FISCAL 2024 FIRST QUARTER KEY FINANCIAL

HIGHLIGHTS

- First quarter revenues were $2.50 billion, a 1% increase

compared to $2.48 billion in the prior year, driven by growth at

the Book Publishing and Dow Jones segments

- Net income in the quarter was $58 million, compared to net

income of $66 million in the prior year

- First quarter Total Segment EBITDA was $364 million,

compared to $350 million in the prior year

- In the quarter, reported EPS were $0.05 as compared to $0.07

in the prior year - Adjusted EPS were $0.16 compared to $0.12 in

the prior year

- Within the Dow Jones segment, professional information

business revenues rose 14% and helped to underpin 10% Segment

EBITDA growth and the highest first quarter profit margins since

News Corp’s acquisition in 2007

- REA Group posted strong revenue growth driven by the

residential business, which benefited from a double digit yield

increase and improving listing volumes in Australia

- Book Publishing revenues grew 8%, while Segment EBITDA

increased 67%, driven by higher book sales combined with improved

returns

News Corporation (“News Corp” or the “Company”) (Nasdaq: NWS,

NWSA; ASX: NWS, NWSLV) today reported financial results for the

three months ended September 30, 2023.

Commenting on the results, Chief Executive Robert Thomson

said:

“We had a sterling start to the new Fiscal Year, with rising

revenues and increased profitability despite difficult economic

conditions in some of our markets. Our first quarter revenues were

slightly higher at $2.5 billion, while our profitability rose 4

percent, marking the second consecutive quarter of profit

growth.

Our positive performance in the quarter follows the three most

profitable years since the creation of the new News Corp. In our

view, these results certainly highlight the disparity between the

value of our company and our share price, which we believe does not

reflect our present profitability, yet alone the potential of our

incomparable, growing businesses.

The quarter particularly highlighted the prowess of Dow Jones,

led by its professional information business, where revenues surged

14 percent, driven by Risk & Compliance and Dow Jones Energy.

Book Publishing reported a 67 percent increase in profitability,

with the logistical issues at Amazon resolved, and both the

frontlist and backlist performing.

We are actively working to make the most of our premium content

for AI and are engaged in advanced discussions that we expect to

bring significant revenue to the company in return for the

authorized use of our peerless content. Our quest is to maximize

value for all investors, so we are assiduously reviewing our

structure.”

FIRST QUARTER RESULTS

The Company reported fiscal 2024 first quarter total revenues of

$2.50 billion, a 1% increase compared to $2.48 billion in the prior

year period, primarily driven by increased physical book sales and

improved returns at the Book Publishing segment resulting from the

absence of Amazon’s reset in the prior year and higher revenues at

the Dow Jones segment due to robust growth in its professional

information business. The increase was partly offset by lower

revenues at the Digital Real Estate Services segment due to

continued challenging housing market conditions in the U.S., a $14

million negative impact from foreign currency fluctuations and

lower advertising revenues at the News Media segment. Adjusted

Revenues (which excludes the foreign currency impact, acquisitions

and divestitures as defined in Note 2) were up 1% compared to the

prior year.

Net income for the quarter was $58 million, a 12% decrease

compared to net income of $66 million in the prior year, impacted

by non-cash impairment charges of $21 million at the News Media

segment related to the write- down of fixed assets associated with

the proposed combination of certain U.K. printing operations with

those of a third party, and lower Other, net. These impacts were

partially offset by higher Total Segment EBITDA, as discussed

below.

The Company reported first quarter Total Segment EBITDA of $364

million, a 4% increase compared to $350 million in the prior year

primarily due to higher revenues, as discussed above, and gross

cost savings related to the announced 5% headcount reduction

initiative. The increase was partly offset by higher sports

programming rights costs at the Subscription Video Services

segment, higher technology and employee costs at the Dow Jones

segment and higher employee costs at the Book Publishing segment.

Adjusted Total Segment EBITDA (as defined in Note 2) increased

5%.

Net income per share attributable to News Corporation

stockholders was $0.05 as compared to $0.07 in the prior year.

Adjusted EPS (as defined in Note 3) were $0.16 compared to $0.12

in the prior year.

SEGMENT REVIEW

For the three months ended

September 30,

2023

2022

% Change

(in millions)

Better/

(Worse)

Revenues:

Digital Real Estate Services

$

403

$

421

(4

)%

Subscription Video Services

486

502

(3

)%

Dow Jones

537

515

4

%

Book Publishing

525

487

8

%

News Media

548

553

(1

)%

Other

—

—

—

%

Total Revenues

$

2,499

$

2,478

1

%

Segment EBITDA:

Digital Real Estate Services

$

122

$

119

3

%

Subscription Video Services

93

111

(16

)%

Dow Jones

124

113

10

%

Book Publishing

65

39

67

%

News Media

14

18

(22

)%

Other

(54

)

(50

)

(8

)%

Total Segment EBITDA

$

364

$

350

4

%

Digital Real Estate Services

Revenues in the quarter decreased $18 million, or 4%, compared

to the prior year, reflecting an $11 million, or 2%, negative

impact from foreign currency fluctuations. Segment EBITDA in the

quarter increased $3 million, or 3%, compared to the prior year,

primarily due to higher revenues at REA Group and cost savings

initiatives at Move, which were largely offset by lower revenues at

Move and a $5 million, or 4%, negative impact from foreign currency

fluctuations. Adjusted Revenues and Adjusted Segment EBITDA (as

defined in Note 2) decreased 2% and increased 8%, respectively.

