By Trefor Moss

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 21, 2020).

HONG KONG -- Airlines around the world are counting the cost of

the coronavirus that has led to thousands of China flights being

canceled, with several Asian airlines teetering on the brink of

ruin if the nation's shutdown persists.

Many carriers have taken emergency measures in hope of

offsetting expected losses resulting from the continuing slump in

global traffic. In Hong Kong, Cathay Pacific Airways Ltd. --

already feeling the impact of the city's antigovernment protests --

has asked all its staff to take three weeks' unpaid leave, while

Hong Kong Airlines Ltd. has sacked more than 400 workers. Asiana

Airlines Inc., South Korea's second largest carrier, also asked

thousands of staff to take unpaid leave.

Even flights not passing through China have been axed from

schedules. Australia's Qantas Airways Ltd. said Thursday it was

reducing services to Hong Kong and Singapore in addition to

suspending flights to mainland China until at least the end of May,

while Thai Airways International PCL has cut flights connecting

Bangkok with Seoul and Singapore, as regional customers lose their

appetite for travel.

China's rise to the world's second busiest aviation market after

the U.S. has been a strong source of growth for all the world's

major airlines, which have expanded direct services to Chinese

destinations in recent years, some offering dozens of flights a

week. American Airlines Group Inc.'s namesake carrier, for example,

normally operates 28 weekly flights between the U.S. and China.

But that has left them badly exposed to major disruption in

China. As the epidemic worsened, many foreign airlines, including

the major U.S. carriers, completely halted flights to Chinese

destinations last month.

China's own airlines have become some of the world's biggest,

establishing a global footprint. All have slashed services over the

past month as the country battles the epidemic, which by Wednesday

had infected 74,576 and killed 2,118 people in mainland China,

according to the official count.

With millions of Chinese people facing travel restrictions and

many others simply avoiding nonessential travel, regional demand

for flights has collapsed, forcing carriers to cancel over 25,000

flights a week in total, according to aviation data company

OAG.

The number of seats available on domestic Chinese flights fell

63% year-over-year to 5.4 million in the second week of February,

OAG said. And many of those seats were empty, with daily passenger

numbers down 91% on year as of Monday, according to the Civil

Aviation Administration of China.

"No event that we remember has had such a devastating effect on

capacity, " OAG's senior analyst John Grant wrote in a Feb. 17

commentary. While the SARS outbreak of 2003 also hit aviation

companies hard, the Chinese air-travel sector has since grown

10-fold, making the coronavirus a critical issue even for airlines

based outside Asia.

The airline industry stands to lose $5 billion in revenues in

the first quarter, the International Civil Aviation Organization

estimates. As of Feb. 14 Chinese airlines had refunded over $2.85

billion to passengers unable to take canceled flights, according to

the CAAC.

While China's three big state-run carriers -- Air China Ltd.,

China Eastern Airlines Corp. and China Southern Airlines Co. -- are

strong financially, some smaller players will struggle to sustain

the crippling of their operations for long, said Paul Yong, an

analyst at DBS Bank in Singapore.

Hainan Airlines is especially vulnerable, he said, thanks to the

well-publicized debt struggles of its parent, HNA Group Co. The

government could take the crisis as its cue to intervene and allow

the big three to carve up Hainan Airlines' routes -- a move that

was the subject of industry rumors long before the coronavirus

epidemic began.

Earlier this month Hong Kong Airlines, another HNA unit, said it

would sack at least 400 of its 3,500 employees and ask others to

take unpaid leave as it struggles to weather the crisis. On

Wednesday it said it would eliminate all in-flight services in a

further cost-cutting measure. Hainan Airlines and Hong Kong

Airlines didn't respond to requests for comment.

The region's low-cost carriers are also vulnerable to prolonged

disruption, aviation analysts say.

"It becomes a question of who has the strongest balance sheets,"

said Mr. Yong. "We could potentially see some smaller players going

bankrupt."

Thailand's Nok Air, a budget carrier that has grown partly off

the back of a boom in Chinese people vacationing in Thailand, looks

shaky, he said; 10 of Nok Air's 19 overseas destinations are cities

in China.

VietJet is another Asian low-cost carrier heavily dependent on

Chinese travelers: 10 of the 20 destinations it serves outside

Vietnam are Chinese.

The number of flights from China to Thailand and Vietnam were

down 60% and 84% respectively in the second week of February

compared with last year, according to OAG. Nok Air and VietJet

didn't respond to requests for comment.

Larger carriers have also been scrambling to insulate themselves

against the continuing slump in Chinese traffic. Cathay Pacific's

request that all employees take three weeks' unpaid leave for the

rest of 2020 came after the airline cut 90% of its flights to the

mainland, accounting for roughly a third of its total capacity.

Cathay Pacific was already reeling from a backlash among Chinese

customers over its perceived support for the protests in Hong Kong.

That led to a slump in the airline's China business and to the

resignations last year of its chairman and chief executive.

Asiana Airlines said Tuesday that it was asking thousands of

staff to take unpaid leave after it was forced to reduce its China

services by over 70%. The airline, which lost $562 million in 2019,

faces "a crisis of a massive operating loss this year" because of

the epidemic, the Yonhap news agency quoted Chief Executive Han

Chang-Soo as saying.

Yin Yijun contributed to this article.

Write to Trefor Moss at Trefor.Moss@wsj.com

(END) Dow Jones Newswires

February 21, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

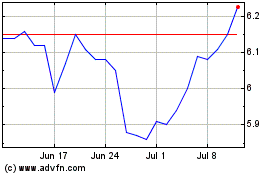

Qantas Airways (ASX:QAN)

Historical Stock Chart

From Oct 2024 to Nov 2024

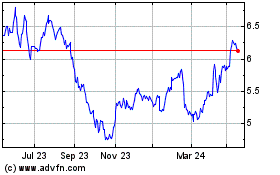

Qantas Airways (ASX:QAN)

Historical Stock Chart

From Nov 2023 to Nov 2024