illimity Presents First Voluntary Non-Financial Statement and

Announces it Achieved Carbon Neutrality in 2020

via InvestorWire-- illimity Bank S.p.A.

(“

illimity” or the “

Bank”)

presents its first Voluntary Consolidated Non-Financial Statement

(NFS) pursuant to the Italian Legislative Decree no. 254/2016 and

announces that it already achieved carbon neutrality at a Group

level in 2020.

Since starting activities in 2019, the Bank has

always placed specific emphasis on environmental, social and

governance (“ESG”) issues. Taking a native approach, illimity has

embarked on a path of building these into the Group’s strategies,

processes and governance. This commitment is also reflected in the

Group’s decision to prepare its first voluntary NFS, continuing the

reporting and transparency process started last year with the

publication of its Sustainability Profile.

With its first Non-Financial Statement, illimity

provides a wide range of information on its ESG performance to all

its stakeholders. The report – based on the figures as of December

31, 2020 – has been prepared in compliance with the GRI

Sustainability Reporting Standards (“GRI Standards”) –

“Core” option, to which voluntary qualitative and quantitative

indicators have been added. The preparation of this report, in the

name of the digital innovation that has always set the Bank apart,

involved all the main corporate functions and divisions using an

ESG Digital Governance collaborative platform.

“The illimity Group’s first Sustainability

Report represents an important moment for sharing the

responsibilities that guide us in helping people, families and

businesses to unleash and enhance their potential with all of our

stakeholders,” stated illimity Chairperson Rosalba

Casiraghi. “I am especially proud of also chairing the

Sustainability Committee—a testament to our strong commitment to

ESG issues—an involvement that unites us all, from the Bank’s top

management to its single functions and areas.”

“We are continuing our commitment to ensuring

solid profits for people who have invested in illimity. This

innovative project aims to be useful to society as a whole while

advancing sustainability and sustainable growth in our country,”

said illimity CEO Corrado Passera. “Italy can and

must reactivate its economic and social potential this year. And we

in illimity intend to play our part in that process.”

The Non-Financial Statement is structured on the

basis of five strategic pillars – Principles of Governance,

People, Prosperity, Planet and Society and Innovation - in

line with international trends, which range from the priorities of

the G20 under the Italian Presidency to the new Stakeholder

Capitalism Metrics.

The following paragraphs set out the results

achieved and the initiatives begun in 2020 for each of the five

pillars:

1. Principles of

Governance A rule-based culture and

integrity in business conduct act as the basis for

the way in which corporate governance operates and staff work. In

addition, diversity and expertise are central values, and in

practice these are reflected in the Group’s corporate governance

system: In this respect, illimity’s Board of Directors is one of

the few in Italy with a Chairperson, Rosalba Casiraghi, in office

since 2018 and re-appointed as head of the new Board of Directors

on April 22, 2021. Since February 2021, illimity’s Board of

Directors is well-balanced in terms of gender,

with 56% of directors being men and 44% women. A

Sustainability Committee looks after

sustainability issues, providing proposals and advice to the Board

of Directors. The Communication & Stakeholder Engagement

Function coordinates the process for monitoring and reporting

non-financial matters, in constant collaboration with the Group’s

various functions and divisions.

2. PeopleDiversity

and inclusion are crucial factors in a Group consisting of over 600

illimiters having 20 nationalities and coming from more than 200

organisations operating in 17 different industries. From the

beginning, illimity has always set its sights on closing

the gender pay-gap, which, owing to grade

and work experience, is at a physiological level of 3.6%. Specific

emphasis is given to reconciling work with family

life. Parental leave for new fathers allows for an

extension to 20 days compared to the seven days envisaged in the

new contract for the banking sector, and since the start of the

health emergency, employees who have to look after children or

relatives have been granted two hours of paid leave a day. For the

second consecutive year, the Bank has been recognised as a

Great Place to Work, with an especially positive

perception by employees of the working environment: 85% of them

consider it excellent. In addition, the year saw the launch of the

“illimitHER” programme, created to enhance the potential of young

women promoting under-35 role models who have followed STEM paths.

The programme involved over 10 speakers, 20 partners and inspired

6,000 young people in its first eight months of activity.

3. ProsperityThe

illimity Group’s aim is to generate long-term value for its

stakeholders. Its business divisions are committed in this sense,

having as their objective the unleashing and enhancement of the

potential of people, families and businesses.

The SME Division of illimity supports

small and medium enterprises (SMEs) in development, restructuring

and relaunch processes, with the resulting positive

repercussions on society, such as jobs and entrepreneurship.

Financing totalling EUR 247 million was directed towards

relaunching businesses in difficulty in 2020. In addition, at an

environmental level, EUR 29 million was disbursed in operations

dedicated to sectors involved in the circular economy, green

transportation and renewable energy. An ESG rating has been

gradually introduced to integrate sustainability and related risks

in the credit assessment process.

The Distressed Credit Investment & Servicing

Division is one of Italy’s leading operators specialising in

corporate non-performing loans (NPL) and unlikely-to-pay (UTP). The

division focuses on purchasing distressed loans, financing

third-party investors that purchase bad loans and, through its

neprix servicing platform, managing and enhancing the value of

distressed loans. As part of its servicing activity, the Division

provides professional support for its customers, seeking to

conclude out-of-court agreements that speed up settlement periods

and contribute to recover the exposure. The Collaborative

Agreement Index, the ratio between the number of positions

closed through out-of-court proceedings and the total number of

positions, ended the year at 80.8%.