In the quarter, revenues at REA Group increased $9 million, or

4%, to $261 million, driven by higher Australian residential

revenues due to price increases, increased depth penetration and an

increase in national listings, as well as $3 million, or 25%, of

higher revenues from REA India. The increase was partly offset by

an $11 million, or 4%, negative impact from foreign currency

fluctuations and $4 million of lower financial services revenues

due to a decrease in settlement activity. Australian national

residential buy listing volumes in the quarter increased 1%

compared to the prior year, with listings in Sydney and Melbourne

up 16% and 14%, respectively.

Move’s revenues in the quarter decreased $27 million, or 16%, to

$142 million, primarily as a result of lower real estate revenues.

Real estate revenues, which represented 80% of total Move revenues,

decreased $29 million, or 20%, driven by the continued impact of

the macroeconomic environment on the housing market, including

higher mortgage rates, which has led to lower lead and transaction

volumes. Revenues from the referral model, which includes the

ReadyConnect Concierge℠ product, and the traditional lead

generation product decreased due to these factors. Based on Move’s

internal data, average monthly unique users of Realtor.com®’s web

and mobile sites for the fiscal first quarter declined 12%

year-over-year to 76 million. Lead volume declined 11%, which was

an improvement from the prior quarter.

Subscription Video Services

Revenues of $486 million in the quarter decreased $16 million,

or 3%, compared with the prior year, due to a $21 million, or 4%,

negative impact from foreign currency fluctuations. Adjusted

Revenues of $507 million increased 1% compared to the prior year.

Higher revenues from Kayo and BINGE, driven by increases in both

volume and pricing, were partially offset by the impact from fewer

residential broadcast subscribers. Foxtel Group streaming

subscription revenues represented approximately 30% of total

circulation and subscription revenues in the quarter, as compared

to 25% in the prior year.

As of September 30, 2023, Foxtel’s total closing paid

subscribers were nearly 4.6 million, a 2% increase compared to the

prior year, primarily due to the growth in streaming subscribers

driven by Kayo and BINGE, partially offset by fewer residential

broadcast subscribers. Broadcast subscriber churn in the quarter

improved to 11.4%, compared to 14.2% in the prior year. Broadcast

ARPU for the quarter increased 3% year-over-year to A$85

(US$56).

As of September 30,

2023

2022

(in 000's)

Broadcast Subscribers

Residential

1,310

1,439

Commercial

233

219

Streaming Subscribers (Total (Paid))

Kayo

1,411 (1,403 paid)

1,270 (1,259 paid)

BINGE

1,506 (1,449 paid)

1,451 (1,342 paid)

Foxtel Now

167 (161 paid)

197 (191 paid)

Total Subscribers (Total (Paid))

4,646 (4,573 paid)

4,605 (4,465 paid)

Segment EBITDA of $93 million in the quarter decreased $18

million, or 16%, compared with the prior year, which includes the

$4 million, or 3%, negative impact from foreign currency

fluctuations. Adjusted Segment EBITDA of $97 million decreased 13%

compared to the prior year, primarily due to higher sports

programming rights costs driven mainly by contractual increases

across AFL and NRL partially offset by higher revenues in constant

currency and lower employee costs.

Dow Jones

Revenues in the quarter increased $22 million, or 4%, compared

to the prior year, driven by growth in circulation and subscription

revenues led by growth in professional information business

products. Digital revenues at Dow Jones in the quarter represented

81% of total revenues compared to 79% in the prior year. Adjusted

Revenues increased 3%.

Circulation and subscription revenues increased $22 million, or

5%, including a $4 million, or 1%, positive impact from foreign

currency fluctuations. Professional information business revenues

grew 14%, primarily due to 23% growth in Risk & Compliance

revenues, driven by both financial and corporate customers, and 20%

growth in Dow Jones Energy revenues (which includes OPIS and CMA)

as a result of price increases, new products and customers and a

modest benefit from new events and one-time items. Circulation

revenues increased 1%, primarily due to the continued growth in

digital-only subscriptions, which was helped as a result of

bundling, partially offset by lower print volume. Digital

circulation revenues accounted for 70% of circulation revenues for

the quarter, compared to 68% in the prior year.

During the first quarter, total average subscriptions to Dow

Jones’ consumer products reached 5.3 million, an 8% increase

compared to the prior year. Digital-only subscriptions to Dow

Jones’ consumer products grew 12%. Total subscriptions to The Wall

Street Journal grew 6% compared to the prior year, to 4.0 million

average subscriptions in the quarter. Digital-only subscriptions to

The Wall Street Journal grew 10% to over 3.4 million average

subscriptions in the quarter, and represented 87% of total Wall

Street Journal subscriptions.

