Arbitrum Whales Dump 3.73 Million Tokens, Impacting Market Prices

April 03 2023 - 8:46AM

NEWSBTC

Arbitrum, a popular scaling solution for Ethereum, experienced a

major setback when two large addresses sold 3.73 million ARB

tokens, resulting in a significant loss of over $400,000. The dump

came at a time when the Arbitrum Foundation’s token allocation

process had already generated a maelstrom of controversy, and the

market was bracing for the worst. According to CoinGecko, the

current price of ARB is $1.19, which has decreased by 4.3% in the

last 24 hours, and the 7-day decrease is at 7.2%. Source: Coingecko

Whale Sighting In SushiSwap’s ARB Token A large trader identified

as 0x1dd9 sold off off 2.03 million tokens at an average price of

$1.14 USDT, resulting in a loss of roughly $160,000. Despite the

setback, the address still holds 500,000 ARB, implying a strategic

decision to cut losses while keeping a stake in the game. Related

Reading: These Top 5 Meme Coins Are Bleeding As March 2023 Ends –

Here’s Why Another significant player, 0xca71, unloaded 1.7 million

ARB tokens at an average selling price of $1.16 USDT, incurring a

loss of around $270,000. Currently, the address only retains 50,000

ARB in SushiSwap’s pair liquidity, representing a significant

contrast to the volume previously held. Arbitrum Foundation’s Token

Allocation Process The Foundation’s recent decision to allocate

millions of ARB tokens has come under intense scrutiny and

criticism from all sides. 鲸鱼 0xca71 于 5 小时前卖出 170 万 $ARB : 该鲸鱼是在

3/24-28 从交易所提出+链上买入 195 万 ARB,综合成本约 $1.32。 他的出售均价为 $1.16,大致亏损 $27

万。 目前该鲸鱼地址仅剩 #SushiSwap 中组流动性的 5 万 ARB。 pic.twitter.com/ObAffEnUVx

— 余烬 (@BitcoinEmber) April 3, 2023 To quell the rising tide of

discontent, the Foundation has taken steps to provide clarity on

the situation. In an effort to address the heated debates that have

erupted on its governance platforms, the Foundation has come

forward with an explanation for the token allocation. They revealed

that 40 million ARB tokens were loaned to a well-known player in

the financial markets sector, a move that has been met with mixed

reactions. Price Drop The buzz circling the token allocation

process of the Arbitrum Foundation has caused a seismic shakeup in

the value of the ARB token. The uproar has only intensified with

the sudden appearance of two behemoth wallets, spilling a

staggering 3.73 million ARB tokens into the market. This

unwelcome surprise has added to the already prevalent pessimism,

resulting in a bleak outlook for the once-promising ARB token.

Traders and investors are holding their breath, anxiously awaiting

the next chapter in this unfolding saga, with hopes of a positive

turn in the future. Crypto total market cap currently pegged at the

$1.14 trillion level on the daily chart at TradingView.com Related

Reading: Top 5 Coins To Watch In The First Week Of April 2023 The

Arbitrum Foundation’s token allocation process has become the

latest scandal to rock the cryptocurrency industry. The price drop

has only added to the controversy, with market participants and

observers keeping a close eye on how the situation unfolds. As

always, the world of cryptocurrencies remains unpredictable, with

new developments occurring by the minute. -Featured image from

Coinpedia

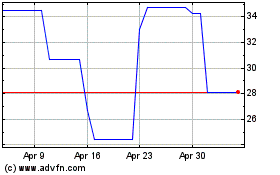

Arweave (COIN:ARUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Arweave (COIN:ARUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024