This PEPE Holder Cohort Is The Reason Price Is Struggling To Reclaim $0.00002

July 31 2024 - 2:30PM

NEWSBTC

PEPE bulls have encountered challenges in their attempts to push up

the meme cryptocurrency’s price over the past week. Notably, PEPE

has experienced a decline of approximately 4% in the last 24 hours

alone, with a more substantial drop of 6.5% over the course of the

past seven days. The selling sentiment surrounding PEPE has

increased significantly since the middle of July. Throughout this

period, the meme coin has struggled to break above resistance at

$0.0000126, facing repeated failures each time it approached this

critical price point. A deeper analysis of market behavior

reveals that this prevailing selling sentiment can be largely

attributed to a notable shift in the composition of PEPE investors.

There has been a strong increase in the number of short-term

holders, accompanied by a corresponding decrease in long-term

holders. Jump In Short-Term Holders According to on-chain

data from IntoTheBlock, short-term PEPE holders have increased

noticeably in the past 30 days. This observation is derived from

IntoTheBlock’s Balance by Time Held metric, which follows the

variation over time of the balance in wallet addresses and groups

them into holders, cruisers, and traders, depending on their

average time. Related Reading: Institutional Investors Show

Interest In Cardano, Triggering 300% Surge Notably, this metric

shows that the balance in the wallets belonging to the trader

cohort has increased by over 31% in the past 30 days. This is

interesting because the trader cohort is made up of those who

generally hold their assets for less than a month before selling.

The behavior of this cohort suggests a shift towards more

speculative trading, as these investors are looking to capitalize

on quick market movements rather than committing to long-term. On

the other hand, the balance in cruiser addresses have fallen by

6.24% in the same timeframe. Cruisers are those addresses that hold

their tokens for between one to twelve months before selling. This

decrease in the balance of cruisers suggests many long-term holders

have been selling their PEPE tokens in the past 30 days. What Does

This Mean For PEPE? The influx of short-term holders is creating a

more volatile environment for PEPE. Currently, they account for 20%

of the entire circulating supply of PEPE. As these investors tend

to buy and sell quickly based on market fluctuations, they are more

likely to create frequent price swings. This increased volatility

is making it challenging for PEPE to maintain a stable upward

trajectory. Related Reading: Analyst Says ETH Price Will Struggle

As Spot Ethereum ETFs Expectations Crash At the time of writing,

PEPE is trading at $0.00001135. Although the crypto is still up by

42% from a 2-month low of $0.000007975 recorded on July 5, the

upward trajectory has been stalled by the activity of short-term

holders. PEPE now finds itself trading around a two-week

significant support of $0.00001133. A bounce above this price point

would enable PEPE to resume its uptrend and continue approaching

the $0.00002 threshold. Featured image created with Dall.E, chart

from Tradingview.com

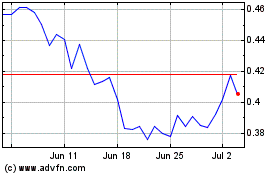

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024