For the three months ended

September 30,

2023

2022

% Change

(in thousands, except %)

Better/(Worse)

The Wall Street Journal

Digital-only subscriptions

3,457

3,157

10 %

Total subscriptions

3,991

3,778

6 %

Barron’s Group

Digital-only subscriptions

1,055

862

22 %

Total subscriptions

1,197

1,040

15 %

Total Consumer

Digital-only subscriptions

4,611

4,099

12 %

Total subscriptions

5,308

4,922

8 %

Advertising revenues decreased $3 million, or 3%, primarily due

to 6% and 2% declines in print and digital advertising revenues,

respectively. Digital advertising accounted for 66% of total

advertising revenues in the quarter, compared to 65% in the prior

year.

Segment EBITDA for the quarter increased $11 million, or 10%,

primarily as a result of the higher revenues discussed above. The

higher revenues were partially offset by higher technology and

employee costs. Adjusted Segment EBITDA increased 9%.

Book Publishing

Revenues in the quarter increased $38 million, or 8%, compared

to the prior year, primarily driven by the increase in physical

book sales and improved returns in the U.S. resulting from the

absence of the impact of Amazon’s reset of its inventory levels and

rightsizing of its warehouse footprint in the prior year. Key

titles in the quarter included Tom Lake by Ann Patchett, Demon

Copperhead by Barbara Kingsolver and The Collector by Daniel Silva.

Adjusted Revenues increased 6%. Digital sales increased 3% compared

to the prior year. Digital sales represented 22% of Consumer

revenues for the quarter compared to 23% in the prior year.

Backlist sales represented approximately 61% of total revenues in

the quarter compared to 65% in the prior year.

Segment EBITDA for the quarter increased $26 million, or 67%,

compared to the prior year, primarily driven by the higher revenues

discussed above, lower manufacturing costs, primarily due to

product mix, and lower freight and distribution costs as supply

chain challenges and inventory and inflationary pressures have

begun to ease, partly offset by higher employee costs. Adjusted

Segment EBITDA increased 59%.

News Media

Revenues in the quarter decreased $5 million, or 1%, as compared

to the prior year, primarily driven by lower advertising revenues,

partially offset by the $7 million, or 1%, positive impact from

foreign currency fluctuations and higher circulation and

subscription revenues. Within the segment, revenues at News Corp

Australia decreased 7%, driven by a 5% negative impact from foreign

currency fluctuations and lower advertising revenues, while News UK

increased 3% driven by the 7% positive impact from foreign currency

fluctuations. Adjusted Revenues for the segment decreased 2%

compared to the prior year.

Circulation and subscription revenues increased $6 million, or

2%, compared to the prior year, primarily due to a $5 million, or

2%, positive impact from foreign currency fluctuations, price

increases and digital subscriber growth, partially offset by lower

print volumes.

Advertising revenues decreased $10 million, or 5%, compared to

the prior year, primarily due to lower print and digital

advertising at News Corp Australia, lower print advertising at News

UK and a decline in traffic at some mastheads due to platform

related changes. The decline was partially offset by a $2 million,

or 1%, positive impact from foreign currency fluctuations.

In the quarter, Segment EBITDA decreased $4 million, or 22%,

compared to the prior year, driven by lower revenues, as discussed

above, and a $1 million, or 5%, negative impact from foreign

currency fluctuations. News UK also incurred one-time costs

pertaining to the proposed combination of print operations with DMG

Media which, pending regulatory approval, is expected to provide

long-term savings. The decrease was partially offset by lower

production costs at News UK, driven by lower volume. Adjusted

Segment EBITDA decreased 17%.

Digital revenues represented 37% of News Media segment revenues

in the quarter, compared to 36% in the prior year, and represented

35% of the combined revenues of the newspaper mastheads. Digital

subscribers and users across key properties within the News Media

segment are summarized below:

- Closing digital subscribers at News Corp Australia as of

September 30, 2023 were 1,049,000 (937,000 for news mastheads),

compared to 1,012,000 (929,000 for news mastheads) in the prior

year (Source: Internal data)

- The Times and Sunday Times closing digital subscribers,

including the Times Literary Supplement, as of September 30, 2023

were 572,000, compared to 532,000 in the prior year (Source:

Internal data). The previously disclosed methodology change

resulted in a 59,000 and 64,000 increase to the closing digital

subscriber number at September 30, 2023 and 2022, respectively

- The Sun’s digital offering reached 134 million global monthly

unique users in September 2023 (Source: Meta Pixel; prior year

comparable statistic unavailable)

- New York Post’s digital network reached 127 million unique

users in September 2023, compared to 151 million in the prior year

(Source: Google Analytics)

CASH FLOW

The following table presents a reconciliation of net cash used

in operating activities to free cash flow and free cash flow

available to News Corporation:

For the three months ended

September 30,

2023

2022

(in millions)

Net cash used in operating activities

$

(55

)

$

(31

)

Less: Capital expenditures

(124

)

(104

)

Free cash flow

(179

)

(135

)

Less: REA Group free cash flow

(39

)

(37

)

Plus: Cash dividends received from REA

Group

44

50

Free cash flow available to News

Corporation

$

(174

)

$

(122

)

Net cash used in operating activities of $(55) million for the

three months ended September 30, 2023 was $24 million higher than

$(31) million in the prior year, primarily due to higher working

capital and higher restructuring payments, partially offset by

lower tax payments and higher Total Segment EBITDA, as noted

above.

