australia, Westpac Banking and Australia &

New Zealand Banking Group each added 1%.

Investors appeared to have largely shrugged off a report by

Moody's Investors Service that cautioned headwinds were mounting

for the big banks and their ability to preserve margins could be

challenged by a prolonged period of low interest rates. Bank shares

came under pressure last week when the prudential regulator said

the major banks would likely need to raise additional capital and

Standard & Poor's revised the outlook on their "AA-" ratings to

negative to reflect a similar move on the country's sovereign

rating.

Most other industry sectors were higher Thursday, although the

energy and materials subindexes faltered after oil and iron-ore

prices retreated.

Woodside Petroleum slipped 1.1%, Oil Search fell 0.1% and Santos

lost 1%.

BHP Billiton and Rio Tinto were down 1.2% and 1.1%,

respectively, and iron-ore miner Fortescue Metals Group was 4.1%

weaker.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

July 14, 2016 03:33 ET (07:33 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

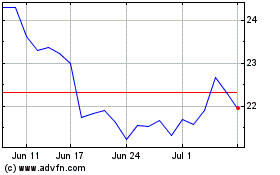

Fortescue (ASX:FMG)

Historical Stock Chart

From Nov 2024 to Dec 2024

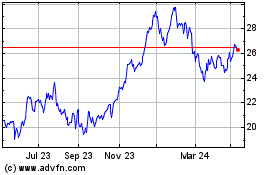

Fortescue (ASX:FMG)

Historical Stock Chart

From Dec 2023 to Dec 2024