In addition, the Division identified the

energy sector as an area of

further specialisation, also given the contribution the segment

provides to green-style energy conversion. A

dedicated desk has therefore been set up having not only financial

expertise but also technical and legal skills in energy-based and

environmental matters.

The Bank’s Digital Direct Division,

illimitybank.com, was set up with the aim of providing value-added

services and contents and in 2020 initiated projects for the

dissemination of financial culture. Appreciation for the Bank’s

initiatives and services was reflected in its Net Promoter

Score – an index that measures customer satisfaction and

loyalty – for which it achieved 48 points compared

to an industry average of 9.

4. Planet

and SocietyMeasuring, mitigating and offsetting

emissionsillimity’s business model, with its fully digital

and cloud-based infrastructure, minimises direct environmental

impacts and makes the responsible use of resources more efficient.

The Bank’s process for measuring environmental

impacts was originally set up from the beginning of its

activity and further extended to include all Group companies in

2020.

illimity introduced mitigation

activities as a means of making consumption more efficient and

reducing usage by way of initiatives designed to discourage the use

of lifts, printers and (FSC certified) paper, encouraging the

exchange of digital documents. The Milan offices are equipped with

a system of timers that enable lighting and air-conditioning

systems to be automatically switched off. In addition, from 2021

the electricity used in the two main offices in

Milan and Modena is produced from 100% “GO” (Guarantee of

Origin) certified renewable sources.

Despite the limited environmental impact, right

from the start the Bank decided to offset the emissions arising

from its business activities (Scope 1 and Scope 2); these

emissions, amounting to 489 tCO2eq. in 2020, represent the Group’s

Carbon Footprint. Carbon Neutrality is

achieved by purchasing “Gold Standards” carbon credit

certificates linked to the “Clean Cookstoves Mozambique” project in

Maputo, Mozambique, which has led to the replacement of high-usage

coal burners with more efficient systems designed to reduce CO2

emissions and the resulting benefits on the savings and health of

the local populations.

Initiatives to combat the Covid-19

emergencyillimity’s smart native, innovative and

technological nature enabled the Bank to be one of the first

businesses to introduce continuous smart working as the standard

way of working right from the beginning of the emergency. In

addition, a continuous screening process has been

introduced for all employees and collaborators, who have the

possibility of undertaking a free-of-charge swab test in their

offices once a week, and a specific Covid-19 insurance

policy has been taken out.

In terms of business support, illimity took

prompt action to implement the measures introduced by the

legislator, setting up a lean, streamlined process for obtaining

the suspensions contemplated in the “Cura Italia” Decree Law and

ABI moratoria. In 2020 suspensions and moratoria

were concluded in almost 200 cases for a total of

approximately EUR 86.5 million (now reduced to

approximately EUR 48 million). illimity further

acted on a timely basis by donating medical equipment worth

EUR 270 thousand that was needed to deal with the

health emergency at the disposal of hospital facilities.

5. InnovationIn

illimity, innovation is the driver capable of generating value for

the whole business, the strategic lever that pervades the entire

organisation and provides a real contribution to achieving the

Group’s business objectives and responding to stakeholders’ needs.

A focus on technology and the digital approach is

one of the distinctive features of the Bank, the first Italian

institution to be set with 100% of its systems using cloud

computing. Aware that innovation and a digital approach

represent a fundamental approach to a country’s growth, illimity

consistently proposes services that respond to the new needs of the

customer by combining cutting edge technologies with the human

dimension.From a fully Open Platform perspective,

the Bank has extended its range of services to include functions

that support a greener lifestyle, particularly by fostering

sustainable mobility and physical well-being. Noteworthy among the

services launched last year is illimity connect, a

program enabling customers to make payments from a single digital

touchpoint. This innovation is an example of how Open

Banking technology can be used to help people to improve

the relationship with their finances, giving them greater control

and awareness. illimity's growth in Open Banking has seen a very

strong acceleration in the last part of the year since the creation

of the joint venture in HYPE, the leading Italian

fintech platform with over 1.3 million customers.

To obtain further information and download the

2020 NFS, consult the website

https://www.illimity.com/en/who-we-are/sustainability.

For further information:

Investor RelationsSilvia Benzi:

+39.349.7846537 - +44.7741.464948

- silvia.benzi@illimity.com

| Press

& Communication illimity |

|

| Isabella Falautano, Francesca D’Amico |

Sara Balzarotti, Ad Hoc Communication Advisors |

| +39.340.1989762 press@illimity.com |

+39.335.1415584 sara.balzarotti@ahca.it |

Wire Service Contact:InvestorWire

(IW)Los Angeles, Californiawww.InvestorWire.com212.418.1217

OfficeEditor@InvestorWire.com

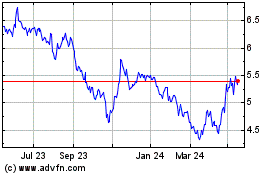

Illimity Bank (BIT:ILTY)

Historical Stock Chart

From Dec 2024 to Jan 2025

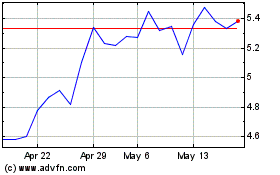

Illimity Bank (BIT:ILTY)

Historical Stock Chart

From Jan 2024 to Jan 2025