Free cash flow in the three months ended September 30, 2023 was

$(179) million compared to $(135) million in the prior year. Free

cash flow available to News Corporation in the three months ended

September 30, 2023 was $(174) million compared to $(122) million in

the prior year. The decrease in both free cash flow and free cash

flow available to News Corporation was primarily due to higher cash

used in operating activities, as mentioned above, and higher

capital expenditures. Foxtel’s capital expenditures for the three

months ended September 30, 2023 were $50 million compared to $40

million in the prior year.

Free cash flow and free cash flow available to News Corporation

are non-GAAP financial measures. Free cash flow is defined as net

cash provided by (used in) operating activities, less capital

expenditures, and free cash flow available to News Corporation is

defined as free cash flow, less REA Group free cash flow, plus cash

dividends received from REA Group.

The Company believes free cash flow provides useful information

to management and investors about the Company’s liquidity and cash

flow trends. The Company believes free cash flow available to News

Corporation, which adjusts free cash flow to exclude REA Group’s

free cash flow and include dividends received from REA Group,

provides management and investors with a measure of the amount of

cash flow that is readily available to the Company, as REA Group is

a separately listed public company in Australia and must declare a

dividend in order for the Company to have access to its share of

REA Group’s cash balance. The Company believes free cash flow

available to News Corporation provides a more conservative view of

the Company’s free cash flow because this presentation includes

only that amount of cash the Company actually receives from REA

Group, which has generally been lower than the Company’s unadjusted

free cash flow. A limitation of both free cash flow and free cash

flow available to News Corporation is that they do not represent

the total increase or decrease in the cash balance for the period.

Management compensates for the limitation of free cash flow and

free cash flow available to News Corporation by also relying on the

net change in cash and cash equivalents as presented in the

Company’s consolidated statements of cash flows prepared in

accordance with GAAP which incorporates all cash movements during

the period.

COMPARISON OF NON-GAAP TO U.S. GAAP INFORMATION

Adjusted Revenues, Total Segment EBITDA, Adjusted Total Segment

EBITDA, Adjusted Segment EBITDA, adjusted net income attributable

to News Corporation stockholders, Adjusted EPS, constant currency

revenues, free cash flow and free cash flow available to News

Corporation are non-GAAP financial measures contained in this

earnings release. The Company believes these measures are important

tools for investors and analysts to use in assessing the Company’s

underlying business performance and to provide for more meaningful

comparisons of the Company’s operating performance between periods.

These measures also allow investors and analysts to view the

Company’s business from the same perspective as Company management.

These non- GAAP measures may be different than similar measures

used by other companies and should be considered in addition to,

not as a substitute for, measures of financial performance

calculated in accordance with GAAP. Reconciliations for the

differences between non-GAAP measures used in this earnings release

and comparable financial measures calculated in accordance with

U.S. GAAP are included in Notes 1, 2, 3 and 4 and the

reconciliation of net cash used in operating activities to free

cash flow and free cash flow available to News Corporation is

included above.

Conference call

News Corporation’s earnings conference call can be heard live at

5:00 p.m. EST on November 9, 2023. To listen to the call, please

visit http://investors.newscorp.com.

Annual Meeting of Stockholders

News Corporation’s 2023 Annual Meeting of Stockholders will be

held exclusively via live webcast on Wednesday, November 15, 2023,

beginning at 10:00 a.m. EST. The webcast can be accessed at

www.virtualshareholdermeeting.com/NWS2023. A replay will be

available at the same location for a period of time following the

meeting.

Cautionary Statement Concerning Forward-Looking

Statements

This document contains certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements include, but are not

limited to, statements regarding trends and uncertainties affecting

the Company’s business, results of operations and financial

condition, the Company’s strategy and strategic initiatives,

including potential acquisitions, investments and dispositions, the

Company’s cost savings initiatives, including announced headcount

reductions, and the outcome of contingencies such as litigation and

investigations. These statements are based on management’s views

and assumptions regarding future events and business performance as

of the time the statements are made. Actual results may differ

materially from these expectations due to the risks, uncertainties

and other factors described in the Company’s filings with the

Securities and Exchange Commission. More detailed information about

factors that could affect future results is contained in our

filings with the Securities and Exchange Commission. The “forward-

looking statements” included in this document are made only as of

the date of this document and we do not have and do not undertake

any obligation to publicly update any “forward-looking statements”

to reflect subsequent events or circumstances, and we expressly

disclaim any such obligation, except as required by law or

regulation.

About News Corporation

News Corp (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) is a global,

diversified media and information services company focused on

creating and distributing authoritative and engaging content and

other products and services. The company comprises businesses

across a range of media, including: digital real estate services,

subscription video services in Australia, news and information

services and book publishing. Headquartered in New York, News Corp

operates primarily in the United States, Australia, and the United

Kingdom, and its content and other products and services are

distributed and consumed worldwide. More information is available

at: www.newscorp.com.

NEWS CORPORATION

CONSOLIDATED STATEMENTS

OF OPERATIONS

(Unaudited; in millions,

except per share amounts)

For the three months ended

September 30,

2023

2022

Revenues:

Circulation and subscription

$

1,129

$

1,111

Advertising

391

406

Consumer

502

467

Real estate

311

323

Other

166

171

Total Revenues

2,499

2,478

Operating expenses

(1,273

)

(1,273

)

Selling, general and administrative

(862

)

(855

)

Depreciation and amortization

(171

)

(179

)

Impairment and restructuring charges

(38

)

(21

)

Equity losses of affiliates

(2

)

(4

)

Interest expense, net

(23

)

(27

)

Other, net

(35

)

(18

)

Income before income tax expense

95

101

Income tax expense

(37

)

(35

)

Net income

58

66

Less: Net income attributable to

noncontrolling interests

(28

)

(26

)

Net income attributable to News

Corporation stockholders

$

30

$

40

Weighted average shares outstanding:

Basic

572

581

Diluted

574

583

Net income attributable to News

Corporation stockholders per share, basic and diluted

$

0.05

$

0.07

NEWS CORPORATION

CONSOLIDATED BALANCE

SHEETS

(Unaudited; in

millions)

As of September 30, 2023

As of June 30, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

1,529

$

1,833

Receivables, net

1,559

1,425

Inventory, net

378

311

Other current assets

503

484

Total current assets

3,969

4,053

Non-current assets:

Investments

391

427

Property, plant and equipment, net

1,947

2,042

Operating lease right-of-use assets

998

1,036

Intangible assets, net

2,417

2,489

Goodwill

5,104

5,140

Deferred income tax assets

360

393

Other non-current assets

1,289

1,341

Total assets

$

16,475

$

16,921

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

324

$

440

Accrued expenses

1,153

1,123

Deferred revenue

624

622

Current borrowings

61

27

Other current liabilities

875

953

Total current liabilities

3,037

3,165

Non-current liabilities:

Borrowings

2,909

2,940

Retirement benefit obligations

134

134

Deferred income tax liabilities

147

163

Operating lease liabilities

1,081

1,128

Other non-current liabilities

431

446

Commitments and contingencies

Equity:

Class A common stock

4

4

Class B common stock

2

2

Additional paid-in capital

11,347

11,449

Accumulated deficit

(2,114

)

(2,144

)

Accumulated other comprehensive loss

(1,347

)

(1,247

)

Total News Corporation stockholders'

equity

7,892

8,064

Noncontrolling interests

844

881

Total equity

8,736

8,945

Total liabilities and equity

$

16,475

$

16,921

NEWS CORPORATION

CONSOLIDATED STATEMENTS

OF CASH FLOWS

(Unaudited; in

millions)

For the three months ended

September 30,

2023

2022

Operating activities:

Net income

$

58

$

66

Adjustments to reconcile net income to net

cash used in operating activities:

Depreciation and amortization

171

179

Operating lease expense

24

30

Equity losses of affiliates

2

4

Cash distributions received from

affiliates

2

1

Impairment charges

21

—

Other, net

35

18

Deferred income taxes and taxes

payable

19

(4

)

Change in operating assets and

liabilities, net of acquisitions:

Receivables and other assets

(129

)

(96

)

Inventories, net

(55

)

(61

)

Accounts payable and other liabilities

(203

)

(168

)

Net cash used in operating activities

(55

)

(31

)

Investing activities:

Capital expenditures

(124

)

(104

)

Acquisitions, net of cash acquired

(20

)

(3

)

Investments in equity affiliates and

other

(15

)

(8

)

Proceeds from property, plant and

equipment and other asset dispositions

—

4

Other, net

—

(19

)

Net cash used in investing activities

(159

)

(130

)

Financing activities:

Borrowings

925

328

Repayment of borrowings

(933

)

(337

)

Repurchase of shares

(29

)

(127

)

Dividends paid

(28

)

(31

)

Other, net

—

18

Net cash used in financing activities

(65

)

(149

)

Net change in cash and cash

equivalents

(279

)

(310

)

Cash and cash equivalents, beginning of

period

1,833

1,822

Exchange movement on opening cash

balance

(25

)

(54

)

Cash and cash equivalents, end of

period

$

1,529

$

1,458

NOTE 1 – TOTAL SEGMENT EBITDA

Segment EBITDA is defined as revenues less operating expenses

and selling, general and administrative expenses. Segment EBITDA

does not include: depreciation and amortization, impairment and

restructuring charges, equity losses of affiliates, interest

(expense) income, net, other, net and income tax (expense) benefit.

Management believes that Segment EBITDA is an appropriate measure

for evaluating the operating performance of the Company’s business

segments because it is the primary measure used by the Company’s

chief operating decision maker to evaluate the performance of and

allocate resources within the Company’s businesses. Segment EBITDA

provides management, investors and equity analysts with a measure

to analyze the operating performance of each of the Company’s

business segments and its enterprise value against historical data

and competitors’ data, although historical results may not be

indicative of future results (as operating performance is highly

contingent on many factors, including customer tastes and

preferences).

Total Segment EBITDA is a non-GAAP measure and should be

considered in addition to, not as a substitute for, net income

(loss), cash flow and other measures of financial performance

reported in accordance with GAAP. In addition, this measure does

not reflect cash available to fund requirements and excludes items,

such as depreciation and amortization and impairment and

restructuring charges, which are significant components in

assessing the Company’s financial performance. The Company believes

that the presentation of Total Segment EBITDA provides useful

information regarding the Company’s operations and other factors

that affect the Company’s reported results. Specifically, the

Company believes that by excluding certain one-time or non-cash

items such as impairment and restructuring charges and depreciation

and amortization, as well as potential distortions between periods

caused by factors such as financing and capital structures and

changes in tax positions or regimes, the Company provides users of

its consolidated financial statements with insight into both its

core operations as well as the factors that affect reported results

between periods but which the Company believes are not

representative of its core business. As a result, users of the

Company’s consolidated financial statements are better able to

evaluate changes in the core operating results of the Company

across different periods. The following table reconciles net income

to Total Segment EBITDA for the three months ended September 30,

2023 and 2022:

For the three months ended

September 30,

2023

2022

Change

% Change

(in millions)

Net income

$

58

$

66

$

(8

)

(12

)%

Add:

Income tax expense

37

35

2

6

%

Other, net

35

18

17

94

%

Interest expense, net

23

27

(4

)

(15

)%

Equity losses of affiliates

2

4

(2

)

(50

)%

Impairment and restructuring charges

38

21

17

81

%

Depreciation and amortization

171

179

(8

)

(4

)%

Total Segment EBITDA

$

364

$

350

$

14

4

%

NOTE 2 – ADJUSTED REVENUES, ADJUSTED TOTAL SEGMENT EBITDA AND

ADJUSTED SEGMENT EBITDA

The Company uses revenues, Total Segment EBITDA and Segment

EBITDA excluding the impact of acquisitions, divestitures, fees and

costs, net of indemnification, related to the claims and

investigations arising out of certain conduct at The News of the

World (the “U.K. Newspaper Matters”), charges for other

significant, non-ordinary course legal or regulatory matters

(“litigation charges”) and foreign currency fluctuations (“Adjusted

Revenues,” “Adjusted Total Segment EBITDA” and “Adjusted Segment

EBITDA,” respectively) to evaluate the performance of the Company’s

core business operations exclusive of certain items that impact the

comparability of results from period to period such as the

unpredictability and volatility of currency fluctuations. The

Company calculates the impact of foreign currency fluctuations for

businesses reporting in currencies other than the U.S. dollar by

multiplying the results for each quarter in the current period by

the difference between the average exchange rate for that quarter

and the average exchange rate in effect during the corresponding

quarter of the prior year and totaling the impact for all quarters

in the current period.

The calculation of Adjusted Revenues, Adjusted Total Segment

EBITDA and Adjusted Segment EBITDA may not be comparable to

similarly titled measures reported by other companies, since

companies and investors may differ as to what type of events

warrant adjustment. Adjusted Revenues, Adjusted Total Segment

EBITDA and Adjusted Segment EBITDA are not measures of performance

under generally accepted accounting principles and should not be

construed as substitutes for amounts determined under GAAP as

measures of performance. However, management uses these measures in

comparing the Company’s historical performance and believes that

they provide meaningful and comparable information to investors to

assist in their analysis of our performance relative to prior

periods and our competitors.

The following table reconciles reported revenues and reported

Total Segment EBITDA to Adjusted Revenues and Adjusted Total

Segment EBITDA for the three months ended September 30, 2023 and

2022:

Revenues

Total Segment EBITDA

For the three months ended

September 30,

For the three months ended

September 30,

2023

2022

Difference

2023

2022

Difference

(in millions)

(in millions)

As reported

$

2,499

$

2,478

$

21

$

364

$

350

$

14

Impact of acquisitions

(7

)

—

(7

)

(1

)

—

(1

)

Impact of foreign currency

fluctuations

14

—

14

8

—

8

Net impact of U.K. Newspaper Matters

—

—

—

3

6

(3

)

As adjusted

$

2,506

$

2,478

$

28

$

374

$

356

$

18

Foreign Exchange Rates

Average foreign exchange rates used in the calculation of the

impact of foreign currency fluctuations for the three months ended

September 30, 2023 and 2022 are as follows:

Fiscal Year 2024

Q1

U.S. Dollar per Australian Dollar

$0.65

U.S. Dollar per British Pound Sterling

$1.27

Fiscal Year 2023

Q1

U.S. Dollar per Australian Dollar

$0.68

U.S. Dollar per British Pound Sterling

$1.17

Adjusted Revenues and Adjusted Segment EBITDA by segment for the

three months ended September 30, 2023 and 2022 are as follows:

For the three months ended

September 30,

2023

2022

% Change

(in millions)

Better/(Worse)

Adjusted Revenues:

Digital Real Estate Services

$

411

$

421

(2

)%

Subscription Video Services

507

502

1

%

Dow Jones

533

515

3

%

Book Publishing

514

487

6

%

News Media

541

553

(2

)%

Other

—

—

—

%

Adjusted Total Revenues

$

2,506

$

2,478

1

%

Adjusted Segment EBITDA:

Digital Real Estate Services

$

128

$

119

8

%

Subscription Video Services

97

111

(13

)%

Dow Jones

123

113

9

%

Book Publishing

62

39

59

%

News Media

15

18

(17

)%

Other

(51

)

(44

)

(16

)%

Adjusted Total Segment EBITDA

$

374

$

356

5

%

The following tables reconcile reported revenues and Segment

EBITDA by segment to Adjusted Revenues and Adjusted Segment EBITDA

by segment for the three months ended September 30, 2023 and

2022:

For the three months ended

September 30, 2023

As Reported

Impact of Acquisitions

Impact of Foreign Currency

Fluctuations

Net Impact of U.K. Newspaper

Matters

As Adjusted

(in millions)

Revenues:

Digital Real Estate Services

$

403

$

(3

)

$

11

$

—

$

411

Subscription Video Services

486

—

21

—

507

Dow Jones

537

—

(4

)

—

533

Book Publishing

525

(4

)

(7

)

—

514

News Media

548

—

(7

)

—

541

Other

—

—

—

—

—

Total Revenues

$

2,499

$

(7

)

$

14

$

—

$

2,506

Segment EBITDA:

Digital Real Estate Services

$

122

$

1

$

5

$

—

$

128

Subscription Video Services

93

—

4

—

97

Dow Jones

124

—

(1

)

—

123

Book Publishing

65

(2

)

(1

)

—

62

News Media

14

—

1

—

15

Other

(54

)

—

—

3

(51

)

Total Segment EBITDA

$

364

$

(1

)

$

8

$

3

$

374

For the three months ended

September 30, 2022

As Reported

Impact of Acquisitions

Impact of Foreign Currency

Fluctuations

Net Impact of U.K. Newspaper

Matters

As Adjusted

(in millions)

Revenues:

Digital Real Estate Services

$

421

$

—

$

—

$

—

$

421

Subscription Video Services

502

—

—

—

502

Dow Jones

515

—

—

—

515

Book Publishing

487

—

—

—

487

News Media

553

—

—

—

553

Other

—

—

—

—

—

Total Revenues

$

2,478

$

—

$

—

$

—

$

2,478

Segment EBITDA:

Digital Real Estate Services

$

119

$

—

$

—

$

—

$

119

Subscription Video Services

111

—

—

—

111

Dow Jones

113

—

—

—

113

Book Publishing

39

—

—

—

39

News Media

18

—

—

—

18

Other

(50

)

—

—

6

(44

)

Total Segment EBITDA

$

350

$

—

$

—

$

6

$

356

NOTE 3 – ADJUSTED NET INCOME (LOSS) ATTRIBUTABLE TO NEWS

CORPORATION STOCKHOLDERS AND ADJUSTED EPS

The Company uses net income (loss) attributable to News

Corporation stockholders and diluted earnings per share (“EPS”)

excluding expenses related to U.K. Newspaper Matters, litigation

charges, impairment and restructuring charges and “Other, net”, net

of tax, recognized by the Company or its equity method investees,

as well as the settlement of certain pre-Separation tax matters

(“adjusted net income (loss) attributable to News Corporation

stockholders” and “adjusted EPS,” respectively), to evaluate the

performance of the Company’s operations exclusive of certain items

that impact the comparability of results from period to period, as

well as certain non-operational items. The calculation of adjusted

net income (loss) attributable to News Corporation stockholders and

adjusted EPS may not be comparable to similarly titled measures

reported by other companies, since companies and investors may

differ as to what type of events warrant adjustment. Adjusted net

income (loss) attributable to News Corporation stockholders and

adjusted EPS are not measures of performance under generally

accepted accounting principles and should not be construed as

substitutes for consolidated net income (loss) attributable to News

Corporation stockholders and net income (loss) per share as

determined under GAAP as a measure of performance. However,

management uses these measures in comparing the Company’s

historical performance and believes that they provide meaningful

and comparable information to investors to assist in their analysis

of our performance relative to prior periods and our

competitors.

The following table reconciles reported net income attributable

to News Corporation stockholders and reported diluted EPS to

adjusted net income attributable to News Corporation stockholders

and adjusted EPS for the three months ended September 30, 2023 and

2022:

For the three months ended

September 30, 2023

For the three months ended

September 30, 2022

(in millions, except per share data)

Net income attributable to

stockholders

EPS

Net income attributable to

stockholders

EPS

Net income

$

58

$

66

Less: Net income attributable to

noncontrolling interests

(28

)

(26

)

Net income attributable to News

Corporation stockholders

$

30

$

0.05

$

40

$

0.07

U.K. Newspaper Matters

3

0.01

6

0.01

Impairment and restructuring charges

(a)

38

0.06

21

0.04

Other, net

35

0.06

18

0.03

Tax impact on items above

(19

)

(0.03

)

(15

)

(0.03

)

Impact of noncontrolling interest on items

above

3

0.01

(1

)

—

As adjusted

$

90

$

0.16

$

69

$

0.12

(a)

During the three months ended September

30, 2023, the Company recognized non-cash impairment charges of $21

million at the News Media segment related to the write-down of

fixed assets associated with the proposed combination of certain

U.K. printing operations with those of a third party.

NOTE 4 – CONSTANT CURRENCY REVENUES

The Company believes that the presentation of revenues excluding

the impact of foreign currency fluctuations (“constant currency

revenues”) provides useful information regarding the performance of

the Company’s core business operations exclusive of distortions

between periods caused by the unpredictability and volatility of

currency fluctuations. The Company calculates the impact of foreign

currency fluctuations for businesses reporting in currencies other

than the U.S. dollar as described in Note 2.

Constant currency revenues are not measures of performance under

generally accepted accounting principles and should not be

construed as substitutes for revenues as determined under GAAP as

measures of performance. However, management uses these measures in

comparing the Company’s historical performance and believes that

they provide meaningful and comparable information to investors to

assist in their analysis of our performance relative to prior

periods and our competitors.

The following tables reconcile reported revenues to constant

currency revenues for the three months ended September 30,

2023:

Q1 Fiscal 2023

Q1 Fiscal

2024

FX impact

Q1 Fiscal 2024

constant currency

% Change - reported

% Change - constant currency

($ in millions)

Better/(Worse)

Consolidated results:

Circulation and subscription

$

1,111

$

1,129

$

(9

)

$

1,138

2

%

2

%

Advertising

406

391

(1

)

392

(4

)%

(3

)%

Consumer

467

502

7

495

7

%

6

%

Real estate

323

311

(9

)

320

(4

)%

(1

)%

Other

171

166

(2

)

168

(3

)%

(2

)%

Total revenues

$

2,478

$

2,499

$

(14

)

$

2,513

1

%

1

%

Digital Real Estate Services: Circulation and subscription

$

3

$

3

$

—

$

3

—

%

—

%

Advertising

35

35

—

$

35

—

%

—

%

Real estate

323

311

(9

)

$

320

(4

)%

(1

)%

Other

60

54

(2

)

$

56

(10

)%

(7

)%

Total Digital Real Estate

Services segment revenues

$

421

$

403

$

(11

)

$

414

(4

)%

(2

)%

REA Group revenues

$

252

$

261

$

(11

)

$

272

4

%

8

%

Subscription Video Services:

Circulation and subscription

$

425

$

415

$

(18

)

$

433

(2

)%

2

%

Advertising

64

62

(3

)

$

65

(3

)%

2

%

Other

13

9

—

$

9

(31

)%

(31

)%

Total Subscription Video Services segment

revenues

$

502

$

486

$

(21

)

$

507

(3

)%

1

%

Q1 Fiscal 2023

Q1 Fiscal

2024

FX impact

Q1 Fiscal 2024

constant currency

% Change - reported

% Change - constant currency

($ in millions)

Better/(Worse)

Dow Jones:

Circulation and subscription

$

414

$

436

$

4

$

432

5

%

4

%

Advertising

94

91

—

$

91

(3

)%

(3

)%

Other

7

10

—

$

10

43

%

43

%

Total Dow Jones segment revenues

$

515

$

537

$

4

$

533

4

%

3

%

Book Publishing:

Consumer

467

502

7

$

495

7

%

6

%

Other

20

23

—

$

23

15

%

15

%

Total Book Publishing segment

revenues

$

487

$

525

$

7

$

518

8

%

6

%

News Media:

Circulation and subscription

$

269

$

275

$

5

$

270

2

%

—

%

Advertising

213

203

2

$

201

(5

)%

(6

)%

Other

71

70

—

$

70

(1

)%

(1

)%

Total News Media segment

revenues

$

553

$

548

$

7

$

541

(1

)%

(2

)%

News UK

Circulation and subscription

$

134

$

144

$

10

$

134

7

%

—

%

Advertising

61

59

3

$

56

(3

)%

(8

)%

Other

26

25

2

$

23

(4

)%

(12

)%

Total News UK revenues

$

221

$

228

$

15

$

213

3

%

(4

)%

News Corp Australia

Circulation and subscription

$

112

$

107

$

(5

)

$

112

(4

)%

—

%

Advertising

104

93

(4

)

$

97

(11

)%

(7

)%

Other

39

38

(2

)

$

40

(3

)%

3

%

Total News Corp Australia revenues

$

255

$

238

$

(11

)

$

249

(7

)%

(2

)%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231109323318/en/

Investor Relations Michael Florin

212-416-3363 mflorin@newscorp.com

Anthony Rudolf 212-416-3040 arudolf@newscorp.com

Corporate Communications Jim

Kennedy 212-416-4064 jkennedy@newscorp.com

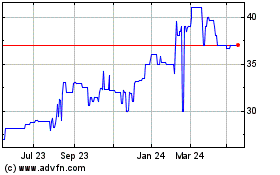

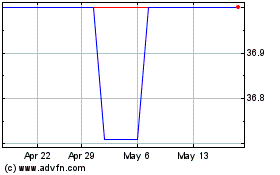

News (ASX:NWSLV)

Historical Stock Chart

From Jan 2025 to Feb 2025

News (ASX:NWSLV)

Historical Stock Chart

From Feb 2024 to Feb 2025